by John Lynch, Chief Investment Strategist, LPL Financial

KEY TAKEAWAYS

- The new tax law, better economic growth, robust manufacturing activity, and a weak U.S. dollar were among the factors contributing to such a strong first quarter earnings season.

- Companies with more overseas revenue generally saw faster earnings growth this season, while corporate buybacks and capital spending were on the rise.

- Earnings growth may slow, but an earnings growth peak does not mean a recession is looming.

First quarter earnings season was excellent by almost any measure. The numbers were strong even without the boost from the new tax law. In this week’s commentary, we recap the outstanding near-complete first quarter earnings season, highlight some of the key themes, and show why a potential peak in earnings growth is not cause for immediate concern.

GREAT NUMBERS

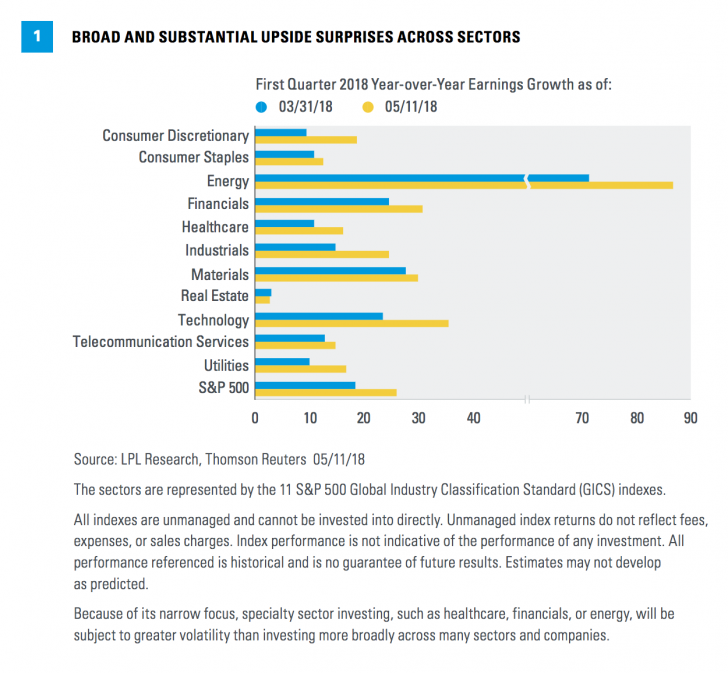

We expected a strong first quarter earnings season and we got it. Growth was very impressive, with S&P 500 Index earnings growing 26% year over year, the best since the fourth quarter of 2010. Even when excluding the impact of the new tax law (estimated at 6–7%), earnings growth accelerated from the prior quarter and approached 20%. A broad range of sectors produced substantial upside surprises [Figure 1].

Overall, just about any way you slice it, it was an excellent earnings season; other notable highlights:

- S&P 500 earnings have now increased at a double-digit clip four out of the past five quarters.

- The streak of consecutive quarters with earnings exceeding expectations is now 36, based on Thomson Reuters’ data.

- The percentage of companies beating earnings estimates at just over 78% is the highest since FactSet began tracking the data in 2008.

- The magnitude of the upside surprise, at 7.5%, was the biggest since 2010.

- Revenue grew more than 8% year over year, fastest since 2011 (and in line with the fourth quarter of 2017).

- Estimates for the next four quarters rose during reporting season, a relatively rare positive development.

CAUSE FOR APPLAUSE

Why so good? As we pointed out in our earnings preview in April, in addition to the new tax law, several other factors contributed to the strong numbers:

- Better economic growth. Accelerating economic growth in the U.S., based on gross domestic product, helped boost corporate profits. U.S. economic growth was 2.9% year over year for the first quarter (2.3% quarter-over-quarter annualized), above recent trends. Growth remains generally solid around the world too.

- Robust manufacturing activity. The U.S. manufacturing sector is booming, with the Institute for Supply Management (ISM) Manufacturing Index averaging near 60 year to date. Earnings are closely linked to the manufacturing sector.

- Weak U.S. dollar. During the first quarter, the average U.S. Dollar Index level was more than 10% below the year-ago quarter, which propped up overseas earnings for U.S.-based multinationals.

- Higher oil prices. A more than 20% jump in oil prices from the year-ago quarter drove a sharp rebound in energy sector profits.

KEY THEMES

KEY THEMES

Several themes have emerged during this strong first quarter earnings season:

- Companies with more overseas revenue exposure generally grew earnings faster. According to FactSet data, companies with more than half of their revenue outside the U.S. grew earnings 7% faster, on average, than those with less than half of their revenue coming from outside the U.S. The drop in the U.S. dollar was a big factor here in addition to stronger growth in developing economies.

- Buybacks are on the rise. Proceeds from the tax boost are clearly giving buybacks a lift. Goldman Sachs forecasts a record $650 billion in share buybacks in 2018, up 23% from 2017. Buyback authorizations year to date are up 48% versus the same period last year. Capital spending is also on the upswing.

- Trade policy not (yet) having much impact. Although a fair number of companies highlighted the uncertainty surrounding trade policy, particularly industrial companies, the first quarter came too soon for enacted tariffs to have material impact. Further, the potential for more tariffs does not appear to have negatively affected companies’ guidance.

- Cost pressures emerging. Some companies cited wage and input cost pressures, which is normal at this relatively late stage of the business cycle. But overall profit margins rose during the first quarter, both on a year-over-year and quarter-over-quarter basis. Business is simply good enough that companies have been able to mostly offset higher costs, even excluding the impact of the new tax law.

AS GOOD AS IT GETS?

In our preview we mentioned that the peak earnings narrative might garner some attention. It certainly has — more than we anticipated — in part because Caterpillar’s management stated that the first quarter may be the “high-water mark” for the year on the company’s earnings call.*

The 26% earnings growth rate expected for the quarter may be as good as it gets for the rest of the current business cycle. Consensus estimates call for slower growth over the course of 2018, as wage and other cost pressures have started to build, and comparisons get tougher in 2019 after the anniversary of the tax law passes. But does that mean a recession is forthcoming? Is peak earnings growth a good time to sell stocks?

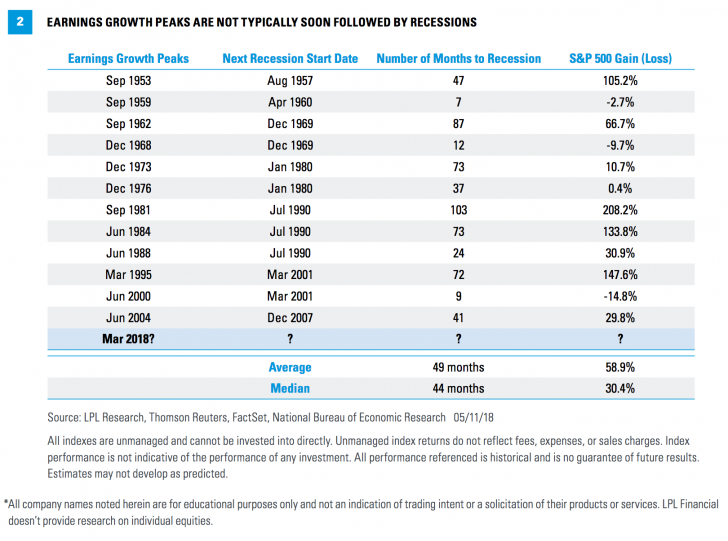

We don’t think so. We show why in Figure 2, where we identified S&P 500 earnings growth peaks and calculated the number of months from those dates until the next recession. The average time to recession based on the last 12 earnings growth peaks since 1953 is about 4 years. Should this relationship hold, we could expect a recession in mid-2022, which would make the current U.S. economic expansion the longest ever, at 13 years old.

The short time to recession following the 2000 earnings growth peak (9 months) was a product of the dotcom bubble; conditions today are not as extreme in terms of over-exuberance and over-investment.

Also note that the S&P 500 was up an average of 59% during these periods between the earnings growth peak and the start of the next recession, meaning selling at these peaks may not be the best strategy.

As a result, we are not overly concerned about an earnings growth peak and believe more good earnings growth may be ahead of us. Assuming the economic expansion continues well into 2019 as we expect, while benefits from the new tax law (e.g., capital spending incentives and buybacks) are still cycling through, S&P 500 earnings per share growth in 2019 may reach or potentially exceed its long-term average of 7–8%.

*All company names noted herein are for educational purposes only and not an indication of trading intent or a solicitation of their products or services. LPL Financial doesn’t provide research on individual equities.

CONCLUSION

First quarter earnings season was excellent by virtually any measure, while several tailwinds remain in place that suggest strong earnings may continue in the coming quarters. Earnings growth may slow, but an earnings growth peak does not necessarily mean a recession is looming.

We reiterate our 2018 S&P 500 earnings forecast of $152.50 per share, representing growth in the mid-teens; this estimate may prove conservative given the substantial impact of the new tax law that is still cycling through. We expect strong earnings growth to drive a double-digit return for the S&P 500 in 2018, though as we have seen recently, those gains may come with higher volatility.**

**As noted in Outlook 2018: Return of the Business Cycle, LPL Research’s S&P 500 Index total return forecast of 8–10% (including dividends), is supported by a largely stable price-to-earnings ratio (PE) of 19 and LPL Research’s earnings growth forecast of 8–10%. Earnings gains are supported by LPL Research’s expectations of better economic growth, with potential added benefit from lower corporate tax rates.

IMPORTANT DISCLOSURES

The opinions voiced in this material are for general information only and are not intended to provide specific advice or recommendations for any individual. To determine which investment(s) may be appropriate for you, consult your financial advisor prior to investing. All performance referenced is historical and is no guarantee of future results.

The economic forecasts set forth in the presentation may not develop as predicted and there can be no guarantee that strategies promoted will be successful.

Investing in stock includes numerous specific risks including: the fluctuation of dividend, loss of principal, and potential liquidity of the investment in a falling market.

All investing involves risk including loss of principal