by William Smead, Smead Capital Management

What should long-duration common stock owners like us do with the news of the horrific flood in Texas, the Category 5 hurricane in the Caribbean, the heightened tensions created by North Korea’s Dictator, Kim Jong-un, and the 8.1 magnitude earthquake in Southern Mexico? What is wise behavior in a more volatile stock market environment created by outside events? More than 30 years in the industry have taught us that outside events come and go, but patience matters. Just look at the similarities with Billy Joel’s 1989 hit “We Didn’t Start the Fire.”1 The song named 100 major people, political and economic events in the first 40 years of his life. As you can see, it is interesting how the same subjects continue to pop up in the 38 years since the song hit the top of the Billboard charts.

Doris Day, Red China, Johnnie Ray

South Pacific, Walter Winchell, Joe DiMaggio

Joe McCarthy, Richard Nixon, Studebaker, television

North Korea, South Korea, Marilyn Monroe

If Joel rewrote the song, he would add Saddam Hussein, the leader of Iraq, who led the invasion of Kuwait, its neighbor from the south in 1990. It was an unprovoked violation of the sovereignty of another nation. Investors were mesmerized by the ramifications and the market fell around 20% from early August to late October. Oil prices spiked to $40 per barrel from the low $20s and the U.S. economy came to a grinding halt.

We didn’t start the fire

It was always burning

Since the world’s been turning

We didn’t start the fire

No we didn’t light it

But we tried to fight it

All of this came at the tail end of a big washout in financial institutions like banks and savings & loans. Defaults on foreign debts from Brazil and other emerging nations had crippled major money center banks and pummeled their stock prices. In late October of 1990, I was in New York meeting with a group of research analysts and investment product specialists at Smith Barney. Virtually every single person referenced their opinions by stating, “all bets are off if a major money center bank goes out of business.” The “B” word (bankruptcy) was music to my contrarian ears because John Neff, Vanguard Windsor’s lead portfolio manager, and John Templeton, the dean of mutual fund stock pickers, were raving about the bargains in financial stocks. Remember, Charlie Munger says that plagiarism is totally acceptable in investing!

The wise investor in 1990 bought the banks which were under the greatest duress before economic behavior normalized.

Hemingway, Eichmann, “Stranger in a Strange Land”

Dylan, Berlin, Bay of Pigs invasion

“Lawrence of Arabia”, British Beatlemania

Ole Miss, John Glenn, Liston beats Patterson

Pope Paul, Malcolm X, British politician sex

JFK, blown away, what else do I have to say

Billy also would have certainly added the September 11, 2001 attack by Al-Qaeda, killing over 3,000 Americans and shutting down the stock market for four days. Air travel around the country was shut down and when reopened, the nation saw travel plans and business travel fall off a cliff. U.S. stocks, as represented by the S&P 500 Index, fell 11.56% through the 21st of September. Declines were heaviest among travel and recreation-related companies like Disney (DIS), which saw its shares fall from $23.26 per share at the close on September 10, 2001 to $16.75 per share on September 20, 2001. Disney shares retested the 9/11 attack lows in 2003, but have had a nice run since with a six-fold increase plus dividends. “What else do I have to say”?

Harry Truman, Rosenbergs, H-bomb, Sugar Ray, Panmunjom

Brando, “The King and I” and “The Catcher in the Rye”

Eisenhower, vaccine, England’s got a new queen

Marciano, Liberace, Santayana goodbye

Joseph Stalin, Malenkov, Nasser and Prokofiev

Rockefeller, Campanella, Communist Bloc

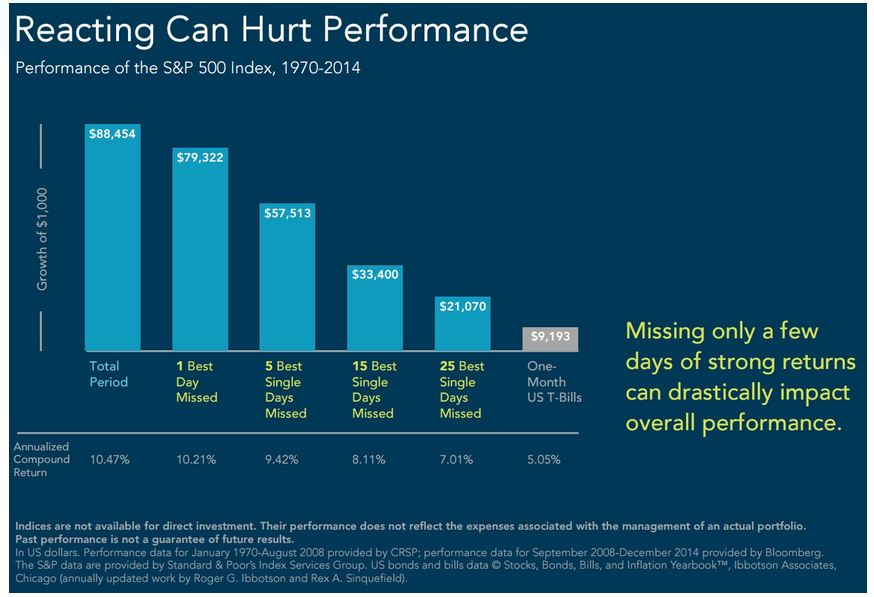

Therefore, what do you do as a long-duration investor in a market environment dominated by extremely popular technology stocks during a repeat of concerns over North Korea, Russia and existing/potential natural disasters of very large magnitude? First, compare the benefit of jumping in and out of the market versus staying put.2

Missing the five best days in a 45-year stretch can crush your results. We know it is trite to say, but it is time in the market, not market timing, which creates wealth. Besides, who owns a crystal ball?

Second, you stick to your discipline. In our case, this means owning meritorious companies which meet our eight criteria for stock selection. Third, you use history as a guide and lean into the companies which are negatively impacted by the news weighing heavily on investor attitudes. Lennar (LEN) is a homebuilder in Texas and Florida. As an owner, we can choose to be depressed about short run business disruption or be “greedy” and think of all the homes which need to be built to replace flooded homes. Don’t forget, the demographics indicate a massive number of millennial Americans will need a home built for them, because boomers are going to live longer and stay in their existing homes.

We didn’t start the fire

It was always burning

Since the world’s been turning

We didn’t start the fire

No we didn’t light it

But we tried to fight it

Historically, common stocks have been a better performing liquid asset to own over long periods of time because of the volatility connected to the fact that “we didn’t start the fire.” By sticking to our discipline, we assume that “since the world’s been turning” horrible acts, dangerous events and bad people will exist, regardless. As the long-term chart of the index shows, historically, it hasn’t paid “to fight it.”

Warm Regards,

William Smead

1Source: “We Didn’t Start the Fire” by Billy Joel

2Source: Plancorp

The information contained in this missive represents Smead Capital Management’s opinions, and should not be construed as personalized or individualized investment advice and are subject to change. Past performance is no guarantee of future results. Bill Smead, CIO and CEO, wrote this article. It should not be assumed that investing in any securities mentioned above will or will not be profitable. Portfolio composition is subject to change at any time and references to specific securities, industries and sectors in this letter are not recommendations to purchase or sell any particular security. Current and future portfolio holdings are subject to risk. In preparing this document, SCM has relied upon and assumed, without independent verification, the accuracy and completeness of all information available from public sources. A list of all recommendations made by Smead Capital Management within the past twelve-month period is available upon request.

© 2017 Smead Capital Management, Inc. All rights reserved.

This Missive and others are available at www.smeadcap.com.

Copyright © Smead Capital Management