by Johann Schneider, Russell Investments

Last week, we worked to dispel the myth that active management can’t add value after taking fees into account.

Today, we tackle another myth: Active management is broken; long-term performance proves it.

The basis for the myth

The Wall Street Journal recently published an article stating that “Indexes Beat Stock Pickers Even Over 15 Years.” The article concludes that “Even over a full market cycle, which includes peaks and troughs, we still see the majority of active managers performing unfavorably against their benchmarks.”2

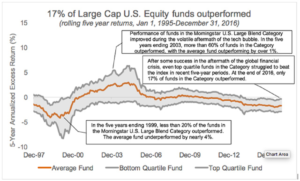

This sentiment has reverberated throughout the industry for a while. After all, only 17% of the mutual funds included in the Morningstar U.S. Large Blend Category outperformed the Russell 1000® Index for the five years ending 2016.3

This has led many investors to interpret the struggles of large cap U.S. equity funds as a failure of active management in general. But let’s pause there.

As a multi-asset provider that believes both active AND passive management can play a role, we are confident that skilled active managers can add value in every asset class, and we believe that active management success moves in cycles—which are at times difficult to predict.

Before jumping to conclusions, we encourage a deeper analysis of the bigger picture.

A more balanced picture

- Other substantial parts of diversified portfolios have witnessed active management success

During the same five-year period ending December 2016 that saw Large cap U.S. equity mutual funds struggle:

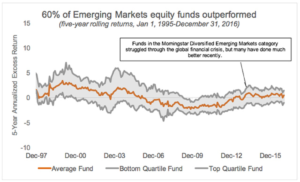

- 60% of emerging markets equity funds(Morningstar Diversified Emerging Markets Category) beat the MSCI Emerging Markets Index;

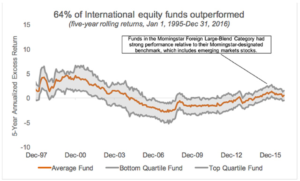

- 64% of international equity mutual funds(Morningstar Foreign Large-Blend Category) beat the MSCI All-Country World ex-U.S. Index;

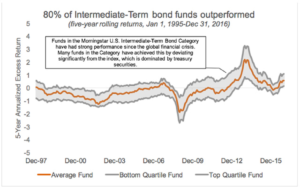

- 80% of intermediate-term bond mutual funds(Morningstar U.S. Intermediate-Term Bond Category) beat the Bloomberg Barclays U.S. Aggregate Bond Index.

So clearly, the large cap U.S. equity experience has not been globally contagious.

- You’re not average, so look at the range of active returns to judge success.

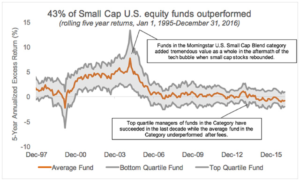

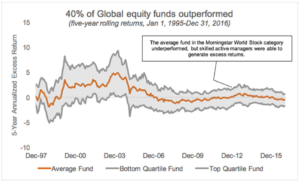

In our last blog in the series, we discussed that the average active manager is expected to underperform the market, net of fees. That’s why they are called average. While looking at the average active manager can be a good signal, an even better way to judge success is to look at the range of returns. For instance, based on Morningstar categories of actively-managed Large cap U.S. equity, Small cap U.S. equity, Emerging markets equity, International equity, Global equity and Intermediate-term bond mutual funds, at least 40% of funds outperformed in every category except Large cap U.S. equity, indicating there was a significant opportunity for skilled managers to outperform in the five-year period ending 2016. (see charts at the end of this blog post) - Active fund returns move in cycles

As the chart above illustrates, even within Large cap U.S. equity, there have been periods where active managers have had success beating the index, based on Morningstar categories of actively-managed mutual funds. For instance, in the aftermath of the tech bubble. In the five years ending 2003, more than 60% of funds in the Morningstar U.S. Large Blend Category outperformed, with the average fund outperforming by over 1%.There’s no reason to believe the same can’t happen again. In fact, we believe factors may be in place to help drive aggregate active manager performance again. We will address the cyclicality of active management in a future blog post in this series. - When analyzing active management performance, consider using:

- Five-year rolling time periods to temper end-point dependency and aligns with the length of a typical market cycle historically. For instance, the charts below use rolling five-year performance periods. Each data-point represents a five-year period. The last data-point on each chart represents the period from January 1, 2012–December 31, 2016.

- Morningstar peer categories because they represent broad, rules-based universes of various asset classes with assigned benchmarks.

- Net-of-fee excess returns. All mutual fund performance is reported net-of-fees relative to the Morningstar category benchmark. It is important to illustrate active fund performance after fees.

- Interquartile range of returns(e.g., top, median, bottom quartiles) to achieve a clearer picture of whether the majority of funds have done well and express the magnitude of success/failure relative to a benchmark for top funds and bottom funds. This range of returns can also be more helpful than focusing on simply the average return, since an investor is unlikely to experience the precise average return.

These are the best practices we used in constructing the charts at the end of this post.

The bottom line

Most large cap U.S. equity mutual funds have faced performance challenges relative to the benchmark over the last five years ending 2016. This has caused many investors to question the value of active management. However, we caution against a wholesale indictment of active management based solely on a specific (albeit meaningful) asset class’ performance. We believe active management is cyclical and that truly skilled active managers can outperform. Impressive performance in emerging market equity, international developed and intermediate-term bond mutual funds over the past five years confirm this.

The following exhibits show historical active mutual fund returns in commonly used asset classes:

1 Source: Morningstar. Passive products include long-term and sector mutual funds and ETFs. Excludes leveraged long/short products, money market funds and fund of funds. Active management includes all mutual funds, except money market funds and fund of funds.

2 Source: https://www.wsj.com/articles/indexes-beat-stock-pickers-even-over-15-years-1492039859

3 Source: Morningstar.

*****