Five Reasons To Take A Look At Japan

by John Lynch, Chief Investment Strategist, LPL Financial

KEY TAKEAWAYS

- Japan’s economy is improving, and Prime Minister Shinzo Abe has a mandate for more stimulus after his latest election victory.

- Japanese valuations are attractive and pessimism toward the market may be overdone.

- Technical analysis reveals favorable chart patterns.

It’s time to take a look at Japan. The Nikkei’s 15-day win streak, its longest on record, has our attention. When thinking about Japan, many who started following markets closely in the 1980s or later know nothing else besides year after year of recession, deflation, and a poorly performing stock market. It’s been a long, slow process but we believe that investing conditions are changing in Japan for the better, making the country’s markets worth a look. This week we discuss five reasons to take a serious look at Japan.

International investing involves special risks such as currency fluctuation and political instability and may not be suitable for all investors. These risks are often heightened for investments in emerging markets.

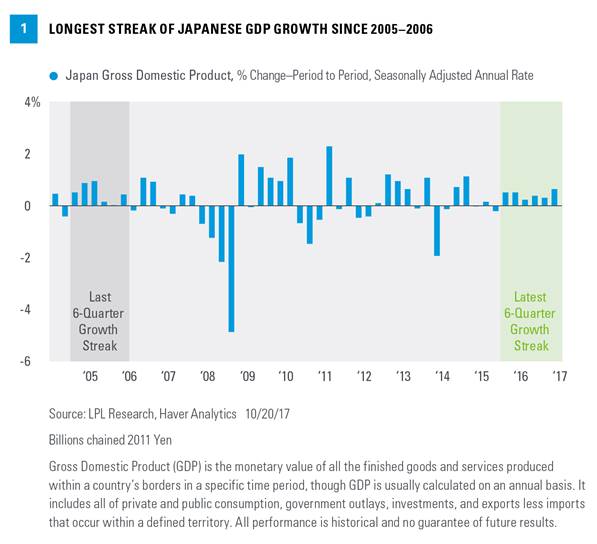

Reason #1: Improving economy

Economic growth has been improving in Japan with six straight quarters of real gross domestic product (GDP) growth, the longest streak since 2005–2006 [Figure 1]. That streak included a quarter that was essentially flat, so you have to go back to the mid-1990s to find a streak of six quarters with meaningful growth. A potential 1.5% increase in GDP in 2017 (based on Bloomberg consensus forecasts) does not sound like much, but it is the fastest rate of growth since 2013. And for an economy — the world’s third largest — that has been regularly in and out of recession for three decades, it represents progress.

Japan is also making progress in its battle against inflation. Wages have started to pick up, albeit gradually, putting some upward pressure on Japanese interest rates. Although low unemployment in Japan is not newsworthy (historically it has always been low), the quality of jobs is improving. More stimulus and additional structural reforms could help an already improving picture.

Reason #2: More Abenomics

Prime Minister Shinzo Abe has consolidated power with this weekend’s election victory in which his ruling coalition — his Liberal Democratic Party (LDP) and coalition partner Komeito — retained its two-thirds parliamentary majority, providing a mandate for more of Abe’s “three arrows” plan, including: 1) government spending, 2) monetary policy, and 3) structural reforms.

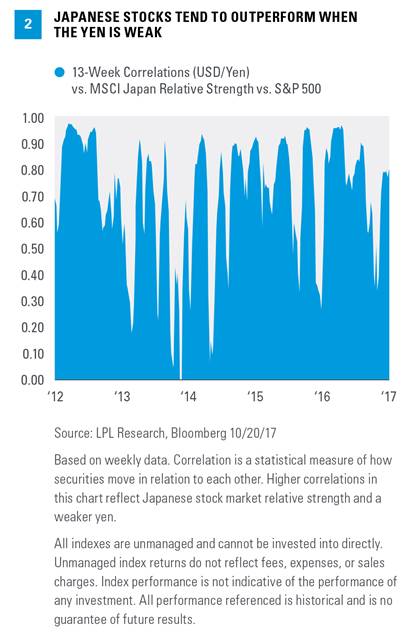

The first arrow, government spending, is tricky given Japan’s heavy debt load. Opposition to more government spending came to light after a proposed sales tax to help pay down debt was met with resistance. But the second arrow is firing on all cylinders, as the Bank of Japan (BOJ) is expected to continue its aggressive securities purchases. The BOJ is also expected to continue capping interest rates at zero to support bank lending and encourage investor risk taking, even as the U.S. and Europe pull back support. This divergence in monetary policy may help keep the value of the yen down, which may help Japanese stocks. Figure 2 shows that when the U.S. dollar is strong versus the yen (higher in the chart), Japanese stocks tend to outperform their U.S. counterparts. A weak yen helps support Japanese exporters, which are critical to the country’s growth prospects (note that Japanese exports rose 13% year over year in August, the latest reported month). For those with the choice, we consider currency-hedged Japanese equity exposure preferred to unhedged, all else equal.

The structural reform arrow is still a work in progress, but deregulation, immigration reform, and encouraging women in the workforce are among some of the policies that can help offset the demographic headwinds of an aging population. A strong military is also a part of Abe’s platform — and helped his LDP party win votes over the weekend in light of the North Korean threat — so we could see more defense spending.

Reason #3: Corporate Governance

For many years, one of the big knocks on Japanese stocks was that the companies were not managed for the shareholders, but rather for social good. The corporate culture in Japan has been changing, and increasingly we are seeing companies run more for the shareholders, with smarter capital allocation decisions and more cash returned to shareholders in the form of dividends or buybacks.

For example, since 2006, dividends for the MSCI Japan Index have grown more than 75%, or 5.9% per year — not far behind the equivalent in the U.S. (7.5%). Growth in share buybacks has been even stronger over this period, increasing by more than 150% over the past 10 years, or 9.8% per year, more than five times the growth rate of buybacks for the S&P 500 Index.

Greater focus on return on equity (ROE), a measure of profitability, is another positive development in corporate Japan. Stock valuations and ROE are connected, so companies with large cash hordes and depressed ROEs — like many in Japan — have tended to be penalized with lower valuations. A greater focus on ROE helps provide incentive for companies to put cash on their balance sheets to productive use and may also help support higher stock prices.

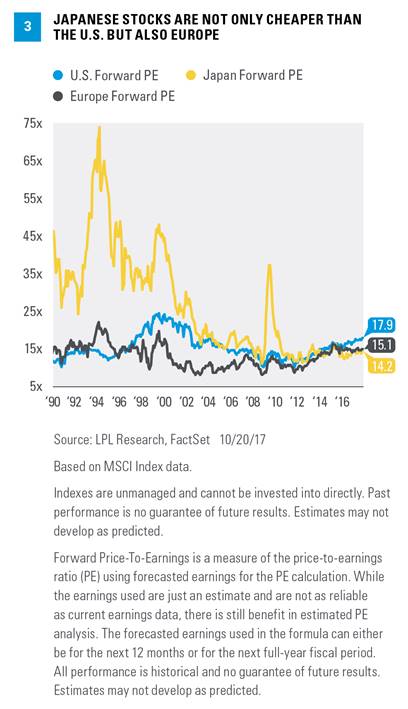

Reason #4: Attractive Valuations

In theory, better corporate governance, returning more capital to shareholders, and higher ROE should translate into higher valuations for Japanese stocks. Yet, as shown in Figure 3, the Japanese market is quite a bit cheaper than the U.S. and also cheaper than Europe. On a forward price-to-earnings ratio (PE) basis, the PE for Japan is 14.2 compared with 17.9 in the U.S. and 15.1 for Europe, despite comparable expected earnings growth in Japan. Consensus earnings estimates are calling for 18% earnings growth for 2017 and 7% in 2018.

Pessimism toward the Japanese equity market is another reason it might present an attractive opportunity. According to the latest data on investor positioning, U.S. investors are underweight the country’s equities. In fact, the recent Barron’s Big Money poll — a survey of more than 140 money managers across the country — showed that only 6% expect Japan to be the top-performing market over the next 12 months, the lowest of the five choices (emerging markets, Europe, U.S., China, and Japan). When there are few bulls, the opportunity exists for more to emerge and push stocks higher.

Reason #5: Technical Momentum

The Japanese Nikkei broke out to fresh 21-year highs last week, along the way closing higher 15 consecutive days. This strong momentum has led to some favorable chart patterns for this market from a technical analysis perspective, including a bullish head-and-shoulder pattern [Figure 4]. This pattern is a trend reversal with three successive troughs — two shoulders at similar levels and a lower “head.” The so-called “neckline” connects the high points of the pattern and acts as resistance. If the resistance is broken to the upside, the expectation is that the price will continue to rise. The current pattern, which began forming in July 2015, executed to the upside in September 2017 with a confirmed breakout above resistance, increasing the likelihood that the price continues higher over the long term.

Although not shown in Figure 4, the relative strength of Japanese stocks versus U.S. stocks (represented by the MSCI Japan Index versus the S&P 500) also looks to be breaking out of a longer-term bottoming pattern increasing the likelihood that relative performance continues to improve over the next 6–12 months.

Conclusion

We think the Japanese equity market is worth a look. Prime Minister Abe has a mandate for continued policy stimulus and structural reforms. Corporate Japan is acting more in the best interests of shareholders. Valuations are attractive. And the technical analysis picture is positive. Of course, the North Korean threat remains an obvious concern, demographic challenges are significant, and the country’s latest resurgence could be another in a long history of head fakes. But all in all, we see enough to consider Japanese equities here, especially for appropriate investors concerned about elevated valuations in the U.S.

*****