Say goodbye to closet indexers

by Rob Mikalachki, Chief Investment Officer, Trimark Investments, Invesco Canada

I’m writing here in response to questions I’ve received from advisors and to piggyback on comments I’ve made at our recent due diligence events. First, I’m going to dispense with the strict “active vs. passive” construct of the current debate. I’ll make my case for the value of true active management and introduce you to the elements of a portfolio that I believe make it truly active. I’m going to cover a lot of ground here, but I’ll do my best to keep it concise.

Goodbye “active vs. passive”

The debate as it has been argued to date is oversimplified. In my opinion, it’s framed in a way that doesn’t take into account all of the various products available to investors. It’s more than simply active or passive, so let’s look at it in a different way.

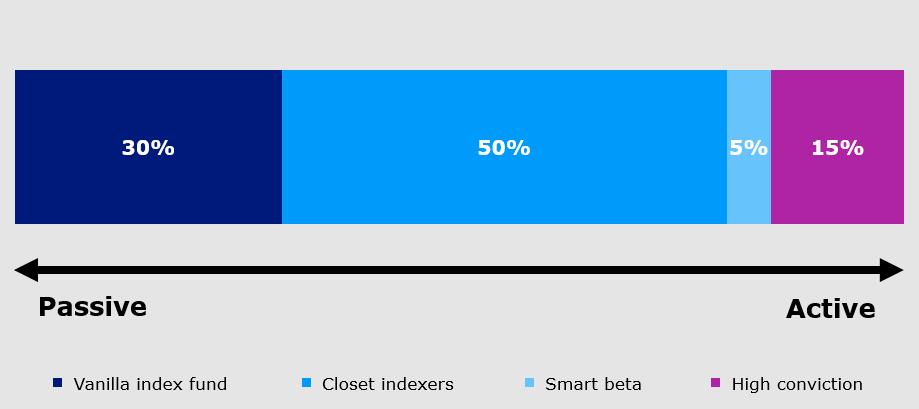

Based on data from FactSet Research Systems Inc., as at June 30, 2017.

On the far left of the chart above are vanilla index funds that track broad indices and are generally lower cost. By investing in a market-cap weighted ETF, the one thing you are guaranteed is that it will underperform the index. The fee may be small, but it is a fee nonetheless and it’s taken off the top of any returns gained by whichever index the ETF tracks. There is absolutely a place for these in a well-diversified investor portfolio, but it’s certainly not the place that aims to bring long-term outperformance. There is also a small, but growing portion of assets invested in smart beta strategies, which I believe can also play a targeted role in a portfolio.

The middle is where things are often misrepresented. Fifty percent of invested dollars today are in what I would call closet index funds. These are the funds that focus on where holdings are, plus or minus, versus their benchmark index. Managers of these funds typically don’t want to make big decisions, or veer far from the index, but charge fees as if they do. These funds are dinosaurs, and in my opinion, they don’t fit into today’s competitive marketplace. My view is that closet index funds that charge as if they are actively managed can’t and won’t last. Period.

Finally, on the far right side are high-conviction, active portfolio managers, like us here at Invesco, who aim for significant outperformance versus our benchmarks over the long term.

Why active?

The rhetoric we’ve heard for years is that active can’t beat passive – that it never has, never will. History tells us a very different story. History tells us that outperformance from active managers has been cyclical. The data points to specific time periods when active significantly outperformed, and others when it underperformed.

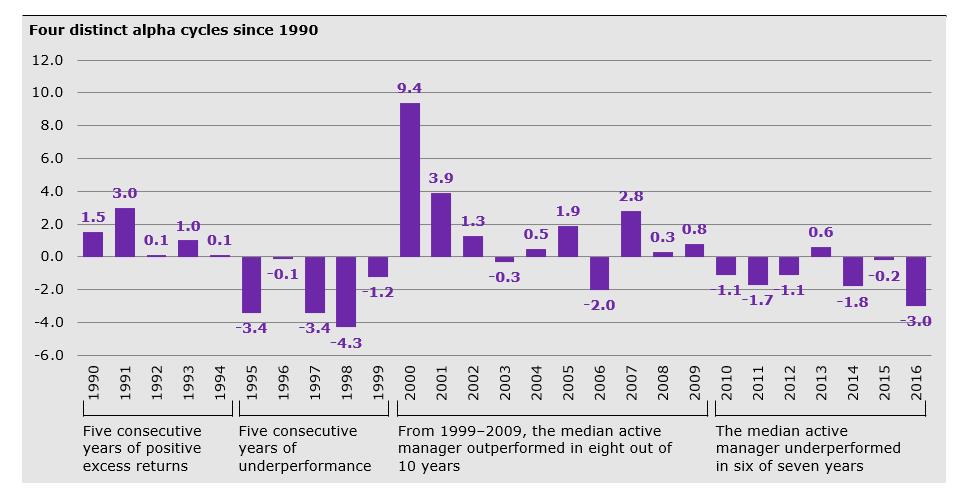

Sources: eVestment and Goldman Sachs Global Investment Research 2017. The chart provides median excess returns vs. the benchmark; it includes actively managed large-cap, long-only U.S. mutual funds. Past performance is not indicative of future results.

When have actively managed funds outperformed? When the markets sell off in times of crisis. The tech bubble correction, for example, can be seen in the chart above between 2000 and 2002. Active management can be a safety blanket. In times that are toughest for investors, history shows that active management can help you by outperforming an index.

Looking at the chart above, there are a couple of glaring observations. Active management is currently in a trough. There hasn’t been a correction in nine years, and these are the environments in which we active managers thrive. This is the time to decide your approach to the next five years. Taking the contrarian approach is tough, but history shows that it can pay off. I believe that when conventional wisdom is firmly sitting with one opinion, as it is now with index investing, it’s a signal, like a neon sign, telling us to take a different approach. Groupthink rarely benefits the group – in any field.

How to know if your active manager is really active

Let’s say you’ve made the call to pursue active management for certain areas of a portfolio. How do you choose a portfolio management team or fund? How do you separate the wheat from the chaff and, most importantly, weed out the closet indexers that are charging active fees? Deciphering which high-conviction managers will outperform an index over the long-term is a pursuit that demands research and judgment, but there are two key elements that can help guide the path.

- Active share.1 How different is a fund versus its index? You can’t beat the index if you are the same as the index.

- Concentrated portfolios. Holding fewer companies allows better research and higher conviction in the companies the fund is invested in.

Academic research2 has found the higher a fund’s active share, the higher the overall performance has been. Of course, it’s not as simple as “being different,” but in my opinion, active share is a good place to start. As Martijn Cremers noted in his 2017 follow-up study, Active Share and the Three Pillars of Active Management: Skill, Conviction, and Opportunity,3 managerial skill, high conviction (including long holding periods) and opportunity (low constraints) are key ingredients in successful fund performance.

I can’t speak for other active managers, but at Trimark our funds look very, very different from their indices. Active share is simply a by-product of the way we invest. We look for great companies that fit our strict criteria, without any preconceived constraints around geography, industry or company size. We want a strong business at the right price. That’s it. And, coincidentally enough, year after year, our funds tend to look very different from the indices that serve as their category benchmarks.

If you have any questions, don’t hesitate to reach out in the comments section below. Thanks for reading.

Glossary

Smart beta: An index methodology that employs alternative weighting and security selection with the goal of outperforming a market-cap-weighted benchmark, reducing portfolio risk, or both. Smart beta ETFs may underperform cap-weighted benchmarks and/or increase the portfolio risk.

This post was originally published at Invesco Canada Blog

Copyright © Invesco Canada Blog