This post is a guest contribution by Asha Bangalore * of The Northern Trust Company.

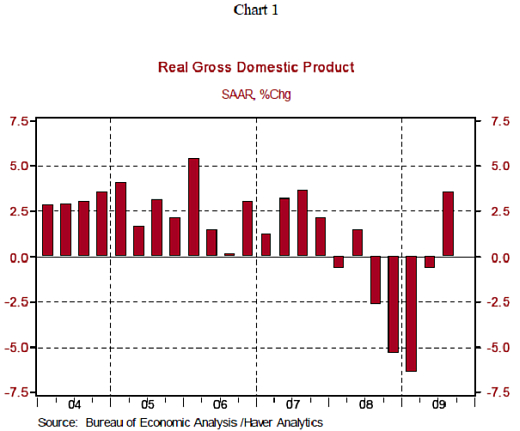

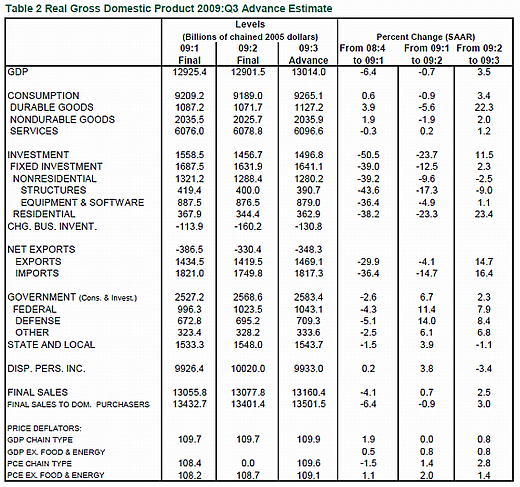

The recession is behind us. Real gross domestic product of the U.S. economy grew at an annual rate of 3.5% in the third quarter after a 0.75 drop in the prior quarter. This is the first increase of real GDP after a string of four quarterly declines. Real GDP has declined in five out of the six quarters of the recession.

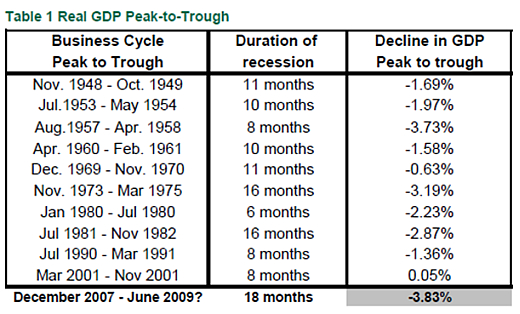

The Business Cycle Dating Committee of the National Bureau of Economic Research will make the official announcement after it confirms the turning point based on revisions of economic data. This recession is the longest on record in the post-war period and the deepest also. Real GDP has declined 3.8% from the peak in the second quarter of 2008 to the trough in the second quarter of 2009. This is the largest peak-to-trough decline of real GDP in the post-war period (see table 1).

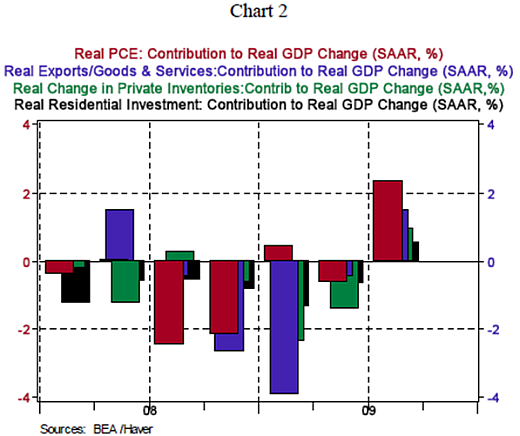

In the third quarter, consumer spending accounted for the largest part of the growth in real GDP, followed by exports, inventories and residential investment expenditures. Of these four components, exports and inventories are most likely to continue to make large contributions in the quarters ahead. Consumer spending is projected to advance in the quarters ahead but at a noticeably slower pace. The surge in auto sales from the “cash for clunkers” program in the third quarter provided the temporary lift to consumer spending.

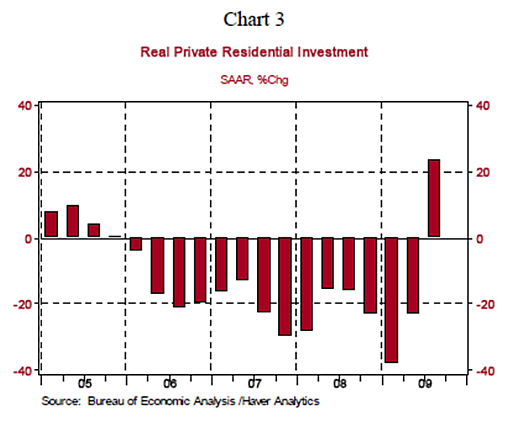

Residential investment expenditures grew at an annual rate of 23.4% in the third quarter, after a string of fourteen quarterly declines. Third quarter spike is encouraging but it is unclear if the robust pace will remain durable. The $8000 first-time home buyer tax credit program helped boost home sales in addition to low mortgage rates and home prices.

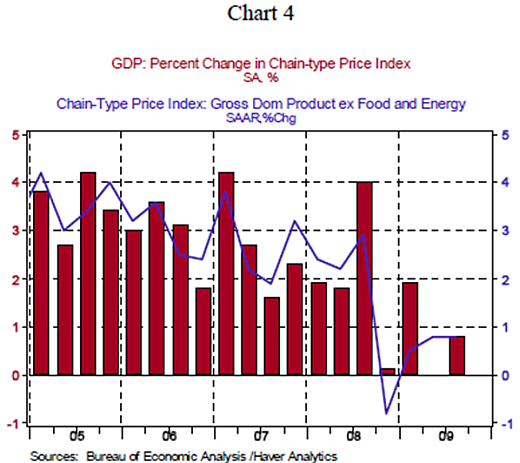

Final sales to domestic purchasers increased at an annual rate of 3.0% in the third quarter. The 2.3% increase in government expenditures is expected to show a more robust gain in the near term, which should show the impact of fiscal spending plan envisaged for 2010. The GDP price indexes suggest that inflation is contained, again underscoring that inflation is not the primary issue at the present time.

Going forward, the lift to the headline GDP number in the third quarter is partly from future auto sales, which implies that consumer spending and GDP growth are most likely to show more muted growth in the fourth quarter of 2009 and first quarter of 2010. The Fed is hold for several months until it is confirmed the unemployment rate has peaked.

Source: Asha Bangalore, Northern Trust Daily, October 29, 2009.

* Asha Bangalore is vice president and economist at The Northern Trust Company, Chicago. Prior to joining the bank in 1994, she was consultant to savings and loan institutions and commercial banks at Financial & Economic Strategies Corporation, Chicago.