by Richard Bullas, Vice President Portfolio Manager and Research Analyst, Franklin UK Equity Team

In a world of rapid change, it can be easy to lose focus and chase the next big thing. When it comes to investing in smaller stocks, Richard Bullas, vice president, portfolio manager and research analyst, Franklin UK Equity team, thinks investors should go back to the basics and focus on the fundamentals. He explains why he’s sticking with a bottom-up approach and focusing on individual companies in his search for small-capitalisation value opportunities.

The first half of 2017 proved to be an engaging time for the small-capitalisation (small-cap) end of the UK market. After a tough period, we’ve seen small caps reassert leadership over the wider UK market. We’ve seen a reduction in recessionary fears and concerns over sterling weakness that had initially benefitted large-cap multinational companies.

The investment backdrop in the United Kingdom has, in our view, has remained fairly supportive. Economic and corporate news flow has been generally reassuring. UK gross domestic product appears reasonably healthy, albeit exhibiting signs of slower growth. Unemployment and interest rates remain low, while the recent bout of sterling strength has shone a favourable light on small caps due to their domestic bias.

As investor confidence has increased, there’s been a willingness to take on extra risk within the small-cap space. Investors are searching for extra returns within a generally lower-growth, lower-return environment. This has led to a period of strong demand for growth stocks, particularly those companies exhibiting superior growth characteristics (i.e., structural-growth companies, industry disruptors, technology innovators, and companies with the potential to gain significant market share). This has led to a big rerating—when investors are willing to pay a higher share price—in many of these types of companies. A number of these larger, more liquid names are listed on the top end of the FTSE AIM market, which has outperformed other small-cap indexes.1

We’re seeing evidence of a return to growth and momentum investing taking precedence over fundamentals. However, we see amber lights starting to flash on some stocks trading at historically elevated valuations. As a result, our active, focused and stock-specific investment approach becomes increasingly important in order to navigate this environment.

Company fundamentals, valuations and balance-sheet strength are always at the forefront of our minds. We look for investments that we think should do well regardless of the economic cycle, and where the entry valuation isn’t already capturing the majority of the upside potential.

A Buoyant Period

We’ve been able to find some interesting new ideas within the initial public offering (IPO) market. The increase in the number of companies looking to list on the stock market is a marked change from the wait-and-see stance many companies adopted in the immediate aftermath of the Brexit vote last year. This pent-up demand has provided a window of opportunity to selectively invest in new stocks. We’ve seen a good mix of what we view as quality companies across a range of sectors, priced sensibly and attractively.

Merger-and-acquisition (M&A) activity has also been buoyant. Businesses have been looking to acquire for growth or to divest in order to improve company focus and quality, such as balance sheet strength and profitability. Companies looking to raise new equity for acquisitions can also be a source of new investment opportunities.

The large size of the investible universe and breadth of opportunities available mean we have a large number of prospects to choose from. Our investment “sweet spot” at the moment—the area of the market we’re able to find the most attractive opportunities—is around the £100 million to £500 million market-cap area. Neither too small nor too big, we believe this range offers a strong combination of attractively valued companies the wider market has often overlooked.

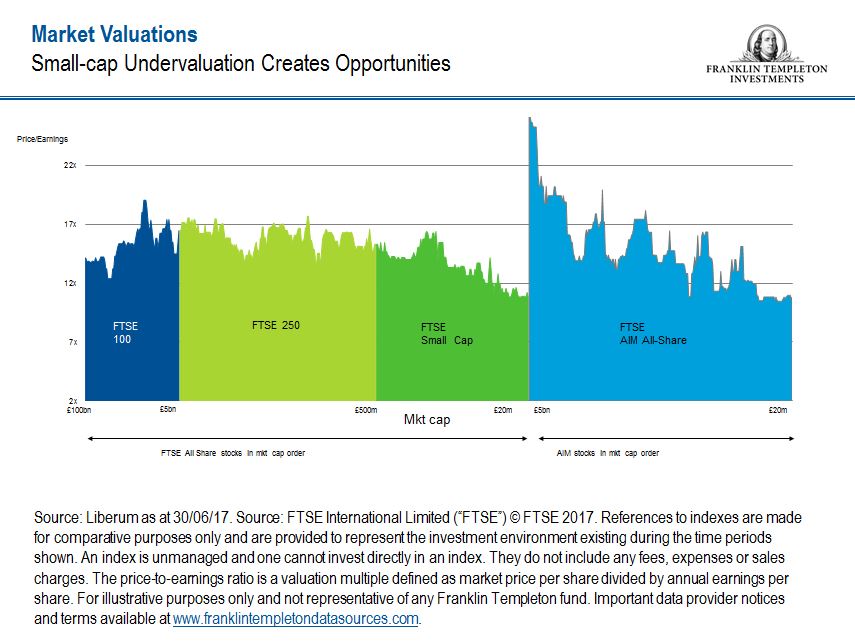

We think the FTSE Small Cap Index represents a good proxy for this area of the market, as it includes stocks that are less than approximately £500m in size.2 The index is currently trading at around a 10% price-to-earnings discount to the FTSE All-Share Index.3 This could be due in part to reduced liquidity at the smaller end of the market, but also could be due to the domestic skew that small-cap stocks have towards earnings. It has a much larger weighting towards the consumer sector, an area which has heavily de-rated and become less attractive to investors.

The market valuations chart below highlights the small-cap value proposition we see. It also illustrates how the larger FTSE AIM stocks have already hit quite full valuations—some are even off the chart.

We think the good earnings growth so far this year provides a reasonably positive corporate earnings backdrop for the rest of the year. This should play an important role in small-cap performance going forward, especially compared against the top end of the market, where the tailwind of sterling depreciation has now virtually faded.

While we’ve seen some of the growth-orientated names outperform and re-rate to higher valuations, some investors have shunned the domestic consumer-focused sectors. This has resulted in a wide valuation gap opening up between growth names and domestic cyclical companies. In our view, the uncertainty around Brexit negotiations and the mixed UK domestic economic data points has clearly been weighing on sentiment towards these domestic-oriented stocks.

From a contrarian perspective, there are some really interesting opportunities in these domestic stocks at the moment, but we feel it’s not quite the right time yet to move wholeheartedly into them. To us, it’s a matter of balancing this valuation opportunity against the earnings risk, which we are monitoring closely.

Under the Microscope

Our research process involves keeping in close contact with many corporate management teams. We hear first-hand about company strategies for future growth, and the general impression we have been getting is that companies operating in niche or structural growth sectors continue to do well, as well as companies categorised as global growth plays.

Conversely, businesses operating within the consumer discretionary space are starting to find the environment a little tougher. As inflation in the economy increases at a faster pace than real wage growth, the UK consumer is being squeezed. The result is lower discretionary spending power.

In order to maintain living standards, there’s been an increased appetite for credit. That equates to a much-reduced savings ratio and increased consumer debt levels. A cautious consumer environment can represent an economic headwind. Our central case for the UK has been for slower growth, rather than no growth. As a result, we are less sanguine about the consumer-driven sectors such as retail, travel and leisure and consumer goods.

Looking ahead, we think bottom-up news flow and earnings growth are likely to play an increasingly important component of stock performance. There is a chance that rising bond yields and the prospect of rising interest rates may cap further price-to-earnings expansion.

A fast-paced and changing world presents investors with opportunities and threats, but our investing philosophy remains focused on the long term. We look for opportunities across a range of diverse stocks and sectors that exhibit both growth and value characteristics.

Despite an environment where attentions can easily be drawn to the next big thing, we focus on the pillars of our investment foundation (company fundamentals, valuation and balance-sheet strength) to tackle the unknowns that may come our way.

The comments, opinions and analyses are the personal views expressed by the investment manager and are intended to be for informational purposes and general interest only and should not be construed as individual investment advice or a recommendation or solicitation to buy, sell or hold any security or to adopt any investment strategy. It does not constitute legal or tax advice. The information provided in this material is rendered as at publication date and may change without notice, and it is not intended as a complete analysis of every material fact regarding any country, region market or investment.

Data from third-party sources may have been used in the preparation of this material and Franklin Templeton Investments (“FTI”) has not independently verified, validated or audited such data. FTI accepts no liability whatsoever for any loss arising from use of this information, and reliance upon the comments, opinions and analyses in the material is at the sole discretion of the user. Products, services and information may not be available in all jurisdictions and are offered by FTI affiliates and/or their distributors as local laws and regulations permit. Please consult your own professional adviser for further information on availability of products and services in your jurisdiction.

Get more perspectives from Franklin Templeton Investments delivered to your inbox. Subscribe to the Beyond Bulls & Bears blog.

For timely investing tidbits, follow us on Twitter @FTI_Global and on LinkedIn.

What Are the Risks?

All investments involve risk, including possible loss of principal. The value of investments can go down as well as up, and investors may not get back the full amount invested. Stock prices fluctuate, sometimes rapidly and dramatically, due to factors affecting individual companies, particular industries or sectors, or general market conditions. Special risks are associated with foreign investing, including currency fluctuations, economic instability and political developments. Smaller and newer companies can be particularly sensitive to changing economic conditions. Their growth prospects are less certain than those of larger, more established companies, and they can be volatile.

___________________________________________

1. The FTSE AIM (Alternative Investment Market) All-Share Index is a capitalisation-weighted index of small and emerging companies traded on the London Stock Exchange. Indexes are unmanaged and one cannot directly invest in them. They do not include any fees, expenses or sales charges. Past performance is not an indicator or a guarantee of future performance.

2. The FTSE Small Cap Index is a small market capitalisation index consisting of the 351st and 619th largest listed companies of the London Stock Exchange. Indexes are unmanaged, and one cannot directly invest in them. They do not include any fees, expenses or sales charges. Past performance is not an indicator or a guarantee of future performance. The price-to-earnings ratio is a valuation multiple defined as market price per share divided by annual earnings per share.

3. The FTSE All-Share Index is a capitalisation-weighted index comprising of the FTSE 350 and the FTSE Small Cap Indexes. Indexes are unmanaged and one cannot directly invest in them. They do not include any fees, expenses or sales charges. Past performance is not an indicator or a guarantee of future performance.

Copyright © Franklin UK Equity Team