by James T. Tierney, Jr., Chief Investment Officer—Concentrated US Growth, AllianceBernstein

Amazon.com has shaken up US retailers and manufacturers, a trend amplified by the recent purchase of Whole Foods Market. But despite Amazon’s dominance, investors can still find resilient businesses in a vast sector.

Retail sales, excluding auto sales, make up one-fifth of the US economy. In the span of just a decade, Amazon’s market share has grown many times over. The company’s current market share matches that of Costco Wholesale.

Margin Squeeze

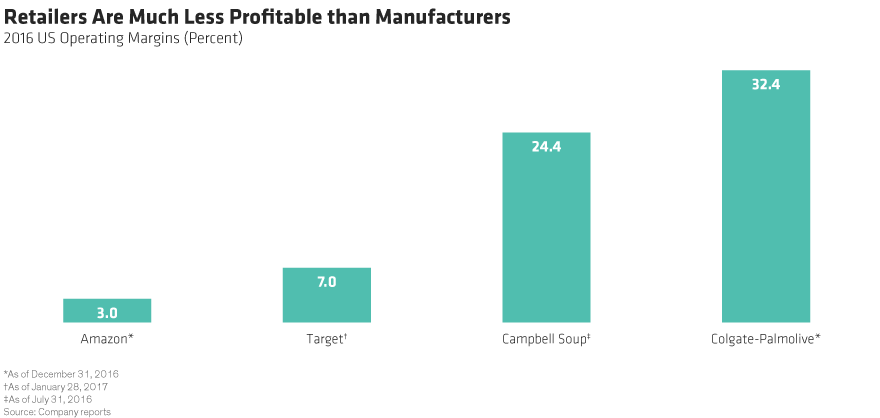

But sales growth only tells part of the story. Look at profitability and you see how Amazon’s squeeze on operating margins is dramatically changing the industry. Amazon operates on modest margins while providing a shopping experience considered superior to that of many traditional in-person stores. In 2016, its operating margin in the US was just 3%, compared to 7% at Target. We believe this margin pressure will persist on traditional retailers.

Manufacturers are also feeling the bite from Amazon. Their normally tense relationship with retailers is becoming even more fraught. Campbell Soup, for example, recently lowered sales expectations because its reluctance to lower prices raised the possibility that its products might be dropped by a major retail competitor of Amazon’s.

Companies like Campbell face pressure on margins from two directions. First, consumers have embraced discounted private-label products. Second, the slimmer margins of retailers make manufacturers’ profitability look bloated (Display). With a margin of 24.4% in 2016 in its US business, Campbell remains lucrative even if growth is scarce. Others, like Colgate-Palmolive, with a US operating margin of 32.4%, are even more profitable. Amazon CEO Jeff Bezos famously vowed to go after profitable industries like manufacturers, saying, “Your margin is my opportunity.”

Market Gloom Is Overdone

Unsurprisingly, the market has become skittish toward retail-related shares (Display). But we believe that recent malaise from the Amazon–Whole Foods deal is misplaced in some cases. For example, while news headlines predicted big price reductions at Whole Foods, little actually changed. Overall store prices fell by about 1% according to some surveys.

Protective Factors: Brand, Immediacy, Experience

Gloomy headlines may distract investors from attractive companies in the industry. We think it’s important to focus on five key factors that can insulate businesses from the turbulence:

1. Iconic brands serve as a moat around a business, as long as the company cultivates its brands and avoids mistreating customers.

2. Immediacy is still an advantage for physical stores when consumers need a product today. While Amazon aspires to same-day delivery, right now this isn’t feasible.

3. Price level matters. Companies that can provide consumers with significant discounts should be able to retain business and loyalty. A 10% saving on a $3 product is not as meaningful and sought out as a 10% saving on a $100 product.

4. Products and services that can’t readily be sold online are likely to withstand pressure. For example, companies that make perishable food like Hershey chocolates or offer dining out like Starbucks seem more resilient than clothing retailers, whose products can be shipped easily.

5. In-store experiences command value, especially when combined with an exciting retail concept, which can lure shoppers more effectively than online retailers.

It’s a good time for investors to start thinking creatively about the sector, as anxiety over the Whole Foods acquisition recedes. Profitability will continue to be a point of contention. Yet investors who examine the cloudy retail landscape with the right frame of reference can find businesses that are poised to weather the battles—and even prosper—in Amazon’s new world order.

The views expressed herein do not constitute research, investment advice or trade recommendations and do not necessarily represent the views of all AB portfolio-management teams.

Copyright © AllianceBernstein

.png)