by Ryan Detrick, LPL Research

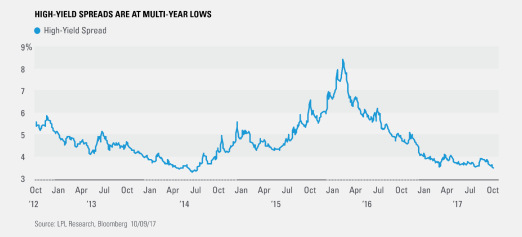

High-yield corporate bonds have performed impressively so far this year, with the Bloomberg Barclays High Yield Bond Index returning 7.2% year to date (as of October 9, 2017) on the heels of a strong 17.1% return in 2016. Declining credit spreads have driven much of this return. When investors deem default risks to be relatively low, they demand less of a yield premium over Treasuries. This differential is known as a credit spread, which can be seen as a gauge of perceived risk in the markets. As of October 9, 2017, spreads over comparable maturity U.S. Treasury bonds have declined to their lowest levels since mid-2014.

Tight credit spreads are a double-edged sword, however, as they can be interpreted differently by investors:

First, they indicate confidence in corporate America generally, and that high-yield issuers will be able to repay their debt obligations in a timely manner.

Second, they limit return potential. With spreads at their current levels, a repeat of 2016’s blockbuster performance is almost impossible. There is simply not enough room for spreads to tighten further to produce such a return.

Fundamentals remain solid for high yield—default levels, default forecasts, and loosening bank lending standards all point to relative stability for the asset class in the near future. These positives are largely priced into the market, however, and prices are currently slightly on the expensive side of fair value, in our view. Should stability reign, high yield could be poised for solid, but not spectacular, returns in the near term.

*****

IMPORTANT DISCLOSURES

Past performance is no guarantee of future results. All indexes are unmanaged and cannot be invested into directly.

The opinions voiced in this material are for general information only and are not intended to provide or be construed as providing specific investment advice or recommendations for any individual security.

The economic forecasts set forth in the presentation may not develop as predicted.

The Bloomberg Barclays High Yield Bond Index is an unmanaged index of corporate bonds rated below investment grade by Moody’s, S&P or Fitch Investor Service. The index also includes bonds not rated by the ratings agencies.

This research material has been prepared by LPL Financial LLC.

To the extent you are receiving investment advice from a separately registered independent investment advisor, please note that LPL Financial LLC is not an affiliate of and makes no representation with respect to such entity.

Not FDIC/NCUA Insured | Not Bank/Credit Union Guaranteed | May Lose Value | Not Guaranteed by any Government Agency | Not a Bank/Credit Union Deposit

Securities and Advisory services offered through LPL Financial LLC, a Registered Investment Advisor Member FINRA/SIPC

Tracking #1-653715 (Exp. 10/18)

Copyright © LPL Research