The median price of a US single-family home has risen just over 40% since the last housing-market crash. While newspaper headlines may put readers on edge, our analysis indicates a gradual slowdown, not a bursting bubble—in most regions.

That’s largely because inventories remain tight and future demand looks healthy. Some market observers worry that recent declines in new and existing home sales are a possible warning of an impending crash. But we’ve done a deep dive into the market’s fundamentals to better understand the risks. The result? We believe the recent slump in home sales is due to lower housing affordability.

All About Affordability

Housing affordability declined in 2018 because of higher home prices and rising mortgage rates. Could this be a sign of an impending secular decline in home prices?

We don’t think so. We view today’s reduced affordability as a speed bump instead of a cliff. That’s because housing affordability is a function not only of mortgage payments but also of income. And income has been rising as the economy continues to chug along. Over time, this should help to moderate the negative effect of higher mortgage payments.

Furthermore, the decline in housing affordability hasn’t been massive. Homes are still more affordable than they were between 1999 and 2003, which was a healthy period in the housing market. And they are only moderately less affordable than between 2013 and 2016, which some observers consider the new normal.

That said, affordability could continue to decline as mortgage rates rise. If mortgage rates rise another 1.4%, for example, while home prices and income both hold steady, affordability will likely return to its 1999–2003 average.

Assessing Supply

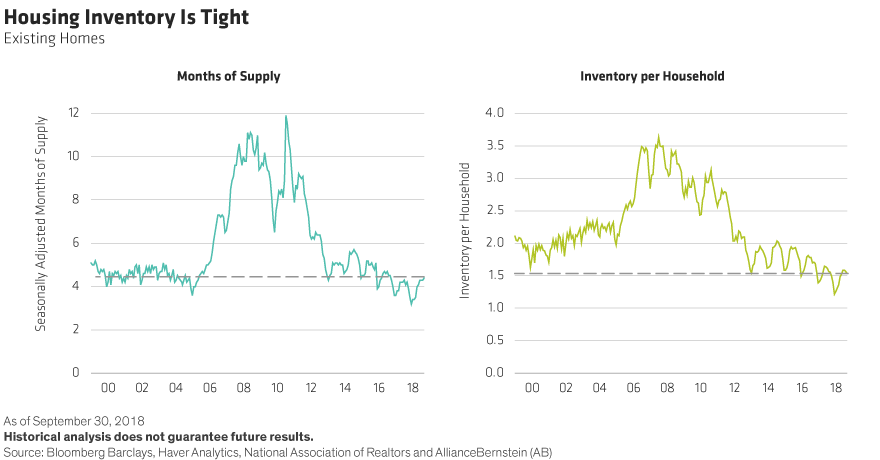

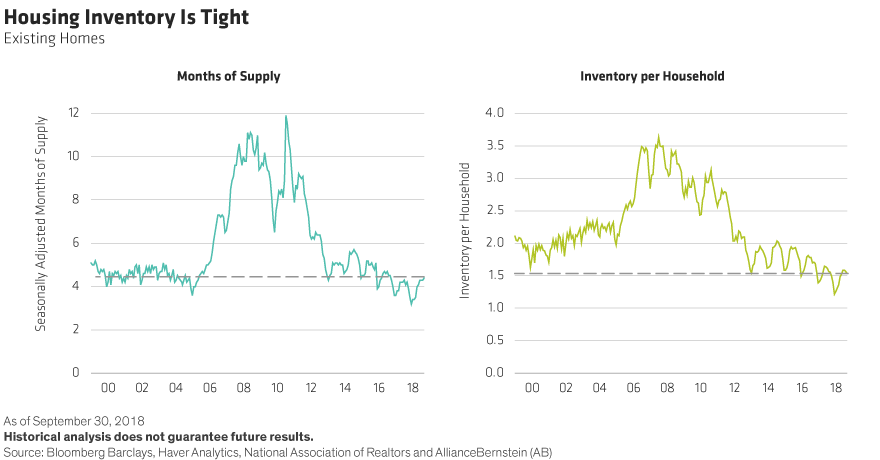

If declining affordability is leading to lower home sales, the next question is whether lower home sales are leading to increased inventories. Such excess supply contributed to the last housing downturn.

Thankfully—and importantly—we aren’t seeing that today. Instead, supply remains tight.

It’s true that the inventory of new unsold homes recently reached seven months, its highest level since 2011. But there’s no drama in this figure. Even with the increase, new-home inventory remains at healthy levels and only slightly above its 50-year average of 6.2 months.

Why the difference between the last downturn and today? We saw a lot of speculative building leading up to the housing crisis, when builders were constructing homes without knowing future demand. Home developers are far more cautious now, having been burned so recently. They’re building to visible demand instead.

Supply is even tighter for existing homes (Display). Many existing homeowners are choosing to stay in their homes because upgrading to a new home has become more expensive. In turn, the extremely tight inventory of existing homes puts further upward pressure on home prices.

Millennials to the Rescue

While supply is supportive of home prices, we still must consider demand. We believe that demand will remain supportive too.

Population demographics will help the market over the next few years. Many millennials are approaching the age of a first-time home buyer. Of course, not all of them will want to buy a home. But even if the millennial generation purchases homes at a lesser rate than previous generations, it will translate into a significant increase in demand, thanks to the generation’s sheer size.

In addition, demand for shelter is now skewed toward ownership, which has outpaced renter formation for seven consecutive quarters. The sharpest recent increase in the homeownership rate came from buyers under the age of 35.

Given these various outlooks for affordability, supply and demand, we expect home prices to continue to rise over the next few years—albeit at a slower pace. We anticipate US home-price growth of 3% to 4%, versus the 6% rate of the past several years.

Some Regions Are More at Risk

Unfortunately, our expectation for a slowdown in home-price growth rather than a correction is at the national level. Regionally, we think we could see minor corrections.

Localities that have witnessed the biggest increases in home prices—especially relative to income—are most vulnerable. Also, the 2017 tax reform bill included a cap on the deductibility of state and local income taxes. This reduces homebuyers’ effective income in highly taxed areas, which in turn makes higher-priced homes less affordable for them.

Lastly, overseas investments can also affect home prices. Flows from Chinese investors have decelerated since China started to implement capital controls, dampening prices in regions popular for such investments.

Because of all these factors, regions that could see a minor correction in home prices include Seattle, San Francisco, and New York City and its surrounding areas.

Mortgage Sector Remains Attractive

For investors in bundled residential mortgage debt—whether agency-issued mortgage-backed securities (MBS) or credit risk–transfer (CRT) securities—there is yet another fundamental factor to be considered: average borrower quality.

Borrower quality for these types of debt reflects not only a robust labor market—marked by both high employment and rising wages¬—but also very strict underwriting standards. That was not the case in 2006 and 2007, when many borrowers had no job, no income and no paperwork.

Investors who are worried about deteriorating borrower quality point to an increase in the average ratio of debt to income. This figure increased slightly from less than 35% two years ago to 37% today, as the growth of home prices and the resulting amount of mortgage debt outpaced income growth.

We acknowledge rising debt-to-income ratios as a risk factor, but we see other mitigating factors, for now. For instance, the average credit score remains stable: in the last two years, it dropped just two points, to 749.

Additionally, the mortgages included in agency MBS and CRTs have minimal risk layering, which describes multiple high-risk metrics accompanying an individual loan. In other words, these mortgages avoid borrowers with any combination of more than one high-risk metric: poor loan-to-value ratio, low credit score, and high debt-to-income ratio. Risk layering drove the high credit losses associated with many underlying loans in nonagency mortgage securities during the housing crisis. In contrast, today’s borrower fundamentals are solid.

Lastly, CRT investors can take advantage of dynamics across vintages, or dates of issue. For example, rising home prices add value for existing homeowners, making them more likely to stay current on their payments. This is especially true for mortgage securities issued between 2014 and 2017, as these securities have more home-price appreciation built in than securities issued in 2018. They also offer more attractive risk-adjusted yields than newer vintages.

In an environment of low but rising yields, investors need income, and as many diverse sources of income they can find. CRTs help answer that need. Not only do they provide a different set of fundamentals from corporates or emerging markets, but their floating-rate income has added appeal as rates trend higher.

With no correction in sight for US housing, investors who back out of the mortgage market today may find themselves regretting the lost income.

The views expressed herein do not constitute research, investment advice or trade recommendations and do not necessarily represent the views of all AB portfolio-management teams.

Copyright © AllianceBernstein