MarketFolly.com has been diligently tracking the activities of 35+ hedge fund managers, and one of the most notable of these has been John Paulson (no relation to Treasury secretary), founder of Paulson & Company, the King of the "Subprime Meltdown."

According to SEC filings covered below, Paulson has recently accumulated some very large positions in gold and gold producers.

Many have been critical of hedge funds and their activities over the past year, particularly in the financial sector, and Paulson, a target, has unapologetically, but humbly, faced the markets' scorn for profiting so triumphantly off the subprime and credit crisis of the last 2 years.

What is worth noting is that in the early days of Paulson's bets against the housing and financials market, which he began accumulating years before the crisis unfolded, is that he faced the professional burden of being early, and grappling with both his partners, as well as the agony of the rising housing market's ability to outlast and wrest away, the convictions of the majority of those who said it couldn't last.

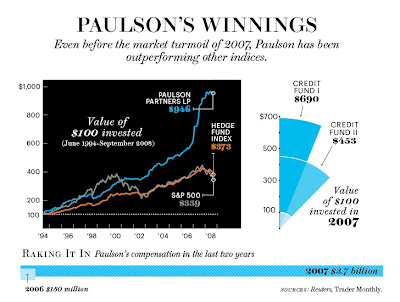

Fittingly, below is the graphic from the end of 2007, which shows how successful Paulson and Company was already, well before the credit crisis and last year's collapse in financial markets.

(click image to enlarge)

(click image to enlarge)Here we quote MarketFolly.com, its analysis of Paulson's SEC filings:

The second hedge fund in our series is Paulson & Co ran by John Paulson. His hedge fund has generated massive returns over the past two years, as he bet against financials and all things subprime. One of his funds was even up 589%. And, in the first part of 2009, he had also profited by shorting UK banks. Although Paulson is obviously one of the main brains behind the operation, there are also many talented individuals there. Unfortunately for Paulson, one of his co-portfolio managers has left to start his own fund, and we'll be keeping an eye on that. At the end of 2008, Paulson's Advantage Plus fund ended the year +37.58%, as detailed in our year end 2008 hedge fund performance post. For more information on how Paulson performed in 2008, be sure to check out their year end letter & report.

Paulson began shorting collateralized debt obligations and buying credit default swaps back in 2005 as he had conviction in his bet. His Credit Opportunities fund launched in 2006 with $150 million aimed to short subprime mortgage backed securities. This fund enjoyed immediate success, causing him to launch the Credit Opportunities II fund. At the end of 2007, the Opportunities fund was up 590% and his Opportunities II fund was up 353%. Such sterling performance led Paulson's hedge funds to be the #1 and #4 funds as ranked in Barron's hedge fund rankings (top 100). Paulson's funds earned this distinction due to their solid 3 year annualized performance metrics. Additionally, Paulson sits at #3 on Alpha's hedge fund rankings list for 2009, which is compiled based on assets under management (aum).

Obviously, such great performance has led to many other accolades for Paulson on a personal level. Recently, Paulson graced Forbes' billionaire list, but that one is almost a no-brainer. More notably, he was among the top 25 highest paid hedge fund managers of 2008. In terms of recent portfolio performance, Paulson's Advantage Plus Fund returned 4.8% through April as noted in our round up of hedge fund performance numbers.

The following were their long equity, note, and options holdings as of March 31st, 2009 as filed with the SEC. We have not detailed the changes to every single position in this update, but we have covered all the major moves. All holdings are common stock unless otherwise denoted.

Some New Positions(Brand new positions that they initiated in the last quarter):

SPDR Gold Trust (GLD)

Gold Fields (GFI)

Gold Miners ETF (GDX)

Anglogold Ashanti (AU)

Capital One Financial (COF)

JPMorgan Chase (JPM)

Petro-Canada (PCZ)

Schering Plough (SGP)

Wyeth (WYE)Some Increased Positions (A few positions they already owned but added shares to)

St Jude Medical (STJ): Increased by 134%

Peoples United Financial (PBCT): Increased by 12%

Kinross Gold (KGC): Increased by 8%Some Reduced Positions (Some positions they sold some shares of - note not all sales listed)

Rohm & Haas (ROH): Reduced by 11.5%

Removed Positions (Positions they sold out of completely)

BCE (BCE)

Genentech (DNA)

Istar Financial (SFI)

Merrill Lynch (MER)

NRG Energy (NRG)

National Citty (NCC - inactive, acquired by PNC)

Northern Trust (NTRS)

Teva Pharma (TEVA)

Time Warner Cable (TWX)

Tronox (TRXAQ)

UST (UST)

ProShares Ultrashort Financial (SKF)

Wachovia (WB)

Wells Fargo (WFC)Top 15 Holdings (by % of portfolio)

- SPDR Gold Trust (GLD): 30.37% of portfolio

- Wyeth (WYE): 13.96% of portfolio

- Rohm & Haas (ROH): 13.44% of portfolio

- Boston Scientific (BSX): 8.4% of portfolio

- Gold Miners ETF (GDX): 6.81% of portfolio

- Kinross Gold (KGC): 5.87% of portfolio

- Philip Morris International (PM): 3.42% of portfolio

- Petro-Canada (PCZ): 2.96% of portfolio

- Schering Plough (SGP): 2.26% of portfolio

- Mirant (MIR): 2.22% of portfolio

- Gold Fields (GFI): 2.21% of portfolio

- JPMorgan Chase (JPM): 1.65% of portfolio

- Anglogold Ashanti (AU): 1.15% of portfolio

- St Jude Medical (STJ): 0.91% of portfolio

- Embarq (EQ): 0.81% of portfolio

The first major move that everyone will be talking about is Paulson's big entrance into gold. His position in the Gold Trust (GLD) is brand new and is brought up to a whopping 30% of his portfolio. Now, there are indeed a few caveats with this move: Paulson & Co have said themselves that they have done so as a hedge, as they now own well over 8% of this exchange traded fund (ETF). Their hedge funds have a share class that is denominated in gold (instead of in US dollars or Euros). Still though, that's quite a large hedge to have. Not to mention, Paulson also has a copious amount of gold miners now littered throughout his equity portfolio. Previously, we had posted up when he started his large stake in Anglogold Ashanti. Now though, he has boosted his stake in Kinross Gold (KGC) and he has also started new positions in Gold Fields (GFI) and the Gold Miner ETF (GDX). Gold is clearly the name of the game for Paulson at present. And, such a massive position in gold and gold miners has to be for more than merely a hedge.

One other thing to consider with Paulson's portfolio is that these holdings listed above are only his long equity holdings. The main reason why we bring this up is because the holdings above represent only a piece of his overall portfolio pie. Many of the positions above are merger arbitrage and event driven positions. While his gold stakes may be a large part of the assets disclosed in this filing, they are not quite as big when you compare them to his total assets under management. So, keep that in mind.

As many are already aware, Paulson bet against subprime and made a ton of money. As such, a lot of his holdings are in other markets. And, since the SEC only requires funds to disclose their equity, options, and note/bond positions, there is much of Paulson's portfolio left unseen. Besides any omitted positions in mortgage backed securities or other markets, we also do not get to see Paulson's shorts. The only short positions we can ever see in these filings (as per SEC regulations) are via positions in put options. And, Paulson does not have any such positions.

Another major move Paulson made last quarter was to buy a new stake in Wyeth (WYE). They brought their new WYE position all the way up to their #2 holding, which will turn a few heads. Aside from those major moves, Paulson also still retains the rest of his merger arbitrage style positions in Boston Scientific and Rohm & Haas, which we've covered previously. Additionally, Paulson still holds a position in Mirant (MIR), whom he filed a 13G on back in January.

We also noticed that Paulson essentially swapped out of Merrill Lynch, Northern Trust, Wells Fargo, and Wachovia in favor of Capital One and JP Morgan Chase. While this move is intriguing, it is fairly insignificant (at least at this time). All his financial positions are relatively tiny to his overall portfolio, with JPMorgan being the largest at only 1.65% of their portfolio, which is not saying much. We'll have to monitor this development going forward to see if Paulson is getting constructive here, or mainly using these as proxies for something else in the shorter-term.

Assets from the collective holdings reported to the SEC via 13F filing increased from $6 billion last quarter up to $9.36 billion this quarter. Overall, Paulson is a great fund to keep an eye on simply because they nailed the crisis and have a solid track record. However, much of his portfolio is not present in these 13F filings, so take everything with a grain of salt. If you want to keep an eye on someone else who had worked with Paulson in betting against subprime, then check out our recent piece on Kyle Bass of Hayman Capital, where we divulge his latest prediction.

Source: MarketFolly.com, May 19, 2009