by Blaine Rollins, CFA, 361 Capital

It was another week of new highs across the major indexes as the markets ignored Washington and geopolitics, focused on the global economic picture and waited for the surge of corporate earnings reports. Drug and Health Care stocks were sent to the doghouse as the White House ramped up its war against pricing and made executive order changes to Obamacare which will remove dollars from the total system. HMOs, Hospitals, Drugs/Biotech and Distributors were all hit. The industry was a leader in the market for the year but Washington may have just given the group the flu.

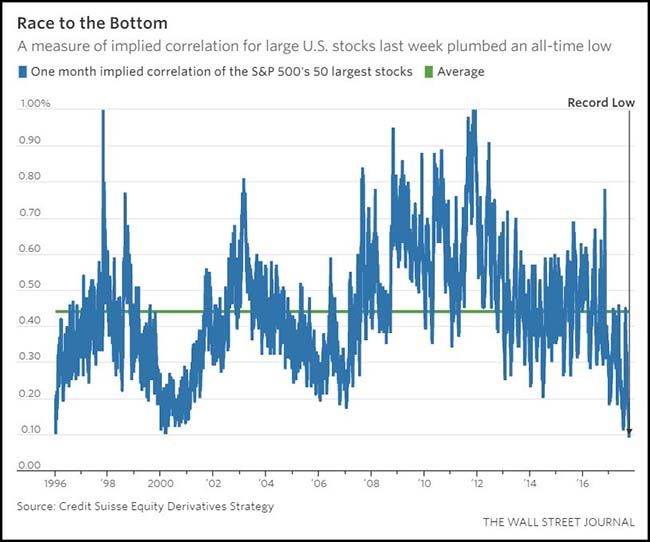

Correlations among stocks remain near two decade lows which continues to provide opportunities for active managers to outperform.

If you can own the right geographies, sectors and individual names, you can outperform. We even saw evidence of this last week in the early reports from the banking group where Bank of America gained +1.5% on its earnings report while Citigroup and Wells Fargo fell -3% on theirs. Expect much more dispersion among earnings stocks in the next few weeks as portfolio managers fight for names to own and not own as they look to finish up 2017 on a strong note. Active managers who can beat their indexes by 300+ basis points going into year-end will no doubt catch the attention of investors looking to find some outperformance. If they are lucky, they might even be able to win some assets from the passive ETFs!

(WSJ)

To receive this weekly briefing directly to your inbox, subscribe now.

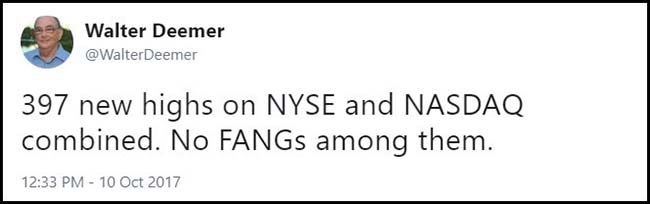

Not only are correlations low and breadth is running high…

But Walter reminded us last week that this market is no longer being led by the FANG stocks. This is again great news for active managers who don’t concentrate in the top market cap stocks like the indexes and ETFs do.

Another good place for alpha generation has been in Emerging Market stocks…

Which just posted their highest levels in 10 years.

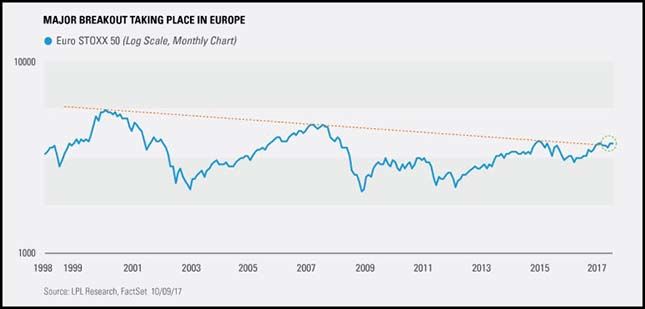

Ryan reminds us that even Europe is about to break out of a long-term trend…

@RyanDetrick: The Euro STOXX 50 is nearing a major breakout nearly 17 years in the making. We take a closer look here …

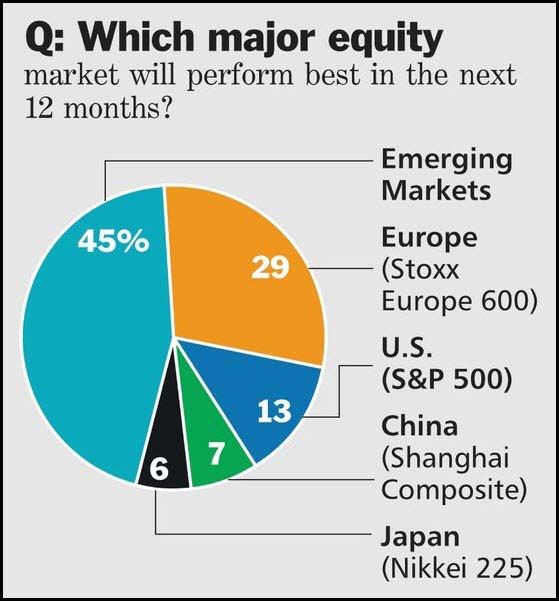

No surprise that Portfolio Managers are highlighting the equity opportunities Overseas…

WASHINGTON DYSFUNCTION, plus high valuations, are pushing more managers to look abroad. Among our Big Money managers, 45% said they expected emerging markets to perform best in the next 12 months. Of the rest, 29% chose European markets to outperform. Just 13% named the U.S. Expectations are lowest for China and Japan.

“If you believe the bull case, the best place to put money is into emerging markets that will likely outperform developed markets,” says Scott Minerd, global chief investment officer for New York–based Guggenheim Partners, which has $260 billion in assets. “They are strengthening in their own right.”

He cites valuations as another argument for emerging markets: The MSCI Emerging Markets Index trades at 12 times 2018 earnings forecasts, versus 18 for the S&P 500 and 15 for the MSCI Europe Index.

(Barron’s)

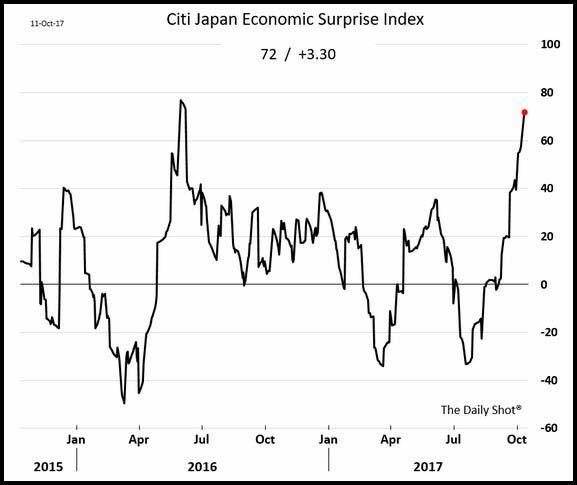

Tough to not be excited about Japan given their positive economic surprises…

If there is one area of the world which could use some inflation, it would be Japan.

(WSJ/Daily Shot)

One place that you don’t want to see inflation today would be in the U.S. Budget Deficit…

At this point in the cycle, this data stream should be falling, not rising. As a result, the U.S. dollar will be feeling a strong headwind versus other major global currencies. So the Portfolio Managers in the above survey are again smart to be focused on their International equities.

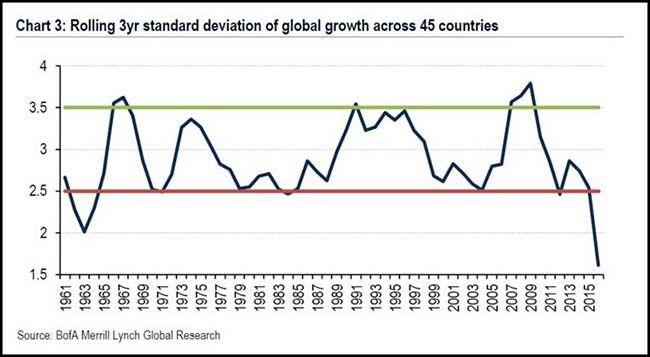

Another reason that equity market volatility is low…

Is that global growth has become less volatile. You can thank Central Bank coordination and the synchronized global recovery. Now what will happen when the Central Banks start pulling back will be the million dollar question?

Looking at the Port of Long Beach data shows that U.S. trade looks quite healthy…

Looks like many of strings of Christmas lights, winter sleds and stuffed animals have made their way to the west coast port.

The 701,619 twenty-foot equivalent units (TEUs) processed in Long Beach for September — up 28.3 percent — also resulted in the Port’s best quarter ever. In the third quarter (July, August and September), the Port of Long Beach handled 2,114,306 TEUs, as volumes swelled 15.9 percent over the same period last year.

“Simply put, we are having the best trade months in Port history,” said Harbor Commission President Lou Anne Bynum. “Back-to-school merchandise was strong for us, and it looks like retailers are optimistic about the holiday season.”…

Volumes have been strong throughout the summer with 9 percent gains in June, 13 percent increases in July and an 8 percent improvement in August. July was the Port’s busiest month ever, and now September is the third-busiest ever. For the calendar year, container volumes have surged 8.9 percent.

As long as the global economy continues to click, Byron Wien will have less to worry about…

What would really worry me would be an inverted yield curve, but there is now almost an eighty basis point spread between the two-year Treasury and the ten-year. I would also be concerned if retail investors were euphoric about equites as they were in 1999 or 2007. They are generally optimistic, but not excessively so, although earlier this year sentiment did rise to a worrisome level. Investors large and small are also leaning toward the defensive. Hedge fund net exposure clearly shows a mood of caution: it is just under 50% now; it was mostly 55%–60% in the 2000–2008 period. Individuals are still buying bond funds even at these low yields because of their lack of confidence in the stock market. Institutions, in their desperate search for yield, have bid up the price of lower-quality bonds to the point where their spread with Treasurys is historically low. Warnings of trouble ahead, however, would usually be associated with high spreads. Maybe investors are too complacent, but this may not be the case if the economy continues to grow.

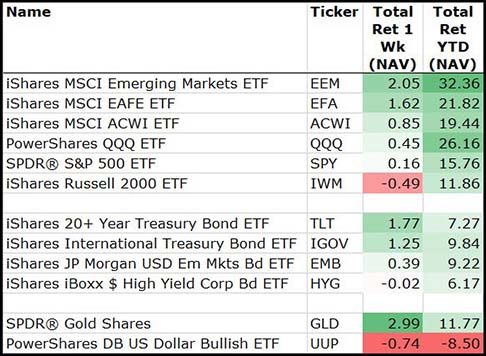

For the week, International Markets, Gold and Bonds led…

Small Caps took a breather along with the U.S. dollar.

(10/13/2017)

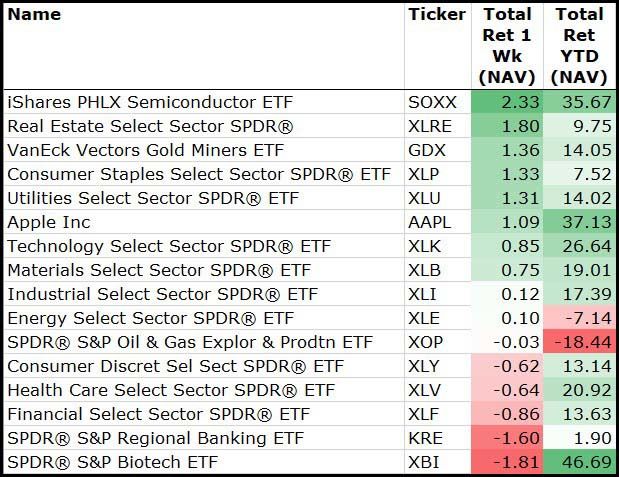

Among sectors, Semis and Defensive stocks led…

Biotech and Health Care were hit on the White House moves. Banks and Financials lagged on the weaker than expected earnings reports.

(10/13/2017)

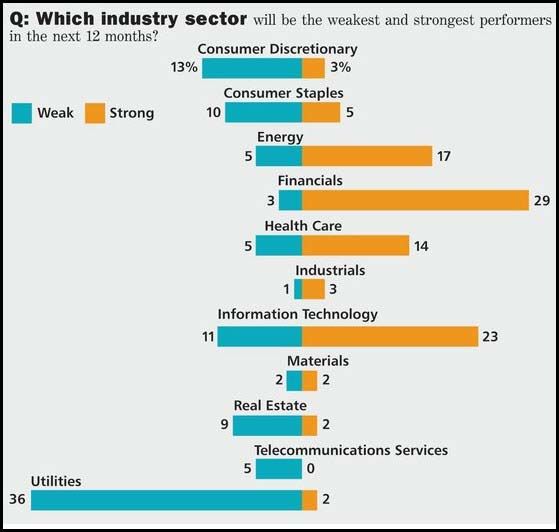

Portfolio managers love the outlook for Financial stocks. I am less excited…

Without a strengthening in loan growth and continued rise in interest rates, I think that it will be difficult to offset the inevitable rise in credit costs. And U.S. bank operating expenses are already quite efficient. Add this to the risk in competitive threats to their consumer business (like Amazon, Paypal, Bitcoin, etc.) and I have a tough time making U.S. Bank stocks my number one bet.

(Barron’s)

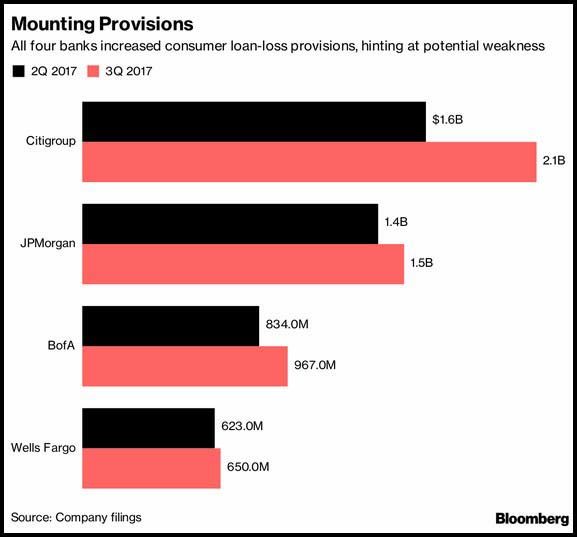

What caused the concern in early bank earnings last week? Consumer credit costs…

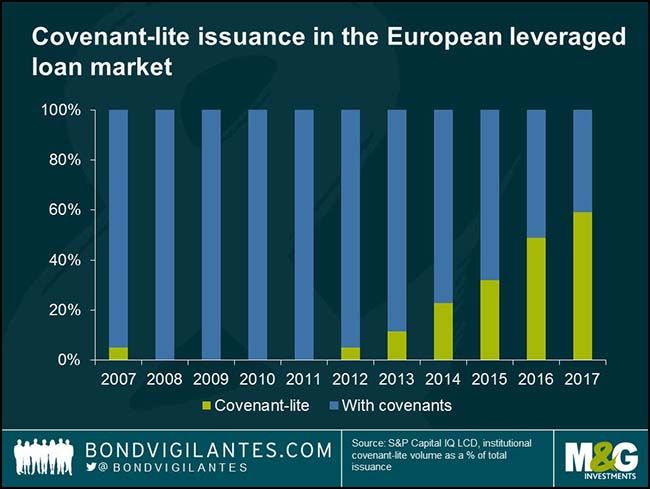

And we know that the relaxation of commercial credit will eventually cause a further rise in credit costs…

This chart is focused on Euro lending but it looks similar to the experience of loans in the U.S.

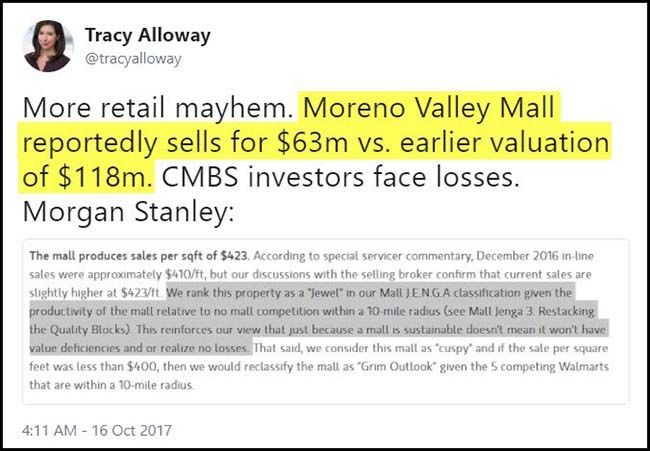

And if you own Retail real estate or mortgages, you might want to look at your marked values…

You know what is happening in mall-based retail…

J.Jill missed their numbers last week and the stock was cut in half.

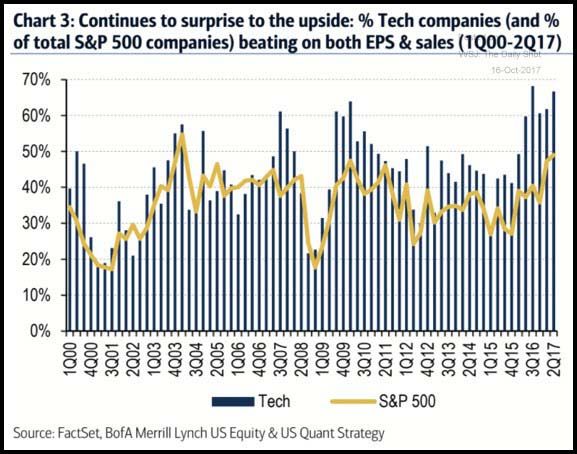

If you are looking to where the earnings beats are more likely to occur, the Tech sector should remain at the top of your list…

(WSJ/Daily Shot)

Speaking of earnings, here is the visual for this week’s thundering herd of reports…

(@eWhispers)

JPMorgan is looking for many reasons to smile this Q3…

JPM US Equity Strategy – Earnings to Outperform Sharply Lower Expectations

We are expecting another solid earnings season for S&P 500 companies with quarterly EPS reaching a record ~$33.75 in 3Q17 — a positive earnings surprise of ~4.5% vs. consensus EPS of $32.32. In our view, the macro backdrop remains supportive for earnings growth (y/y) with lower USD (especially favorable for Technology, Healthcare, and Industrials), a goldilocks scenario for Financials with expanding NIM and multi-decade low credit costs, and rising commodity prices (Energy and Materials).

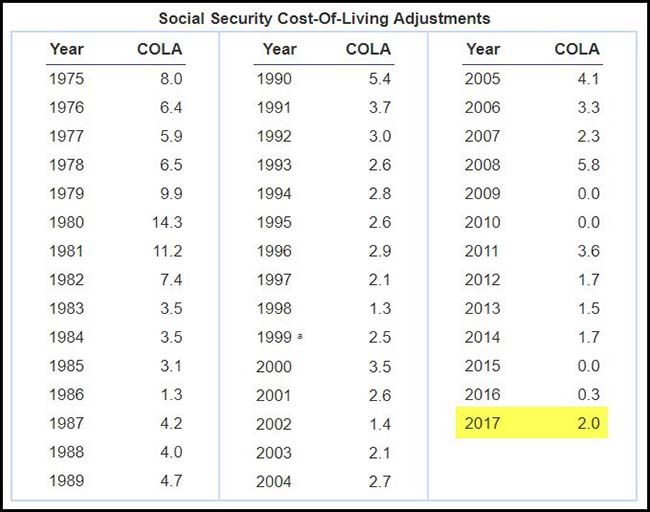

Found some important inflation this weekend which will be music to the ears of 20% of America…

66m Americans had reason to cheer on Friday as Social Security Administration set the 2018 cost of living adjustment to 2.0%.

(Social Security Administration)

If 2017 is the pivotal year for Electric Vehicles, the Washington Post says that these will be the 3 key catalysts…

The tipping point, experts say, follows three developments, each rippling outward with economic and cultural consequences.

1. China’s flexing: In addition to setting aggressive production quotas for EVs, China plans to scrap internal combustion engines entirely as soon as 2030. By taking a lead role in the shift to plug-ins, the world’s largest auto market is forcing the rest of the international community to follow in its footsteps.

2. The debut of Tesla’s Model 3: The company’s first mass-market vehicle has ushered in an era of excitement about EVs because of the car’s slick design and starting price of around $35,000.

3. Major automakers announce plans for an “all-electric future.” General Motors finished 2016 as the world’s third-largest automaker, meaning its decision to create 20 new electric vehicles by 2023 is bound to have an impact on the global marketplace. Volvo, Volkswagen, Mercedes, Audi, BMW and Ford have also announced EV plans in recent months.

( Washington Post )

The White House is once again lining up the Health Care industry. This report by the Washington Post and 60 Minutes will only make matters worse for the drug manufacturers and distributors…

In April 2016, at the height of the deadliest drug epidemic in U.S. history, Congress effectively stripped the Drug Enforcement Administration of its most potent weapon against large drug companies suspected of spilling prescription narcotics onto the nation’s streets.

By then, the opioid war had claimed 200,000 lives, more than three times the number of U.S. military deaths in the Vietnam War. Overdose deaths continue to rise. There is no end in sight.

A handful of members of Congress, allied with the nation’s major drug distributors, prevailed upon the DEA and the Justice Department to agree to a more industry-friendly law, undermining efforts to stanch the flow of pain pills, according to an investigation by The Washington Post and “60 Minutes.” The DEA had opposed the effort for years.

The law was the crowning achievement of a multifaceted campaign by the drug industry to weaken aggressive DEA enforcement efforts against drug distribution companies that were supplying corrupt doctors and pharmacists who peddled narcotics to the black market. The industry worked behind the scenes with lobbyists and key members of Congress, pouring more than a million dollars into their election campaigns.

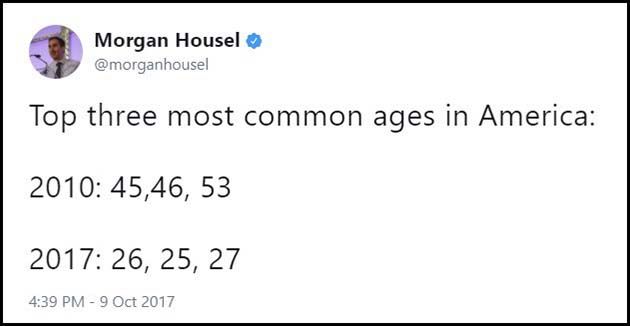

Millennials now sit upon the Iron Throne…

Parking lot sign of the week…

If you have visited Fastenal then you have no doubt seen the sign.

Copyright © 361 Capital