by Richard Turnill, Chief Global Investment Strategist, Blackrock

Richard explains why we still like the momentum style factor even after a recent break in its rally.

The momentum style factor—stocks that are trending higher in prices—has outperformed the broader market so far this year. We believe that sustained above-trend economic growth and solid earnings prospects could help extend momentum’s gains, but the road ahead could be bumpy.

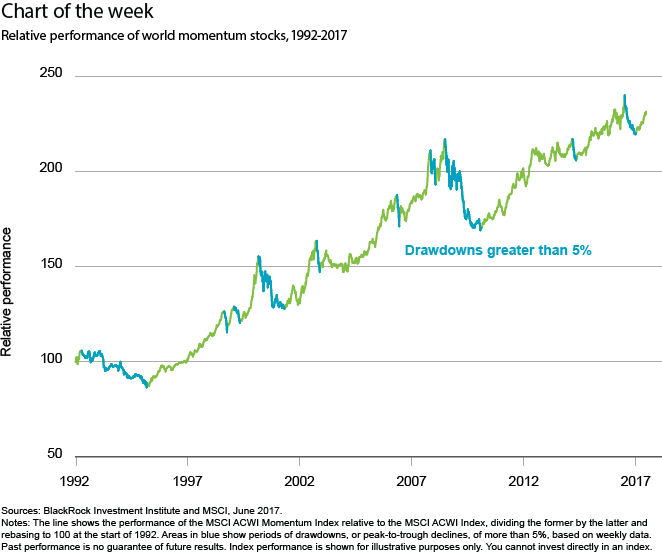

Momentum has historically outrun the broader market, but with periodic sharp drops. The biggest dips in the performance of the MSCI ACWI Momentum Index relative to the MSCI ACWI Index have mostly coincided with recessions and financial crises, as the chart shows. Our research shows that momentum tends to perform the best during sustained economic expansions. We are in such a phase, and we see this cycle having ample room to run.

Not just about tech

The technology sector has become the main driver behind momentum recently. The sector has the highest earnings growth forecast in 2017 outside of energy and materials, and technology is increasingly disrupting traditional business models.

A sharp drop in tech stocks caused a break in the momentum rally in mid-June. But we believe such episodes shouldn’t spook investors. Momentum drawdowns typically last two months or less, barring major economic or financial shocks, our analysis of market data since 1991 suggests. The momentum factor today includes significant exposure to financials, which can help cushion the downside during any tech selloff. In addition, analysis by BlackRock’s Scientific Active Equity team points to an unusually broad set of macro and fundamental drivers behind the momentum factor. And we don’t see the factor as particularly crowded or expensive. This points to resilience behind the trend.

We see the sustained economic expansion keeping us in a low-volatility regime longer than many expect. This bodes well for momentum trades. But a sudden shift in stock leadership as a result of a global growth slowdown, weaker-than-anticipated profits or a spike in bond yields could threaten the rally. Bottom line: We like momentum in today’s economic environment, even if its performance could be prone to short-lived reversals.

Read more market insights in my Weekly Commentary.

Richard Turnill is BlackRock’s global chief investment strategist. He is a regular contributor to The Blog.

*****

Investing involves risks, including possible loss of principal.

This material is not intended to be relied upon as a forecast, research or investment advice, and is not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy. The opinions expressed are as of June 2017 and may change as subsequent conditions vary. The information and opinions contained in this post are derived from proprietary and nonproprietary sources deemed by BlackRock to be reliable, are not necessarily all-inclusive and are not guaranteed as to accuracy. As such, no warranty of accuracy or reliability is given and no responsibility arising in any other way for errors and omissions (including responsibility to any person by reason of negligence) is accepted by BlackRock, its officers, employees or agents. This post may contain “forward-looking” information that is not purely historical in nature. Such information may include, among other things, projections and forecasts. There is no guarantee that any forecasts made will come to pass. Reliance upon information in this post is at the sole discretion of the reader.

©2017 BlackRock, Inc. All rights reserved. BLACKROCK is a registered trademark of BlackRock, Inc., or its subsidiaries in the United States or elsewhere. All other marks are the property of their respective owners.

Copyright © Blackrock