There has been a lot of talk this year about the flattening of the US yield curve—which is a graphical representation of the spread between short- and long-term interest-rate instruments.

In the past, when spreads between short- and long-term rates narrow, it typically suggests that the market believes economic growth and inflation are not sustainable and will fall in the future.

However, our senior investment leaders make a case that the “predictive power” of the yield curve when it comes to the US economy may not really be so predictive this time around.

Why the Yield Curve Is Flattening

Through monetary policy actions—that is, buying or selling securities–the US Federal Reserve (Fed) has control over two short-term interest rates, the discount rate and the fed funds rate. The fed funds rate (considered the “benchmark” rate) is the rate which banks and other depository institutions lend money to each other on an overnight basis.

It is this rate that is more often manipulated, and typically impacts other short-term lending rates along the yield curve. Since 2015, the Fed has been increasing this benchmark rate in response to a growing US economy, and other short-term rates have followed.

Meanwhile, various factors have kept a lid on long-term rates for much of this year. And some market observers have noted, without another quantitative easing programme, the Fed can’t control the long end of the yield curve, represented by instruments such as 10- and 30-year Treasuries.

Simply put, we have seen the Fed raise short-term rates without a corresponding rise in long-term rates, causing a flattening of the curve.

US Yield Curve as a Recession Indicator

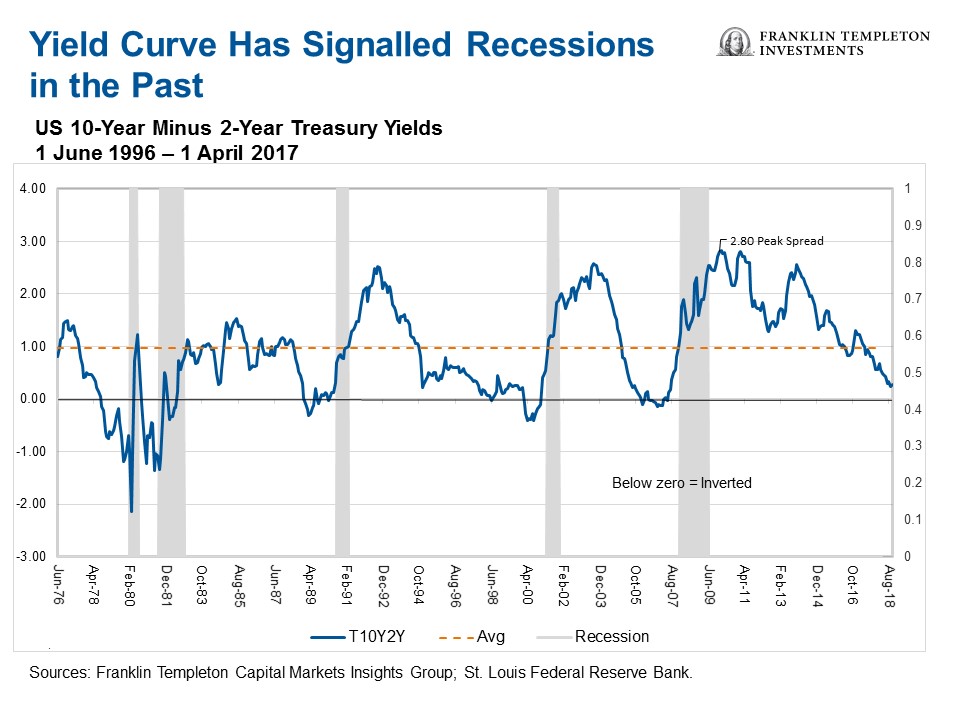

The spread between long-term and short-term rates has historically been considered a closely watched indicator used to gauge the health of the economy. In the past, changes in the yield curve have been a useful barometer to determine what phase of the cycle the US economy is currently in.

As the yield curve has flattened over the course of this year, some investors may be wondering if the yield curve could eventually invert, or fall below zero.

In this article, Ed Perks, CIO of Franklin Templeton Multi-Asset Solutions, points out that an inverted yield curve has been an indicator of US recessions in the past. As the chart below shows, the gap between two-year and 10-year Treasury notes narrowed to roughly 24 basis points in August, and the yield curve compressed to a level not seen since August 2007.

“This metric is closely watched due to its apparent predictive value—every recession in the past 60 years has been preceded by the yield curve inverting, or falling below zero.”

Why an Inverted Yield Curve May Be Losing Significance

Even if the yield curve inverts, some of our senior investment leaders have seen signs the predictive power of the yield curve may not be as powerful as it has been in the past. For example, in early September, a leading Fed official argued that the central bank should not be inhibited by a potential inversion of the yield curve in determining the optimal path for monetary policy.

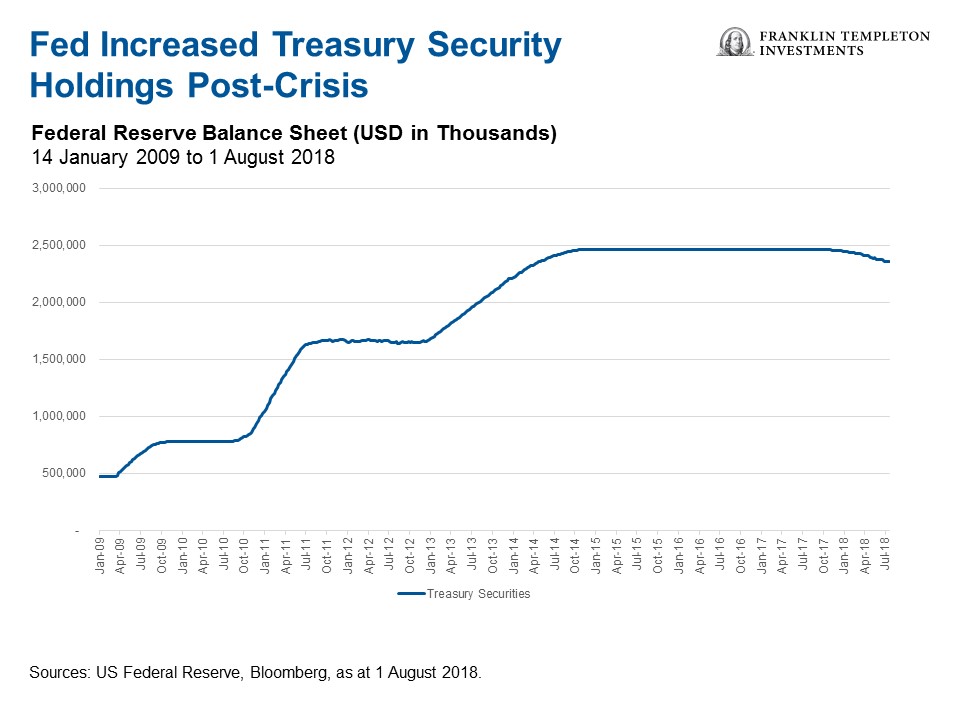

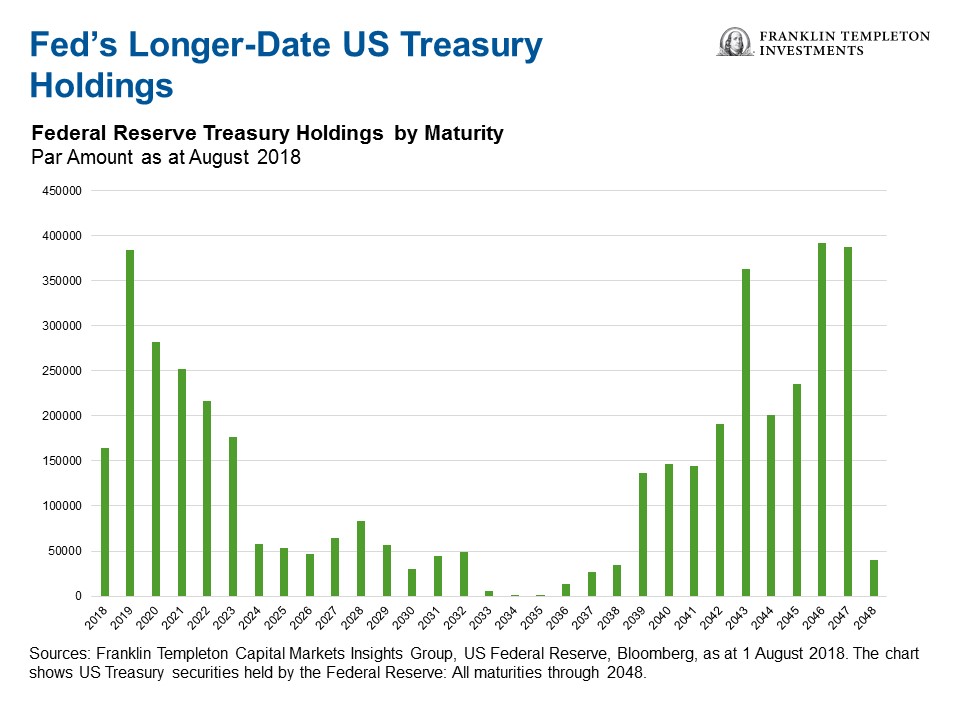

In this article, Chris Molumphy, chief investment officer, Franklin Templeton Fixed Income Group, says in this era of global quantitative easing, central banks are acting on the markets in an untraditional way. For example, after the 2008 financial crisis, the Fed purchased significant volumes of Treasuries at longer maturity dates, as the charts below show. Molumphy says this Fed buying has impacted the price of securities, meaning there are non-fundamental forces at work.

Investment Implications

Overall, our senior investment professionals are optimistic about continued US economic growth, and are not concerned about a possible recession―at least not yet.

That said, Ed Perks says, should the US economy start to show some typical end-of-cycle signs, such as slowing earnings momentum or inverted yield curves, he would expect to reassess the situation.

But for now, given the solid US economic backdrop, Molumphy thinks it’s healthy for the Fed to continue its gradual tightening path.

“We continue to view the Fed’s normalisation of rates as a positive and the biggest market risks are probably non-fundamental ones. The United States is pretty far into its current economic expansion cycle, and it is prudent to have a lot of ammunition at the end of the cycle to be prepared for the next recession.”

The comments, opinions and analyses expressed herein are for informational purposes only and should not be considered individual investment advice or recommendations to invest in any security or to adopt any investment strategy. Because market and economic conditions are subject to rapid change, comments, opinions and analyses are rendered as of the date of the posting and may change without notice. The material is not intended as a complete analysis of every material fact regarding any country, region, market, industry, investment or strategy.

Data from third-party sources may have been used in the preparation of this material and Franklin Templeton Investments (“FTI”) has not independently verified, validated or audited such data. FTI accepts no liability whatsoever for any loss arising from use of this information and reliance upon the comments, opinions and analyses in the material is at the sole discretion of the user. Products, services and information may not be available in all jurisdictions and are offered by FTI affiliates and/or their distributors as local laws and regulations permit. Please consult your own professional adviser for further information on availability of products and services in your jurisdiction.

Get more perspectives from Franklin Templeton Investments delivered to your inbox. Subscribe to the Beyond Bulls & Bears blog.