Back in November, we recalled overhearing the interview with Herbjorn Hannson, CEO, and his report on the earnings of his company, Nordic American Tanker (NYSE: NAT), which in the midst of the turmoil of the market and worsening global economy, reported its 3rd best quarterly earnings in the history of the company, which has been in operation since 1997. Regrettably, but not because it got away, but rather, it was an interesting story, we did not publish a note about this then.

This is one of those rare instances of a company/stock story that sticks out like a bright beacon in the darkness to guide the way, as an example of what types of businesses are out there that are seriously worthy of consideration, if not investment. We are not making a recommendation here, just pointing out something really interesting. The shares are trading for around $23-25 and they have been more or less rangebound, having recently been as high as $35 during the last three months since November, when we first heard the story, and is now back down to same price it was at then, give or take a few bucks then. At 23-24 its a much better price resulting in a far more attractive yield of over 14%.

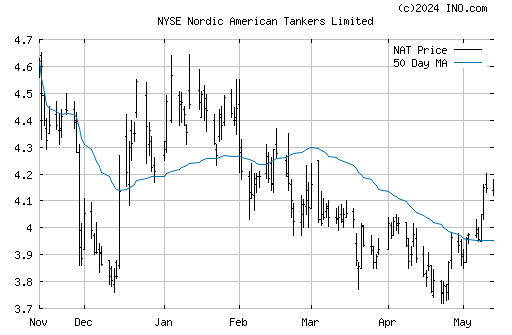

Nordic American Tanker (NYSE:NAT), 6 months, vs. 50 MA.

The company is debt-free, has consistently paid a cash-dividend of over 10%, has a strong cash position and unused credit lines totalling $500-million, and all they do is ship crude oil.

This is a must read, must view. Every now and then, there are some truly interesting stories worthy of your time and thought, if not action.

Herbjorn Hannson, CEO, Nordic American Tankers, pays a visit to CNBC February 13, 2009. Click play to watch:

Here is the transcript of Herbjorn Hansson, on CNBC, February 13, 2009, with Erin Burnett, Mark Haines and Doug Mavrinac, Head of Maritime Research for Jefferies.

Herbjorn Hansson, CEO, Nordic American Tanker, CNBC, February 13, 2009

Erin Burnett: With the drop in Crude oil prices, Nordic American Tankers share price has fallen about 12%; now crude as you can see is down about 22%. Despite that NAT came out with 4th quarter earnings this morning, and guess what, they were better than expected. What is going on here? Joining us on set is our friend, Herbjorn Hansson, CEO of Nordic American Tanker, and in Houston, Doug Mavrinac, Head of Maritime Research at Jeffries.

Herbjorn, first of all, I know that the link is not perfect between where crude oil prices are and where shipping rates are, but there is a big issue with demand around the world dropping. Is that really the story, or is this a time of great opportunity?

Herbjorn Hansson: In the short term, demand [for oil] is dropping, but we must remember that this is the first time in history that we have a recession in a globalized world. There are very strong forces at work, and we are the highest paying dividend stock on Wall Street. We have turned in more than 10% annually in cash dividend yield.

This is a time for opportunity for us, because if and when markets are down, many ship owners are in a distressed situation.

EB: They have a lot of debt, you don't. You have no debt.

HH: No. No debt at all, and we have a strong cash position; we have an unused credit line of $500-million, and it is my firm view that when we re-emerge, if you wish, from this mess, we will be a much stronger company having more ships, so I'm optimistic, as far as our company is concerned. But of course, you know there may some muddy waters in the near term. But rates are excellent at this time, and another point, the Dry Cargo business is a completely different story.

Mark Haines: Rates are excellent at this time?

HH: Yeah, I would say so.

MH: Even though demand is down for oil?

HH: Yes, that's true. We have something that's called contango. The contango, and then we use oil tankers for storage, and that means that tankers are withdrawn from the market. That's good for us. We are talking about substantial amounts. Secondly, also we see slow-steaming; the tankers go more slowly, and when you go down from 15 knots to 13.5 knots, that is a reduction of 10%, which is equivalent to 35-million deadweight tons which is a huge amount. I take a much more optimistic view. I believe that you in America, and China, on the international level will have to drag us from out of this. And you have put a lot of measures in hand and there is no question these measures will work.

Nordic American boosts oil tanker fleet to 15

By Jonathan Kent, Published: February 19. 2009 08:50AM, The Royal Gazette (Bermuda)

Bermuda-based Nordic American Tankers Ltd. yesterday boosted its earnings capacity with the delivery of its latest tanker, named Nordic Sprite.

The debt-free oil tanker operator has now expanded its fleet to 15 Suezmax tankers — so called because they are the largest-sized ships that can negotiate the Suez Canal — including two newly build vessels, expected to be delivered in December 2009 and April 2010.

In the midst of the global economic crisis, NAT continues to make a profit and pay out attractive dividends to shareholders. The company has a policy of paying out all of a quarter's free cash flow as dividends — last week NAT announced a dividend of 87 cents per share for the fourth quarter.

With the shares trading at around $28.20 a share yesterday, that amounts to an annualised dividend yield of more than 12 percent.

Rates remain healthy in NAT's business of hiring out tankers, even though the price of crude oil has plummeted from $147 a barrel last July to around $35 yesterday.

NAT said the average daily hire rate for each of its vessels in the spot oil market was $40,157 net. The company estimates its break-even price is less than $10,000.

The fourth-quarter rates were much higher than the $27,000 average NAT achieved in the same period for the prior year, despite the dramatic fall in the price of oil and the slump in demand.

What has helped to buoy rates is oil companies and commodity traders hiring out oil tankers to use for storage, because of the large differential between today's lowly oil price and that purchased for delivery a few months later.

For example, at 2.46 p.m. yesterday afternoon, light, sweet crude oil for March delivery was trading at $35.09 a barrel on the Nymex Exchange in New York, while contracts for December 2009 delivery were selling for $47 a barrel.

Royal Dutch Shell and Citigroup are among the companies who have hired tankers to take advantage of the market in a practice known as "contango". That has tied up a significant amount of tanker capacity, which has decreased the availability of vessels to actually transport oil, thereby boosting rates.

NAT said in its earnings statement last week that it believes approximately 35 very large crude carriers (VLCCs) are being used for storage now.

How long tanker rates can remain high is debatable, particularly with the global downturn keeping demand low, inventories growing in the US, the world's biggest oil consumer, and the Organisation of Petroleum Exporting Countries likely to make further production cuts.

NAT chief executive officer Herbjorn Hansson told business TV channel CNBC last week: "There may be muddy waters in the near term, but rates are excellent."

Yesterday, Goldman Sachs downgraded Bermuda-based Frontline, which is the world's largest owner of supertankers, to "sell" from "neutral", citing a weaker-than-average balance sheet and a likely drop in hire rates.

There will likely be a "sharp decline" in rental rates in the second quarter as ships stop storing oil at sea and Opec cuts output, analysts led by Hugo Scott-Gall in London wrote in a note.

The shares were added to the bank's "conviction sell" list, having previously been rated "neutral". The stock fell by around five percent in Oslo trading.

NAT's debt-free status means it has a clean balance sheet. It has a history of selling shares to raise capital in order to add to its fleet, instead of borrowing money, since it started with its first three tankers in 1997.

While it could be argued this has had the effect of diluting the value of shares for existing shareholders, the tanker acquisitions have added to earnings capacity, as well as dividends. The strategy is paying off handsomely during the ongoing credit crunch, with companies finding it difficult to borrow money.

NAT said last week it had gained $107 million in cash on January 15 this year from a follow-on share offering and also boasts an untapped $500 million credit facility.

According to a report by Morgan Stanley, published last week, the company offers a "safe harbour in a choppy tanker market".

"NAT is holding all the cards now, in our view and should greatly strengthen its relative position in a down market," the report stated.

Nordic American Tanker Shipping Limited is an international tanker company that now owns 15 modern double-hull Suezmax tankers averaging approximately 155,000 deadweight tons (dwt) each. It owns and operates crude oil tankers. The Company's fleet consists of 15 modern double-hull Suezmax tankers, of which two are newbuildings. These include Gulf Scandic, Nordic Hawk, Nordic Hunter, Nordic Voyager, Nordic Freedom, Nordic Fighter, Nordic Discovery, Nordic Saturn, Nordic Jupiter, Nordic Apollo, Nordic Cosmos and Nordic Moon. Source: Wikinvest.com

Disclosure: No positions in NAT