by Blaine Rollins, CFA, 361 Capital

It was a great September and 3rd Quarter for the markets, but it has been a challenging one for the human spirit. Last night’s news out of Las Vegas, combined with the devastation from the hurricanes have weighed upon all of our hearts. Our thoughts and prayers are with everyone affected by the many tragedies in the last month. As a strong believer in reversion to the mean, I expect there to be much good news in the months ahead.

For the eighth straight quarter, the S&P 500 finished in the green. You might even say that the market finished in the dark green, as virtually every major index closed at all-time highs. Bond investors even joined in the positive column as early quarter gains were barely held onto by the end of the month. While equity investors appear to have the wind at their backs, bond investors are going to be earning their entire coupons as they navigate the global strengthening in GDP, rising inflation pressures and central bank tightening. As bond volatility continues to increase relative to stock volatility, it will be interesting to watch how investors react if bonds yields continue to chart a course for higher highs. This will be unexplored territory for many conservative investment portfolios.

To receive this weekly briefing directly to your inbox, subscribe now.

I can’t sum the markets up any better this week…

Markets Sanguine Amid Prospects of Tax Reform and Monetary Policy Normalization US stocks finished the week at fresh all-time highs, though volumes remained uninspiring and volatility stayed at historically low levels. Breadth expanded with the Transports, Russell 2000 and the NASDAQ joining the S&P at new highs. The Dow held back some, which may have been partially due to quarter-end profit taking and rotation out of large caps. Small caps and banks, in particular, benefited by an aggressive push by President Trump and congressional republicans to get a tax reform package approved by the end of this year. The growing hopes for fiscal stimulus reignited support for the reflation trade resulting in a move higher in rates and notable bounce in the Greenback. Treasury yields backed up and curves steepened. Central bank speak was pervasive with officials on both sides of the Atlantic indicating a continued willingness to push ahead with the admittedly gradual pace of normalization.

(Trade The News)

Wall Street week…

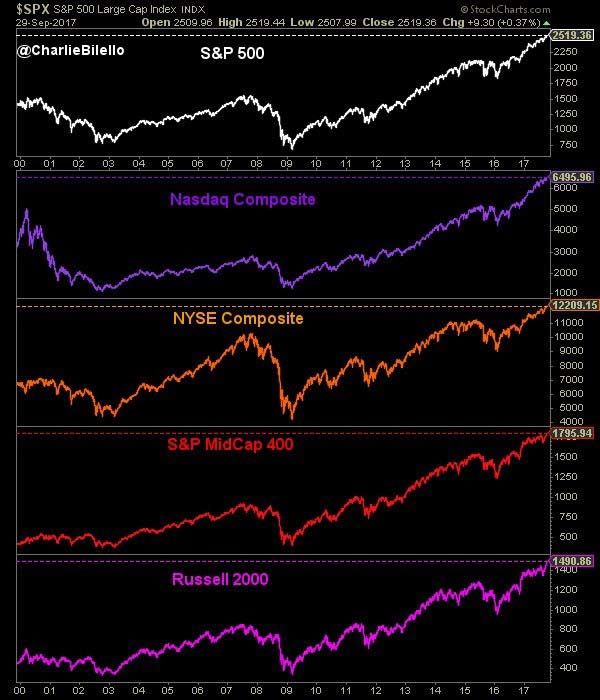

S&P: All-Time High

Nasdaq: All-Time High

NYSE: All-Time High

S&P Mid-Cap 400: All-Time High

Russell 2000: All-Time High

(@charliebiello)

Just the month of September had some incredible sprints in Small Caps, Semis, Regional Banks and even Energy…

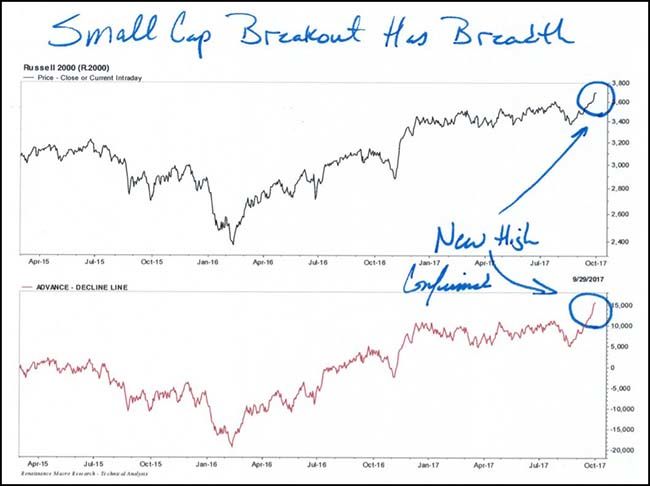

Not only is breadth expanding in the S&P 500, but it is even accelerating throughout the Russell 2000…

(RenMac)

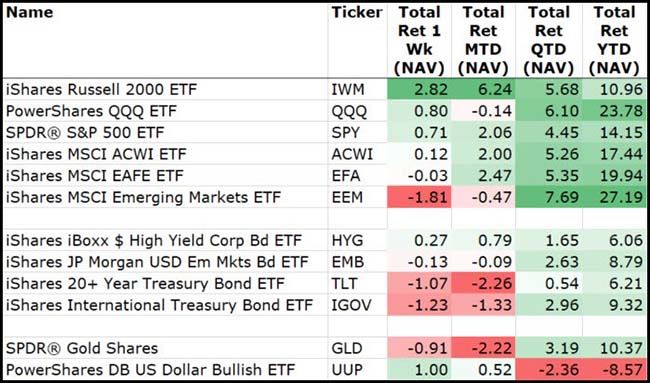

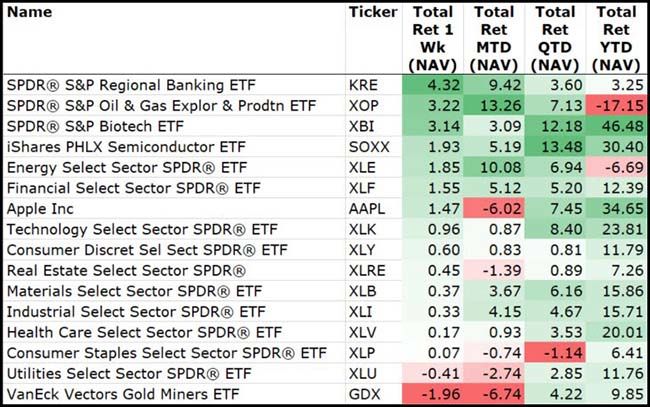

A glance across the multiple time frames at week’s end…

Small Caps have surged to gather much ground for the Q3 and even make for a more respectable 2017. The most recent bounce in the U.S. Dollar has helped here. Emerging Markets were hurt by the U.S. Dollar recently but still led for the Q3 and 2017. Safety is running into headwinds as Bonds and Gold begin to post negative returns in the short term. I have to think that the longer term returns will also begin to be challenged unless the synchronized global growth begins to slow.

(9/29/17)

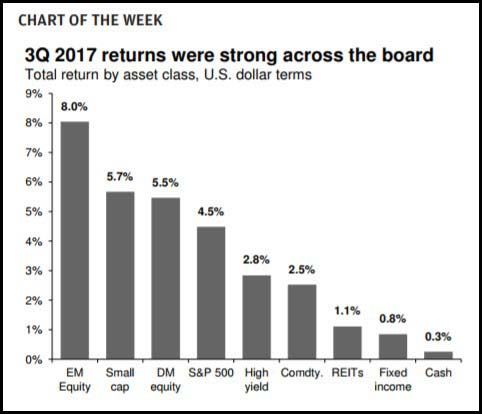

If you prefer a visual of Q3 asset returns, JPMorgan has one for you…

Looking across the U.S. sectors at week’s end…

Bank stocks continue to love the upward rise in bond yields. Energy stocks continue to find fans with a rising Oil price and increasing U.S. production. Biotech and Semis continue to drive the higher beta end of the spectrum with both ending Q3 with double digit returns. The perceived safest sectors (Utilities, REITs and Staples) finished September in the red.

(9/29/17)

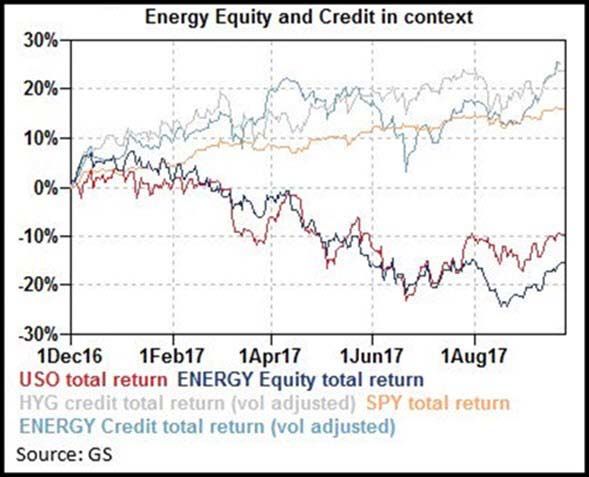

With their recent momentum, energy stocks look like a good bet to catch up with their energy credit performance…

@DriehausCapital: ICYMI: YTD, energy credit following SPX much more than energy equities. YS

Keep an eye on this… “Inflation is going to jump dramatically in the next year”

Economic modeling by Gillespie’s group suggests that a confluence of dynamics, from agriculture to energy, drove down the U.S. inflation rate in the middle of this year. That’s poised to change in coming months, sending six-month annualized gains in the consumer price index excluding food and energy to 3 percent, he said.

Investors may at first dismiss bigger CPI gains as being temporary, related to passing shortages caused by recent hurricanes, said Gillespie, who got his start in trading at Bankers Trust back in the early 1990s. But by the December CPI report, which comes hours before the Federal Reserve’s policy announcement on Dec. 13, it will be clear that inflation is trending higher, he says.

The 2-year Treasury yield looks like one of the best charts in the market right now which should be a concern for many…

Byron Wien makes the case for more equity upside…

Cycles usually do not last this long. We all know it can’t go on forever, but I believe we could continue on a positive course for both the economy and the market for several more years.

The principal reason for this conclusion is that the usual factors that warn of a bear market or recession are not evident. I think we will have a favorable environment for equities at least until 2019. What would really worry me would be an inverted yield curve, but there is now almost an eighty basis point spread between the two-year Treasury and the ten-year. I would also be concerned if retail investors were euphoric about equites as they were in 1999 or 2007. They are generally optimistic, but not excessively so, although earlier this year sentiment did rise to a worrisome level. Investors large and small are also leaning toward the defensive.

Hedge fund net exposure clearly shows a mood of caution: it is just under 50% now; it was mostly 55%–60% in the 2000–2008 period. Individuals are still buying bond funds even at these low yields because of their lack of confidence in the stock market. Institutions, in their desperate search for yield, have bid up the price of lower-quality bonds to the point where their spread with Treasuries is historically low. Warnings of trouble ahead, however, would usually be associated with high spreads. Maybe investors are too complacent, but not this may not be the case if the economy continues to grow.

(Barron’s)

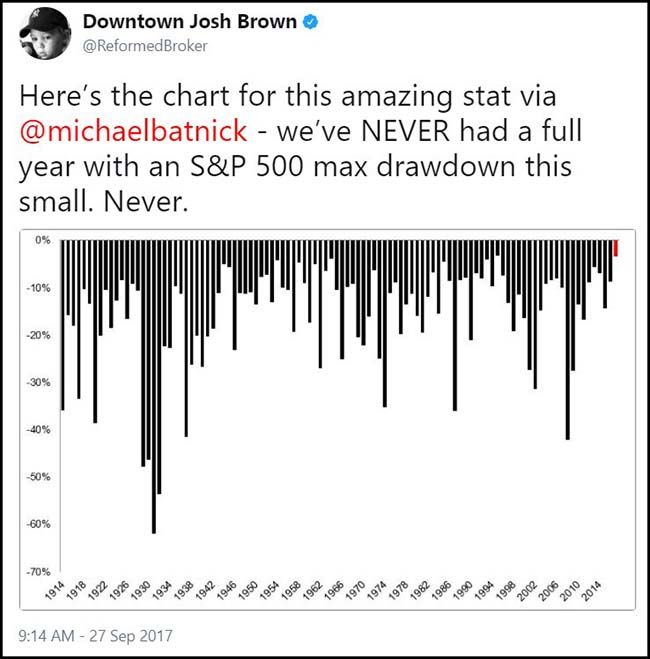

This is an amazing chart…

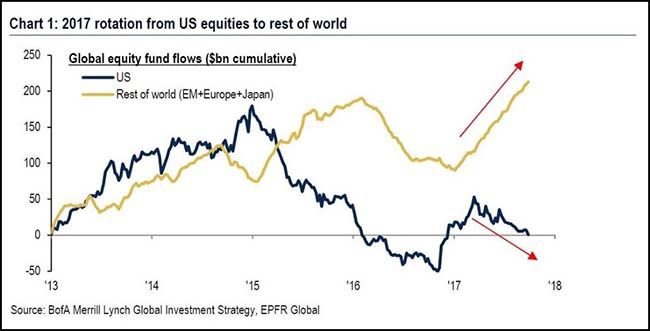

While the U.S. equity markets continue to gain, the real interest is still in the International equity markets…

@WhatILearnedTW: .@BofAML: For quarter, U.S. equity outflows totaled $23b vs $41b in inflows to the rest of the world @MarketWatch

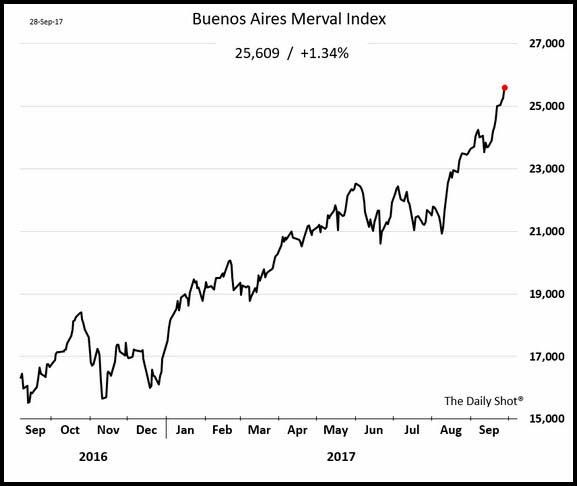

With equity performances like this out of Argentina, who can argue…

(WSJ/Daily Shot)

But as gains come easy for some, another high-profile hedge fund manager calls it quits…

Hedge fund manager Whitney Tilson announced on Thursday that he is shuttering Kase Capital Management and returning capital to investors, saying that “reporting sustained under-performance to you was making me miserable”. Mr Tilson said that while he had endured periods of under-performance before, he had been certain that those losses were temporary since the cheap stocks in their portfolio would rebound. “Alas, I don’t have that feeling today,” he said, adding: Historically, I have invested in high-quality, safe stocks at good prices as well as lower-quality ones at distressed prices. Given the high prices and complacency that currently prevail in the market, however, my favorite safe stocks (like Berkshire Hathaway and Mondelez) don’t feel cheap, and my favorite cheap stocks (like Hertz and Spirit Airlines) don’t feel safe. Hence, my decision to shut down.

Meanwhile, a leading Senator with a head for finance and numbers is retiring with a key parting shot…

Retiring Sen. Bob Corker said Republicans’ battle on tax reform will make health care look like a “piece of cake,” and he won’t vote for legislation that adds to the deficit — something the Trump administration’s plan very well might.

The Tennessee Republican, speaking to reporters on Capitol Hill, said there’s a big difference from tax reform — actually overhauling the system — and tax cuts. Tax reform takes intestinal fortitude, and staring people down for the good of the country, he said. Tax cuts are simple, he said.

(CBS News)

London was a great place to own real estate for the last 1,000 years…

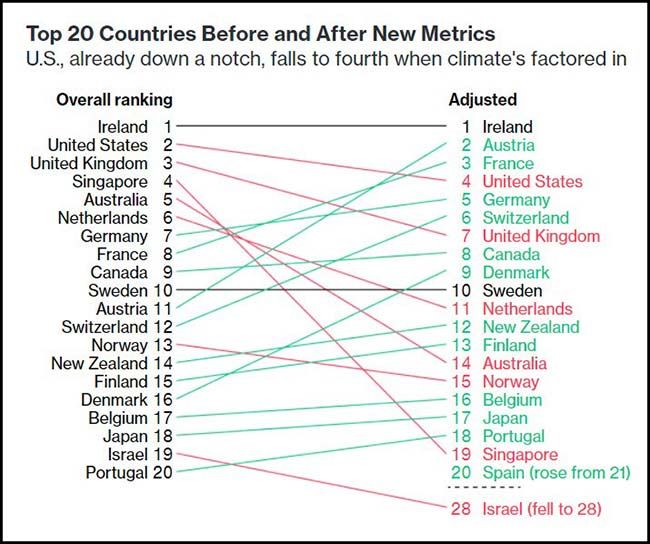

But my money is on Dublin for the next 1,000 years. It has got to be one of the best positioned cities in the world right now for future growth.

If you need a quick Dublin commercial real estate update…

Amazon.com Inc. is searching for office space in Dublin that could hold as many as 800 employees, according to two people with knowledge of the matter.

The e-commerce giant is looking for as much as 7,432 square meters (80,000 square feet) of office space in the Irish capital, said the people, who asked not to be named because the information is private. Amazon declined to comment.

Last year, Amazon said it would bring another 500 jobs to Ireland, adding to more than 1,400 people in Dublin. Amazon’s search may add to a squeeze in the Irish capital’s office market as companies from JPMorgan Chase & Co. to Barclays Plc expand in the city following the U.K.’s decision to depart the European Union.

While the office vacancy rate in Dublin stands at about 9 percent, the figure falls to less than 1 percent for top-quality buildings in prime areas of the city, Savills Plc said last week.

Further, Ireland is ranked #1 in its ability to feed its own population…

I’m hoping that Royal Caribbean and Celebrity Cruise lines will see a spike in bookings in the coming months…

@cnni: Royal Caribbean is rescuing about 2,200 from San Juan, and will evacuate up to 1,000 more from the US Virgin Islands http://cnn.it/2hAOw8I

There are sports team owners, and then there is Mark Cuban…

And we hope that Elon Musk can get 25 hours a day out of his Nevada gigafactory…

In addition to building electric cars, Tesla also sells an at-home battery pack, the Powerwall, that can capture energy generated by solar panels. Tesla is now shipping hundreds of Powerwalls to Puerto Rico as the island continues to suffer from power outages, Bloomberg first reported.

Puerto Rico was already grappling with power outages after Hurricane Irma, a cateogry 5 storm, hit the island. At least 60,000 people were already without power when Hurricane Maria, a category 4 storm, knocked out power for the entire island’s 3.5 million residents.

Generators are currently helping power high-priority buildings like hospitals, but power likely won’t return to the entire island for another six months. Tesla’s Powerwall could help bridge the gap in some areas as Puerto Rico works to repairs its electrical grid.

Tesla employees are on the ground in Puerto Rico to help install battery packs and repair solar panels, a Tesla spokesperson confirmed to Business Insider.

Copyright © 361 Capital