by Jeffrey Kleintop, Senior Vice President and Chief Global Investment Strategist, Charles Schwab & Co., Inc.

Key Points

- There has been a simple relationship between unemployment and inflation.

- If central banks move too aggressively in anticipation of a tightening global labor market reviving inflation, the impact of their actions on financial conditions could undermine the bull market in stocks.

- Global labor markets may now be at a point where wages may finally rise more rapidly.

Next month marks 59 years since economist William Phillips found a relationship between unemployment and inflation. It’s very simple: when unemployment is low, the competition for workers pushes up wages; higher wages mean higher costs for firms, which pass them onto consumers by raising prices. The opposite is true when unemployment is high.

This can be a very useful relationship for anticipating inflation, but there are two important things to note:

- The magnitude of the effect on wages is greater at lower unemployment rates. If the unemployment rate falls from 11% to 10%, this may only have a slight effect on supporting wages. But if it falls from 6% to 5% the effect on wages could be much greater.

- It only works over the medium-term, within an economic cycle. It does not work over the long-term across multiple economic cycles. Economist Milton Friedman explained that a government isn’t able to lower unemployment over the long-term by pushing up inflation and wages.

We can see wages and unemployment move in opposite directions during economic cycles and that they have both trended lower over time in the chart below of the 36 major countries tracked by the Organization for Economic Cooperation and Development (OECD).

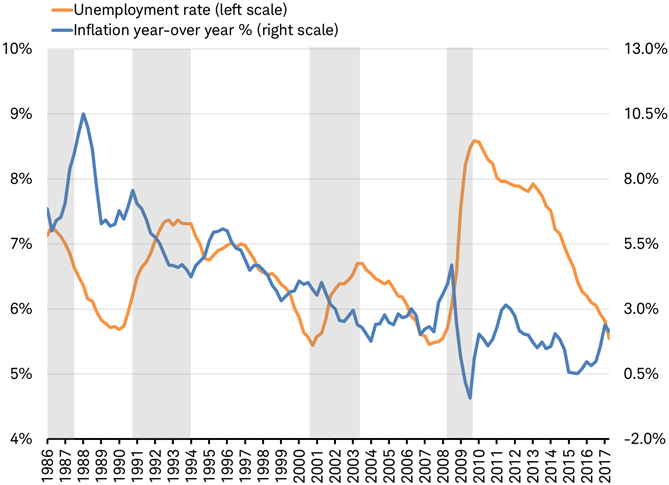

Global unemployment and inflation

Inflation rate is the year-over-year change in the OECD Consumer Price Index.

The unemployment rate is for OECD developed countries.

Shaded areas represent major recessions for the OECD member nations.

Source: Charles Schwab, Organization for Economic Cooperation & Development (OECD) data as of 10/1/2017.

Technology has played a role in restraining wages and inflation, but unemployment is now at the point when inflation should be ticking up. The last three times unemployment was at this level, inflation started to rebound until cut short by a recession.

Although the chart shows inflation rising from 0.5% in 2015 to around 2% today, much of that rebound has to do with the bounce back in oil prices from the 2015 plunge. If there is no acceleration in wage growth, it is unlikely the recent rise in inflation can be sustained.

Why it matters

The U.S. Federal Reserve is trimming their balance sheet and raising interest rates and the European Central Bank is tapering their quantitative easing program. They are both taking these actions in anticipation of higher inflation brought on by more competitive labor markets. The financial markets seem to think they may be wrong and they won’t need to take these actions, based on what is priced into the interest rate futures markets. If central banks move too aggressively in anticipation of inflation, the impact of their actions on financial conditions could undermine the bull market in stocks.

The past three recessions were all caused by the bursting of bubbles: the housing bust led to the financial crisis of 2008-09; the collapse of dotcom stocks triggered the early 2000s recession; and the widespread bank failures of the Savings and Loan crisis preceded the early 1990s recession. But, unlike the last few recessions, the next one may end up being more like those of 1960s, 70s, and 80s. Those recessions were generally triggered by aggressive rate hikes.

So the big question of 2018 is: are the central bankers right? Or, in other words, will inflation rebound in the coming year? It doesn’t look like it, but looks may be deceiving.

Relationship looks broken

It may look as if the relationship between unemployment and wages hasn’t been working. Labor markets have been increasingly tight in the United Kingdom, Japan, and the United States, yet there is little wage pressure.

- In the U.K., the unemployment rate is the lowest since the 1970s, but there is little wage growth.

- In Japan, the unemployment rate is the lowest since 1993, with the ratio of job openings to applicants the highest since 1974. Yet, wages in Japan are barely rising.

- In the U.S., the unemployment rate is the lowest since 2001 and the labor force participation rate for the primary workforce (those ages 25-54) has rebounded 1% from the low of 80.6% set in 2015, yet wages are growing at just 2.5%.

The global perspective

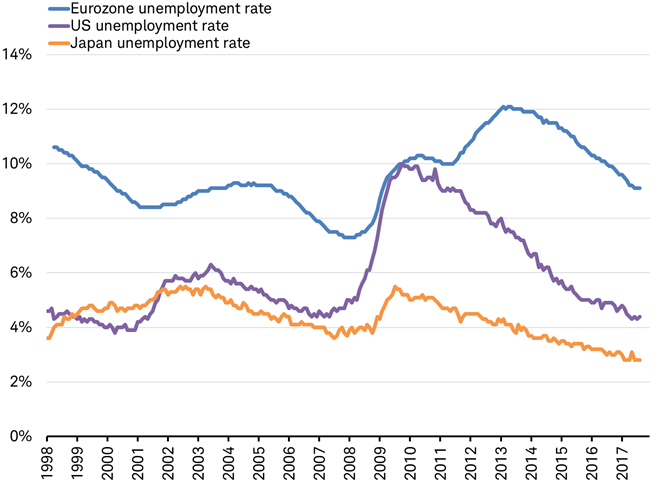

The problem with the single country perspectives above is that these nations are outliers. For example, Europe’s labor market, which is larger than the U.S., has not been tight at all. In fact, the unemployment rate has been above its 20-year average until April of this year, as you can see in the chart below. This is very important for wages which are increasingly determined by the global labor supply.

Europe’s unemployment rate has been well above that of the U.S. and Japan.

Source: Charles Schwab, Bloomberg data as of 9/30/2017.

The average unemployment rate among 36 major countries, seen in the first chart of this commentary, has only recently fallen below its 30-year average. Clearly, global labor markets have not been all that competitive in recent years despite tightness in some countries.

The global labor market is quickly changing. The global unemployment rate has been dropping rapidly in the past year or so and is now in line with 30-year lows. There is typically a lag in the relationship between unemployment and wages, and global labor markets may now be at a point where wages may start to rise more rapidly. Going forward, a further decline in the unemployment rate may cause wage inflation to increase more rapidly starting next year.

Evidence relationship is working

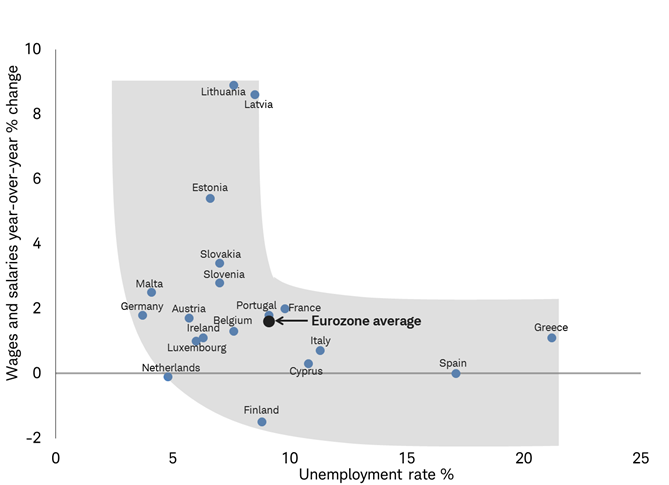

We can see the relationship between wages and unemployment still works when we look at individual Eurozone countries, rather than just the average of those countries. In the Eurozone, wages in countries with lower rates of unemployment are rising faster, as you can see in the chart below. For example, Spain’s unemployment rate is 17% and wages are flat while in Germany the unemployment rate is under 5% and wages are rising at about 2%.

Wages in Eurozone countries with lower unemployment are rising faster

Shaded area encompasses most countries and therefore illustrates the current relationship between wages and unemployment.

Source: Charles Schwab, Eurostat data as of 9/6/2017.

While unemployment rates clearly differ in the Eurozone, the rates for each country has been trending lower and now the average seems to be near an inflection point. As unemployment falls from here, wages could begin to move up more steeply.

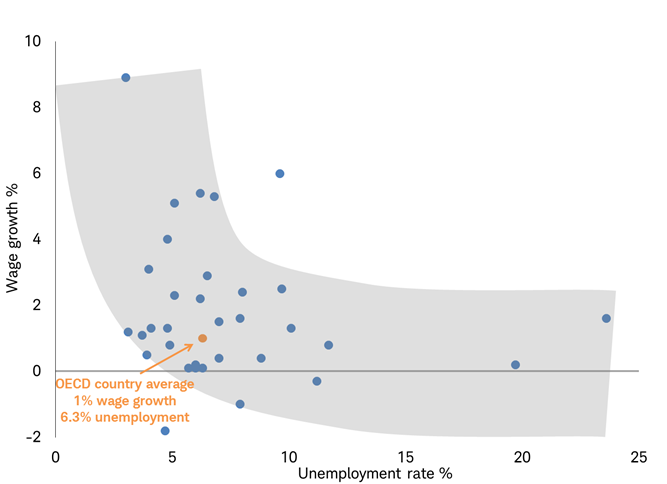

Now that the major developed country labor market of Europe is finally beginning to tighten, the U.S., U.K. and Japanese labor markets may respond with higher wages. The global labor market, reflected in the 36 countries in the chart below, may be at a point where average global wages begin to rise more steeply and result in a faster pace of inflation, justifying the moves signaled by the world’s major central banks.

Is the current global average unemployment rate near an inflection point for wage growth?

Each dot represents an OECD member country.

Shaded area encompasses most countries and therefore illustrates the current relationship between wages and unemployment.

Source: Charles Schwab, OECD data as of 9/6/2017.

Getting it right

All this matters to investors since central banks are behaving as if wages and inflation will revive in the year ahead. If they don’t, and central banks don’t alter their policy path, the global stock markets could be in for a rough 2018.

We expect central banks may get the big question of 2018 right, or at least mostly right, leading to gradually tighter monetary policy that doesn’t derail the bull market or disrupt economic and earnings growth (see our recent article on how inflation tends to boost corporate earnings: U.S. vs. International: What Do Earnings Tell Us About What May Be Ahead?). But, there is a lot riding on it for investors and we will be watching the relationship between unemployment and wages closely.

Copyright © Charles Schwab & Co., Inc.