by Blaine Rollins, CFA, 361 Capital

Better yet, grab Jose and dance away into the Atlantic. Congress has a lot on its plate right now and the U.S. does not need to worry about additional storms after the damage done to Houston. No matter what some may believe, natural disasters are not good for the economy. Sure, they might temporarily benefit some industries, but in total they pull spending away from other things like education and infrastructure. And massive disaster spending hogs resources causing disruption and inflation across the U.S. Just imagine owning a construction company in Phoenix, Denver or Dallas and find out that half of your work crew just drove to Houston to spend the next three to five years. Or, consider your next Avis rate as 20 rental cars from every airport in the U.S. are now being loaded on a truck headed for south Texas. And insurance stocks? Well they can handle one big event risk, but two might hurt the industry and impact future prices for all insurance buyers. Big hurricanes are not a positive for America.

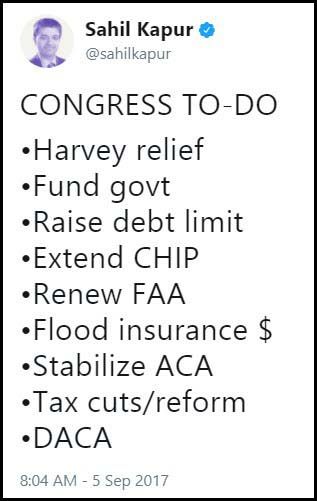

While Congress gets to watch the Weather Channel for the month of September, they will also be tackling the Debt Ceiling, Tax Reform and now DACA. Meanwhile they get to also watch the White House’s actions on North Korea and Iran. The list is only growing longer as open items are not being closed. It is a short week, so let’s hope that Congress can at least cross one item off their to-do list.

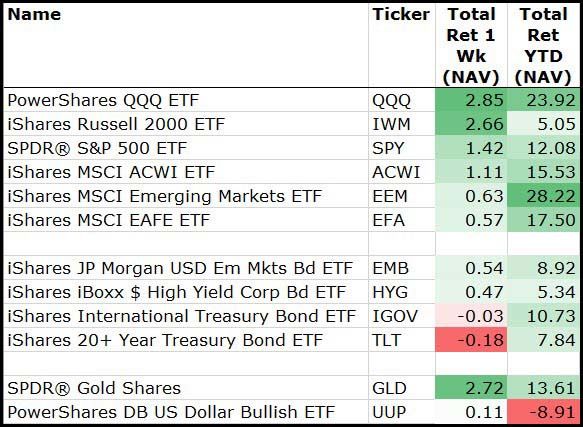

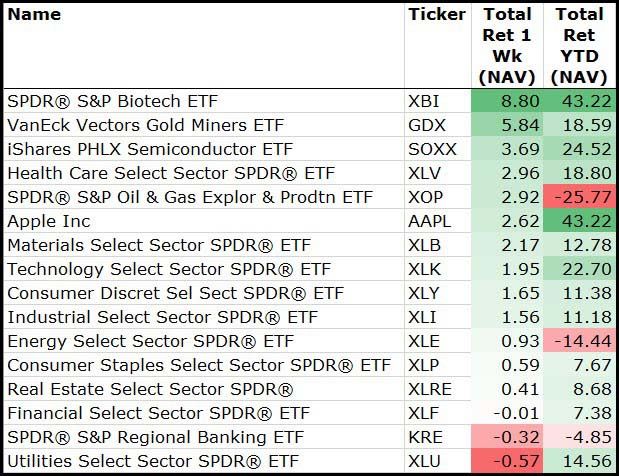

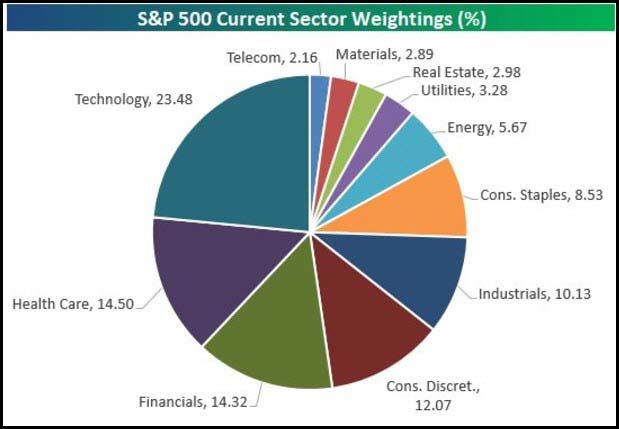

The markets are taking things in stride. While the major indices continue to hold their own, investors appear to want to own strength and sell weakness. The milestone of the week was that Healthcare passed Financials to become the 2nd largest industry sector in the S&P 500. Biotech has been the invisible hand to the back of Healthcare stocks increasing 8%+ on the week. Still plenty of interest in Tech stocks, Materials and Industrial Metals. Then there is Gold. Plenty of interesting moves all across the asset classes.

To receive this weekly briefing directly to your inbox, subscribe now.

It’s September 5th. Do you know where your Congress is?

Another good week for the markets even with the North Korea launch over Japan on Monday…

Small caps did extremely well, especially given the weak U.S. dollar.

(9/1/17)

Among sectors, plenty of dispersion…

Biotech, Gold Miners and Semis straight up, Utilities and Banks down.

(9/1/17)

The Healthcare sector is now your new #2 weighting…

(@bespokeinvest)

Looking at those sectors trading at Q3 highs and above their moving averages…

Globally, there are many Emerging Market ETFs also trading strong…

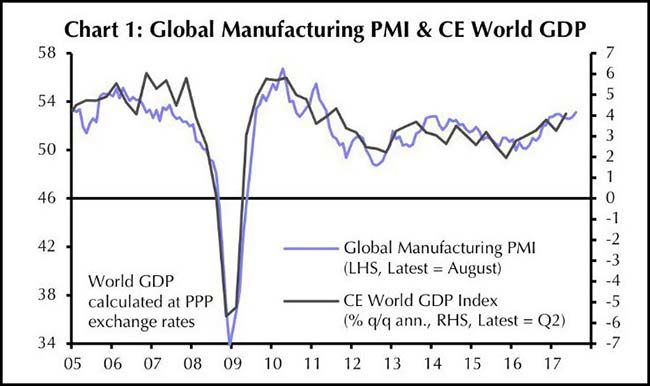

It is difficult to be bearish on the markets with the global pull of manufacturing higher…

(@LONGCONVEXITY)

However, Barron’s is trying to plan your exit from the stage of Equities…

(Barron’s)

Gold is now helping the commodity chain higher…

And a big move in the precious metals miners.

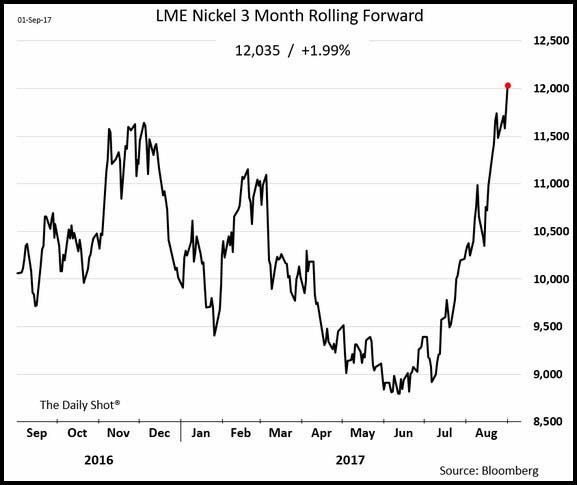

We know industrial metals are rolling higher. Here is Nickel…

(WSJ/Daily Shot)

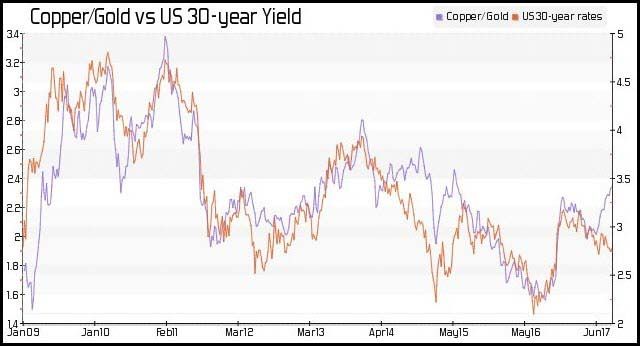

Some concern with this chart of Copper outrunning Gold…

Of course the recent break could be explained if growth in the Rest of the World > United States. It can also be explained by Washington D.C.

(@Market_Time)

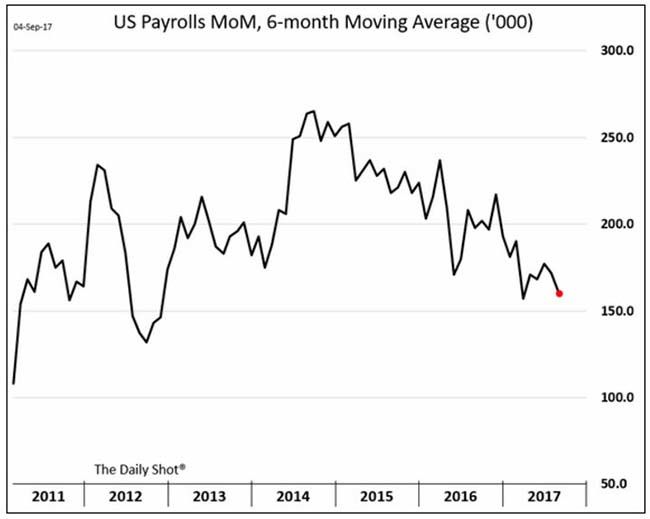

We had a jobs data point on Friday. It was a yawner.

The weaker-than-expected U.S. jobs report for August should not materially change expectations for the economy, which remains, for now, stuck in a “new normal” low-growth equilibrium.

The data released Friday will amplify expectations of a Federal Reserve that remains looser for even longer, placing downward pressures on market interest rates and the dollar, but that also will have to compete with the latest news from the European Central Bank. And within the Fed, it amplifies the tug of war between those who are worried about lowflation and those concerned about the risk of future financial instability.

Job creation, at 156,000, came in slightly lower than the 180,000 consensus expectations. This was coupled with a downward revision to previous months’ numbers. With the secularly low participation rate remaining unchanged, the unemployment rate edged up to 4.4 percent. Meanwhile, wage growth remained muted, rising only 0.1 percent and keeping the annual increase at 2.5 percent.

Should we begin to worry that we have run out of people willing to work?

While hiring remains robust, the overall trend points to a slowdown over the past three years. Economists think that this is the result of a tightening labor market: the pool of available workers is gradually shrinking.

(WSJ/DailyShot)

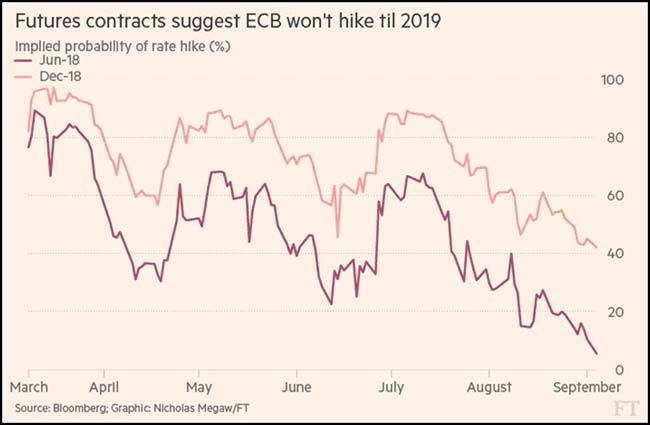

Meanwhile to the east, rate hike expectations for the ECB are getting pushed out…

Will the Euro-Financials begin to get concerned like the U.S. financials have?

Interest rate futures markets now suggest there is only a 42 per cent chance that the ECB will lift interest rates by next December, according to Bloomberg. That figure has fallen sharply from more than 90 per cent six months ago, and was still around 20 per cent before last month’s Jackson Hole economic symposium.

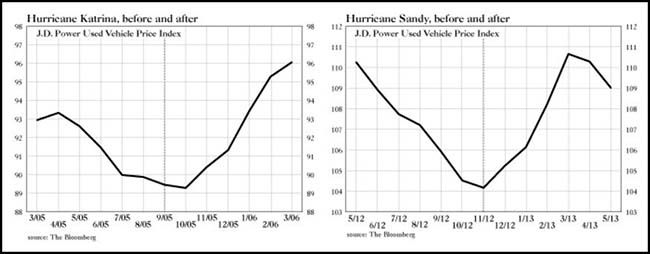

One area that will benefit from a hurricane: auto prices

There may have been 500,000 autos lost in Hurricane Harvey. Below are the charts showing used vehicle prices after the last two major hurricanes.

(Grants)

As you would expect, no one wants to own big strip/shopping centers anymore…

Don’t be surprised that Washington D.C. is getting hardest hit. This is likely happening across all parts of their local economy.

According to a recent Cap Rate Survey by CBRE Group, the property type that suffered the greatest decline in value from the second half of 2016 to the first half of 2017 were retail “power centers,” where typically two or three big box stores are surrounded by other retail and parking. Their average cap rate rose to 7.31% the first half of this year, compared with 6.92% six months earlier.

The rate of owners falling behind on loan payments also has increased this year. In July, a Moody’s Investors Service delinquency tracker of a popular type of commercial mortgage-backed security was at 6.7%, compared with 6% at the end of 2016. That’s well below the peak of 10.1% the tracker hit in July 2012. But the current number is much higher than the tracker was at in 2008: 0.5%.

Some regions are being hit worse than others. The delinquency rate in Washington, D.C., is 2.5 times the national average with the problem resulting largely from “suburban office properties with concentrations of government tenants,” Moody’s said in a report this month. “The federal government has curtailed or consolidated its footprint in the region, exacerbating recent negative trends,” the report said.

(WSJ)

The U.S. rental apartment market is starting to show much dispersion…

The supply dynamics are hard at work here so not just based on job growth. Chicago -26% from peak prices 2 years ago?

(@WolfStreetStox)

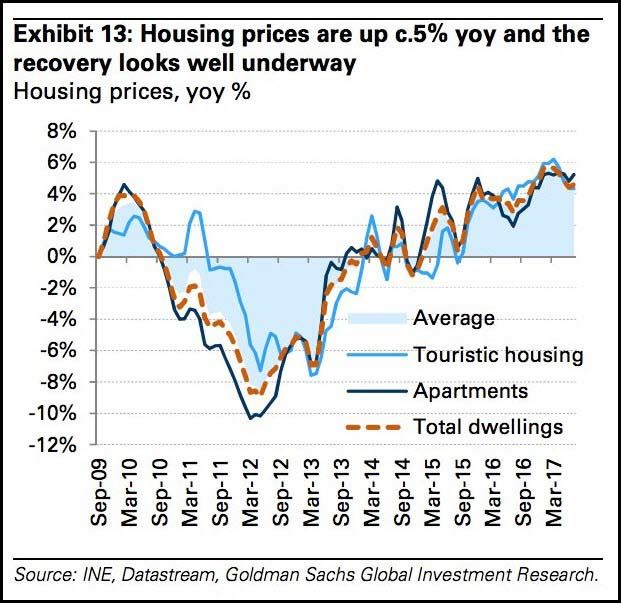

Portugal was the ‘P’ in PIGS. Now look at it…

@joshdigga: Portugal: Housing prices recovery looks well underway

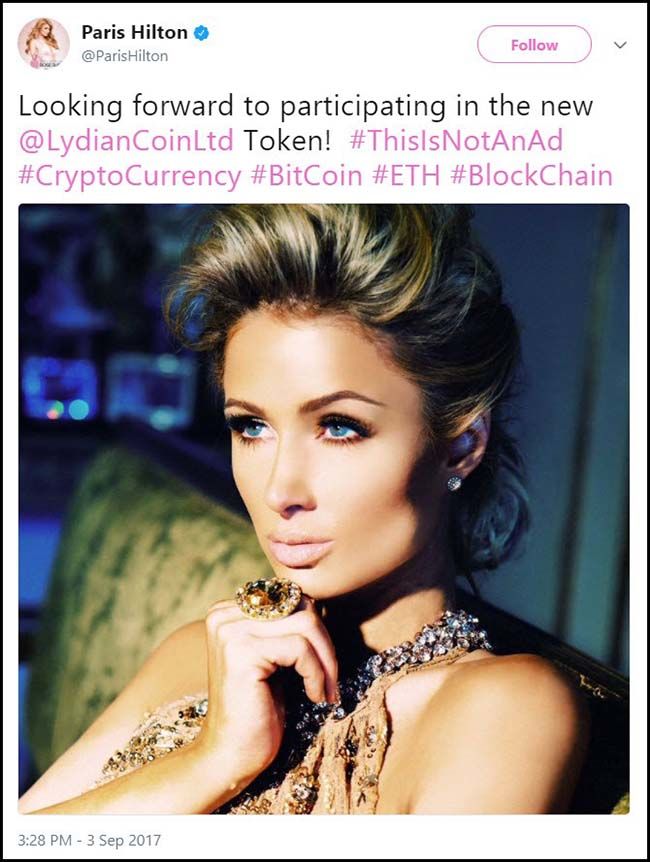

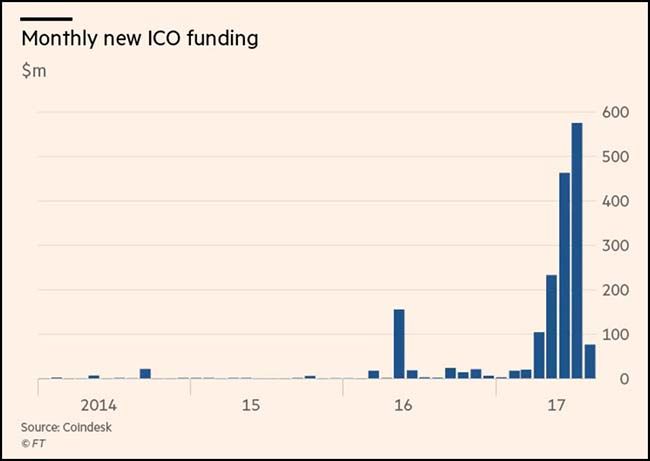

Maybe all of the real estate investing dollars are moving into crypto-currencies?

And maybe it is happening all too quickly…

Although ICOs have been around for several years, Marshall Swatt, co-founder of digital currency exchange Coinsetter, said the huge increase in the value of digital currencies had brought new interest from “investors, traders, the media, and average individuals”, including people who want to invest their now valuable digital assets in other virtual projects. In 2013, bitcoin were being traded for about $135, nowadays they are moving towards $5,000.

But some established members of the industry say they are alarmed by the ICO boom and want tougher regulation.

“There are people in the ICO market right now who will end up in orange jumpsuits,” said Brad Garlinghouse, chief executive of Ripple, a company that provides interbank payment software using blockchain and runs its own virtual currency, XRP.

Just to be safe, China has banned all ICOs and the SEC is also soon to put them under a microscope…

Mark Mobius is sensing danger in the explosive growth of cryptocurrencies.

Governments will begin clamping down on digital currencies because of their use in illicit financing, with terrorist groups to drug dealers contributing to their rise, Mobius, executive chairman at Templeton Emerging Markets Group, said in an interview in Hong Kong Monday.

“Cryptocurrencies are beginning to get out of control and it’s going to attract the attention of governments around the world,” Mobius said. “You’re going to get a reversion back to gold because people are going to wonder, can I really trust these currencies?”

And the crackdown may have already started — at least in China, home to the majority of bitcoin miners.

The People’s Bank of China said Monday that initial coin offerings are illegal and that all related fundraising activity should be halted immediately. The central bank said it has completed investigations into organizations and individuals who have conducted so-called ICOs, and have ruled that such activities disturb financial order and will be banned.

Copyright © 361 Capital