by Blaine Rollins, CFA, 361 Capital

I love the earnings reporting season. I want to see the report cards of companies and then I want to see the surprise and reactions from the portfolio managers who own (or don’t own) those companies. In high school and college, I used to love to play poker for coins but nothing can compare to sitting around a global table of investors looking to buy and sell companies based on an earnings release or conference call. And there is nothing scarier than being long a name that knocks the cover off only to have the stock decline meaningfully. (If you don’t know who the sucker is at the table…)

Investors today cry about the lack of volatility in the indexes. They should try and look away from their SPY position and peek under the hood during the reporting season to see where volatility lives and breathes. This reporting season has had its share of ups and downs. Overall, the numbers look good but the reactions remain a varied scatter with the Industrial and Financial areas seeing more weakness while Tech and the Consumer sectors have been better received. Hopefully you are using the volatility to upgrade your portfolio for the next projected move. I have been through over 100 reporting seasons so far in my career and I with the help of my Peloton cycle, I hope to be around for another 200+. Now back to the earnings.

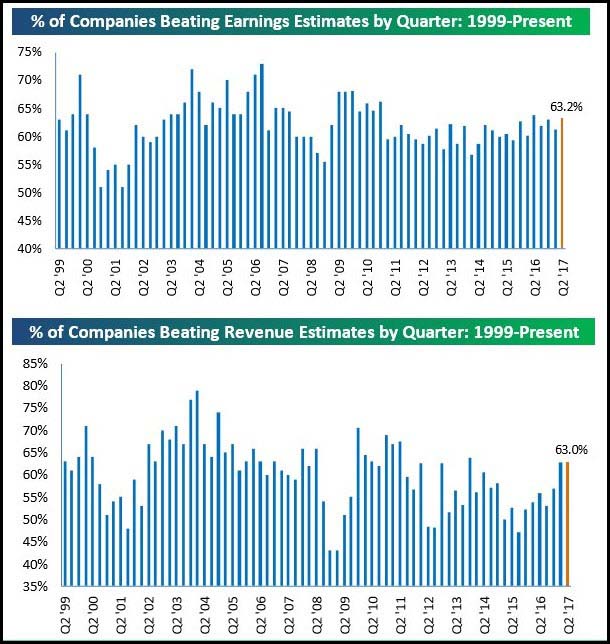

According to Bespoke, another decent reporting season is underway…

(@bespoke)

And just as one would expect, companies beating earnings are seeing better price action than those that missed earnings…

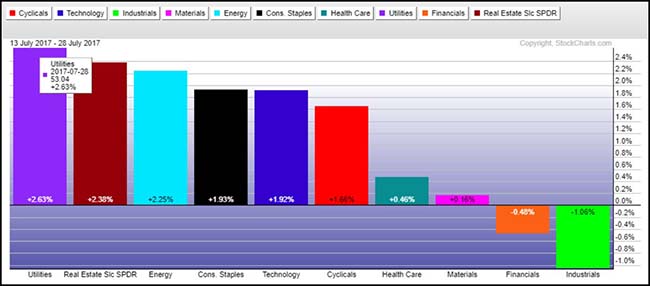

Since the reporting season got underway, here is how the sectors have fared…

The most memorable disappointments came early with those big bank reports and then were followed with several industrial misses (like GE and the Transports to point at some). The Utes, REITs and Energy have yet to really get reporting so chalk those moves up to moves in Bonds and Oil prices. Definitely a bulk of winners in the Tech and Consumer spaces.

Here is last week’s list of big movers in the S&P 500…

As you can see, the list is 90% earnings driven. Need some VIX?

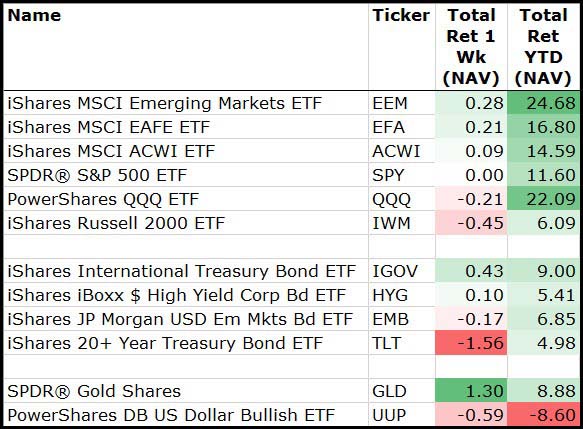

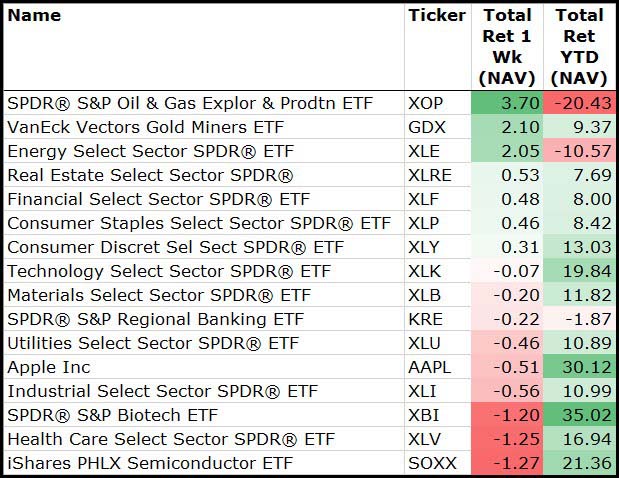

For the week, the decline in the U.S. Dollar led to more gains overseas and in gold.

Among sectors, a bit of a reversal during the heaviest week of earnings with Semis and Biotech leading at the bottom…

Nifty Fifty? Not yet…

@Callum_Thomas: 5. It’s far from the dot-com peak, but note how the top 10 companies almost = 20% … h/t @LeutholdGroup

Where could future risk lay? Try here…

The Federal Reserve’s plan to start unwinding quantitative easing as early as September could be derailed if Congress fails to tackle the looming deadlock over the US debt ceiling, analysts warn.

Republican failures to win legislative victories — embodied by the collapse of healthcare reforms — last week injected an early bout of nerves into financial markets as investors confronted the possibility of a disorderly stand-off over the US’s public debt limit. In a worse-case scenario, this could lead to a government shutdown as well as market turmoil.

While yields on three-month Treasury bills subsided somewhat at the end of last week, jitters have come sooner than during the debt ceiling countdowns of 2011 and 2013, according to Mark Cabana, a strategist at Bank of America Merrill Lynch. This is striking given that Republicans have control of both wings of Congress and the White House, which ought to put them in a stronger position to reach a deal.

Or here…

“Uncertainty about the outlook for government policy in health care, regulation, taxes, and trade can cause firms to delay projects until the policy environment clarifies,” (Stanley Fischer, Federal Reserve Vice Chairman)

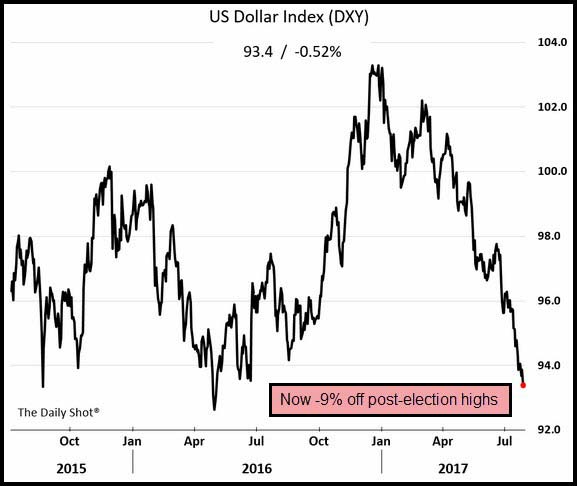

Maybe also in the rapidly collapsing U.S. Dollar?

Which now ranks as the worst YTD move since 1986.

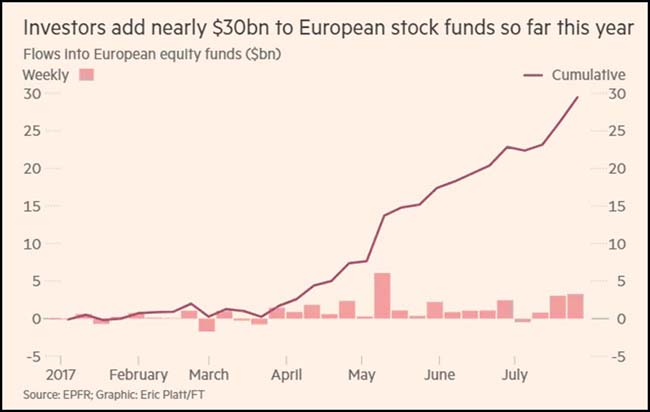

Investors seem to continue to allocate away from the falling U.S. Dollar…

Investors added $3.3bn to European equity funds in the week to July 26, according to flows tracked by EPFR. The figure was up slightly from the week prior and the largest since Emmanuel Macron swept to victory in French presidential elections in May. The inflows accompany a rally in the euro to a more-than-two-year high, with the common currency up 11 per cent against the US dollar this year. By contrast, US stock funds suffered their sixth consecutive week of outflows, the longest streak in more than a year. Investors redeemed nearly $600m from the asset class last week, buoying outflows since mid-June to nearly $20bn.

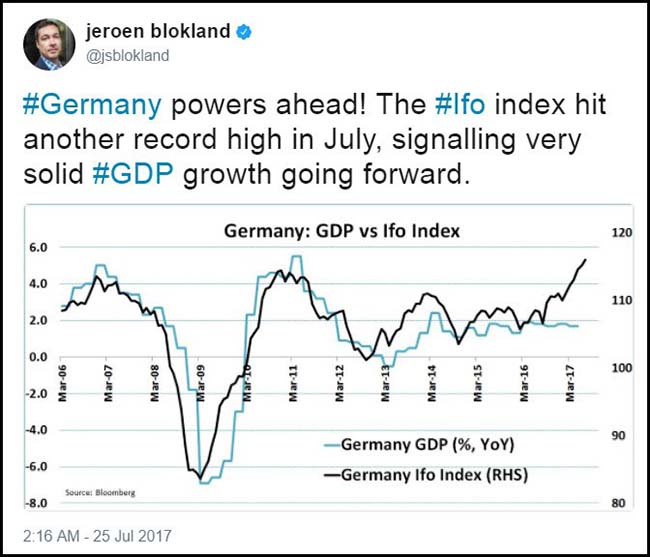

Another reason to invest in Europe is for the improving fundamentals…

There’s optimism in Europe, particularly France

“While we continue to be cautious on the UK and as they prepare to exit the EU, we are optimistic about the overall outlook for Europe…We also see…a great deal of optimism in France, as President Macron has a clear mandate for reforms including labor market reform which should benefit that economy and stimulate better employment growth.” —Manpower CEO Jonas Prising (Temp Staffing)

Germany is also very strong

“Germany, by definition, which is a big engine in Europe is doing well in the manufacturing side. And our business in Europe, if you look upon the portfolio, Industrial business is very strong.” —3M CEO Inge Thulin (Industrials)

And the rapidly improving economic outlooks…

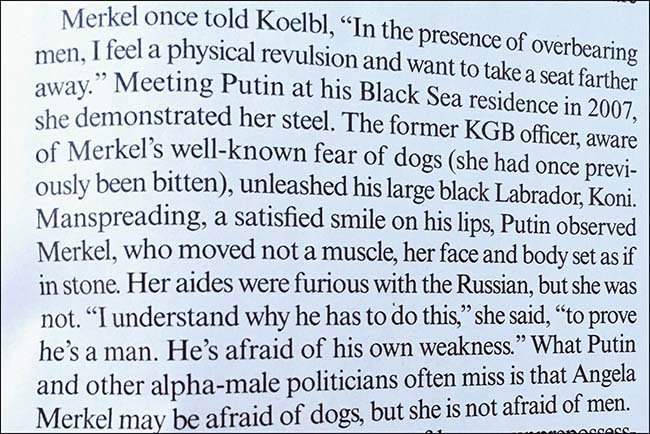

Plus you get Angela Merkel…

(@tweetawesomely)

Investors are also allocating to the Emerging Markets…

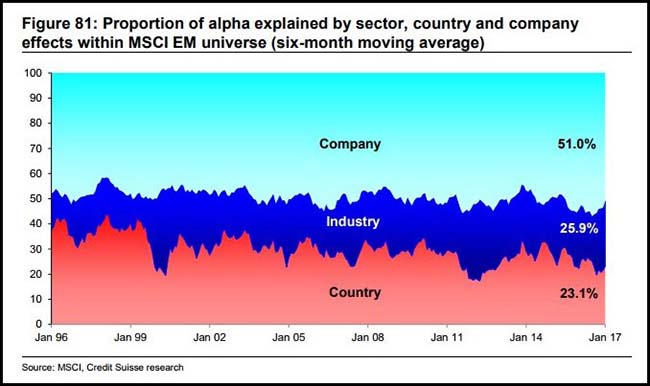

And I love this chart which shows how EM investors get their alpha. You can make so much more in return by getting the right country, then industry and finally the individual name. (But if you want to only stick with EEM…)

(@NickatFP)

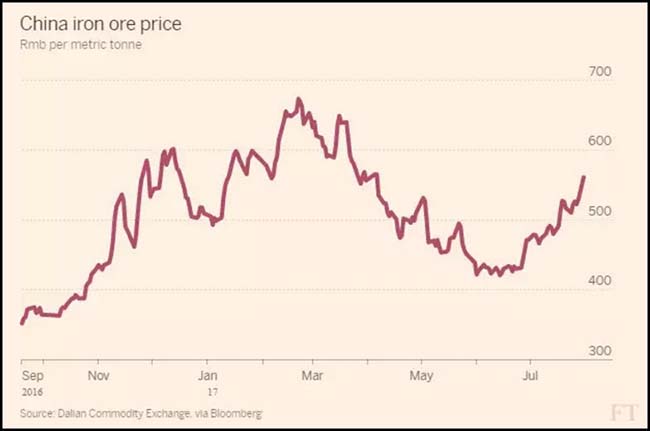

Pay attention to EM growth rates as Chinese iron ore prices are picking up again…

Active Management likes all of these various moving pieces in the markets…

The last time hedge funds started a year with six straight monthly gains? Well, that would be 2007.

While observers are certainly wary of a market correction, few are expecting another Great Recession. And recent gains suggest more measured exuberance. Right before the last recession, hedge funds shot out of the gate, rising 7.35%. The first half of this year saw more modest returns of 4.33%.

In that time, emerging markets, up 8.13%, have been the leading performers for hedge funds, edging out activist funds, which added 8.10%, followed by European funds, which surged 6.15%, according to data from BarclayHedge.

(Barron’s)

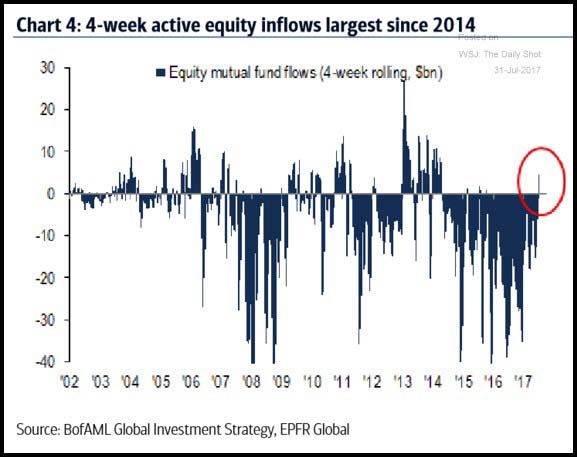

[Lifts head off desk] Did someone just say Large Cap Equity search?

Well, maybe not, but investors just put a slug of money into Active Management.

(WSJ/Daily Shot)

If you think there will be a stock market crash tomorrow, this chart doesn’t show it. Remember, the credit markets are bigger (and usually smarter) than the equity markets.

@DriehausCapital: ICYMI: Spreads on the JPM BB/B Leveraged Loan Index haven’t been this tight since Oct 07. (& back then LIBOR was 5%) KCN

And Steve Eisman sees reduced compared to 10 years ago…

Steve Eisman, the US investor who successfully predicted the subprime crisis and was portrayed on screen in The Big Short, the Oscar-winning film, says the world’s financial system is safer than it has been for decades.

The fund manager, who made a fortune betting against subprime mortgages and the banks holding them in the run-up to 2008, said that regulations introduced since the financial crisis to shore up banks, such as the US’s Dodd-Frank rules, should avert future systemic problems.

“The world is a very different place to what it was pre-crisis. For the first time in my working life, which is more than 30 years, I would regard the financial system as safe,” Mr Eisman told FTfm on the eve of the 10-year anniversary of the subprime mortgage crisis. “The system is now heavily regulated and closely watched, which I believe is right.”…

“There is simply not enough leverage in the system to create a major systemic issue like a decade ago,” he said. “The reality is the system is much safer today and there are not any systemic concerns.”

Byron Wien also doesn’t see a near term two by four flying at your portfolio…

Fortunately, earnings are coming in better than expected. After several years of modest increases, primarily because of poor performance in the energy industry, S&P 500 earnings are expected to break out and be up 10% this year to close to $130, or possibly even higher. Earnings improvements in the financial services industry will also help increase 2017 profits for the index. Continued double-digit earnings increases should not be expected, but I could see S&P 500 earnings exceeding $150 by the end of the decade if no recession takes place. While the current expansion is more than eight years old, few excesses are apparent and I am optimistic that the next serious downturn is several years away. If a recession should occur before then, determining what policy steps could be taken to get us out of it will be difficult. With interest rates already so low, the Fed has little room to create stimulus by dropping the Fed funds rate. Also, a Republican Congress is unlikely to pass bills providing significant fiscal stimulus. As a result, the best policy course is one that attempts to defer the next recession for as long as possible.

(Barron’s)

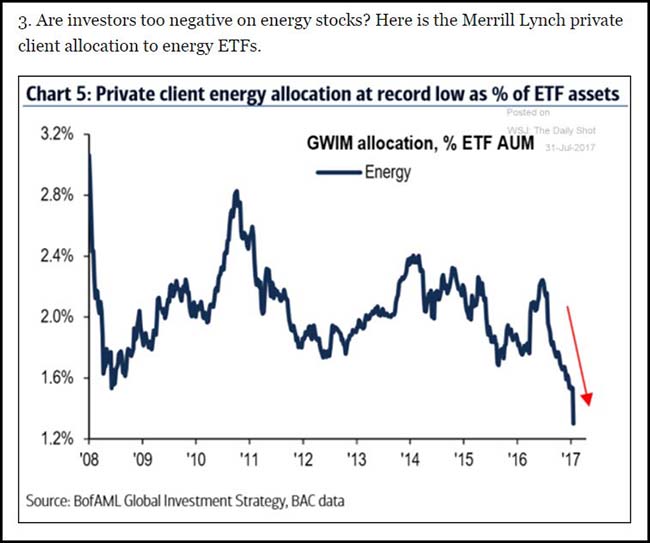

The answer is NO…

(WSJ/The Daily Shot)

There is only one House less stable than OPEC right now…

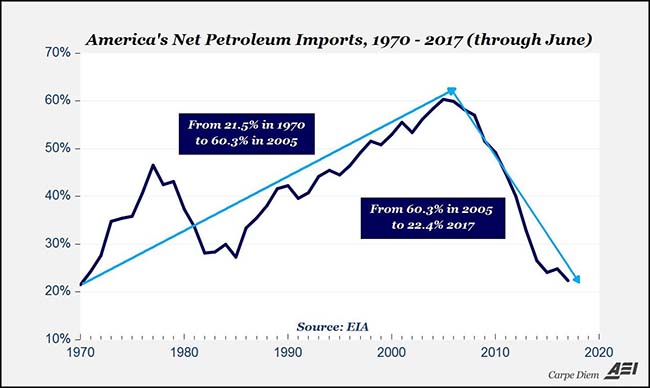

@Mark_J_Perry: Net Oil (Petroleum) Imports in “Saudi America” Are the Lowest This Year (22.4%) in Almost 50 Years, Going Back to 1970. @energytomorrow

Also chipping at Energy prices are increasing Solar deployments…

CEO Mark Widmar told analysts that “pricing has firmed up in the U.S.” for solar panel “modules,’ the components that make up the panels.

“Again, there is a tremendous amount of demand right now for all the segments of the market, which is firming up that pricing.” Offsetting that, the company’s seeing somewhat lower prices as it moves from existing product, known as “Series 4,” and ramps up production of its forthcoming “Series 6” solar cell technology.

(Barron’s)

Solar appears to have found a recent low…

(@beckyhiu)

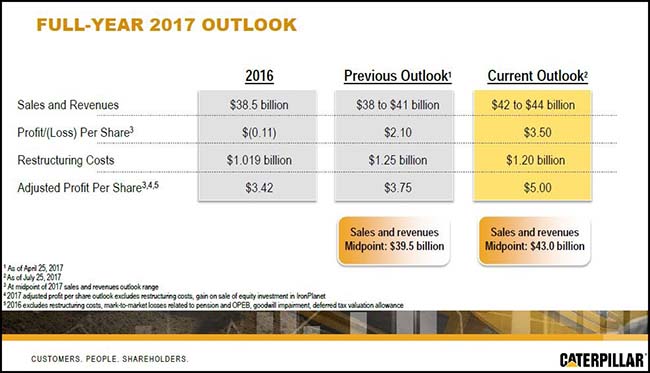

Did you see the upgrade in Caterpillar’s outlook?

Rising commodity prices and a falling U.S. Dollar won’t hurt.

(Catepillar)

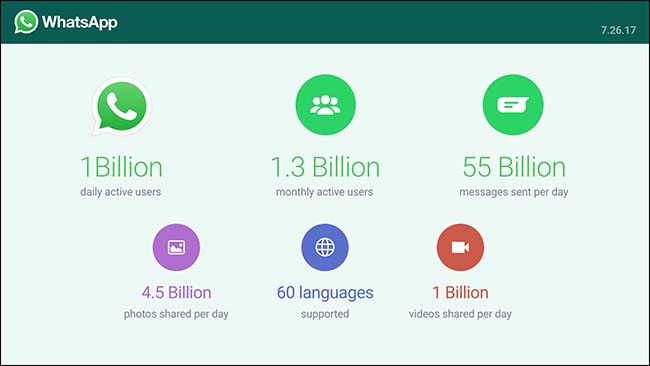

Nice job Mark Zuckerberg. Just incredible numbers at WhatsApp…

(WhatsApp)

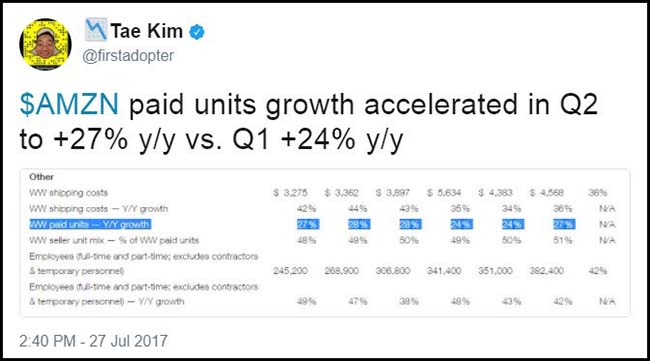

Speaking of growth, could you believe that Amazon accelerated its units to +27%?

Meanwhile, Amazon’s success basically killed Starbuck’s acquisition of Teavana…

“Over the last several years many mall-based retailers have been adversely impacted by reduced foot traffic, resulting from the accelerating shift of consumer behavior away from brick-and-mortar retail and changes in consumer retail activity overall,” Scott Harlan Maw, Starbucks CFO, said in a call with investors at the time. “Our Teavana mall stores have not been immune, with many reporting negative comps and operating losses for some time.”

While Starbucks has invested in new store designs and updated merchandising, Maw said that the rate of decline at mall-based Teavana stores over the last six months has been worse than forecast, and that the company expects further declines.

Most commented, non-political tweet of the week?

On Friday night, the global auto industry accelerated with the introduction of the Model 3…

I felt like I was driving in an Eames chair. That was my first impression as I climbed into the driver’s seat of the Tesla Model 3 at the Fremont Factory on Friday afternoon. It took a moment to orient myself — no gauges, no speedometer, no airplane cockpit cues. Instead, one continuous smooth line between myself and the road ahead, offset by natural, unfinished wood. The premium model of the Model 3 caught me off guard. After hearing so much hype about this car, I was surprised that my first reaction was a profound sense of delight. It wasn’t bland, nor sterile, nor cheap feeling. Here was something different. Here was an exercise in minimalism. Here was the car Elon Musk promised to make 14 years ago.

The Tesla Model 3 might be the newest and “affordable” vehicle in the electric automaker’s lineup, but as I pushed my foot down on its accelerator, I thought, Yeah, this thing’s still a Tesla. There’s the silent driving, the signature rapid acceleration, and the semi-autonomous Autopilot function built right in. The company has been reminding customers that the Model S, its luxury car rolled out in 2012, will remain the flagship sedan and have the fanciest features. But if you’ve lusted after that expensive Model S, you’ll likely be satisfied with the Model 3 too.

(Wired)

Have I ever driven a more startling small sedan? I haven’t. At speed, it gains a laser-alertness I haven’t encountered before. By happenstance, associate road test editor Erick Ayapana had penciled me into a 2.0-liter Alfa Romeo Giulia to get here, and it feels like a wet sponge by comparison. Technological fascination? Besides what I’ve already described, the Tesla Model 3 is available with Enhanced Autopilot ($5,000) and for another $3,000 what’s called “Full Self-Driving Capability” in the future. A lot of money, sure—but how many $35,000 cars offer that? Or for that matter, standard over-the-air updatability?

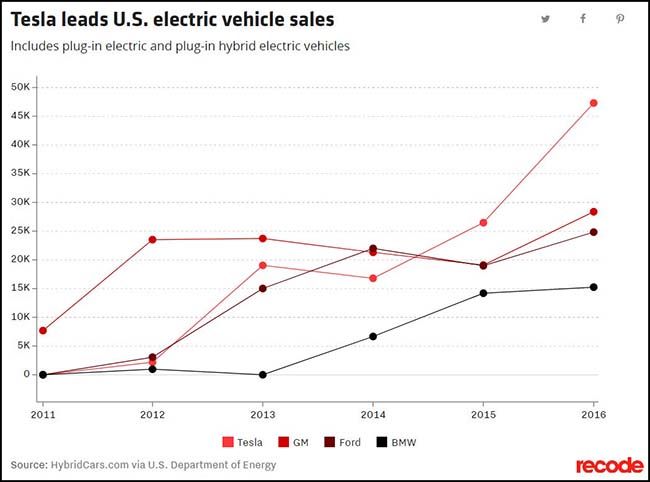

This chart is going to need much more vertical scale…

(Recode)

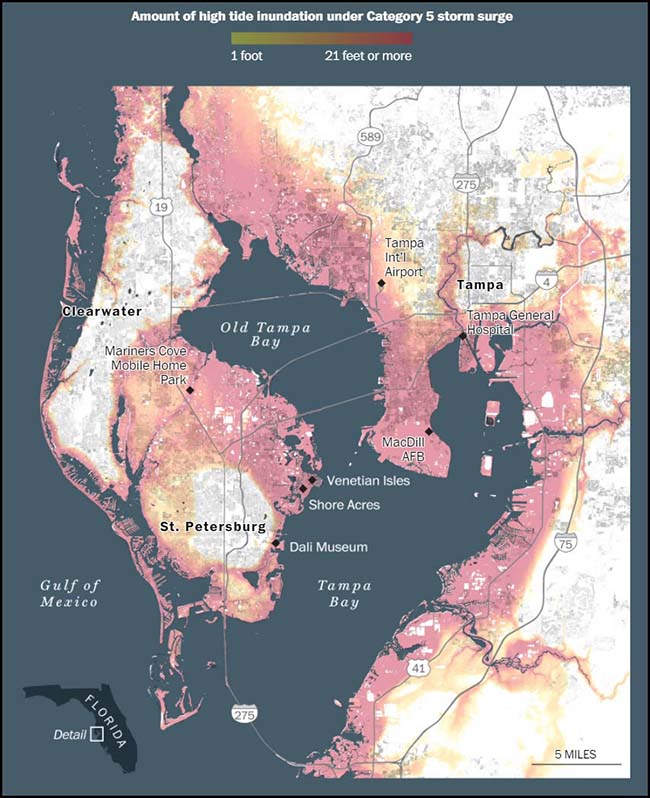

Finally, the scariest non-political article of the week…

The sea in Tampa Bay has risen naturally throughout time, about an inch per decade. But in the early 1990s, scientists say, it accelerated to several inches above normal, so much that recent projections have the bay rising between six inches and more than two feet by the middle of the century and up to nearly seven feet when it ends. On top of that, natural settling is causing land to slowly sink.

Sea-level rise worsens the severity of even small storms, adding to the water that can be pushed ashore. Hard rains now regularly flood neighborhoods in St. Petersburg, Tampa and Clearwater.

By a stroke of gambler’s luck, Tampa Bay hasn’t suffered a direct hit from a hurricane as powerful as a category 3 or higher in nearly a century. Tampa has doubled down on a bet that another won’t strike anytime soon, investing billions of dollars in high-rise condominiums along the waterfront and shipping port upgrades and expanding a hospital on an island in the middle of the bay to make it one of the largest in the state.

Once-sleepy St. Petersburg has gradually followed suit, adorning its downtown coast with high-rise condominiums, new shops and hotels. The city is in the final stages of a plan to build a $45 million pier as a major attraction that would extend out into the bay.

Copyright © 361 Capital