by Liz Ann Sonders, Senior Vice President, Chief Investment Strategist, Charles Schwab & Co

Key Points

- The book is closing on third quarter earnings and it was another stellar season.

- Both earnings and revenues were strong; and importantly, the “beat rates” were well above average.

- The outlook for 2018 is bright, but we are on watch for an expectations bar that gets set too high.

With third quarter earnings season nearly complete, I wanted to give a shout-out to another strong showing by U.S. companies. The topic lends itself to a table-heavy, prose-light report this week.

The inflection point in earnings growth from a four-quarter earnings contraction ending after last year’s second quarter; to the subsequent surge has arguably been the most important catalyst for the market’s strength over the past year (more so than the election). The most notable driver of the massive turn in profitability has been the energy sector—which drove both the contraction and the recovery. But it’s not just a story of energy’s spark.

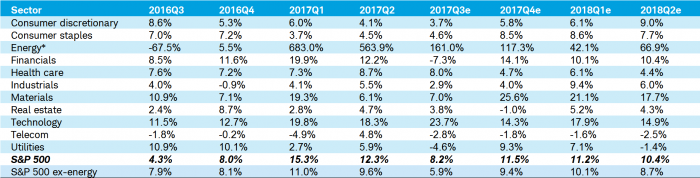

The table below shows not only S&P 500 results/forecasts overall, but sector-based earnings growth as well. It covers the period since earnings moved from contraction to expansion through estimates a year from now. It’s clear that energy has been a major factor in the improved growth over the past year; but there are other sectors—most notably technology—reporting strong growth.

Earnings growth rates

Source: Thomson Reuters, as of November 20, 2017. *17Q1 Energy sector: prior year earnings are negative.

I often note that when it comes to the stock market and underlying fundamentals—either of the earnings or economic variety—“better or worse matters more than good or bad.” In other words, rate of change matters more than level, and relative matters more than absolute. As such, the so-called “beat rate” (the percentage of companies reporting results above analysts’ consensus estimates) is tracked and watched closely by investors.

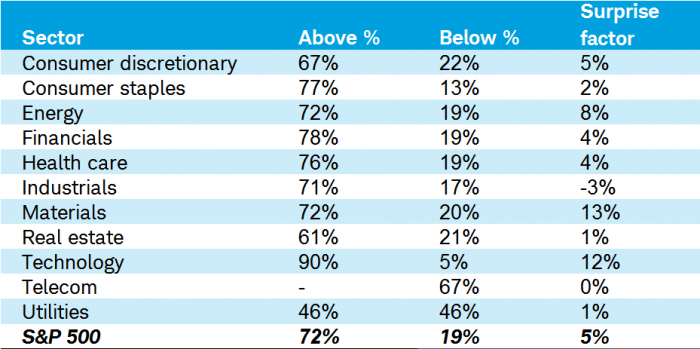

As you can see in the table below, the beat rate for third quarter earnings is 72% to-date—well above the historic average (since 1999) of 62%. The beat winners have been technology and financials (we have outperform ratings on both); while bringing up the rear are utilities and telecom (we have underperform ratings on both).

Q3 Earnings scorecard

Source: Thomson Reuters, as of November 20, 2017.

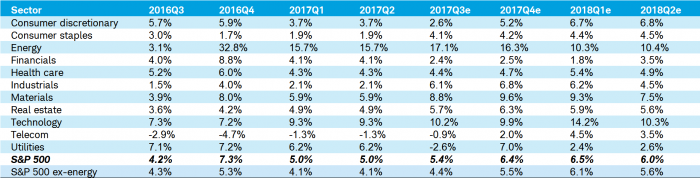

The bottom line earnings story has not been the full story in this latest cycle. Top line revenue growth has been pleasantly surprising as well. The table below covers the S&P overall and at the sector level, like above, but for revenue growth. It’s always important to look at revenue growth as it can’t be manipulated by factors such as write-downs and/or stock buybacks.

Revenue growth rates

Source: Thomson Reuters, as of November 20, 2017.

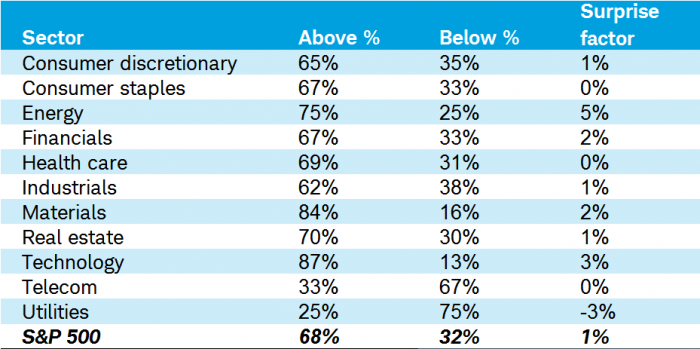

Beat rates are relevant for revenues as well, and the table below highlights the very healthy—and also above historic average—67% beat rate to-date. For revenues, the beat winners have been technology again, but also materials (on which we have a market-perform rating); while bringing up the rear are utilities and telecom.

Q3 Revenue scorecard

Source: Thomson Reuters, as of November 20, 2017.

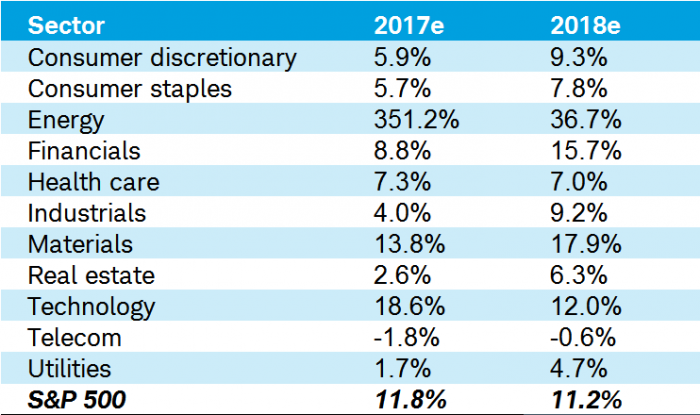

Finally, let’s widen the lens and look into year-end as well as 2018. From an expected earnings growth rate of 11.8% for 2017, it’s expected that 2018 will about match that growth.

Earnings growth rates

Source: Thomson Reuters, as of November 20, 2017.

The net is that there is much in corporate America for which to be thankful. After a brutal earnings recession in 2015-2016, growth has rebounded smartly and S&P 500 earnings (in dollar terms) are at a new all-time high. We will be vigilant in looking for signs of a peak in earnings growth next year, especially given stretched valuations. A risk in 2018 is that the expectations bar gets set too high. Remember, better or worse matters more than good or bad.

In the meantime, have a Happy Thanksgiving everyone.

Copyright © Charles Schwab & Company