What does MSCI’s China A-Shares decision mean for investors?

by Mike Shiao, Chief Investment Officer, Asia ex Japan, Invesco Canada

After four years of discussions, on June 20, 2017, MSCI announced a ”yes” decision on including China A-shares in the MSCI Emerging Markets Index, which tracks $1.6 trillion1 worth of assets around the world, and related indexes.2 The decision is seminal because it provides previously unavailable A-share exposure in emerging markets (EMs) and global indexes.

The initial weight of China A-shares in the MSCI Emerging Markets Index upon the August 2018 inclusion will be 0.73% (2.49 % in the MSCI China Index), comprising 222 onshore-listed stocks. The number of stocks is higher than the originally proposed 169 stocks in March’s consultation paper.

This change is not a surprise to us. My team has expected that China A-share inclusion could realistically happen this year, as both China and MSCI have been very supportive of the change. We welcome this decision as it marks another milestone in recognition of China’s gradual market liberalization efforts, further opening its domestic equity market to global investors. What pleasantly surprised us is the higher number of A-shares stocks to be added and the increased initial inclusion weight in the MSCI Emerging Markets Index (from 0.48% to 0.73%) and MSCI China Index (from 1.70% to 2.49%).

In our view, the inclusion is a wake-up call for global investors to rethink their investment in China. It brings better representation of the entire Chinese economy and diversified exposure to the existing offshore Chinese equity universe.

What made it a “yes” for MSCI this time?

In our view, MSCI’s decision to include A-shares was the result of:

- MSCI’s assessment framework: The most significant change in the MSCI proposal this year was its consideration of the “Stock Connect” programs, rather than the Qualified Foreign Institutional Investor (QFII)/RMB Qualified Foreign Institutional Investor (RQFII) programs, as the Stock Connect programs offer increased foreign accessibility to Chinese markets, no overall aggregate quota and no capital mobility restrictions.3 This change in assessment framework is practical as the inclusion decision no longer rests on the unresolved issue of the 20% monthly repatriation limit under QFII/RQFII programs, which are becoming obsolete. International institutional investors generally welcomed the expansion of the Stock Connect program to include Shenzhen-listed stocks and viewed the program as a more flexible access framework.

- Reduced voluntary trading suspensions: Since the market turmoil in July 2015, Chinese regulators have tightened information disclosure requirements and reduced the length of suspensions. This resulted in a significant decrease in the number of suspended China A-shares – an encouraging development which international investors favour.

- Resolution on the pre-approval requirement issue: MSCI was able to reach a resolution with Chinese stock exchanges on loosening the pre-approval requirement for financial products linked to China A-shares. This addressed the last hurdle for inclusion.

Wake-up call for global investors

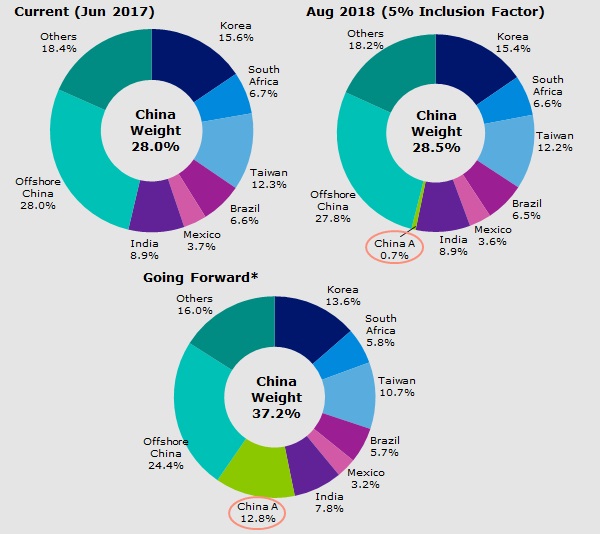

MSCI’s decision on A-share inclusion recognizes China’s increasing importance and validates China A-shares as “recognized” markets, offering adequate market access and investability. This is a structural change to the MSCI Emerging Markets Index and will be significant for years to come. Upon full inclusion, it is estimated that China (combined onshore and offshore) could comprise up to 37.2% of this index.4

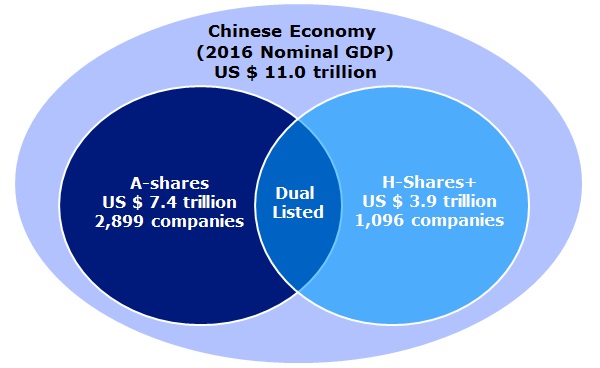

In our view, the inclusion is a wake-up call for global investors. We believe it is important for them to rethink their strategic allocation to China and realize that offshore Chinese equities alone do not represent the entire Chinese economy. In fact, as shown in the chart below, there is greater breadth and depth to the domestic onshore market, given that 2,899 companies are listed onshore, compared to 1,096 companies listed offshore (with 95 that are dual listed).

Offshore Chinese equities alone do not represent the entire Chinese economy

Source: Goldman Sachs; data as of April 28, 2017; “H-shares+” includes H-shares, red chips, Hong Kong-listed China offshore and U.S.-listed China offshore. There are 95 A-H dual-listed companies with H-share market cap of US$616 billion and A-share market cap of US$1,708 billion as of April 28, 2017.

Closer to China’s real economy

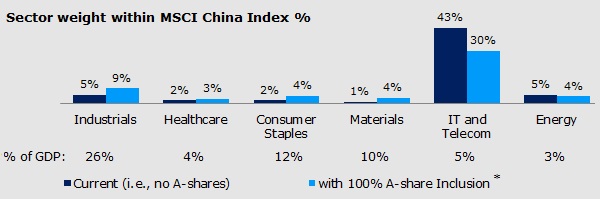

We believe that upon full inclusion of A-shares, the MSCI China Index will offer investors a better representation of the underlying economy. A-shares also offer complementary exposure to existing offshore Chinese equities. Currently, the MSCI China Index provides good exposure in large overseas listings of Chinese banks and internet companies. The 222 A-share stocks are, on the other hand, closer to China’s real economy. The inclusion will bring the weights for industrials, health care, consumer staples, materials, information technology and telecommunications, as well as energy, closer to their respective GDP representation.

At the same time, A-shares also contain many unique companies that are not abundant in the offshore space such as household furnishings, chemicals, renewable power producers, biotechnology and pharmaceutical companies.

MSCI China Index potential sector weight changes (before and after full inclusion)

Sources (sector weight %): MSCI, Citi Strategy Research estimates, as of June 21, 2017 Source (% of GDP): CEIC, NBS, FactSet, MSCI, Citi Research estimates, as of May 2017. Note: There is no official sector breakdown by GDP in accordance with the GICS sector definition.

*For illustrative purposes only. Upon full-inclusion of China A-shares in MSCI China Index.

Timing for full inclusion — a gradual process

MSCI’s recent announcement stated that A-share inclusion will use a two-step process, during May and August 2018 index rebalancing respectively, to account for the existing daily trading limits on Stock Connect. Although MSCI confirms A-share inclusion, they have left the full inclusion timeline open-ended. While it is difficult to predict the exact timeline of the full inclusion, we can use MSCI’s experience with South Korea and Taiwan in its Emerging Markets Index as a reference.

Both South Korea and Taiwan equity markets were included in the MSCI Emerging Markets Index gradually via multiple phases. It took six years (1992 to 1998) in the case of South Korea and five years (1996 to 2001) for Taiwan to be fully included. The pace of inclusions takes into account the limitations that could arise in the opening of equity markets to foreign investors, such as capital controls. Over the years, we have noticed the inclusion process corresponded with the regulatory effort to relax capital controls in both markets. For instance, MSCI decided to increase Taiwan’s weight in the index in 2000 (from 65% to 80% of its total market cap) when the investment ceiling for Taiwan’s Qualified Foreign Institutional Investors was increased.

So based on South Korea and Taiwan, we believe it would be unlikely for the full inclusion of China A-shares in the index to take place abruptly; instead, it would probably occur in gradual steps. But investors should be prepared for full inclusion that may not be far. Full inclusion is estimated to have a 12.8% weight in China A-shares, and a 37.2% weight in the MSCI Emerging Markets Index together with offshore China.

Country weights in MSCI Emerging Markets Index

Source: MSCI, Factset, Citi Research, as at June 21, 2017.

Note: Based on free float market-cap of 222 A-shares stocks to be included, and a 30% upper limit of foreign ownership

* For illustrative purposes only. Upon full-inclusion of China A-shares in MSCI Emerging Markets Index.

Conclusion

With the ”yes” decision from MSCI on the inclusion of A-shares, global investors should realize that going forward, the index will provide a better representation of the Chinese economy and diversified exposure to the current offshore Chinese equity universe. Although the full inclusion will not be immediate, we believe it will not be far, based on previous MSCI experience with Taiwan and South Korea.

We believe market liberalization in China is a structural trend, as China is further opening its equity markets to global investors. The representation of Chinese equities will only get bigger in regional and global indexes. In our view, global investors should embrace this structural shift sooner than later to participate in both onshore and offshore Chinese equities.

This post was originally published at Invesco Canada Blog

Copyright © Invesco Canada Blog