by LPL Research

In this week’s Bond Market Perspectives, we looked at the impact of rising rates on several bond sectors. It was clear that areas of the market with lower yields and longer maturities saw the largest losses during periods of rising rates, but what happens when rates stop rising?

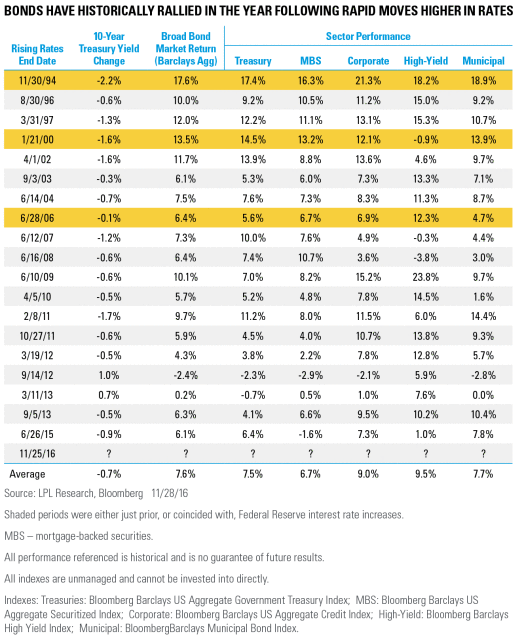

The most common outcome (going back to 1994, at least) has been that bonds rallied over the next year, with the 10-year Treasury yield falling an average of 0.7%, and the Barclays Aggregate Bond Index gaining an almost equity-like return of 7.6%. High-yield bonds, which were one of the most resilient asset classes during periods of rising rates, were also the largest gainers in the following year, with an average return of 9.5% (according to the Barclays High Yield Index). Corporate bonds, which haven’t performed as well historically in rising rate environments given their longer duration (a measure of interest rate sensitivity), also saw an average return of 9.0% in the year after, according to the Barclays Aggregate Credit Index.

Only two out of 19 periods surveyed, those ending in 2012 and 2013, saw rates rise further in the year following a selloff in the 10-year Treasury. Will this time buck the trend and see rates continue to increase?

Hopes of less regulation and a more business-friendly climate have led markets to price in a stronger growth trajectory, along with higher inflation, under the incoming Trump administration. These factors, combined with the potential impacts of fiscal stimulus and Federal Reserve rate hikes mean that rates could rise further (see our Outlook 2017: Executive Summary for more detail). However, it is also important to balance this against two factors: 1) overseas growth remains slow; and 2) loose policy from major foreign central banks is continuing to keep rates low (or even negative) overseas, which may continue to keep U.S. rates lower than they otherwise would be.

Interest rate moves are important and can clearly have an impact on bond prices in the short term. However, it is also important to keep in mind that patience often pays off in bond investing, as interest payments are the major driver of bond returns over the long term.

IMPORTANT DISCLOSURES

Past performance is no guarantee of future results.

The opinions voiced in this material are for general information only and are not intended to provide or be construed as providing specific investment advice or recommendations for any individual security.

The economic forecasts set forth in the presentation may not develop as predicted.

Investing in stock includes numerous specific risks including: the fluctuation of dividend, loss of principal and potential illiquidity of the investment in a falling market.

Bonds are subject to market and interest rate risk if sold prior to maturity. Bond values and yields will decline as interest rates rise, and bonds are subject to availability and change in price.

Government bonds and Treasury bills are guaranteed by the U.S. government as to the timely payment of principal and interest and, if held to maturity, offer a fixed rate of return and fixed principal value. However, the value of fund shares is not guaranteed and will fluctuate.

Municipal bonds are subject to availability, price, and to market and interest rate risk if sold prior to maturity. Bond values will decline as interest rate rise. Interest income may be subject to the alternative minimum tax. Federally tax-free but other state and local taxes may apply.

Mortgage-backed securities are subject to credit, default risk, prepayment risk (that acts much like call risk when you get your principal back sooner than the stated maturity), extension risk, the opposite of prepayment risk, and interest rate risk.

Corporate bonds are considered higher risk than government bonds but normally offer a higher yield and are subject to market, interest rate, and credit risk as well as additional risks based on the quality of issuer coupon rate, price, yield, maturity, and redemption features.

There is no guarantee that a diversified portfolio will enhance overall returns or outperform a nondiversified portfolio. Diversification does not ensure against market risk.

Because of their narrow focus, specialty sector investing, such as healthcare, financials, or energy, will be subject to greater volatility than investing more broadly across many sectors and companies.

The Barclays U.S. Aggregate Bond Index is a broad-based flagship benchmark that measures the investment-grade, U.S. dollar-denominated, fixed-rate taxable bond market. The index includes Treasuries, government-related and corporate securities, MBS (agency fixed-rate and hybrid ARM pass-throughs), ABS, and CMBS (agency and non-agency).

The Barclays U.S. Corporate Index is a broad-based benchmark that measures the investment-grade, U.S. dollar-denominated, fixed-rate, taxable corporate bond market.

The Barclays U.S. Municipal Index covers the USD-denominated long-term tax-exempt bond market. The index has four main sectors: state and local general obligation bonds, revenue bonds, insured bonds, and prerefunded bonds.

The Barclays U.S. Treasury Index is an unmanaged index of public debt obligations of the U.S. Treasury with a remaining maturity of one year or more. The index does not include T-bills (due to the maturity constraint), zero coupon bonds (strips), or Treasury Inflation-Protected Securities (TIPS).

The Barclays U.S. Aggregate Securitized MBS Index tracks agency mortgage backed pass-through securities (both fixed-rate and hybrid (ARM) guaranteed by Ginnie Mae (GNMA), Fannie Mae (FNMA), and Freddie Mac (FHLMC).

The Barclays U.S. Aggregate Credit Index is a broad-based benchmark that measures the investment-grade, U.S. dollar-denominated, fixed-rate, taxable corporate bond market.

This research material has been prepared by LPL Financial LLC.

To the extent you are receiving investment advice from a separately registered independent investment advisor, please note that LPL Financial LLC is not an affiliate of and makes no representation with respect to such entity.

Not FDIC/NCUA Insured | Not Bank/Credit Union Guaranteed | May Lose Value | Not Guaranteed by any Government Agency | Not a Bank/Credit Union Deposit

Securities and Advisory services offered through LPL Financial LLC, a Registered Investment Advisor Member FINRA/SIPC

Tracking #1-560616 (Exp. 12/17)

Copyright © LPL Research