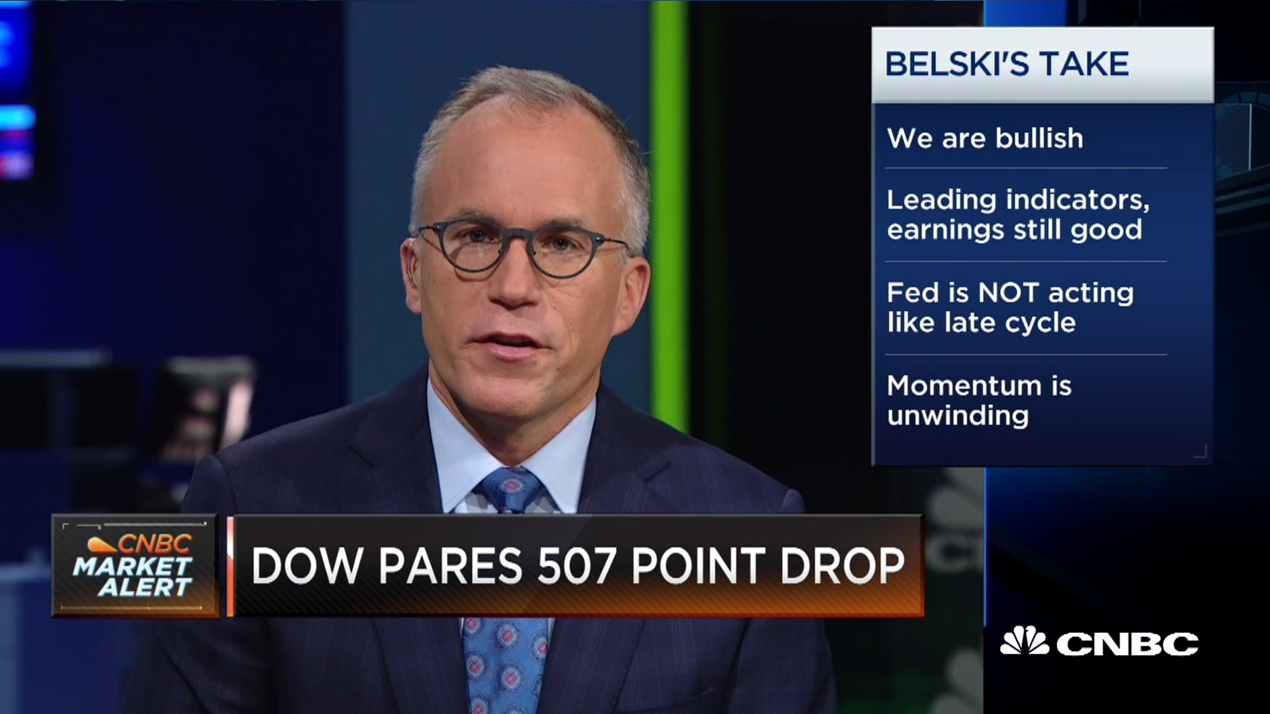

Brian Belski, Chief Investment Strategist at BMO Capital Markets, and Chad Morganlander, Portfolio Manager at Washington Crossing Advisors discuss how worried people should be about the volatility in today's markets.

Belski says that they are bullish, leading indicators and earnings still look good, the Fed is NOT acting as though we are late in the cycle, and that momentum is unwinding. Belski also stated that he hates the term "risk assets" used to describe stocks.

"Equities is where we need to be, in particular U.S. equities. U.S. stocks are on sale, and the more fundamental you are, the more you believe that the stock market is a market of stocks," said Belski. "Stop looking at ETFs only. Banks for example, are giving you a generational opportunity, banks are not going away, and U.S. financials, especially the big ones. We believe this day too shall pass (speaking of December 10th's big market drop)."

Morganlander says that both the U.S. and global economies are slowing down in a moderate fashion, and the Fed will PAUSE after the December rate hike - but they will take a wait and see approach to see how the rest of the world is reacting - with credit slowing, and global trade slowing, that has a meaningful impact. He thinks that overall, the U.S. economy is moderately decelerating, they have a glidepath over the long run of 2.5%, vs. the Fed's less optimistic 1.75%, and because of all these variables, future rate hikes will be conditional upon financial conditions. So, one more rate hike and then question mark.

Belski adds that markets have been behaving as though we are headed for a recession, but counters that stating that "the markets' discounting mechanism has been broken" for as many as 36 months. Slowing down to a growth rate of 1.75% is not a recession.

"We've been so macro-oriented we've forgotten how to pick stocks," commented Belski.

There's a more extended discussion in this segment so stay tuned.