by Mawer Investment Management, via The Art of Boring Blog

About a decade ago, was an investor to ask, “What are the best businesses? The ones nearly immune to competition?” the most robust options on the market were arguably two-way network-effect businesses. The essence of a network-effect business lies in the additional value that each new buyer or seller adds to the overall network. Two-way suggests that adding either a seller or buyer to the network creates additional network value. Even if new competition sprouts up offering a slightly better rating system or other improvements, the company commanding the existing network will more likely retain customers as that’s where the market is. The story of eBay is a classic example of this kind of two-way network-effect business. TMX Group—one of our recent better performers in the Mawer Canadian Equity Fund—also falls into this two-way category.

In 2017, network-effect businesses are still fairly solid investments. But were an investor to ask the same question—what are the best businesses—the answer may lead to a potentially stronger and more competition-immune business model: the data-monopoly business.

Enter data monopolies

We are all familiar with the leviathan status of Google. To search online has long since become ubiquitous in our day-to-day vernacular as “Googling.” For a quick reminder and update on the scale of Google’s search reach, in 2016 it alone accounted for about 94% of all mobile search.

Google’s power as a data monopoly is this: it alone has insight and ownership of that 94% of search data. Even if someone did come up with a better search algorithm, they would struggle to compete for a foothold since Google is constantly learning through millions of daily queries on their servers about what people really want in search. That regularly updated information store allows Google to innovate more dynamically—and continually re-fortify its competitive moat by parlaying what it learns into better search-results for its users.

Moreover, that yet-unforeseen-disruptor algorithm is not the silver bullet—or rather, the bridge to cross the moat. In the fast-paced world of tech, algorithms have become commoditized and thus somewhat dispensable. They are iterations; constantly adopted, changed, and bettered without one sole author controlling its use. In the age of data monopolies, the strength of an algorithm lies not in the coding but rather becomes tied to the amount, granularity, and exclusivity of data you have. Google’s search engine is as robust as it is because of how much data input it’s constantly receiving and already contains. It knows what people want and can hone in on the best way to deliver those results.

Facial recognition software also demonstrates the importance of data over algorithms. The highest-quality facial-recognition programs are not those with the fanciest or quickest algorithms—those are largely commoditized into public off-the-shelf libraries. Instead, it’s the programs with access to the most faces and different lighting, angles, etc. of those faces. Which is to say, it is the programs that have the most data, not the best algorithms, that are the highest-quality.

The fallacy of composition

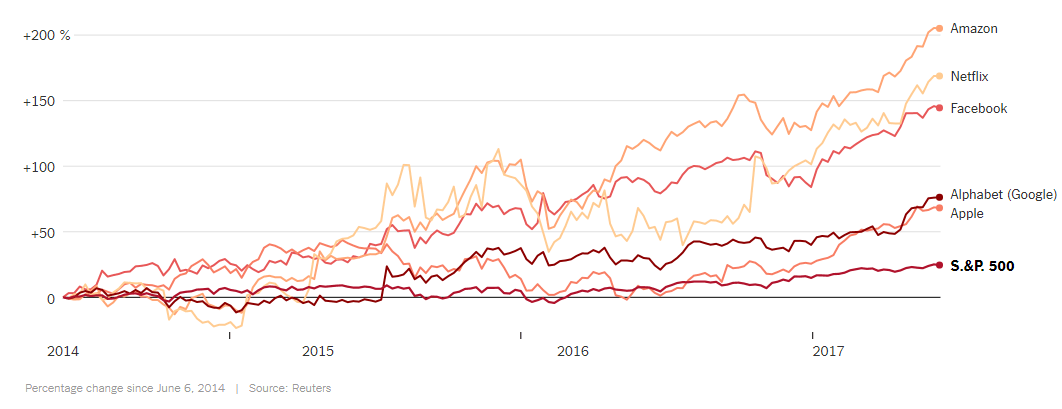

Today’s investor needs to pivot their thinking around how to analyze what makes a great business. A traditional view may look at product companies—particularly in tech—as only high risk. The ghosts of tech failures like Nortel, Nokia, and Blackberry should haunt any prudent investor. Faced with the ever-higher share prices on the graph above, we too have found ourselves asking probing questions. Is this another tech bubble? More hype? Is it too much of a departure from “Be Boring. Make Money.” to buy companies that, in some cases, have yet to generate material profit?

Unfortunately, assessing risk in tech investing often illustrates something called “The Fallacy of Composition”—inferring something is true of the whole based on some part of the whole. Tech companies range from the most speculative stocks (e.g., an unprofitable startup tech-product company) to, I would argue, some of the world’s lowest-risk companies (e.g., the data monopolies). The moats around data monopolies such as Google, are stronger and more robust than ones we’ve ever seen before, and can potentially be incredibly profitable over the long run. Investors should focus on the amount, granularity, and exclusivity of the data that such companies command, and try to identify emerging companies that are busily building out early-stage data-monopolies.

Given the choice, I’ll take a monopoly on data over a superior algorithm any day of the week.

This post was originally published at Mawer Investment Management