by Erik Swarts, Market Anthropology

As if greater transparency could cloud their collective vision any more, a dissonant stream of consciousness has once again begun to seep, from regional Fed bank presidents far and wide. Granted, when we say dissonant, we could also be referring to the same Fed bank president, who perhaps Monday suggested we entirely rethink conventional monetary wisdom and set higher inflation targets – to his concerns Thursday, that "If we wait until we see the whites of inflation's eyes, we don't just risk having to slam on the monetary policy brakes, we risk having to throw the economy into reverse to undo the damage of overshooting the mark"? Suffice to say, there’s little clarity or rest for weary Fed beat reporters, as the markets look towards the main even next week in Jackson Hole.

To be honest, we’re not sure at this point which ultimately will be more painful to watch: falling down the well eight years back or posturing Shakespeare every month or so - to hike or to not hike us out. Perhaps, ‘tis nobler in the mind to suffer… than take arms against a sea of troubles? Suffer we have, although the truth has always been that the markets return from the trough would likely be a painfully long process, despite conventional wisdom that looked towards more contemporary tightening cycles for example. In this regard, score one for Monday's "Good Cop Williams", who appears to approach the situation in better context and with more realistic expectations. Lower for longer indeed, even if Thursday's "Bad Cop Williams" bucket slowly rises – if only to take the slack out of the line as the water level gradually climbs.

With Yellen’s speech on deck next Friday and with the September Fed meeting just a few weeks thereafter, markets are headed towards a rather charged environment when it comes to policy expectations – one that could easily disappoint or further confuse. Speaking of which, we’re reminded of the dog days of 2012, when then Chairman Bernanke in his Jackson Hole speech described the fledgling state of the US labor market and the apparent lack of efficacy of current monetary policy in addressing said concerns.

"The stagnation of the labor market in particular is a grave concern not only because of the enormous suffering and waste of human talent it entails, but also because persistently high levels of unemployment will wreak structural damage on our economy that could last for many years." - Monetary Policy since the Onset of the Crisis 8/31/12

In hindsight, Bernanke’s speech built out the case for further easing that September and what eventually became a massive open-ended QE3 program later that year. Following Jackson Hole, precious metals and commodities enjoyed the greatest bid in the markets through September, as participants continued to see a causal relationship between stimulus and inflation. By their calculus, you only needed to look back at the hint of QE2 in Bernanke’s Jackson Hole speech in 2010 and the subsequent performance of assets closely tied to inflation to see the connection.

Back then, although we had anticipated the rally in precious metals would materialize that summer (see Here), we approached the performance parallels with previous QE with significant skepticism (see Here) to even an intermediate-term outlook. From our point of view, the markets were simply in a different part of the cycle where the impetus of stimulus was significantly less benevolent towards commodities and assets sensitive to inflation.

- The commodity markets, that have rallied so fervently this summer in anticipation of another bolus by the Fed, the ECB and the PBOC - will need to overcome the notion of "pushing on a string", that was not nearly as applicable in 2010 - as it is today. It is my belief, based on my comparative work with the US dollar, the Australian dollar and the CRB, that the commodity rally ignited this summer will fail - and fail as prominently as the equity markets faired to the aggressive monetary policy regimes enacted by the Fed at the end of 2007. Back then, market psychology quickly pivoted from - "Don't fight the fed!" to "the Fed is pushing on a string!" - almost overnight. – A Lucid Confusion 9/17/12

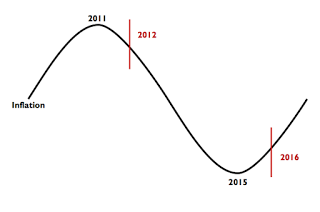

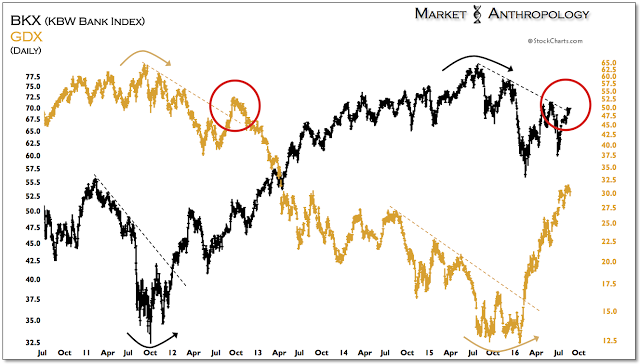

What we find particularly interesting today when it comes to cycles and the intersection of policy, expectations and the markets – is the inverse symmetry of where we currently reside relative to that period and with respect to inflation. This perspective is also framed by the chart of the banks and the gold miners we’ve followed this year, that depicts a mirrored performance pattern primarily driven by trends in the dollar, inflation and hence – the direction of real yields (see recently Here).

What we find particularly interesting today when it comes to cycles and the intersection of policy, expectations and the markets – is the inverse symmetry of where we currently reside relative to that period and with respect to inflation. This perspective is also framed by the chart of the banks and the gold miners we’ve followed this year, that depicts a mirrored performance pattern primarily driven by trends in the dollar, inflation and hence – the direction of real yields (see recently Here).

Long story short, we believe real yields will have further to fall, which consequently should support the performance trends of precious metals and commodities and continue to pressure assets such as the financials. When all’s said and done, the reality is the potential reach of inflation today is likely greater than what the Fed or the market is ultimately willing to stomach in raising rates. In the end, we expect "Good Cop Williams" and his San Francisco Fed's approach towards policy to win out, even if the bucket rises by another 25 basis points this year and the drift towards consensus continues to be more reactionary and forced by the markets – as it has been over the past two years.

How Yellen’s speech is received by the markets over the short-term is anyone’s guess. But following the behavioral cues from the miners in 2012 that has closely mimicked the seasonal performance structure of the financials today – the banks and equity markets may have a bit further room to run into September before the rally exhausts. Notice the trend line break in the miners going into that fall and the subsequent failure into Q4. The KBW Bank Index currently sits above a similar trend line break. Extrapolating the intermarket tea leaves a bit further, this would likely coincide with an extension of the nascent rally in yields as well as a minor retracement rally in the dollar. Moreover, these conditions could present another short-term high for precious metals over the next week or so followed by what we suspect would be the final major retracement decline for precious metals this year.

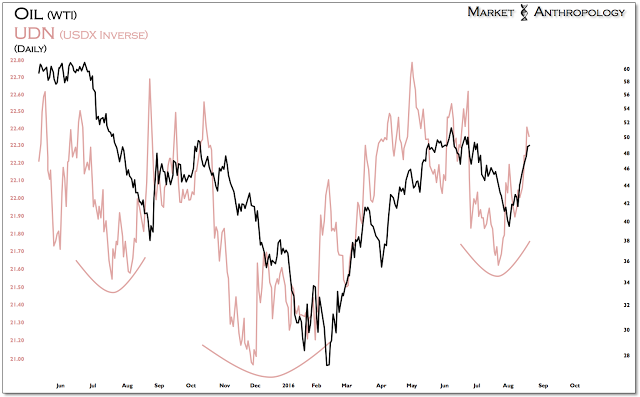

When it comes to the dollar and oil, oil followed the dollar’s pivot (see Here) higher from July as it has over the past year and is now working on the shoulder of the broad reversal we suspect will eventually resolve with fresh 52-week highs later this year.

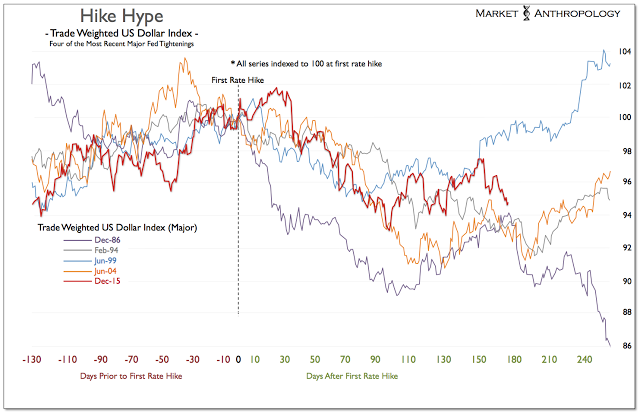

As for the dollar itself, although it remains bracketed by the range of previous major tightening regimes, ultimately, we believe it will continue along a weaker performance pattern, such as the profiles from 1994/1995 and 1986/1987. While into September we expect another minor retracement rally to develop, conditions needed to sustain the move should prove ephemeral and we continue to look for another leg down into Q4.

Copyright © Market Anthropology