by Michael Lebowitz, 720 Global

“Cause when life looks like Easy Street, there is danger at your door” – Grateful Dead

On numerous occasions, we have posited that equity investors appear to be blinded by consistently rising stock prices and the allure of minimal risks as portrayed by record low volatility. It is quite possible these investors are falling for what behavioral scientists diagnose as “recency bias”. This condition, in which one believes that the future will be similar to the past, distorts rational perspective. If an investor believes that tomorrow will be like yesterday, a prolonged market rally actually leads to a perception of lower risk which is then reinforced over time. In reality, risk rises with rapidly rising prices and valuations. When investors’ judgement becomes clouded by recent events, instead of becoming more cautious, they actually become more aggressive in their risk-taking.

In our premier issue of The Unseen, 720Global’s premium subscription service, we quantified how much riskier financial assets are than most investors suspect. The message in, The Fat Tail Wagging the Dog, is that extreme historical price changes occur with more frequency than a normal distribution predicts. Reliance upon faulty theories laced with flawed assumptions can lead investors to take substantial risks despite paltry expected returns.

In this article, we further expand on those concepts and present a simple framework to help readers understand the spectrum of risks that equity holders are currently taking.

Risk Spectrum

When one assesses risk and return, the most important question to ask is “Do my expectations for a return on this investment properly compensate me for the risk of loss?” For many of the best investors, the main concern is not the potential return but the probability and size of a loss. A key factor to consider when calculating risk and return is the historical reference period. For example, if one is to estimate the risk of severe thunderstorms occurring in July in New York City, they are best served looking at many years of summer meteorological data for New York City as their reference period. Data from the last few weeks or months would provide a vastly different estimate. Likewise, if one is looking at the past few months of market activity to gauge the potential draw down risk of the stock market, they would end up with a different result than had they used data which included 2008 and 2009.

No one has a crystal ball that allows them to see into the future. As such the best tools we have are those which allow for common sense and analytical rigor applied to historical data. Due to the wide range of potential outcomes, studying numerous historical periods is advisable to gain an appreciation for the spectrum of risk to which an investor may be exposed. This approach does not assume the past will conform to a specific period such as the last month, the past few years or even the past few decades. It does, however, reveal durable patterns of risk and reward based upon valuations, economic conditions and geopolitical dynamics. Armed with an appreciation for how risk evolves, investors can then give appropriate consideration to the probability of potential loss.

Measuring Risk

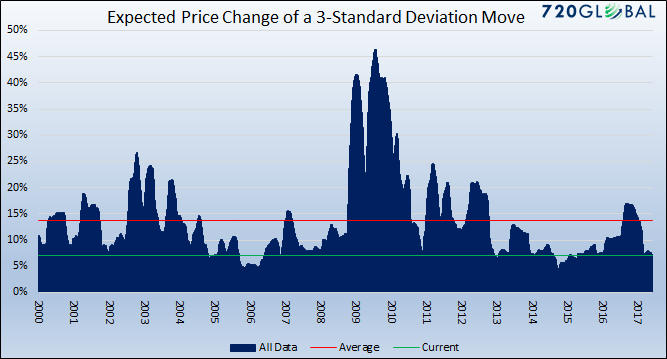

The graph below plots the percentage price change of the S&P 500 that one would expect at each respective date given a 3-standard deviation price change. The data is computed based on price changes from the preceding six months. Essentially, the graph depicts expected outcomes for those solely relying on recency biased risk management approaches. (On a side note, a 3-standard deviation price change should have occurred 14 times over the 17 year period based on a normal distribution. In reality, it happened 249 times!)

Data Courtesy: Bloomberg

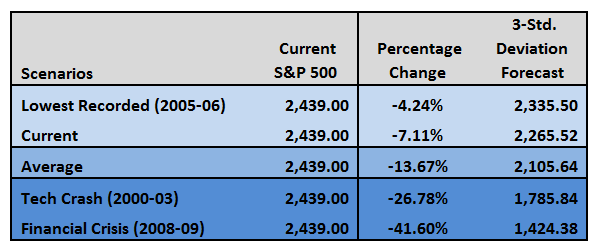

Currently, if one is basing their risk forecast on the last six months of price data, they should anticipate that a “rare” 3-standard deviation change will result in a price change of 7.11% (green line). Accordingly, the table below applies a range of readings from the graph above to create an array of potential draw downs. The historical data is applied to the current S&P 500 price to provide current context.

We caution you, major draw downs are frequently much greater than a 3-standard deviation event.

Summary

As mentioned earlier, the best investment managers obsess not about what they hope to make on an investment but what they fear they could lose. At this juncture, current market dynamics offer a lot of reasons one should be concerned. For those who rest assured that the future will be representative of the immediate past, you likely already stopped reading this article. For those who recognize that regime shifts to higher volatility tend to follow periods when risk is under-appreciated, valuations are high and economic growth feeble, this framework should be a beneficial guide to better risk management. Although the timing is uncertain, we are confident that it will pay handsome dividends at some point in the future.

*****

Michael Lebowitz, CFA

Investment Analyst and Portfolio Manager for Clarity Financial, LLC. specializing in macroeconomic research, valuations, asset allocation, and risk management. RIA Contributing Editor and Research Director. Co-founder of 720 Global Research.

Follow Michael on Twitter or go to 720global.com for more research and analysis.

Copyright © 720 Global