by Richard Turnill, Chief Global Investment Strategist, Blackrock

Richard spells out why good earnings reports have failed to excite equity markets, and what the second-half may look like.

There has been little cheer in the equity market after the largely positive earnings reports this quarter. The excitement of repeated new highs in the stock markets appears to be wearing thin. Yet we see solid fundamentals and returns in the second half, with the latter largely tracking earnings growth.

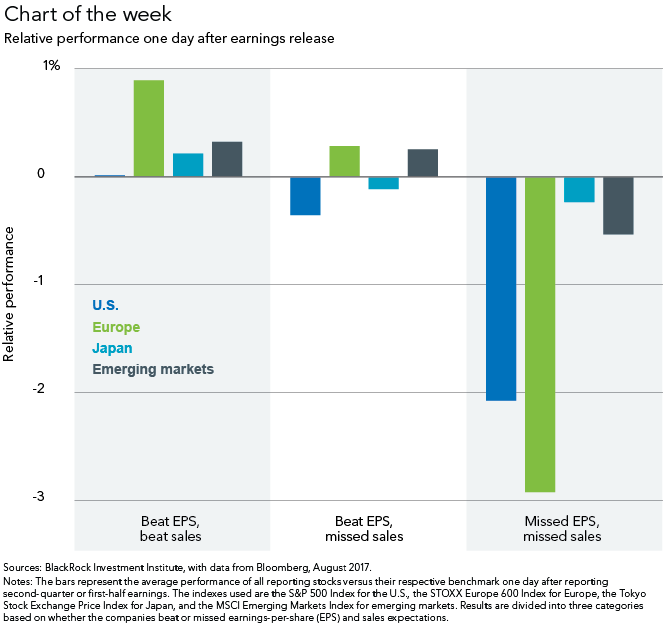

We look at the price reaction in the day after companies released their earnings. Shares of companies that beat estimates of both earnings-per-share (EPS) and sales only outran the broader market slightly, if at all, as the chart above shows. For example, the S&P 500 companies beating on both have on average traded flat compared to the benchmark, versus nearly 1% outperformance last quarter. Meanwhile, shares in companies that missed on both earnings and sales dropped sharply, especially in Europe.

A high bar for the second half

Investors may be on to something: It will be more difficult for companies to achieve the same EPS growth in the second half, as the earnings recovery in the second half of 2016 is a higher hurdle. The energy sector’s strong contribution to earnings is waning, after its earnings rebound has delivered nearly a quarter of the EPS growth in the U.S. market and half of that in Europe in the second quarter. A stronger euro could slow the pace of earnings growth among European companies. The earnings revisions ratio—the ratio of earnings estimate upgrades to downgrades—in Europe has in fact fallen to a one-year low.

A bull market stretching eight years—and nearly weekly new highs—seems to be weighing on investor enthusiasm. That said, this earnings season has affirmed our positive view on equity fundamentals. Second-quarter sales grew nearly 6% on the year in the U.S.—the second-highest growth in five years. We expect technology and financials to lead earnings growth in the second half. And the steady and sustained global economic expansion provides a favorable backdrop for risk-taking.

Bottom line: We expect fundamentals to stay positive in the second half, and see returns generally keeping pace with earnings growth. Cautious investor sentiment should keep valuation multiples in check, particularly in the U.S., we believe. We see opportunities in emerging market equities, as economic reforms, improving corporate fundamentals and reasonable valuations provide support. Read more market insights in my Weekly Commentary.

Richard Turnill is BlackRock’s global chief investment strategist. He is a regular contributor to The Blog.

Listen to Richard Turnill and Jeff Rosenberg talk about BlackRock’s midyear investment outlook on the inaugural episode of our podcast, The Bid.

Investing involves risks, including possible loss of principal.

This material is not intended to be relied upon as a forecast, research or investment advice, and is not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy. The opinions expressed are as of August 2017 and may change as subsequent conditions vary. The information and opinions contained in this post are derived from proprietary and nonproprietary sources deemed by BlackRock to be reliable, are not necessarily all-inclusive and are not guaranteed as to accuracy. As such, no warranty of accuracy or reliability is given and no responsibility arising in any other way for errors and omissions (including responsibility to any person by reason of negligence) is accepted by BlackRock, its officers, employees or agents. This post may contain “forward-looking” information that is not purely historical in nature. Such information may include, among other things, projections and forecasts. There is no guarantee that any forecasts made will come to pass. Reliance upon information in this post is at the sole discretion of the reader.

©2017 BlackRock, Inc. All rights reserved. BLACKROCK is a registered trademark of BlackRock, Inc., or its subsidiaries in the United States or elsewhere. All other marks are the property of their respective owners.

Copyright © Blackrock