by Kara Lilly, Investment Strategist, Mawer Investment Management, via The Art of Boring Blog

Each day we observe events and instantly associate meaning to them. In other words, we are constantly making inferences about the world—usually unconsciously. Unfortunately, we tend to neglect challenging these inferences or even fool ourselves into thinking that they are wholly evidence based. For example, when we say something like “the market is down because of North Korea jitters” it is most likely an inference, a meaning we are assigning to a situation, and not something we know for certain.

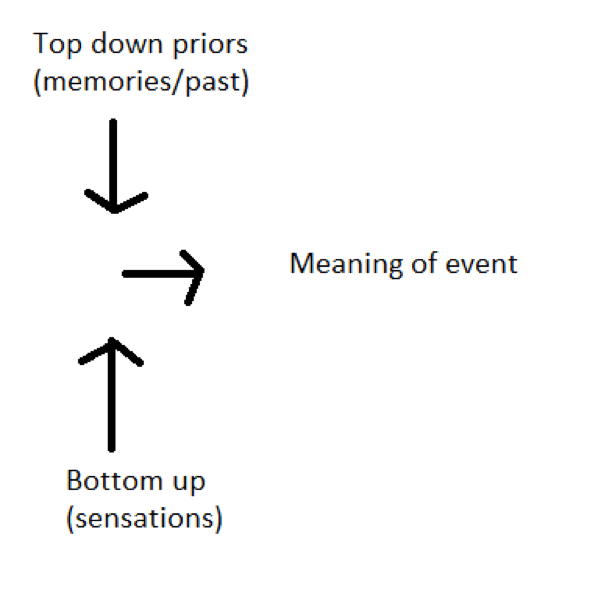

While the brain can immediately react to stimuli such as sights and smells, it also often goes the extra step of assigning associated meaning to these sensations. In Mindsight: The New Science of Personal Transformation, Dr. Dan Siegel, a Harvard medical graduate and a clinical professor of psychiatry at the UCLA School of Medicine, explains how our brains arrive at such meaning. When new data arrives in our cerebral cortex, it interacts with our prior experiences (memories), allowing us to infer a unique interpretation of our current experience.

This revelation tells us that there is no such thing as immaculate perception. We may believe our read on a situation is based 100% on evidence, but this simply isn’t how our brains work. When it comes to making inferences, every event is filtered both by the signals we detect and our past. For example, if we see someone running down the street, we can interpret it as “they are excited to get somewhere” or “they are being chased.” Our interpretation is influenced by our experiences.

This is a useful mental model for investors. Awareness of our personal histories helps us understand how our past might be shaping the inferences we make. For example, a person would probably have very different core beliefs about markets if he began investing in the 1930s versus starting after the crash of 2009.

On our team we make a concerted effort to explicitly acknowledge our histories. For example, our CIO Jim Hall has spent many years as the co-manager of our Canadian mid-large cap strategy. Consequently, he has seen a lot of wealth created by investing in Canadian banks, which have historically been wealth-creating businesses with above average returns on equity. This past compares markedly to David Ragan’s, co-manager of our international equity strategy, who saw numerous European banks go bust shortly after joining the business. In David’s universe, banks don’t tend to be as wealth-creating.

Jim and David understand their brains are primed a certain way towards banks. Awareness of this priming allows them to question the initial inferences or meanings they associate with banks. It is step one in countering the narratives we hold.

As investors, there is a tendency to believe we are being perfectly objective. Neuroscience provides a compelling falsification to this idea. Intellectual honesty begins when we admit that not one of us is a perfectly rational creature, coldly taking in and processing information impartially. Our past automatically influences our perception; accepting this fact is our best bet to loosen its grip.

![]()

About Kara Lilly

Kara Lilly, CFA, is the Investment Strategist at Mawer Investment Management Ltd. She plays an active role in asset mix, risk management and the macroeconomic investment process. Learn more

This post was originally published at Mawer Investment Management