by Lance Roberts, Clarity Financial

This past weekend was riddled with shocking stories from the tragic shooting in Texas that left 26 dead and many more injured, to the arrest of Prince Alwaleed bin Talal who is one of Saudi Arabia’s most prominent businessmen. Prince Alwaleed, who appears fairly regularly on CNBC as his investment firm has holdings in Apple, Citigroup, and Twitter, was one eleven princes arrested along with four ministers and tens of former ministry officials detained on corruption, money laundering and bribery charges.

Then there was the helicopter crash in Saudi Arabia that killed eight more high-ranking government officials including Prince Mansour bin-Muqrin, the official collapse of the Sprint and T-Mobil merger, and the warning from the Chinese Central Bank (PBOC) of “latent risks accumulating, including some that are ‘hidden, complex, sudden, contagious and hazardous.'”

There were more than just those stories, but you get the idea. In normal times, such a negative news flow would surely set the stage for traders to reduce risk related assets by taking some “money off the table.”

But such was not the case Monday morning as bullish investors were blind to the news and continued to chase stocks higher.

Currently, there seems to be nothing that can derail the markets from its bullish advance. After a brief 2-week correction this summer, stocks have reasserted their leadership over the last couple of months as economic and earnings data improved modestly.

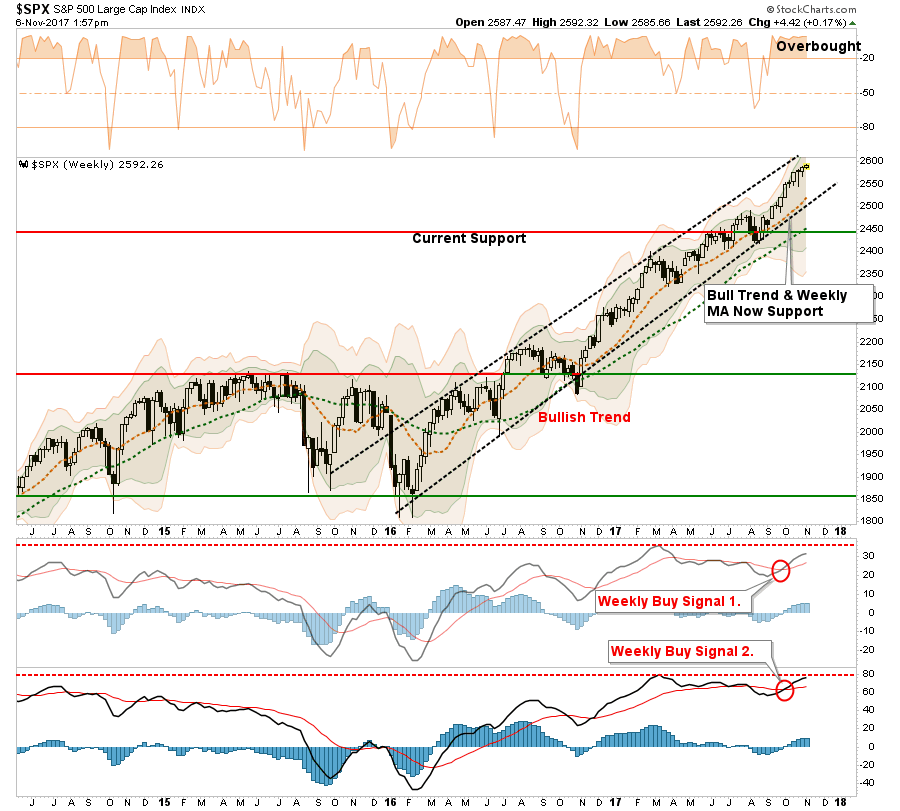

Importantly, as I addressed last week, the “seasonally strong period” of the market was confirmed by both of the weekly MACD’s registering “buy signals” in October as shown in the chart above. The only concern is that those signals were triggered from extremely high levels which tend to be shorter in nature.

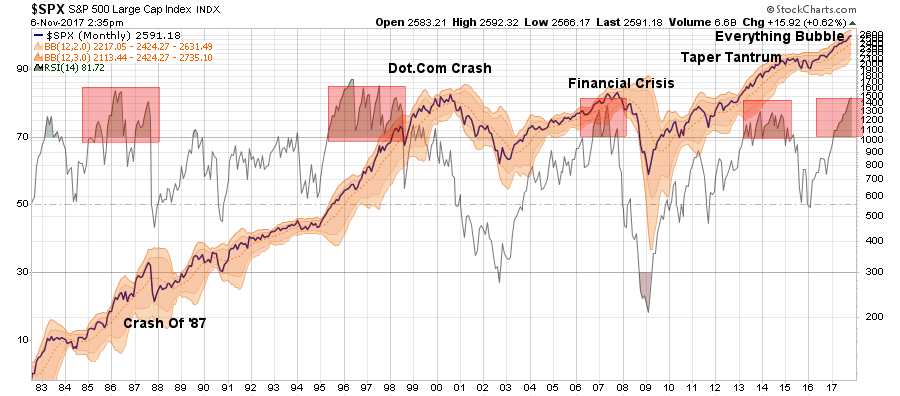

Nonetheless, the bullish trends do remain intact, keeping portfolios allocated towards equity risk currently, investors should not be overly complacent given the extreme overbought conditions that exist. The chart below shows the monthly RSI (Relative Strength Index) for the S&P 500 going back 35 years. Each time the market breached the 70% level, much less the 80% level (currently 81.72) the ensuing reversions have not been kind to investors.

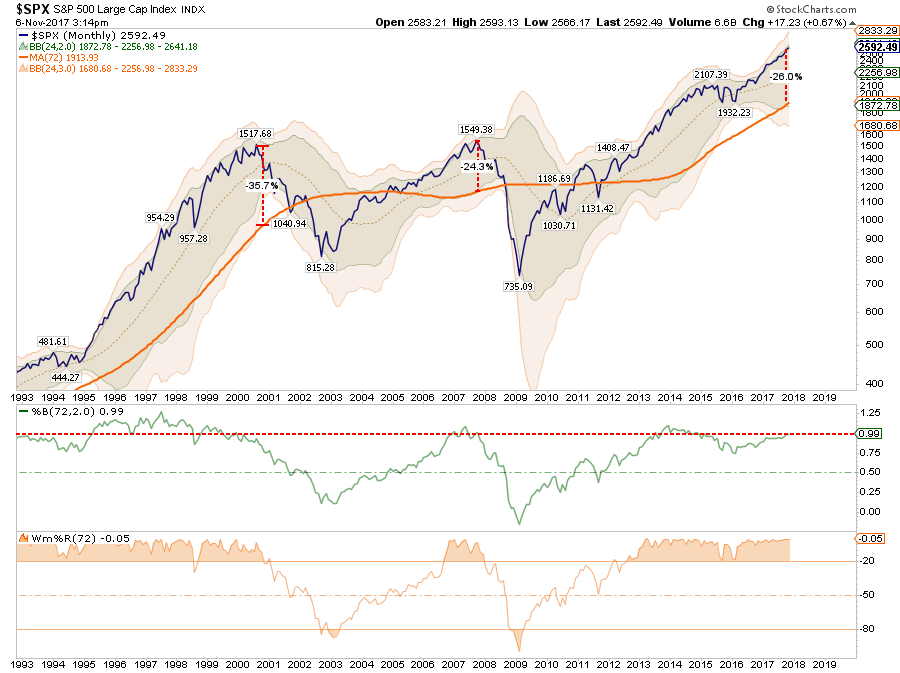

This divergence from long-term trends can also be seen in the chart below which is the deviation of the market from its 6-year (72-month) moving average. Historically, when the deviation has been greater than 20% from the mean, corrections and reversions have occurred. With the current deviation 26% above the long-term mean and pushing 2-standard deviations, investors are being “willfully blind” to the risks of a short-term correction.

Since I was unable to write the newsletter this past weekend, I am updating the sector analysis and portfolio management commentary. This commentary is updated weekly for our newsletter subscribers which is a free service. Simply click the subscription button on the website and enter your email address.

Market & Sector Analysis

Data Analysis Of The Market & Sectors For Traders

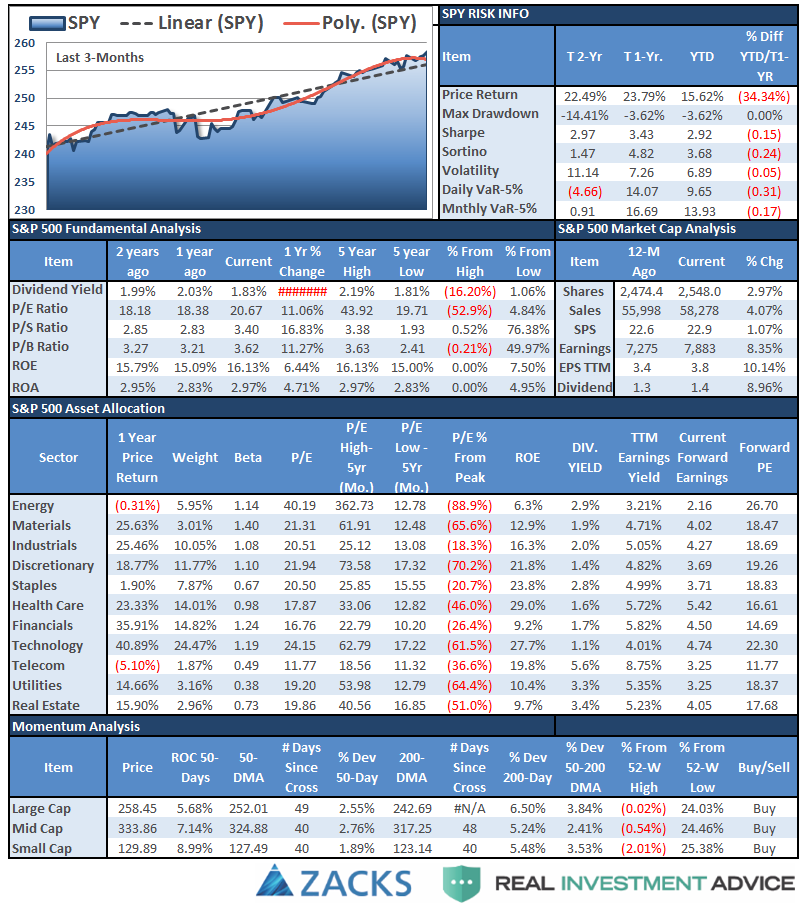

S&P 500 Tear Sheet

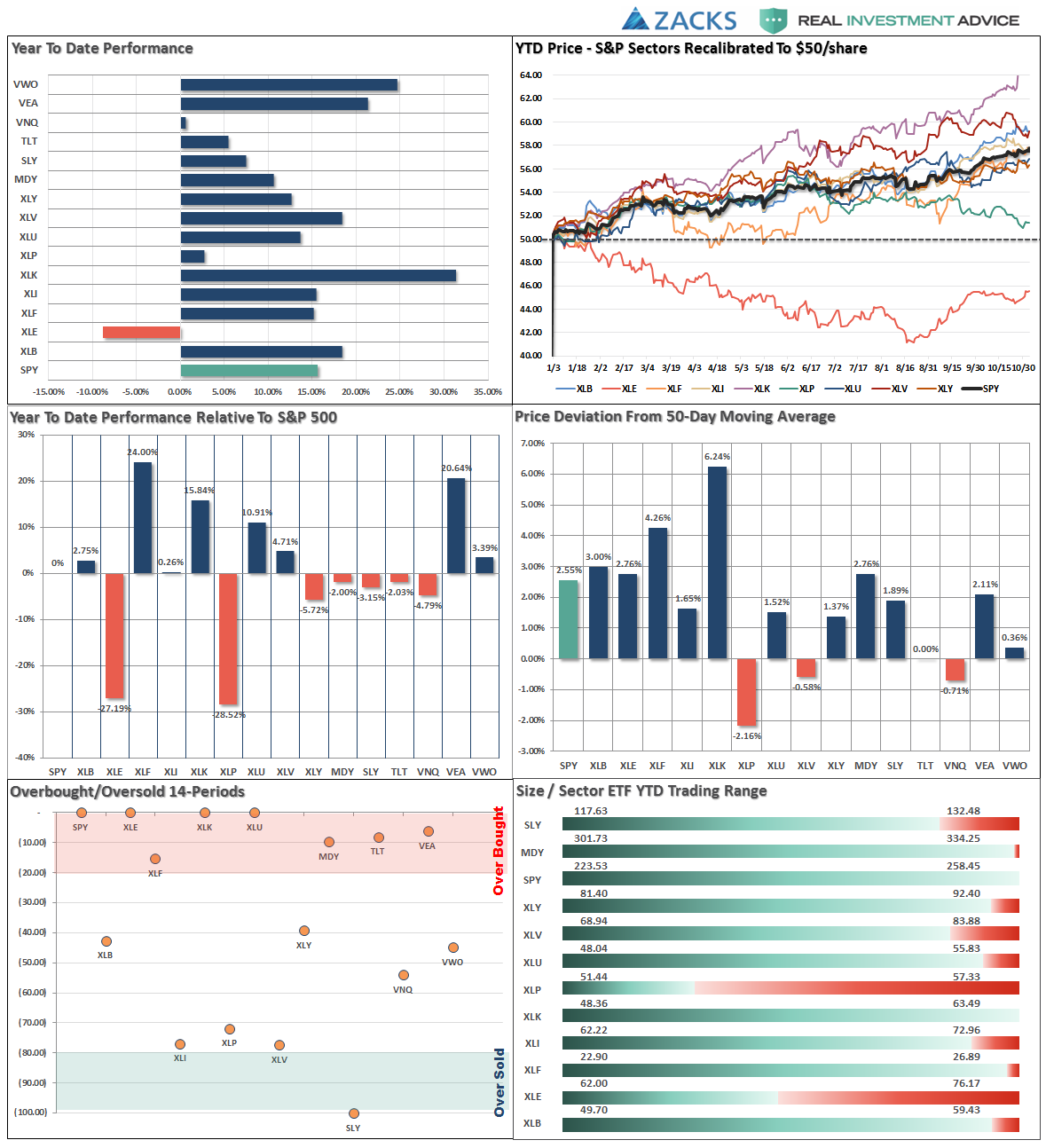

Performance Analysis

ETF Model Relative Performance Analysis

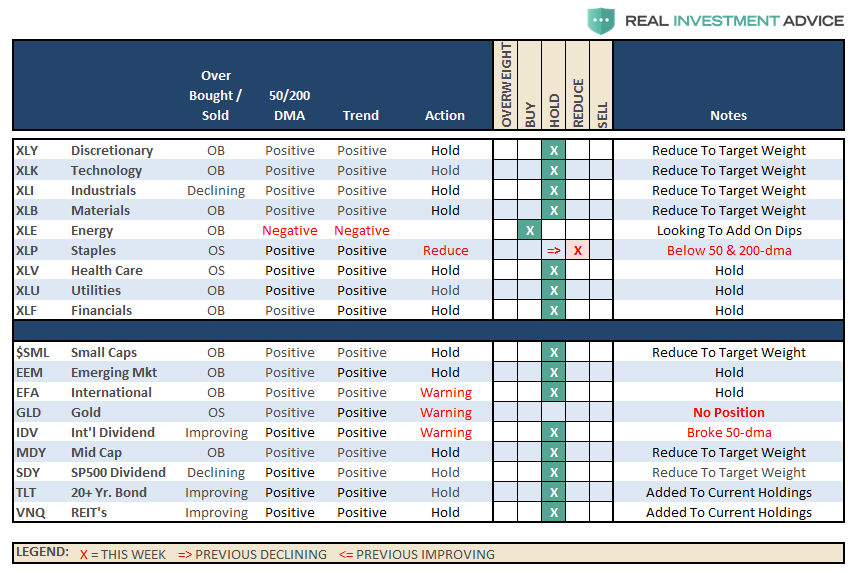

Sector & Market Analysis:

Last week, the market continued its advance, although a bit more wobbly, but did finish the week at all-time highs. More importantly, the S&P 500 has now closed positive for 9-straight quarters which is a feat not seen since the run that begin in 1994.

Let’s look at the sector breakdown.

Technology, Discretionary, Financials – Have continued to push higher particularly as money is chasing technology in particular. While the overall trends are positive, these sectors are becoming quite extended suggesting some profit taking is warranted to rebalance risk.

Staples continue to remain under pressure particularly as earnings reports have been weak. However, the weakness in staples should not be summarily dismissed as this sector in particular is reflective of the broader trends economically speaking. Pay attention as the moving average crossover is close to triggering which will put downward pressure on the sector as a whole.

Basic Materials and Industrials stagnated last week but remain exceedingly overbought with valuations stretched. After big runs in both these sectors on hopes of “tax cuts and infrastructure” from the current administration, some rebalancing of holdings would be prudent.

Healthcare has slipped back to its 50-day moving average. The trend remains positive currently, but watch for a violation of previous lows and any failed rally attempt from the current oversold levels to signal a potential shift in portfolio weightings.

Energy – the underlying technicals have improved and the sector is close to registering a moving average crossover “buy signal.” The recent correction tested, and held, previous support at the 200-day moving average and, along with the breakout of the previous October highs, makes this sector much more appealing from an investment standpoint. The sector is currently grossly overbought so look to add energy exposure on dips to previous supports.

Utilities, we remain long the sector and have moved stops up to the 50-dma. Trends remain positive and interest rates have likely peaked for the current advance.

Small and Mid-Cap Stocks have stalled a bit after a torrid advance beginning last August. With both of the indexes very overbought, some rebalancing of portfolio risks is appropriate.

Emerging Markets and International Stocks have shown some weakness as of late but remain in a bullish trend overall. The recent successful test of the 50-day moving average continues to confirm the bullish trends in these markets. We remain long these markets for now but have moved up stops accordingly.

Gold – I noted previously the failure of precious metals to break back above the 50-dma. With the complete absence of FEAR of a potential crash, gold has temporarily “lost its luster” as a safe haven. We continue to watch the commodity currently, but remain on the sidelines for now.

S&P Dividend Stocks, after adding some additional exposure back in August, the index managed an extremely strong advance which ended two weeks ago as market participation narrowed sharply. We are holding our positions for now with stops moved up to $92. Take some profits and rebalance accordingly. Dividend stocks have gotten WAY ahead of themselves currently as the yield chase continues.

Bonds and REIT’s took a hit this week as “tax reform” moved forward and the expectations for higher inflation, wages, and economic growth pushed rates higher. While the economic benefit from tax reform is “WAY OVERSTATED,” we continue to hold our current exposure and continue to add to holdings on bounces in rates towards 2.4-2.5%.

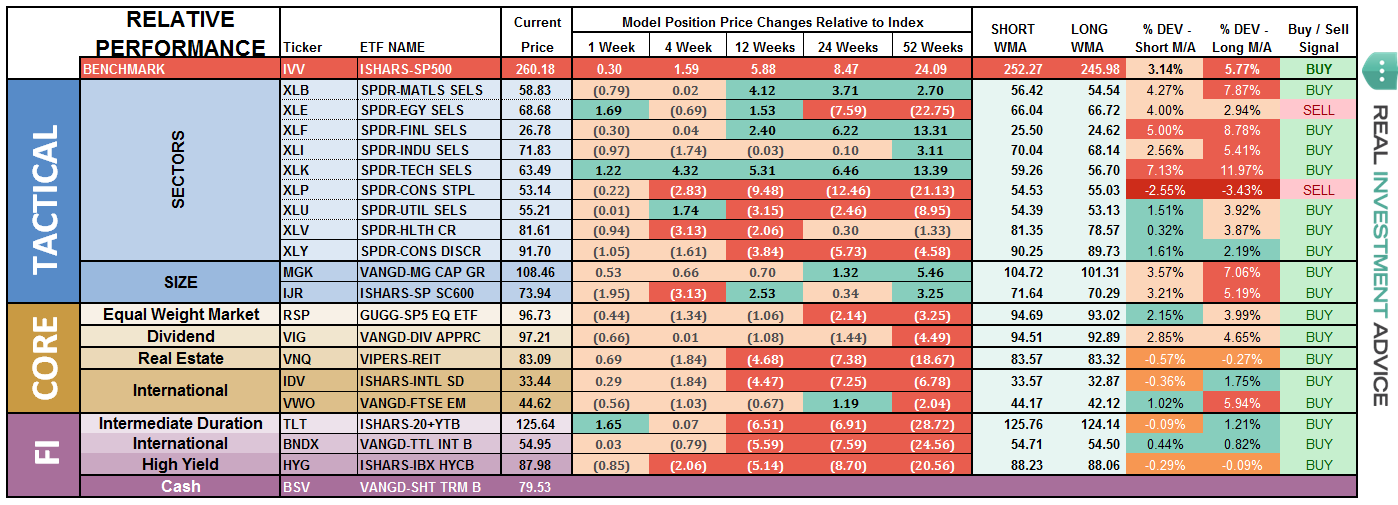

Sector Recommendations:

The table below shows thoughts on specific actions related to the current market environment.

(These are not recommendations or solicitations to take any action. This is for informational purposes only related to market extremes and contrarian positioning within portfolios. Use at your own risk and peril.)

Portfolio Positioning Update

We used the pop in interest rates to move cash management accounts, and larger cash holdings, into our cash allocation strategy providing for better yields. We also added some new bond exposure to accounts. Both of those actions have played out nicely as rates have run back down to 2.32% as of Monday.

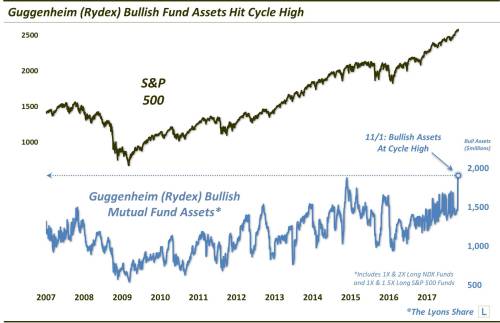

As Dana Lyons recently penned:

“Critics of that notion, again, take exception to the argument on the basis of the structural downtrend in mutual fund assets. ‘Call us when bullish assets rise to an extremely high level’, they say. Well, you can start dialing because Rydex bullish fund assets just hit their highest level of the entire market cycle, going back at least 10 years.“

“With a cycle high in bullish assets and bearish assets still plumbing record lows, there is certainly a good case to be made, on the surface, for overly bullish investor exuberance at the moment.”

While the risks clearly outweigh the potential for reward over the intermediate to long-term, the short-term frenzy to chase assets simply overwhelms logic. But such is always the case when markets enter the “melt-up” phase of the cycle.

We remain extremely vigilant of the risk that we are undertaking by continuing to ride markets at such extended levels, but our job is to make money as opportunities present themselves. Importantly, each week we raise trailing stop levels and continue to look for ways to “de-risk” portfolios to counter this late stage bull market advance.

As always, we remain invested but are becoming highly concerned about the underlying risk. Our main goal remains capital preservation.

“A market that sees no danger is the most dangerous market of all.”

Copyright © Clarity Financial