Key Points

- Consumer confidence is elevated and unemployment is at historic lows, which should mean the American consumer is healthy headed into the holiday shopping season.

- There are some cracks around the edges—not so much to worry about at this point, but something to pay attention to.

- We believe the holiday shopping season will be a good one, but that might not lead to strong performance in the investing world.

The most wonderful time of the year?

Halloween is done, Thanksgiving is right around the corner, and Christmas isn’t far behind! What does that add up to? To us, it means an increased focus on the American consumer as we enter the heart of the holiday shopping season. And according to the National Retail Federation, it’s shaping up to be a solid season with sales expected to rise 4.3-4.8% from a year ago for the November to December time period, down just a bit from the robust 5.5% gain seen last year.

Fundamentally, the consumer is looking to be in good shape as well. Consumers are apparently shrugging off recent market volatility and geopolitical concerns as evidenced by The Conference Board recently reporting consumer confidence reached its highest level in 18 years.

Consumer confidence quite high heading into the holidays

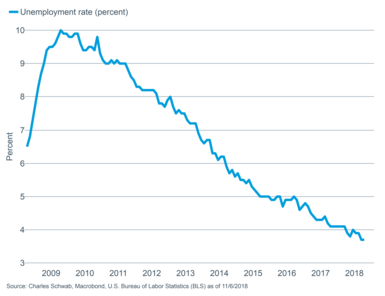

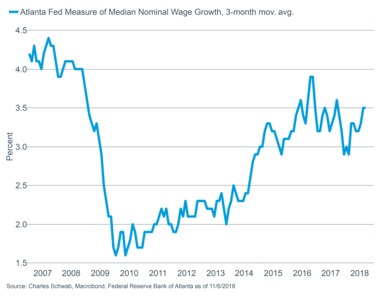

And why shouldn’t they be confident? Unemployment is at historic low levels and wages are trending higher. Admittedly, wage gains have been slow in coming around, but we also believe that has allowed inflation to remain lower than it otherwise might have been, which also stands to benefit the shopper in the form of steady prices.

Unemployment at historic lows

And wages are trending higher

This adds up, to us at least, to leading to the potential for a very good holiday shopping season. We don’t make predictions, and weather could have an impact on the season, but we would tend to believe that the projected gain may be a little on the conservative side. Consumers are working and feeling good, the midterm elections will be behind us, and we believe the cash registers will be ringing!

So what?

That’s all well and good, and at least potentially good news for retailers who rely on these two months for much of their business, but what does the situation look like for investors? Here it gets a little more complicated. As you know, stocks tend to be forward looking instruments and the data above is already well known. But when you look a little deeper, there may be some cracks developing that may warrant a bit of caution in the midst of the holiday cheer.

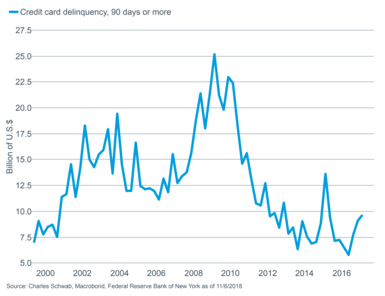

First of all, it appears to us that the recent rise in interest rates is impacting the housing market, with existing home sales falling in September and down 4.1% from a year ago according to the National Association of Realtors. Additionally, prices according to the S&P CoreLogic Case-Shiller Home Price Index grew at a slower pace in August for the fifth consecutive month—not a crisis but a sign of a softening housing market. Additionally, we’ve seen delinquency rates start trend higher.

Delinquency rates are low but rising

These developments do not portend imminent danger to us and we continue to believe the consumer is healthy and will support economic growth in the coming months. But we also think the above are signs that we may be nearing the latter stages of the economic cycle, or at least that we may have seen peak growth rates for the foreseeable future. What that means for sector investors is that having a bit more of a defensive tilt may be beneficial—thus our outperform rating on health care and underperform rating on the communication services sector. More specifically, especially in light of the increased focus on retailers, which reside within the consumer discretionary sector, investors may want to be cautious about making the jump from a good holiday shopping season to an increased investment allocation to the consumer discretionary sector.

Remember, good company results don’t always result in good stock action. The consumer discretionary sector tends to be an early mover in the economic cycle, with data from Ned Davis Research showing the sector generally outperforms in the four years following the start of a recession, but underperforms in the two years leading up to a recession. We don’t see a recession coming at this point, but we are well past the four year mark following the last recession. Additionally, while the November-January time period has historically been the best performing months of the year for the overall stock market, the consumer discretionary sector, after historically having good Novembers, has Decembers and Januarys that lose money as often or more than they gain it (Ned Davis Research).

This isn’t meant to ruin the holiday cheer, or send you to the exits with regard to the consumer discretionary sector—in fact we remain at a neutral marketperform rating on the group. But we do suggest that you resist the temptation to translate those cash registers ringing up holiday sales into investment action. Have fun with the holiday shopping but always remember to separate the company from the stock—sometimes they match up, often times they don’t!

.*The Communications Sector came into existence on 9/28/18, and the year-to-date information is not comparable to rest of the groups so we are omitting it until the end of the year.