by Scott Brown, Ph.D, Raymond James

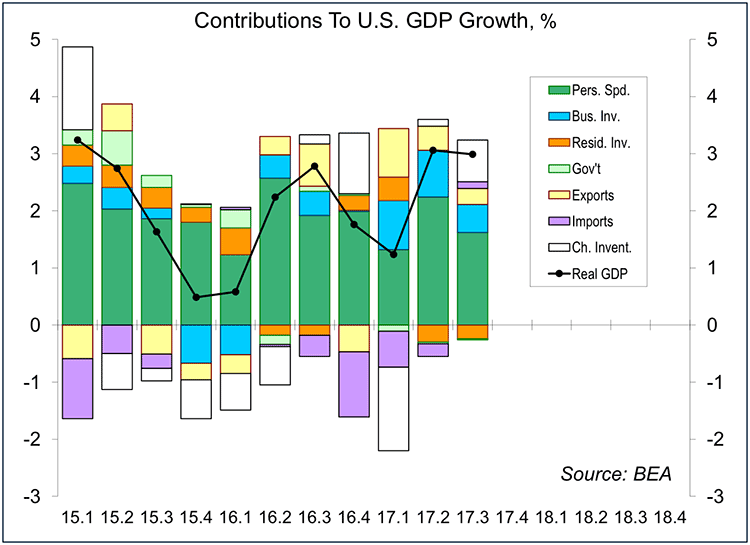

The economy grew at a 3.0% annual rate in the advance estimate for the third quarter, as the hurricanes appeared to have both positive and negative effects. The figures will be revised, but the story is unlikely to change much.

Inventories rose at a faster pace in 3Q17, adding 0.7 percentage point to the headline GDP growth figure. It’s often difficult to tell why inventory growth has picked up. It could signal business expectations of strong future sales, or it might reflect goods unsold due to unexpectedly weak demand. Dealer incentives helped clear the lots of motor vehicle dealers in September, but hurricanes disrupted overall consumer spending. The inventory figure will almost certainly be revised, but the pace had appeared to be picking up ahead of the hurricanes and there is often noise from quarter to quarter.

Net exports (a narrower trade deficit) added 0.4 percentage points to GDP growth in 3Q17, reflecting a further increase in exports (consistent with an improving global economy) and a decrease in imports (imports have a negative sign in the GDP calculation). Hurricane Harvey disrupted port traffic, reducing petroleum imports. Otherwise, imports would have risen (and subtracted from overall GDP growth), consistent with a strengthening domestic economy. This effect ought to unwind in the fourth quarter numbers.

Despite earlier hopes for a large-scale infrastructure spending program, nobody expected the federal government to add much to overall economic growth this year. State and local government budgets have improved in recent years, but we haven’t seen a corresponding unwinding of the budget cuts that took place in the early stages of the economic recovery (as federal support faded and budget strains were binding).

In many of her post-FOMC press conferences, Fed Chair Janet Yellen has spoken about Private Domestic Final Purchases (PDFP). PDFP can be thought of in two ways. It is GDP less net exports and the change in inventories. Inventories and foreign trade are a relatively small part of GDP, but they account for more than their fair share of volatility in quarterly GDP. PDFP is also the sum of consumer spending, business fixed investment, and residential investment – a measure of the “meat and potatoes” of the U.S. economy. PDFP rose at a 2.2% annual rate in the initial estimate for 3Q17, the slowest pace since 1Q16. However, that softness is almost certainly due to the hurricanes.

Consumer spending rose at a 2.4% annual rate in the third quarter, with motor vehicle sales (boosted by model year-end clearances) accounting for 38% of that increase. Hurricane Irma disrupted the tail end of the summer travel industry in Florida. So, we should see a rebound in the fourth quarter. However, prior to vehicle clearance promotions and the hurricanes, consumer spending appeared to be on a relatively soft track. That could reflect the usual quarterly variation in spending results, or it might signal increased budget strains for middle-income households. Fourth quarter numbers should tell the tale. Most likely, consumer spending (69% of Gross Domestic Product) will expand at a moderate pace.

Oil and gas well drilling is capital intensive, showing up in the GDP data as “mining structures.” The pullback following the drop in oil prices in late 2014, depressed overall business fixed investment (and in turn, GDP growth) in 2015 and early 2016. In the first half of this year, the recovery in energy exploration was responsible for 37% of the improvement in nominal business fixed investment. Hurricane Harvey restrained oil and gas well drilling in 3Q17, but we should see a strengthening in the fourth quarter. Beyond energy, investment in structures was weak in the third quarter, especially in manufacturing. In contrast, investment in equipment was strong.

So where does that leave us? GDP growth is likely to be moderately strong in the near term. While consumer spending growth ought to recover from hurricane effects, the pace of motor vehicle sales should pull back to the previous trend (which has been lower this year). The recovery in energy exploration should pick up, but that pace of improvement isn’t going to last forever (as activity reaches some steady-state level). Inventory and foreign trade figures are subject to revision, which will have some impact on 4Q17 GDP forecasts, but underlying domestic demand should be moderate.

Last week, the Bureau of Labor Statistics revised its 10-year outlook for the job market. The labor force is expected to grow at an average annual rate of 0.6% between 2016 and 2026. That works out to an average monthly gain in nonfarm payrolls of about 96,000. We’ve been running well ahead of that, but the Fed is aware of the approaching constraint.

*****

The opinions offered by Dr. Brown should be considered a part of your overall decision-making process. For more information about this report – to discuss how this outlook may affect your personal situation and/or to learn how this insight may be incorporated into your investment strategy – please contact your financial advisor or use the convenient Office Locator to find our office(s) nearest you today.

All expressions of opinion reflect the judgment of the Research Department of Raymond James & Associates (RJA) at this date and are subject to change. Information has been obtained from sources considered reliable, but we do not guarantee that the foregoing report is accurate or complete. Other departments of RJA may have information which is not available to the Research Department about companies mentioned in this report. RJA or its affiliates may execute transactions in the securities mentioned in this report which may not be consistent with the report's conclusions. RJA may perform investment banking or other services for, or solicit investment banking business from, any company mentioned in this report. For institutional clients of the European Economic Area (EEA): This document (and any attachments or exhibits hereto) is intended only for EEA Institutional Clients or others to whom it may lawfully be submitted. There is no assurance that any of the trends mentioned will continue in the future. Past performance is not indicative of future results.

Copyright © Raymond James