by Russ Koesterich, Portfolio Manager, Blackrock

Russ discusses why gold, not a popular asset class until recently, has become so as a hedge.

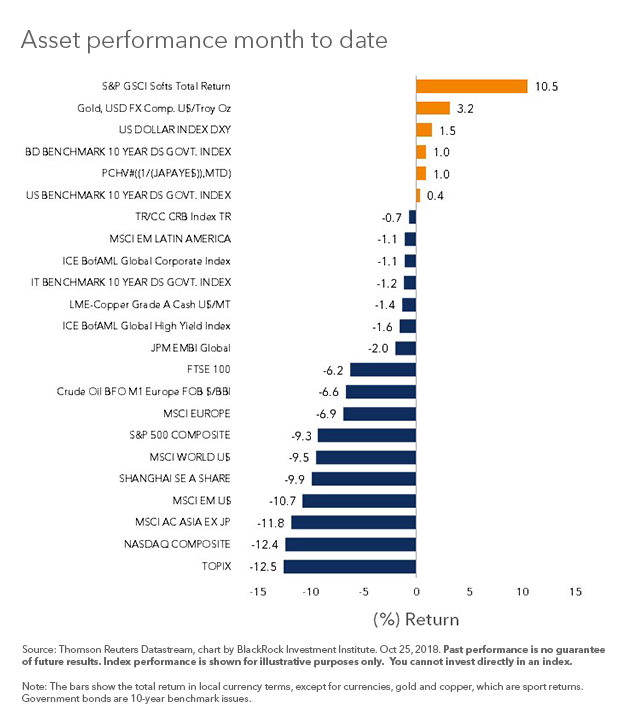

October was not kind to investors. Not only did stocks suffer their worst monthly draw-down in years, but traditional hedges, such as government bonds, did not rallied enough to offset the losses (see Chart 1). As a result, a typical 60/40 stock/bond portfolio experienced one of the worst draw-downs since the financial crisis.

Interestingly, gold, largely left for dead, has rallied. Not only has gold bounced, but it has done so despite a steady dollar. Which raises the question: Why is gold rallying now? Here are four potential reasons:

1. Gold got “cheap.”

Over the very long term gold and the U.S. money supply, measured by M2, tend to move together. Changes in gold prices have roughly equaled changes in the money supply, with the ratio tending to mean-revert towards 1. By the end of September, this ratio had fallen to below 0.7, the lowest since 2005. When the ratio is low, defined as 25% below the long-term average, the average return during the subsequent 12-months is 15%.

2. The dollar has stabilized.

While the DXY Index is pushing against the upper end of its five-month range, the dollar has been relatively stable since May. This is important as a rapidly strengthening dollar, as we witnessed last spring, has historically been a headwind for gold. To the extent the dollar has stabilized, this removes one headwind.

3. Real rates also appear to have plateaued.

Besides the dollar, the biggest challenge for gold in 2018 has been rising real rates, i.e. interest rates after inflation. Higher real rates raise the opportunity cost of an asset that produces no income. Between January and early October, real 10-year yields advanced by 50 basis points. However, since then, real rates seem to have temporarily peaked near the levels reached in 2013.

4. The return of volatility.

While real rates and the dollar are key fundamental drivers for gold, demand for a hedge against volatility also drives gold prices. With the exception of the brief correction in February, that attribute has not been in demand until recently. Prior to the recent swoon, U.S. equities were well on their way towards another year of double-digit gains. Unfortunately, this pleasant trajectory has been interrupted. Equity market volatility, measured by the VIX Index, has doubled since early October. This is important, as gold has a history of performing best versus stocks when volatility is spiking. Historically, in months in which volatility rises by more than 20%, gold typically beats U.S. stocks by more than 5%.

Bottom Line

In short, whether or not gold can continue to rally will largely be driven by the direction of the dollar, real rates and market volatility. Another dollar rally will likely interrupt gold’s recent strength. That said, absent another leg up in the dollar, an environment of rising volatility, particularly one in which economic uncertainty is rising, has historically been exactly the environment when gold has proved its value as a hedge.

Russ Koesterich, CFA, is Portfolio Manager for BlackRock’s Global Allocation team and is a regular contributor to The Blog.