10-yr Treasury yields have jumped 100 bps in the past 5 months, 30-yr fixed-rate mortgages are up almost 70 bps since August (to 4.0%), and the bond market is convinced that the Fed will raise short-term interest rates to 0.75% at its meeting next week. A good part of the rise in 10-yr yields since their all-time low back in early July was due to an improvement in the economy's fundamentals (GDP growth in the third quarter was 3.2%, up from 1.4% in the second quarter), whereas a little over half of the rise in yields has occurred since Trump's surprise election victory. A further breakdown of the rise in yields reveals that about half was due to stronger growth expectations (real TIPS yields are up about 50 bps), and half was due to higher inflation expectations (which are now up to 1.9-2.0% for the next 5 and 10 years).

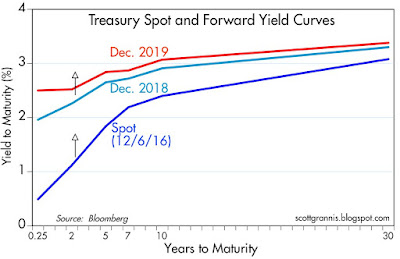

So it would appear that interest rates are well on their way to normalizing, right? Well, not exactly. According to the implied pricing of the Treasury curve, the bond market is expecting only a gradual rise in note and bond yields over the next several years—less, in fact, than what has occurred in the past 5 months. Whether this is reasonable or not is the issue confronting investors today. If rates end up rising by more or by less than the market currently anticipates, that could have a big impact on interest-sensitive sectors such as utilities and real estate, both of which have already been hit by the recent and unexpected rise in rates.

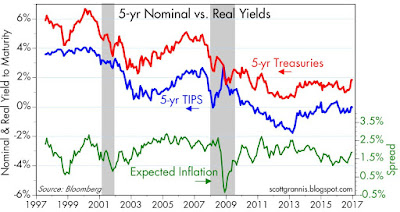

Now let's put these rates in context. As the chart above shows, 5-yr Treasury yields not too long ago were as high as 5%, at a time when core CPI inflation was funning at 2.5-3% and real GDP growth was 2.5-3%. If that was "normal," then today's 1.8% 5-yr yields should be almost 200 bps higher, given the current level of core CPI inflation.

The current level of real and nominal 5-yr Treasury yields (see chart above) tell us that the market is expecting CPI inflation to average about 1.9% per year over the next 5 years. It's unusual, to say the least, for nominal 5-yr yields (currently 1.8%) to be less than the expected future inflation rate over the next 5 years. "Normally," nominal 5-yr yields are 1 or 2 percentage points above expected inflation. Inflation expectations seem reasonable (the core CPI has increased almost 2% per year over the past 10 years), but the level of nominal and real yields seems unusually low, despite their recent jump. This suggests that the market is still priced to miserably low growth expectations. Which further suggests that if Trump's economic plan ends up providing the economy with a significant boost, it's fair to say the market will be quite surprised, and yields will move significantly higher.

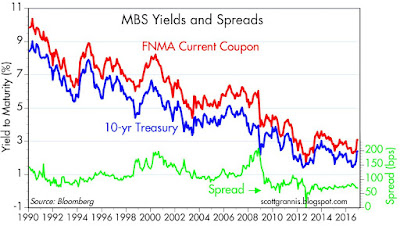

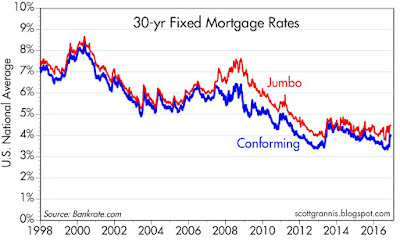

The charts above show how the recent move up in 10-yr Treasury yields has affected 30-yr fixed mortgage rates, which are up about 70 bps from their recent, all-time lows. Mortgage rates are still very low from an historical perspective. They were much higher when the housing market was booming in the early 2000s.

Even with the recent jumps in interest rates, and the Fed's almost certain hike in short-term rates next week, it appears that interest rates are still very low and not expected to rise much more in coming years. If you believe there is a decent chance that Trump's economic policies could get the economy back on a healthier growth track, then you need to be very worried about further unexpected rises in interest rates.

While higher-than-expected increases in 5- and 10-yr Treasury yields would definitely be bad news for bond investors, they would not necessarily be bad news for interest-sensitive sectors of the economy. That's primarily due to the fact that higher-than-expected interest rates would most likely come hand in hand with stronger-than expected growth and possibly higher-than-expected inflation. The negative impact of higher than expected rates on the real estate market, however, could be substantially mitigated by the positive effects of stronger growth and higher inflation. It's not obvious, in other words, whether real estate investors should be worried about higher interest rates. Ditto for the utility sector, where prices have already discounted further hikes in interest rates, but not a further strengthening of the economy.

The key thing to keep in mind is this: if interest rates rise by more than expected, it will almost surely be because growth and/or inflation prove to be stronger than expected. Higher interest rates aren't a threat to growth, because stronger growth will boost interest rates.

Copyright © Scott Grannis