“Tops are a process, bottoms are an event.” – Wall Street adage

It is remarkable to me how, as Divine Ms. M puts it, “There is nothing like price to change sentiment.”

Some of the same people in the business media who were Bearish last Thursday (well, even Tuesday), are now Bullish based on a Federal Reserve who said (and always has been) data dependent.

It is amazing to me how so many investors mark-to-market their market views on an increasingly short term basis. However, to this analyst, a one day (or even three day advance) doesn’t reestablish a “confirmed uptrend” when the signposts of a more meaningful market topping process are still likely intact.

The question at hand this morning is whether it is wise to follow yesterday’s remarkably strong advance (the second best gain of the year) and to conclude that all is safe?

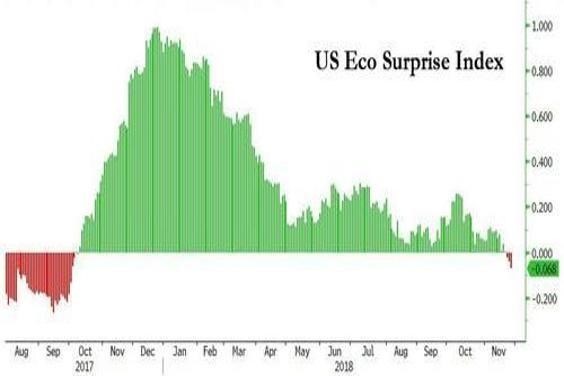

From my perch, that would be foolish – based on the core problem facing the global economy. That is, growth is slowing… and that the slowdown is accelerating. Indeed, for the first time since September, 2017, the Bloomberg Economic Surprise Index has turned negative – as housing (the President blew up the residential real estate market with his tax bill!!), core durable goods, industrial production, jobless claims, consumer sentiment and regional Fed manufacturing data disappoints:

Source: Zero Hedge

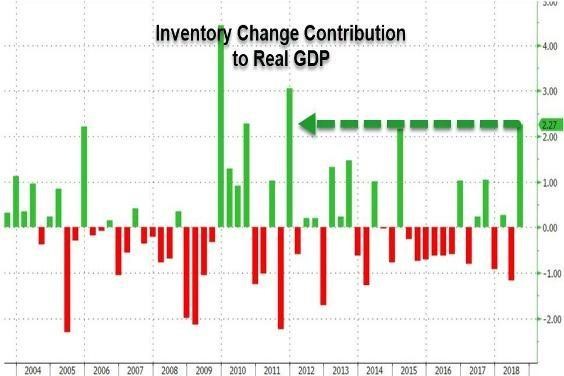

There was less than meets the eye in the 3Q GDP print – as if we take out inventory growth (the largest rise in seven years), growth in real GDP would have been under +1.25%.

Source: Zero Hedge

We only have to look at the yield on the ten year U.S. note (which seems likely to break 3% shortly) to see how the fixed income markets are envisioning such an economic growth slowdown. (Remember in my 15 Surprises for 2019 I am looking for a 2.25% low yield in the first half of next year!) Moreover, the price of crude oil just broke below $50/barrel (to $49.80) – another indicator of moderating economic growth.

Meanwhile, how quickly investors have forgotten the current pivot in monetary policy with the Fed’s balance sheet still shrinking by $50 billion per month and the ECB only one month away from ending QE.

Here are some relevant tweets from Rosie (David Rosenberg at Gluskin Sheff):

- The irony with Powell is what history tells us about what happens when the Fed pauses. The inevitable recession starts six months hence. The bulls should pray he has reason to keep tightening

- But a market that is so hitched to every word or nuance a central bank official has to say cannot possibly be viewed as a particularly healthy one.

- Before Powell’s remarks, we had 37% of investors betting on at least three Fed hikes for 2019 and that was dialed down to 32% by the end of the day. How that translates to a 617 point surge in the Dow truly is anyone’s guess.

- Here’s how you know the stock market is way over-reacting to Powell – the one security that should have screamed “rally!” based on any dovish Fed is the 2-year T-note…and the yield is down a grand total of 2 basis points today??

- Powell blinked! The gap between being “a long way” from neutral to being “just below” was a measly 25 basis points! Who knew?

That Powell blinked (slightly) and the Federal Reserve has come to the same recognition as some of us bears on the economy does not seem supportive of the degree of enthusiasm seen in the markets on Wednesday.

In “Yell and Roar and Sell Some More“, I wrote:

“On the spectacular market strength post the Powell comments, I have continued to fade the machines, algos and price momentum based strategies that “buy high and sell low” today.

This counter punching (both on the downside when I bought and on the upside when I am now selling) got me to the dance – and I am not changing my tactics nor am I changing my tactical approach to the market based on the difference between the current S&P level relative to the expected trading range for the S&P Index which has resulted in an increasingly unattractive reward v. risk.

I may be wrong, but, in my view, the Fed wasn’t likely going to be aggressive in 2019 based on the deterioration in domestic economic fundamentals I have frequently pointed to in my Diary. In fact, my Surprise List for 2019 incorporates NO rate hikes. Rather I see a rate cut in the second half to be followed by another round of quantitative easing as GDP turns negative.

I am holding on to ALL of my individual longs but I continue to build up my (SPY) short.”

Tactically and despite the strength exhibited at this time of the season I began to hedge my medium-sized long exposure yesterday afternoon – by shorting Spyders (SPY) , on average at a price of about $273.50 (I scaled that short from $272.30 to $274.30). This put me back to market neutral in exposure.

S&P cash closed on Wednesday at slightly over 2740 (SPY equivalent of $274.50) and I plan to move back into a net short position on further strength towards the high end of my three to six months trading range of 2550-2775.

Bottom Line

There is little doubt that the dovish tilt provided by Fed Chair Powell lit the market’s fire.

But there is also little doubt that the move was exaggerated by market participants’ poor positioning and the dominance of passive strategies (ETFs and Quants) who exacerbate daily moves – similar to what happened on the day after the midterm elections (but that time, to the downside) when, in a quite similar image to Wednesday’s 60 point S&P advance, rallied from 2755 to 2813.

Despite the resounding rally yesterday, the backdrop of global economic and corporate profit growth is shaky and my baseline expectation is unchanged – the Fed will not hike interest rates in 2019 as Real GDP may display a stunningly swift descent over the next three quarters. So I am, frankly, nonplussed by Powell’s verbiage.

I would observe that with yesterday’s 600 point rise in the Dow Jones Industrial Average, the cumulative increase of all the up-days this year is nearly 22,000 points. The last time that happened was in the Bear Markets of 2000 and 2008.

Indeed, the S&P Index is still more than 5% lower than the last Powell comments weeks ago.

So the Dow pops 354 points – add up all the up-days in 2018 and they come to over 21,000 points. Last time we came close to that was in 2008 and before that 2000. In other words, these happen in bear markets!

To me, Wednesday’s rally was part and parcel of an important topping process that began in late January, 2018 fully described in July in “Tops are Processes and We May in That Process Now:”

“Tops are a process and bottoms are an event, at least most of the time in the stock market. If you looked at an ice cream cone’s profile, the top is generally rounded and the bottom V-shaped. That is how tops and bottoms often look in the stock market, and I believe the market is forming such a top now.

Consider the following fundamentally based issues and concerns:

* Downside Risk Dwarfs Upside Reward. I base my expected market view on the probabilities associated with five separate (from pessimistic to optimistic) projected outcomes that seize on a forecast of economic and corporate profit growth, inflation, interest rates and valuation. In the past I have suggested that this exercise is a guide and is not intended to be a precise calculation, especially in uncertain times. The averages recently have surpassed my expectations of a top in the trading range by about 120 S&P points, or about 4%. With the S&P 500 Index at 2923 at Friday’s close we are significantly above my calculation of intrinsic value.

* Global Growth Is Less Synchronized . The trajectory of worldwide growth is becoming more ambiguous. I have chronicled extensively the erosion in soft and hard high-frequency data in the U.S., Europe, China and elsewhere, so I won’t clutter this missive with too many charts. But needless to say (and as shown by these charts here and here), with economic surprises moderating from a year ago and in the case of Europe falling to two-year lows, we are likely at “Peak Global Growth” in the current quarter. (The data are even worse in South Korea, Taiwan, Indonesia and Thailand.)

* FAANG’s Dominance Represents an Ever-Present Risk. I have warned that earnings disappointments in the FANG stocks represents an immediate risk to this league-leading sector, and to the markets FANG has become GA! Since I initially wrote this article investors have been clearly rotating out of FANG, reflecting misses in important metrics (subs) and some lower broader guidance ahead. As well, the existential threat of increased regulation and antitrust hostility that I warned about nearly a year ago are now on the front burner.

* Market Structure Is One-Sided and Worrisome. Machines and algos rule the day; they, too, are momentum-based on the same side of the boat. The reality that “buyers live higher and sellers live lower” represents the potentially dangerous condition that investors face in a market dominated by passive investors — a threat I have focused on since early 2017.

* Higher Interest Rates Not Only Produce a More Attractive Risk-Free Rate of Return, They Also Make It Hard for the Private and Public Sectors to Service Debt. And over the last 2 1/2 months short-term interest rates have made a decisive move higher. This also serves to reduce the value of stocks as every dividend discount model incorporates a discount factor based on the current level of interest rates.

* Trade Tensions With China Are Intensifying and Mr. Market Is Improperly Looking Past Marginal Risks. From Goldman Sachs’ David Kostin (h/t Zero Hedge). Remember, as previously discussed, the dispute has buoyed second- and third-quarter U.S. GDP. The benefit soon will be over and a third-quarter economic cliff is possible.

* Any Semblance of Fiscal Responsibility Has Been Thrown Out the Window by Both Political Parties. This has very adverse ramifications , which shortly may be discounted in lower stock prices, especially as it relates to the servicing of debt — a subject I have written about often. Not only are our legislators acting irresponsibly and recklessly, but the Republican Party is now considering more permanent tax cuts. Should economic growth moderate, tax receipts diminish and undisciplined spending continue, stock valuations will likely continue to contract.

* Peak Buybacks. Buybacks continue apace, but look who’s selling. As Grandma Koufax used to say, “Dougie, that’s quite a racket!” If I am correct about the peaking in corporate profits, higher interest rates and slowing economic growth, we shortly will have another rate of change — negative in buybacks.

* China, Europe and the Emerging Market Economic Data All Signal a Slowdown. It’s in the early innings of such a slowdown based on any real-time analysis of the economic data. The rate-of-change slowdown on a trending basis is as clear as day. A rising U.S. dollar and weakening emerging-market economic growth sow the seeds of a possible U.S. dollar funding crisis. This slowdown has not gone unnoticed by investors, as emerging markets have declined absolutely over the summer, materially lagging the strength in the S&P index and the Nasdaq.

* The Orange Swan Has Returned. Again, hastily crafted policy delivered by Twitter that conflates politics is dangerous in a flat and networked world. The return of an untethered Orange Swan is market-unfriendly… brace yourselves as the Supreme Tweeter will likely “Make Economic Uncertainty and Market Volatility Great Again” (#MUVGA) This weekend’s allegations against the Supreme Court nominee likely raises the risks of more volatility and may jeopardize some elements of the administration’s agenda.

* We Are Moving Closer to the November Elections, With Their Uncertainty of Outcome and the Potential For a “Blue Wave.” The current sub-40% approval rating (which is trending lower) for the president is historically a losing proposition for the incumbent. We also may be moving toward some conclusion of the Mueller investigation, creating even more uncertainty.

“Confronted with a challenge to distill the secret of sound investment into three words, we venture the motto, Margin of Safety.” – Benjamin Graham

The search for value and comparing it to risk taken is, at its core, the marriage of a contrarian streak and a calculator.

While it is important to gauge the possibility that the market may be making an important top, it is even more important to distill, based on reasonable fundamental input, what the market’s reward versus risk is. This calculus trumps everything else that I do in determining market value.

On that front, I continue to believe that downside risk dwarfs upside reward.

Moreover, there is a growing fundamental and technical list of signposts — many highlighted this morning — that the market is starting to look like it is in the process of making a possible, and important, top.”

As Columbia University’s Joel Greenblatt wrote:

“There’s a virtuous cycle when people have to defend challenges to their ideas. Any gaps in thinking or analysis become clear pretty quickly when smart people ask good, logical questions. You can’t be a good value investor without being an independent thinker – you’re seeing valuations that the market is not appreciating. But it’s critical that you understand why the market isn’t seeing the value you do. The back and forth that goes on in the investment process helps you get at that.”

The S&P has now climbed to the upper end of my short-term projected trading range and I have moved to a market neutral position (from net long) – I will move into a short position on any further strength.

Yell and roar and sell some more – at least I am – as the market’s topping process seems intact.

Note: This missive’s title is a quote from the Divine Ms M (Helene Meisler)

Position: Short SPY