This year's Capital Market Assumptions process has brought updated asset class forecasts and asset allocation recommendations. These are reflected in this month’s tactical views.

by Jim McDonald, Northern Trust

SUMMARY

• Similar outlooks and "stuck" inflation globally lead us to believe central bankers will continue their slow normalization of interest rates

• Global expansion should continue at its current steady pace

• Our biggest risk cases this month are of monetary policy misstep and political leadership openings

OUTLOOK

Last month we wrote about our downgraded outlook for inflation, which has remained remarkably quiescent despite the global economy’s continued advance. In our just-released 2017 Capital Markets Assumptions (CMA) paper, we reiterated our theme of Stuckflation, which posits that technology-enabled supply will continue to easily meet demand muted by high debt and maturing demographics. Federal Reserve Chair Janet Yellen gave a nod toward this outlook last week in her semi-annual testimony to Congress, noting uncertainty among some Fed members about the underlying drivers of today's persistently low inflation. Days later, we received another softer inflation report with the U.S. core consumer price index rising just 1.7% in June. Also noteworthy was Yellen’s comment that the current Fed funds rate would “not have to rise all that much further to get to a neutral policy stance” – indicating that just a few more rate hikes could get the Fed to a neutral position.

This environment of benign inflation is occurring during a period of Entrenched Growth, another of our CMA themes. Despite regular worries about the health of the global economy, we expect the global expansion to continue at a modest but steady pace over the next five years. Earlier in the year, the flattening of the yield curve was being viewed in some quarters as a signal of a growth disappointment in the offing. After several months of uninspiring data releases, however, the global economy is increasingly generating positive surprises versus economist expectations. All major regions are showing expansionary levels of activity, highlighted by improving growth in the United States and continued good growth across Europe.

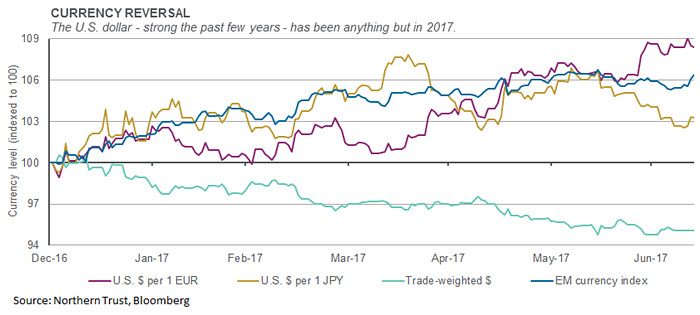

Beyond Stuckflation, the other big story in the markets this year has been the move from dollar strength to dollar weakness, as shown in the exhibit below. Currency levels can be driven by a multitude of factors, and this year’s moves appear to be mostly influenced by changing investor expectations about future investment prospects. The starkest examples are the 5% decline in the value of the U.S. dollar, and related 8% rise in the euro. Certainly, the dollar’s relative high value has played a role. A more likely near-term catalyst is changing investor views around the relative attractiveness of European risk assets compared with those in the United States. As highlighted in our recent report, The Other Half; Non-U.S. Developed Markets Come to the Fore, we think stock markets outside of the United States are looking more attractive after the significant U.S. outperformance during the last eight years.

INTEREST RATES

- Investors took optimistic comments from ECB President Draghi as a cue to push rates higher.

- Amid rising rates, Fed Chair Yellen struck a more dovish tone in Congressional testimony.

- We expect a monetary phase-out and a gradual move higher in interest rates.

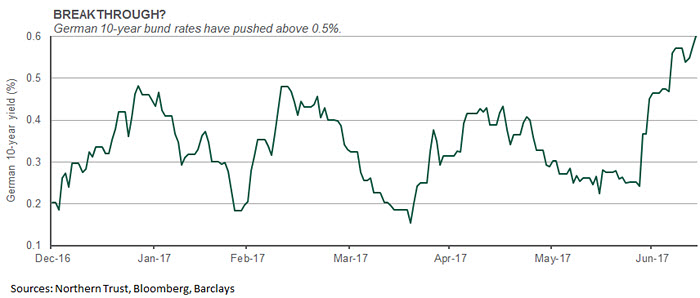

Global central banks appear to be singing from the same song sheet, indicating some increase in rates is in the offing. The biggest surprise has been the Bank of England, which – despite Brexit uncertainties – appears to be edging closer to a rate hike as headline inflation nears 3%. Though likely just removing emergency policy, markets pushed 10-year gilt yields 0.3% higher in the last month (to 1.3%). The European Central Bank (ECB) also appears to be hinting that the era of emergency policy may be ending. With big electoral risks out of the way, the ECB is focusing on the improving fundamentals. ECB President Mario Draghi’s increased optimism pushed German 10-year bund yields up 0.4% (to 0.6%).

This global interest rate backdrop – combined with some less-dovish rhetoric from the Federal Reserve – pushed U.S. interest rates higher over the past month as well. The 10-year U.S. Treasury moved 0.3% higher (to 2.4%), which apparently was enough for Fed Chair Yellen to decide to “walk back” some of the recent Fed speak. The 10-year settled back toward 2.3% in response. U.S. Treasuries have continued to offer investors some of the highest rates in the developed world. This large yield advantage has led foreign investors to pour money into U.S. securities – a trend we do not believe will subside.

CREDIT MARKETS

- High yield returns have been modest, but so has asset class volatility.

- Overall fundamentals remain solid and are reflected in tighter credit spreads.

- We are comfortable with our overweight to high yield as we look for other opportunities.

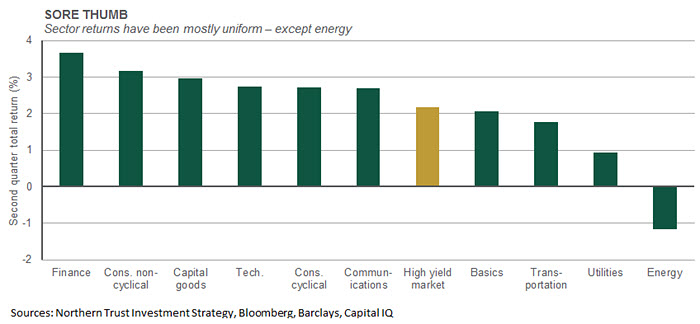

Year-to-date high yield returns have trailed other risk asset classes – gaining just over 5% as compared to 11% for U.S. equities, but this is still a solid return for this relatively low-risk asset class. So far this year, high yield spreads have moved steadily downward in a fairly tight range. Further, volatility among sectors has also been tight of late. In the second quarter, eight of ten sectors (83% of the index) were near or above the market average return of 2.2%. The only real sources of volatility have been in the energy-related sectors. The energy sector delivered a materially negative return, driven by renewed oil price weakness (though oil prices have since stabilized). Utilities underperformed to a lesser extent given less-direct exposure to the energy complex.

The distribution of returns demonstrates the broad stability in the high yield market with only selected areas of volatility driven by acute fundamental weakness. It also suggests an ongoing shift back to fundamentals and security selection after several years in which supportive monetary policy primarily drove returns. At the broad asset class level, we do believe high yield is fully valued; credit spreads currently sit at ~3.7% (vs. pre-crisis lows of ~2.3%) and yields sit at ~5.7% (near all-time lows). However, given solid fundamentals and stability at the index level, we are comfortable holding on to our high yield overweight – and still prefer high yield over investment grade credit.

EQUITIES

- Year-to-date U.S. equity returns are in an unfamiliar place, trailing many other regions.

- European equities look attractive, benefiting from solid growth, low inflation and political momentum.

- We remain overweight all major equity regions, emphasizing developed markets outside the United States.

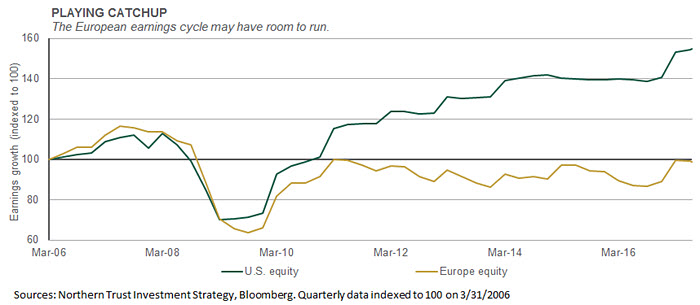

European equity markets have attracted attention given the region’s firming economies, strong expected earnings growth, reduced political risk and more-attractive valuations. With its economy, earnings and corporate margins tracking well behind the growth seen post-crisis in the United States, we expect corporate earnings growth in Europe to have a longer duration. As seen in the chart, while U.S. earnings are significantly higher than the pre-crisis period, Europe has been treading water for the past few years. Coordinated global growth, central banks biased toward gradual removal of accommodation, and improved political conditions in Europe have improved business confidence. Announced merger and acquisition activity has recently shown signs of life in Europe after several years of lackluster activity.

We remain attracted to equities globally, and see particular durability in areas like Europe. As we don’t see great risk in the global growth outlook, the greater risk to equity performance lies in the interest rate outlook. Equity valuations have been clearly supported by a lack of competition from prospective fixed income returns, but we don’t see that as likely to change. Over the next year, we only see the U.S. 10-year rising from 2.3% currently to a range of 2.5% to 3.0%.

REAL ASSETS

- Global real estate faces macro (higher interest rate) and fundamental (lower demand) challenges.

- “New economy” effects are not surprising the industry; new supply is down, especially retail.

- We maintain a strategic position in global real estate for diversification and income purposes.

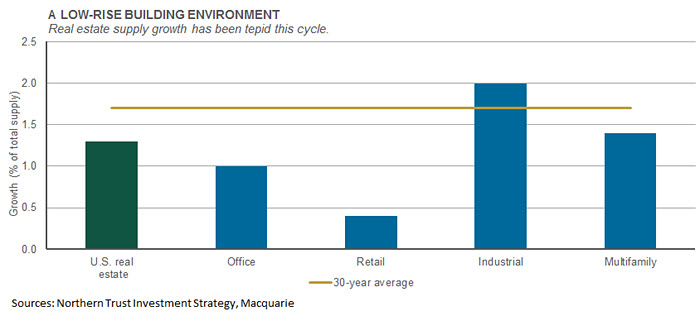

Global real estate faces challenges in the years ahead. Higher interest rates will make financing properties more expensive and the yield (rent) provided by those properties less attractive. Meanwhile, the technological revolution has reduced demand in many real estate sectors. Online shopping makes malls and other retail spaces less essential. The ability to work remotely and “hoteling” has allowed corporations to reduce their office footprint. However, things may not be as bad as they seem. While interest rates are likely to move higher, we expect this to occur very gradually. In the meantime, the 4.0% dividend yield on the FTSE EPRA/ NAREIT Global Real Estate Index still compares very favorably to the 2.3% yield on the U.S. 10-year Treasury. Fundamentally, the industry is well aware of the effect of technology on demand. In the United States, new real estate supply equals 1.3% vs. the 30-year average of 1.7%; retail supply equals 0.4%. Areas with still-robust demand (industrial, multi-family) are appropriately growing faster. Also, do not underestimate the ability for properties to be repurposed; no-longer-needed malls generally occupy prime real estate.

We slightly reduced our tactical allocation to both global real estate and listed infrastructure this month to maintain allocations at strategic levels in the wake of the reduction made to both asset classes in our annual strategic asset allocation update. We remain strategically allocated across all real assets (including natural resources); all retain key roles in a multi-asset class portfolio.

CONCLUSION

The annual release of our Capital Markets Assumptions brings updated asset class forecasts and asset allocation recommendations. Our forecasts this year included higher return expectations in several asset classes, most notably in cash and equities. With the Fed having finally managed to raise the Fed funds rate several times over the last year, our five-year cash forecast has risen from 0.5% to 1.7% this year. Our expected returns for developed market and emerging market equities have increased by 1% to 6.4% and 8.4%, respectively, as we have increased our earnings expectations. We also expect only a modest valuation contraction in developed markets and some valuation expansion in the emerging markets. We think valuations will be supported by a continued low interest rate environment, along with an increasing proportion of more valuable companies in public markets (per our Valuation Superstructure theme).

In this month’s investment strategy meetings, we reaffirmed our positive position of risk taking, and made one small recommendation change to incorporate our updated strategic asset allocation. To maintain a neutral stance in real assets, we have shifted 2% out of global real estate and infrastructure (1% each) – splitting the proceeds between developed ex-U.S. and emerging market equities. This recommendation helps maintain the interest rate sensitivity of our tactical positioning, while also furthering our efforts to increase exposure to equity markets outside the United States. While markets have delivered strong returns in just the first six months of the year, we are still more constructive on stocks than bonds over the next year. We don’t expect a material upside to the growth outlook, allowing central bankers to continue their slow process of “normalizing” interest rates. Our Waiting for Monetary Godot theme, however, highlights that the “new normal” for interest rates will be much lower than historical levels.

We are always on the lookout for what could upend our tactical positioning, and our updated risk cases this month include Monetary Policy Misstep and Political Leadership Openings. The risk with monetary policy involves policy normalization (rate increases, balance sheet adjustments) more aggressive than the growth or inflation outlook warrant. We believe this risk is manageable, but risk assets rest on a foundation supported by low interest rates. Our Political Leadership Openings risk highlights both the upside risk (a more cohesive European Union driven by U.S. policy) and downside potential (opportunism by global bad actors). Economic data has turned constructive in recent months and central bankers seem unlikely to turn hawkish and deflate risk appetites. Meanwhile, we continue to think that investor risk appetite isn't approaching the euphoric levels typically seen at market cycle tops.

-Jim McDonald, Chief Investment Strategist

INVESTMENT PROCESS

Northern Trust’s asset allocation process develops both long-term (strategic) and shorter-term (tactical) recommendations. The strategic returns are developed using five-year risk, return and correlation projections to generate the highest expected return for a given level of risk. The objective of the tactical recommendations is to highlight investment opportunities during the next 12 months where our Investment Policy Committee sees either increased opportunity or risk.

Our asset allocation recommendations are developed through our Tactical Asset Allocation, Capital Markets Assumptions and Investment Policy Committees. Committee membership includes Northern Trust’s Chief Investment Officer, Chief Investment Strategist and senior representatives from our fixed income, equities and alternative asset class areas.

Indexes used: Bloomberg Barclays (BBC) 1-3 Month UST (Cash); BBC Municipal (Muni); BBC Aggregate (Inv. Grade); BBC TIPS (TIPS); BBC High Yield 2% Capped (High Yield); JP Morgan GBI-EM Global Diversified (Em. Markets Fixed Income); MSCI U.S. Equities IMI (U.S. Equities); MSCI World ex-U.S. IMI (Dev. ex-U.S. Equities); MSCI Emerging Market Equities (Em. Markets Equities); Morningstar Upstream Natural Resources (Natural Res.); FTSE EPRA/NAREIT Global (Global Real Estate); S&P Global Infrastructure (Global Listed Infra.)

If you have any questions about Northern Trust’s investment process, please contact your relationship manager.

© 2017 Northern Trust Corporation

The information contained herein is intended for use with current or prospective clients of Northern Trust Investments, Inc. The information is not intended for distribution or use by any person in any jurisdiction where such distribution would be contrary to local law or regulation. This information is obtained from sources believed to be reliable, and its accuracy and completeness are not guaranteed. Information does not constitute a recommendation of any investment strategy, is not intended as investment advice and does not take into account all the circumstances of each investor. Forward-looking statements and assumptions are Northern Trust’s current estimates or expectations of future events or future results based upon proprietary research and should not be construed as an estimate or promise of results that a portfolio may achieve. Actual results could differ materially from the results indicated by this information.

Northern Trust Asset Management is composed of Northern Trust Investments, Inc. Northern Trust Global Investments Limited, Northern Trust Global Investments Japan, K.K, NT Global Advisors Inc., 50 South Capital Advisors, LLC and investment personnel of The Northern Trust Company of Hong Kong Limited and The Northern Trust Company.