by Jeffrey Saut, Chief Investment Strategist, Raymond James

“Thanks I needed that,” (as Bluto guzzles a fifth of whisky and smashes the bottle into a car). “Christ,” says Donald (aka Peter Riegert), “this is ridiculous.” “What are we going to do?” asks Pinto. “ROAD TRIP,” says Otter! (Road Trip)

. . . Animal House (1978)

So, as most of you know we were on a road trip last week. We flew into Albany, New York on Sunday only to be greeted with hotter temperatures than what we left in Florida. The mountain drive to Manchester, Vermont was spectacular, but hereto the temperatures were hotter than Florida. Dinner was at the fabulous Equinox Hotel (Equinox) with a few portfolio managers (PMs). The next day we did two presentations for our financial advisors (FAs) and their clients. On Tuesday it was off to Latham, New York to speak at a lunch, again for our FAs and about 130 clients. After the lunch it was a drive to Burlington, Vermont. Our plan was to take state road #7 to Burlington, but Laetitia (the name of our GPS) took us up New York expressway #87, which was faster than the two lane route #7. What we didn’t know was taking that route entailed riding a ferry from Port Kent to Burlington, across Lake Champlain, which was the highlight of the trip. It also shaved about an hour off the other route. That night was yet another presentation for our FAs and their clients at the Shelburne Museum (Museum) in Burlington. Comes Wednesday, it was a drive to Boston for meetings with our FAs and portfolio managers. Lunch was with folks from the must have Ned Davis Research organization to discuss the markets. After that we met with Matt Weatherbie, captain of Weatherbie Capital, and Jim Tambone from Alger. As a sidebar, Weatherbie Capital sold itself to Alger about a year ago. Also at the meeting was the fund’s two senior PMs, namely George Dai, Ph.D. and Joshua Bennett, CFA.

You know how sometimes when you meet new people there are some that you instantly like? Well that is the way we felt about the good folks at Weatherbie Capital. Maybe it is because all of us have been in the business a long time and have seen many cycles. But for whatever reason, we were of like minds about the stock market and the economy. Weatherbie Capital is a small cap growth stock expert and as a proof statement we suggest you look at the performance record of their mutual fund. Some of the stocks discussed, which have positive ratings from Raymond James’ fundamental analysts, and screen well using our proprietary models, include: Paylocity Holdings (PCTY/$67.65/Outperform); LKQ (LKQ/$33.75/Outperform); XPO Logistics (XPO/$104.64/Outperform); and Everbridge (EVBG/$51.55/Outperform).

The next day we had breakfast with some PMs, and saw a few institutional accounts, before trotting off to see our friends at Putnam. Our first Putnam meeting was with our long-time friend Gerard Sullivan (I own his funds), who worked with Peter Lynch in a life gone by, so it is always fun to swap Peter Lynch stories with Gerry. Also in attendance was Gerry’s right hand guy Ian Estabrooks. Gerry likes the large cap banks, a theme we have been suggesting for months, as well as the airlines. While there were many stocks discussed, most of them are not followed by our analysts and therefore cannot be mentioned in this letter. For ideas we suggest screening the Raymond James research universe.

Next up was Putnam’s Daniel Graña, who manages the Putnam Emerging Markets Equity Fund. We asked him if he had just one country in which to invest what would it be? Without hesitation he said India. He reasons that India is a country that possesses the “rule of law,” has an “equity culture,” and is a democracy. He noted the best days for India are ahead for it with GDP growth expectations somewhere between 6% and 8% per year. India has a large domestic economy and therefore does not need a lot of imports, so trade tariffs should not really be impactful. The negative is that India is a large importer of crude oil. Daniel is also investing in Chinese environmental stocks on the premise China is now spending a lot of money cleaning up its rivers, smog infested cities, and arable land. Recall, China only has about 17% arable land. Deducting the contaminated land leaves that number at around 10%. Of interest is that he stated jogging an hour in Shanghai (he doesn’t recommend it) is tantamount to smoking two and a half packs of cigarettes! Daniel said the emerging markets (EM) space has been difficult due to higher interest rates, a stronger U.S. dollar (chart 1 on page 3), and talk of trade tariffs. However, if your time horizon was more than three years the EM space should outperform. That night it was dinner with about ten Boston-based FAs with Alex Brown, where markets and stocks were discussed and stories told.

Moving on to the stock market, in our “hit” on CNBC early Thursday morning we told Joe Kernen:

On this show we told investors to raise some cash in January, suggested putting most of that cash back to work at the undercut low of February 9, 2018, with trading target of 2860. Well, we tagged the 2860 target on Tuesday of last week and we think the equity markets will stall around these highs given this is the biggest vacation week of the year. However, next week, when the “players” return, we are expecting new all-time highs.

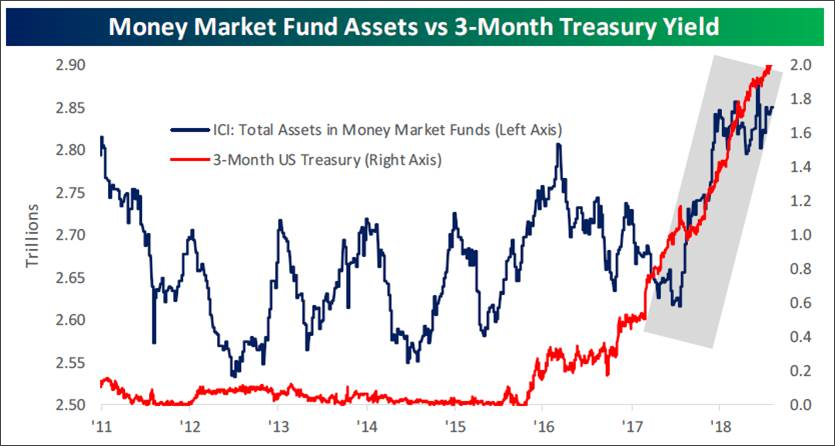

That was pretty much the way the markets traded on Thursday, but overnight news hit about the Turkey Trauma and the preopening futures dove. The result left the S&P 500 (SPX/2833.28) preopening futures off some 20 points and us with egg on our short-term trading face. Clearly we did not expect such news, but they don’t call ‘em surprises because you expect ‘em! The upside breakout above 2800 took the SPX up into no man’s land (chart 2) between 2800 and 2872 (the all-time high). The resulting intraday “island reversal” in the SPX chart left us recalling the recording group Kansas’ song of “The Point of Know Return” (Island). Yet, many of the indices made new all-time highs last week save the SPX. Meanwhile, bullish sentiment probes new lows, as typified by a recent cover from Fortune Magazine declaring “The End Is Near,” as money continues to flow to cash (chart 3 on page 4). The most positive indicator for the equity markets remains the Advance – Decline Line, which as the astute Bespoke organization writes:

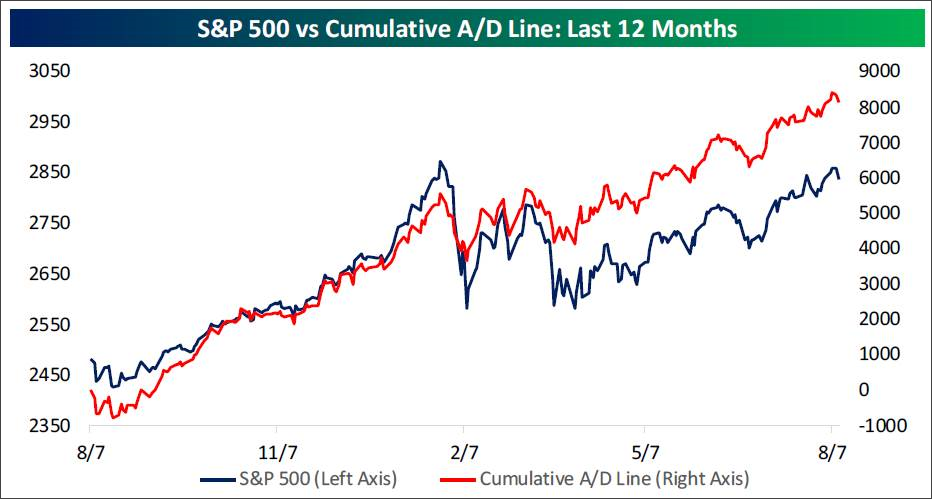

The most positive internal indicator that the market has going for it right now, though, is the cumulative A/D line. Even though the week finished off with three straight negative readings, each of the prior three trading days before Wednesday saw record high readings. Since the S&P 500’s record closing high in January, there have now been 24 all-time highs in the cumulative A/D line. While the strength in the cumulative A/D line contrasts with the percentage of stocks hitting new highs, the magnitude of the “positivity” of the cumulative A/D line outweighs the magnitude of “negativity” in the percentage of stocks hitting new highs. The road to new highs may not be as smooth as many thought earlier this week, and despite uncertainty surrounding geo-political issues, currencies, and tighter monetary policy, as along as breadth continues show strong underlying trends, it’s hard to fight the tape (chart 4).

The call for this week: So, on our road trip we heard numerous questions about the length of the bull market, and the economic cycle, implying they are “long of tooth.” We do not think so since secular bull markets tend to last 14+ years. Speaking to the economic cycle, our friends at Goldman Sachs, as reprised by Federated’s Linda Duessel, note:

Goldman Sachs studied other countries where growth cycles have lasted more than 10 years (Australia from 1992 to the present; the U.K., 1992-2008; Canada, 1992-2008; and Japan, 1975-1992). It found similar advantageous factors exist in the U.S.: a relatively flat Phillips curve (the relationship between inflation and unemployment), strengthened financial regulation and a lack of financial imbalances. In the past three U.S. expansions, the late-cycle phase lasted 2-4 years, indicating the next recession could be as far out as 2021.

This morning, however, the preopening futures are lower as Turkey tumbles and North Korea threatens to end stability. Oh well, it must be an expiration week . . .