by Urban Carmel, The Fat Pitch

Summary: The irony of equity investing is this: if you knew nothing about the stock market and did not follow any financial news, you have probably made a very handsome return on your investment, but if you tried to be a little bit smarter and read any commentary from experienced managers, you probably performed poorly.

The human mind has a tendency to assess risk based on prominent events that are easily remembered. The 1987 crash, the tech bubble, the financial crisis and the flash crash in 2010 are all events that are easily recalled. The mind automatically assigns a high probability to prominent (but rare) events. It ignores the more important "base rate" probability that better informs decisions. The fact that the stock market rises in 76% of all years, that it gains an average of 7.5% per year and that annual falls greater than 20% occur less than 5% of the time, are ignored in decision making. The mind interprets every 10% correction as the beginning of something much worse, even though a 10% fall is a typical, annual occurrence during bull markets.

Bearish market commentary that highlight risk conjure gravitas. Bullish commentary often seems shallow. But remember, in the absence of relevant data, the "base rate" probability is your best guide. Conflating prominent, but rare, events with high probability is an ongoing impediment to better investment returns. Recognizing this inherent deficiency in our decision making is perhaps the biggest potential source for improvement for most investors.

* * *

In the past 12 months, the S&P has returned 22%. In the 3 years since the end of QE3, the total return is 37%. In the past 5 years, returns are over 100%.

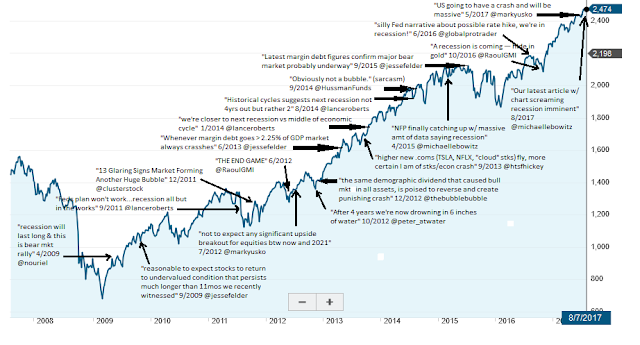

Yet, throughout this period, investors with even a passing interest in financial news have regularly seen commentary from experienced managers that the stock market is highly likely to plunge now (from Daniel Miller). Enlarge any chart by clicking on it.

The irony of equity investing is this: if you knew nothing about the stock market and did not follow any financial news, you have probably made a very handsome return on your investment, but if you tried to be a little bit smarter and read any commentary from experienced managers, you probably performed poorly.

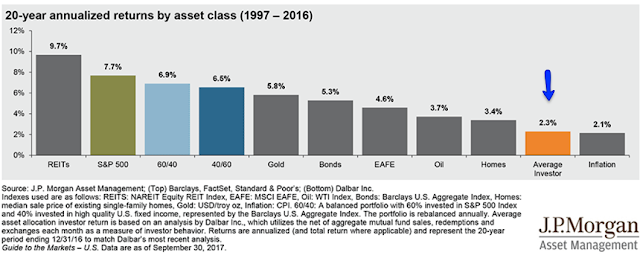

That fact is apparent in the statistics, where the average investor earns a return that is less than 1/3 of what they would have earned if they knew nothing and blindly invested in the stock market (next 3 charts from JPM).

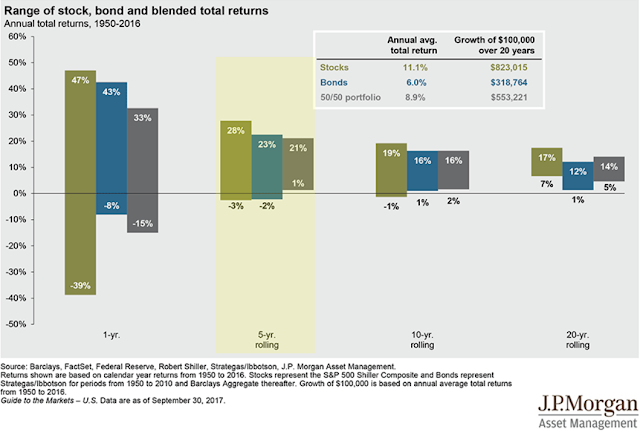

These statistics are not the product of the recent and ongoing bull market either. Since 1950, the lowest return from the S&P was a mere -3% but the highest return was +28% on a rolling 5 year basis. Risk has clearly been to the upside.

Since 1980, the S&P has closed higher 76% of the time and suffered an annual loss of less than 3% an overwhelming 84% of the time.

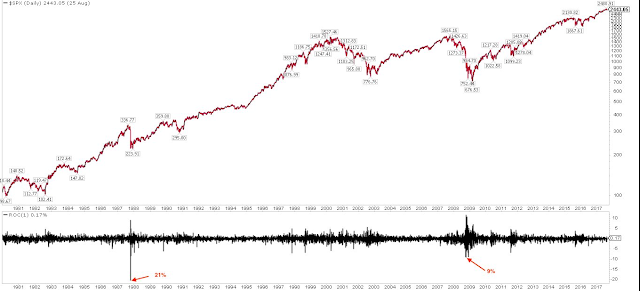

In the past 193 years, US equities have suffered an annual loss greater than 20% just 9 times, a "base rate" of 4.7%. The "base rate" is the probability you would assign to an outcome if you knew nothing other than how often it was statistically likely to happen (from basehitinvesting.com).

All of this came into focus again last week when the S&P celebrated the 30th anniversary of the 1987 crash. Those working at the time can attest to the affect the crash had on investor confidence. In one day, the S&P fell 21%. Over 10 days, the index fell 32%, worse than even the darkest period of 2008, the largest financial crisis in 4 generations.

Various pundits have warned of a repeat to the 1987 crash every year since (a post on this is here). This is stunning. 1987 is obviously an extreme outlier: the worst day in either 1929 or 2008 was half as bad as 1987. The base rate of a repeat of this event is close to zero.

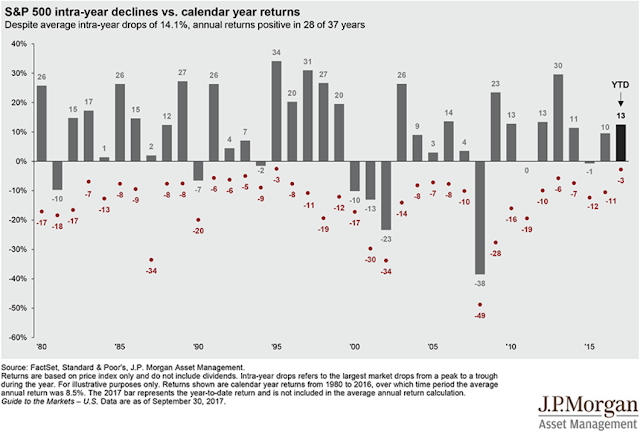

If you are thinking "but the market could still fall 10%," you are right:

Since 1980, the S&P has fallen an average of 14% during the course of the year.

Even if you ignore the worst 5 years (1987, 2001, 2002, 2008 and 2009), the average intra-year fall is still 10.8% during a bull market.

So not only is a 10% fall possible, it is odds-on. But over the past 193 years, stocks have bounced to close the year higher than a 10% loss 87% of the time. Trying to avoid an intra-year fall of 10% is why the average investor earns a return that is barely higher than the annual rate of inflation.

The bad news is that it is not just investors who are bad at assessing risk. This is a basic human trait. The nature of evolution is to favor individuals who avoid risk long enough to propagate the next generation; assertive risk-takers are eliminated over time.

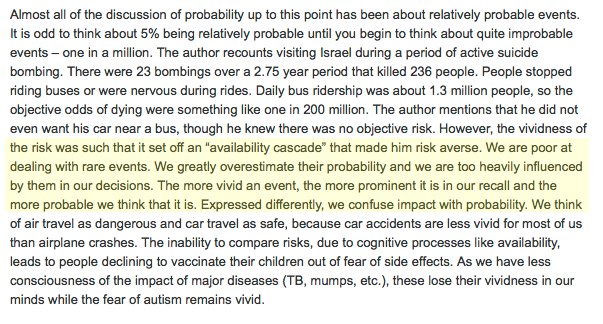

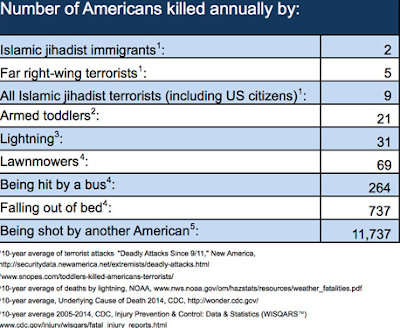

But that means that even risks that are objectively benign are mistakenly assumed to be significant. Nobel psychologist Daniel Kahneman describes overestimating the risk of death by terrorism, even in Israel during a war, when the odds were just one in 200 million.

We greatly overestimate the probability of rare events and "are too heavily influenced by them in our decisions. The more vivid an event, the more prominent it is in our recall and the more probable we think that it is. Expressed differently, we confuse impact with probability."

The human mind's tendency to assess risk based on prominent events that are easily remembered is called the "availability heuristic" (because the events are readily "available" for recall). The 1987 crash, the tech bubble, the financial crisis and the flash crash in 2010 are all events that are easily recalled. The mind uses prominent, but rare, events to assess risk, automatically assigning them a high probability. It ignores the more important base rate data that better informs decisions. Because positive events are less prominent (available), the fact that the stock market rises in 76% of all years, that it gains an average of 7.5% per year and that annual falls greater than 20% occur less than 5% of the time, are ignored. The mind interprets every 10% correction as the beginning of something much worse, even though a 10% fall is a typical, annual occurrence (from the standard.org).

30 years after the 1987 crash, many investors still consider a repeat to be likely. The event was so vivid that most can recall what happened to them on that day. Negative events dominate our memory in a way completely unlike positive events. Few remember much about 1989, a year in which the market rose 30%. When investors think about 1987, how many recall that the year closed with a gain of 2%?

So what is an objective investor to do?

In the spring of 2016, investors were advised to sell equities due to high margin debt, flat profitability, excessive corporate buybacks, the end of Fed support, weakening macro growth, widening high yield debt spreads, China, and a host of other reasons. All of these threats were described with great gravitas but, on closer inspection, were easily shown to be benign. We wrote about this repeatedly at the time (one example is here). SPY has since risen 18 of 19 months and by 30%.

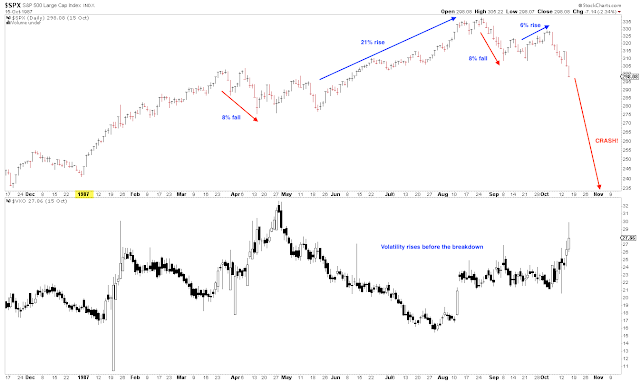

Every week brings new worries. A current concern is low volatility, comparable only to 1964 and 1995. It's an anomaly and thus has an ominous ring to it. But the S&P subsequently rose 8% in 1965 and 20% in 1996. In neither case was low volatility bearish; in fact, volatility has a tendency to rise into a market peak, something it has yet to do in the current environment. This is objectively benign.

If you are worried about a repeat of 1987, remember this: the S&P corrected 8% between March and May 1987, peaked in August, again dropped 8% into September and then rose 6% into early October. It then took another 2 weeks before the crash. In short, the trend weakened well before it reversed. And during this time, the volatility index doubled from 16% to as high as 32%. A similar pattern developed prior to major tops in 2000 and 2007 and also before smaller tops in 2011 and 2015. None of these characteristics are visible at present.

The current bull market is in its 8th year. It's probably much closer to its end than its beginning. And forward equity returns are notably lower when valuations are already high (as detailed here). This post is not advocating complacency. Conflating prominent, but rare, events with high probability is an ongoing impediment to better investment returns. Recognizing this inherent deficiency in our decision making is perhaps the biggest potential source for improvement for most investors.

Bearish market commentary that highlight risk conjure gravitas. Bullish commentary often seems shallow. But remember, in the absence of relevant data, the "base rate" probability is your best guide. 10% market falls are a typical annual event but the stock market finishes better than that an overwhelming 87% of the time.

Copyright © The Fat Pitch