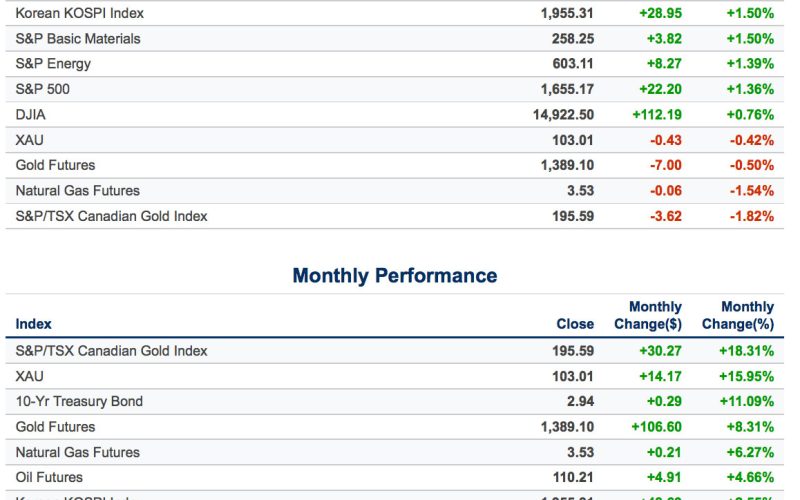

The tables show the weekly, monthly and quarterly performance statistics of major equity and commodity market benchmarks.

Related Posts

Breadth Is Back — But It’s Not the Story Most Investors Think It Is

Schwab's Liz Ann Sonders and Kathy Jones on markets, policy, productivity, and what’s really powering returns beneath the surface

Don’t Rely on the Seer of Seers

Doug Drabik discusses fixed income market conditions and offers insight for bond investors.

New year, same rotation

ClearBridge Investments believes a further continuation of late 2025’s broadening earnings delivery and accompanying market leadership rotation is likely given the underlying fundamental drivers.

Gold, Silver, and the Anatomy of a Crowded Trade

Liz Ann Sonders on Volatility, Positioning, and Why Precious Metals Are No Longer “Sleepy” Assets.

2025’s Implications for the Future: “Some Like it Hot"?

by Jim Masturzo, Research Affiliates Key Points The shift away from the low-rate, low-inflation environment of the past…

How U.S. midterm elections may affect markets

by Matt Miller and Chris Buchbinder, Capital Group With everything happening in the world — from the U.S.…

The Market Cycles Potentially Driving 2026 Returns

by Lance Roberts, RIA Market cycles are once again at the center of the investment narrative as we…

A Touch of Grey During Earnings Season So Far

Earnings results are shaping up to be quite solid this season, albeit a bit weaker relative to prior quarters when it comes to beat rates and price reactions.