by Jeffrey Saut, Chief Investment Strategist, Raymond James

In response, with the recent run up to new highs, we are expecting a softening of upward momentum as the market digests incoming earnings. Spouts of volatility should be expected, but we continue to view weakness as a buying opportunity. Fundamental analysis will drive these tactical calls. As always, we continue to focus on protecting capital while mitigating risk across portfolios. Last Thursday I had the pleasure of spending a few hours with stock market veteran Jeff Saut, someone I hold in high regard and have got to know over the past number of years. Jeff once again eloquently reminded a roomful of some 250 investors,‘The essence of portfolio management is the management of risks, not the management of returns. All good portfolio management begins and ends with this precept.’

. . . Craig White, portfolio manager, Huggan White

“Managing risk,” what a novel concept, but regrettably many investors fail to do just that. My father taught me to manage risk, a trait emphasized in the sentinel book by Benjamin Graham, The Intelligent Investor, which Warren Buffett has deemed, “The best book ever written on investing” and where the aforementioned quote resides. As my dad always reminded me, “If you manage the downside in a portfolio, and avoid the big loss, the upside will take care of itself.” However, managing risk is one of the hardest things to do, which is why you need a good financial advisor to help you manage the risk.

We are always attempting to manage risk and, most of the time, get it right. Sometimes, however, we too get blindsided. As Li Lu (a Chinese-born American investment banker, investor, and hedge fund manager) reminds us:

Investing is about predicting the future, and the future is inherently unpredictable. Therefore, the only way you can do better is to assess all the facts and truly know what you know and know what you don’t know. That’s your probability edge. Nothing is 100%, but if you always swing when you have an overwhelming better edge, then over time, you will do very well.

This is why, from time to time, we make “tactical calls” (short-term trading calls) when we do not feel all that comfortable with the near-term direction of the various markets. Most recently, that occurred at the beginning of August with the S&P 500 (SPX/2502.22) changing hands around 2490 as our short-term model registered a cautionary signal. At the time, we noted that and also suggested our internal energy model was out of energy, implying there should not be a whole lot of upside left for the equity markets. Sure enough, the SPX seems to have stalled with an intraday high “print” of some ~2508. Even our friend, and Canadian investing legend, Leon Tuey is looking for some kind of short-term pause within the construct of this secular bull market, for as he wrote last week:

Short-term, the major market indices and their internal measures are overbought. Moreover, short-term sentiment backdrop has deteriorated. Hence, a pause would not be surprising. After a minor pause, however, the rally will continue as the intermediate gauges are far from overbought. Moreover, momentum is re-accelerating. Long term, the primary trend remains powerfully bullish and the end is nowhere near in sight as the six major factors (monetary, economic, valuation, sentiment, supply/demand, and internal/momentum/technical) continue to give bullish readings. One of the most amazing aspects of this great bull market is sentiment. Although the bull market is in its ninth year and most stocks are up several hundred to several thousand percent, investors remain skeptical and pessimistic. Note that many hedge fund managers are bearish. Seth Klarman’s Blaupost holds 42% of its assets in cash. In terms of asset allocation, funds are sitting on a mountain of cash and very low in equities. In fact, funds are the most underweight in U.S. equities in ten years. Also worth noting is the shrinkage in the supply of stocks. In 1996, over 8000 stocks traded in the U.S. Today, that number has been halved. This supply/demand imbalance creates an explosive situation for the market. When the prevailing bearish sentiment recedes, that huge hoard of cash will find its way back to the equity market. I can hardly wait!

In conclusion, evidence continues to suggest that investors are witnessing the biggest bull market on record. The first leg of this great bull market commenced on October 10, 2008 and ended in May 2015. As always, it was driven by an easy/accommodative monetary policy. The second leg commenced in February 2016, which was driven by improving economic conditions caused by the monetary easing of the last 8.5 years. Hence, earnings momentum accelerates. Accordingly, it is always the longest and strongest [segment of a secular bull market]. Investors should emphasize industrials, technology, healthcare, and resource issues and other economy-sensitive areas.

One of the biggest mistakes investors make in a bull market is selling too soon. Accumulate favored areas when they are oversold and hold for the long-term. The time to liquidate is when the Fed starts to tighten meaningfully, i.e., when the Fed drains liquidity from the system; raises the discount rate many times in succession; and inverts the Classic Yield Curve (13-week T-bill Yield vs. the 20-year T-Bond Yield). Do not be distracted by the “noise” and the black headlines.

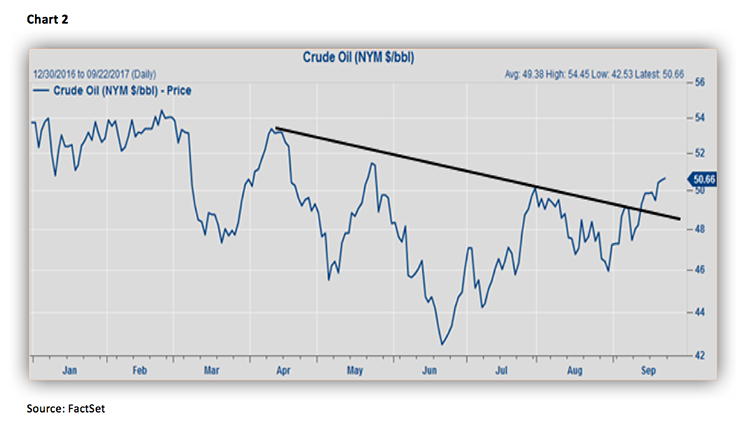

The call for this week: We find Leon’s cogent comments timely and are particularly interested in his emphasis on “resource issues”, since we have been of the opinion that commodities have bottomed. Most recently, we discussed the Energy sector, because crude oil looks to have broken out to the upside in the charts (see Chart 1 on the following page) with particular interest in the midstream MLPs. Moreover, as we wrote last week:

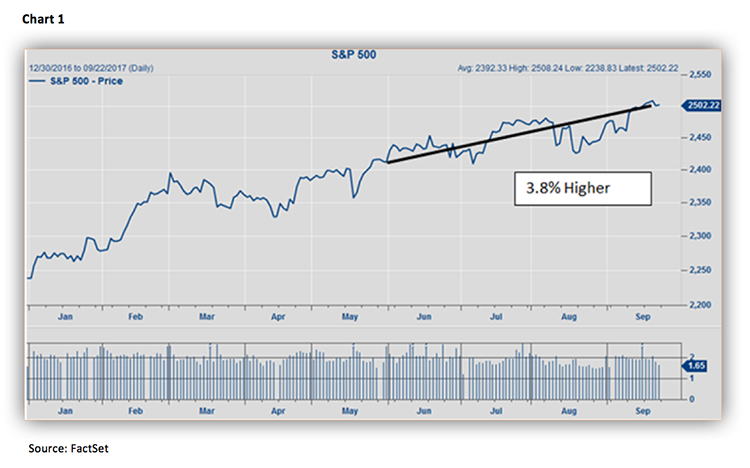

In June, the three major indices traded out to new all-time highs, and we noted that, every time those indices simultaneously trade to new all-time highs, the SPX had an average 3.8% gain within the next three months nearly 100% of the time. Well, it is nearly three months later and the SPX is better by some 3.8%. Regrettably, we have underplayed that 3.8% rally, because our models went into cautionary mode at the beginning of August. Most recently, our stock market internal energy model telegraphed there just is not a whole lot of upside energy available right here. Then too, the momentum indicator theorizes the odds of a trend reversal are high on a short-term basis, the breadth indicator is neutral (no trend reversal), and the sentiment indicator is flashing extreme complacency (high degree for a trend reversal). To be sure, our indicators/models are not always right, but they are right a lot more than they are wrong. Sometimes they are early (September 1999 – bear signal, November 2002 – bull signal, November 2007 – bear signal, October 2008 – bull signal, well you get the idea). But just like when flying an airplane in a blackout, you have to trust your instruments. Our “instruments” continue to counsel for caution on a near-term trading basis, and we are titling portfolios accordingly. Longer-term, we remain in a secular bull market that has years left to run.

This morning, North Korea threatens strikes on U.S. mainland in response to DJT’s insults; the German election results were worse than expected; we expect a bunch of Fed officials to spout off this week with the Fed quiet period having ended last week; and with the NFL protests, we have now seen the politicization of everything! Nevertheless, the preopening S&P 500 futures are only down 4 points at 5:00 a.m.

Additional information is available on request. This document may not be reprinted without permission.

Raymond James & Associates may make a market in stocks mentioned in this report and may have managed/co-managed a public/follow-on offering of these shares or otherwise provided investment banking services to companies mentioned in this report in the past three years.

RJ&A or its officers, employees, or affiliates may 1) currently own shares, options, rights or warrants and/or 2) execute transactions in the securities mentioned in this report that may or may not be consistent with this report’s conclusions.

The opinions offered by Mr. Saut should be considered a part of your overall decision-making process. For more information about this report – to discuss how this outlook may affect your personal situation and/or to learn how this insight may be incorporated into your investment strategy – please contact your Raymond James Financial Advisor.

All expressions of opinion reflect the judgment of the Equity Research Department of Raymond James & Associates at this time and are subject to change. Information has been obtained from sources considered reliable, but we do not guarantee that the material presented is accurate or that it provides a complete description of the securities, markets or developments mentioned. Other Raymond James departments may have information that is not available to the Equity Research Department about companies mentioned. We may, from time to time, have a position in the securities mentioned and may execute transactions that may not be consistent with this presentation’s conclusions. We may perform investment banking or other services for, or solicit investment banking business from, any company mentioned. Investments mentioned are subject to availability and market conditions. All yields represent past performance and may not be indicative of future results. Raymond James & Associates, Raymond James Financial Services and Raymond James Ltd. are wholly-owned subsidiaries of Raymond James Financial.

International securities involve additional risks such as currency fluctuations, differing financial accounting standards, and possible political and economic instability. These risks are greater in emerging markets.

Investors should consider the investment objectives, risks, and charges and expenses of mutual funds carefully before investing. The prospectus contains this and other information about mutual funds. The prospectus is available from your financial advisor and should be read carefully before investing.

Copyright © Raymond James