by Craig Basinger, CFA, Connected Wealth, RichardsonGMP

The human species learned long, long ago that sticking together is a good thing. During our evolution, larger numbers provided safety from predatory animals and other groups of humans. While this may sound abstract today given the lack of dangerous animals looking to make a meal of us, herd behavior is alive and well based on numerous psychological studies. This conforming tendency to align with the opinions and views of a larger group makes us feel safer and helps avoid conflict. Subjects in an experiment would actually later admit to making a selection they knew was wrong but did so after watching other subjects (who were actually planted experimenters) make the wrong choice ahead of them.

Herd behavior also results in groupthink. In corporate meetings, a view that is tabled early in meetings often carries throughout the meeting with others supporting even if they had a different idea going in. This often feeds into an illusion that everyone has the same opinion, creating greater optimism and loyalty to the view. As the view gains more strength, challenging views are often rationalized away. Different views can also be seen as a sign of disloyalty.

Herd behavior reduces internal stress and avoids conflict with others. It is simply easier to just go along and get along.

Herd Behavior when Investing

The desire to conform to the views of the larger group or consensus is often evident in the investment world. Would you feel more comfortable buying a company that has 20 analyst buy ratings vs another company that has 20 hold ratings? Probably. Twenty smart analysts who like the company is a pretty good company to hold. Yet, companies with fewer buy ratings tend to outperform those with the most buy ratings. Unfortunately, it is more stressful investing in companies that nobody likes. Being a contrarian is lonely.

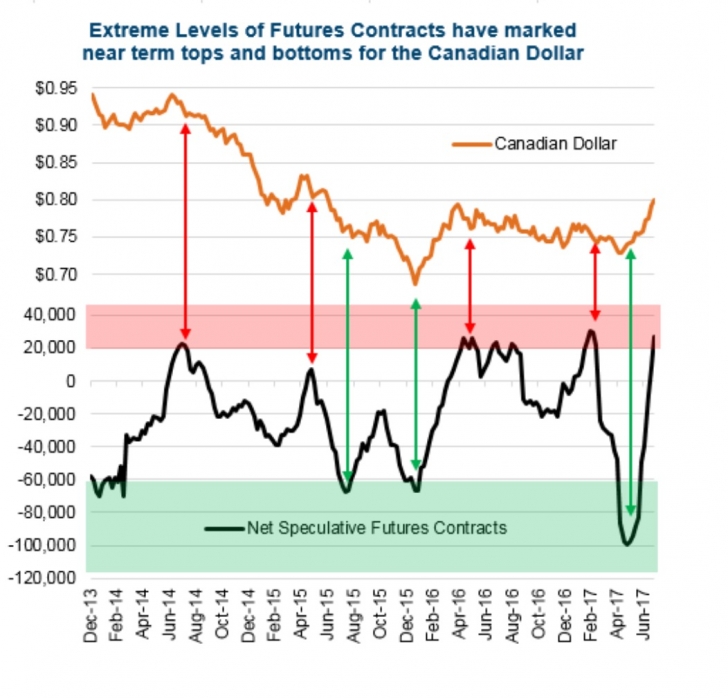

In March of this year, the Canadian dollar was sitting at 75 cents. Among the six big banks, all except one were calling for the loonie to move lower by the end of 2017. Well done BMO, although they expected it to strengthen just marginally to 78 cents. Well it isn’t the end of 2017 but the C$ is already trading at 80.5 cents. Even anecdotally, reports or articles talking up a strong Canadian dollar were few and far between. The herd was certainly entrenched in expecting more loonie weakness, how wrong we all were.

When everyone is expecting one outcome such as the Canadian dollar moving lower or oil moving higher, it is often the case where things go the other way. And it is often cheaper to bet against the herd. If the demand to be long a given stock is pervasive, the cost of carrying a short position will be lower. When markets are doing well, the cost of portfolio insurance is often the lowest. Conversely when participants become fearful, portfolio insurance ends up costing materially more.

Non-commercial Futures Bets

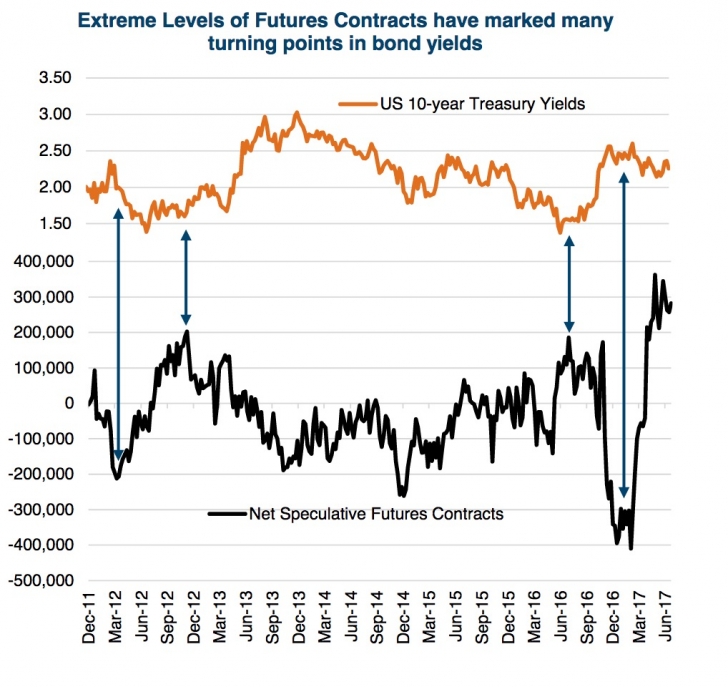

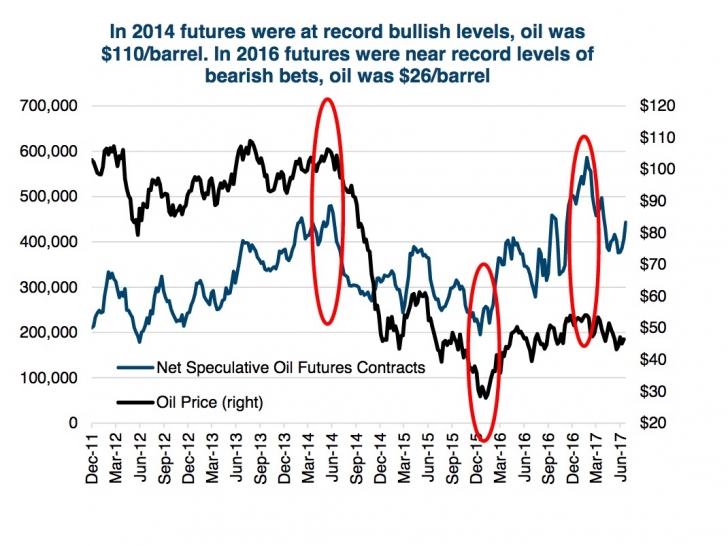

The profitability of going against the herd can often be seen in the futures/options market. Following the non-commercial (aka speculative) futures contracts can often show periods when betting in one direction reaches extreme levels. And often it reverses rather quickly, as any change in direction of the price of the underlying assets hurries these speculators to cover their positions, adding to the speed of the reversal.

The chart on page one is the net speculative futures contracts on the Canadian dollar and the level of the Canadian dollar (CAD). We put red arrows when the speculators were very bullish on CAD, which most often preceded its bearish or downward move. Conversely, the green arrows are when speculators were very bearish, which most often preceded a rally in the CAD. The most recent move higher started when outstanding futures contracts were net betting for CAD weakness.

The top chart on this page is the net speculative futures contracts for U.S. Treasuries vs the yield on the 10-year Treasury bond. While it has not seen extreme position bets often, bullish bets on bonds (net positive futures contracts) were often followed by a higher yields move (which is negative for bond prices). In mid-2016, speculative positions were aligned for a drop in bond yields and they moved materially higher. As this occurred, speculators covered and bet the other way for yields to keep climbing. But bond yields reversed and went lower. Now the speculators are back betting for lower yields…we would not suggest following this herd.

The 2nd chart contrasts net speculative futures positions in oil with the price of WTI oil. When oil was $110 the speculators were at a record level of bullishness. Conversely, after oil plummeted down to below $30, speculators were near record level of bearishness.

Investment Implications

While it is just one input into an investment decision, when most investors are lined up expecting a certain outcome it is often best to avoid the same bet. We would encourage investors to be cognisant of extreme levels in the futures market for potential changes in direction of the underlying asset whether it be a currency, a commodity or interest rates. Or at the very least as a sign a trade has become very crowded. The efficacy of net non-commercial futures contracts also appears to have increased in the last few years. This could be due to more investors using these vehicles to place direction bets on various financial assets.

*****

Charts are sourced to Bloomberg unless otherwise noted. This material is provided for general information and is not to be construed as an offer or solicitation for the sale or purchase of securities mentioned herein. Past performance may not be repeated. Every effort has been made to compile this material from reliable sources however no warranty can be made as to its accuracy or completeness. Before acting on any of the above, please seek individual financial advice based on your personal circumstances. However, neither the author nor Richardson GMP Limited makes any representation or warranty, expressed or implied, in respect thereof, or takes any responsibility for any errors or omissions which may be contained herein or accepts any liability whatsoever for any loss arising from any use or reliance on this report or its contents. Richardson GMP Limited is a member of Canadian Investor Protection Fund. Richardson is a trade-mark of James Richardson & Sons, Limited. GMP is a registered trade-mark of GMP Securities L.P. Both used under license by Richardson GMP Limited.

Copyright © RichardsonGMP