Speaking of hikes…

by Blaine Rollins, CFA, 361 Capital

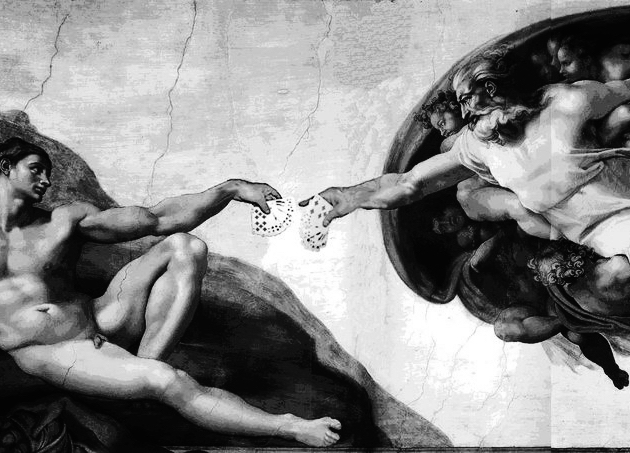

Since it is the end of August, all financial eyes will turn to Jackson Hole for the annual Fedspeak. While it seems like we get plenty of Fedspeak during the rest of the year, it typically takes on an extra level of importance when so many Fed members are gathered together and wearing jeans and open collared shirts. In the run up to this week’s events, we have had plenty to chew on including a new Fed paper suggesting that the inflation target should be raised, and some members suggesting that most datapoints have recovered to the point where rates could be raised. The market is still suggesting that a Dec/Feb/Mar rate hike is a coin flip, so it seems to be as undecided as the Fed. Yellen is the final voice so maybe we will get some strong guidance from her on Friday. Bulls will be hoping that the only hike she has on her mind is the one that starts with long laces and sunscreen.

Meanwhile, the boring equity markets continue to drift…

While a short-term pullback may still be in the cards, the lack of new 52-week lows shows little significant pressure to the downside. Buyers are still in charge right now.

Seasonally, the market has one more month before the true Q4 buying strength begins…

Sell in May and go away looks to be busted for 2016. The summer wasn’t that bad for U.S. equity investors. You got your beach time and made money in stocks at the same time. Just forget about that one stressful Friday in late June.

An amazing chart of realized volatility which illustrates how paint dries on the NYSE…

@DriehausCapital: ICYMI: Over past 5 yrs there’s 1 day where realized 30-day #volatility on $SPX is lower than it is today—7/2/14. KCN

But while volatility is lacking, the Nasdaq Composite will be working on its 9th straight weekly gain which hasn’t occurred since 2009…

Looking at the rest of the market, there are several other areas of large outperformance as the S&P 500 goes nowhere…

A significant bounce in Energy as the U.S.$ feels pressure. Also higher risk cyclicals like Semis, Banks, Transports and Materials seeing buyers. Small Caps again performing well. To the downside, sellers continue to lighten Utilities, REITs and Precious Metals.

(Priced on 8/19/16)

As Energy stocks made new 2016 highs last week, the BIG money has been made in Energy-distressed debt…

Distressed-debt investors largely abandoned the industry last fall after early bets soured. Crude fell to as low as $27.30 a barrel in February, and even the highest-ranking debt of energy producers—first in line for repayment in bankruptcy—fell to discounted levels.

As the slump heads into its third year, private-equity firms are starting to spend the tens of billions of dollars they raised for energy investments. WL Ross, Apollo Global Management LLC, Oaktree Capital Group LLC and other investors that specialize in distressed debt are targeting the troubled producers that might be forced to hand over control to creditors.

(WSJ)

Back to the Fed, expect to hear talk in Wyoming about raising the inflation target…

Central banks need to consider aiming for a higher inflation target as they boost their room for manoeuvre in the context of a sluggish economic environment, a senior Federal Reserve policymaker has said.

John Williams, the president of the Federal Reserve Bank of San Francisco, said the current 2 per cent inflation target is not well suited to an economy with a depressed natural interest rate — the rate consistent with an economy operating on an even keel.

“There is simply not enough room for central banks to cut interest rates in response to an economic downturn when both natural rates and inflation are very low,” he said. A higher inflation target “would imply a higher average level of interest rates and thereby give monetary policy more room to manoeuvre.”

Talk of higher inflation was not friendly to the U.S. Dollar last week…

This week is important for the Dollar. A 2% lower move would set a 20-month low which could cause many ripples.

A shaky U.S. Dollar would have a more positive impact on Gold which has already put together a good 2016 return…

A weaker U.S. Dollar would also benefit BlackRock which sees more opportunities outside of the U.S…

If you had bought the peaks in this chart, your Equity portfolio has probably done well…

If you are looking for a lid for U.S. interest rates, just look to Japan…

As Japanese rates dove into negative territory, foreign bond buying accelerated. Likely the same thing is occurring in Europe as the Central Banks take their rates negative.

“Did I say Two and Twenty? How about One and Fifteen?”…

Investor redemptions for the entire hedge-fund industry totaled $20.7 billion over the three months through July, according to Eurekahedge. In the same period, long/short funds had $18.4 billion withdrawn. An estimated $6.6 billion flowed out of long/short funds last month alone…

How many years until “The Big Short” falls off the cable/streaming channel rotation?

The consumer has not forgotten about the 2008 financial crisis and is being slow to use the primary residence as a piggy bank. Good for them, but bad for retailers and others dependent on discretionary consumer spending. If consumers become more comfortable about their jobs and the economy, this could be fuel for growth in the future. Until then, it will build.

The suburb just south of our office is now offering free weekday Lyft rides to get to the light rail stations…

“Lyft is committed to working with cities and transit to be a first and last mile transportation solution, which is why we are thrilled to partner with Centennial to offer free Lyft Line rides to and from the station,” Lyft General Manager Gabe Cohen said. “We expect many other cities in Colorado and across the country to follow the innovative leadership of the city of Centennial.”

Lyft and Centennial are teaming up on the six-month pilot program, hoping it will prompt people to forego using their cars in favor of the Regional Transportation District’s light rail line along Interstate 25. The service will be limited to those who live and work in the current RTD Call-n-Ride service area, a section of Centennial west of I-25, between Arapahoe and County Line roads.

The free service will run from 5:30 a.m. to 7 p.m. Monday through Friday.

Pittsburgh is going one step further by offering free self-driving Ubers…

Starting later this month, Uber will allow customers in downtown Pittsburgh to summon self-driving cars from their phones, crossing an important milestone that no automotive or technology company has yet achieved. Google, widely regarded as the leader in the field, has been testing its fleet for several years, and Tesla Motors offers Autopilot, essentially a souped-up cruise control that drives the car on the highway. Earlier this week, Ford announced plans for an autonomous ride-sharing service. But none of these companies has yet brought a self-driving car-sharing service to market.

Uber’s Pittsburgh fleet, which will be supervised by humans in the driver’s seat for the time being, consists of specially modified Volvo XC90 sport-utility vehicles outfitted with dozens of sensors that use cameras, lasers, radar, and GPS receivers. Volvo Cars has so far delivered a handful of vehicles out of a total of 100 due by the end of the year. The two companies signed a pact earlier this year to spend $300 million to develop a fully autonomous car that will be ready for the road by 2021…

Over the past year and a half, the company has been creating extremely detailed maps that include not just roads and lane markings, but also buildings, potholes, parked cars, fire hydrants, traffic lights, trees, and anything else on Pittsburgh’s streets. As the car moves, it collects data, and then using a large, liquid-cooled computer in the trunk, it compares what it sees with the preexisting maps to identify (and avoid) pedestrians, cyclists, stray dogs, and anything else. Bridges, unlike normal streets, offer few environmental cues—there are no buildings, for instance—making it hard for the car to figure out exactly where it is. Uber cars have Global Positioning System sensors, but those are only accurate within about 10 feet; Uber’s systems strive for accuracy down to the inch.

Copyright © 361 Capital