by Jason Bloom, Global Market Strategist, PowerShares by Invesco

As I travel around the country to meet with institutional clients, I often hear this question: “What is everyone selling? Because that’s something I’m really interested in buying.” These are clients who have the confidence and experience to contradict the herd mentality that causes many investors to chase market returns (which often results in buying near market tops while selling near market bottoms).

That question is my cue to start talking about commodities.

In a recent blog, I encouraged investors to stay focused on commodity fundamentals, which have improved dramatically over the past few months. But investors seem to have been distracted by the short-term price volatility in energy markets this spring.

- Figure 1 shows a new wave of selling in commodity exchange-traded funds (ETFs) since March, while at the same time the oil price has stayed within its recent range.

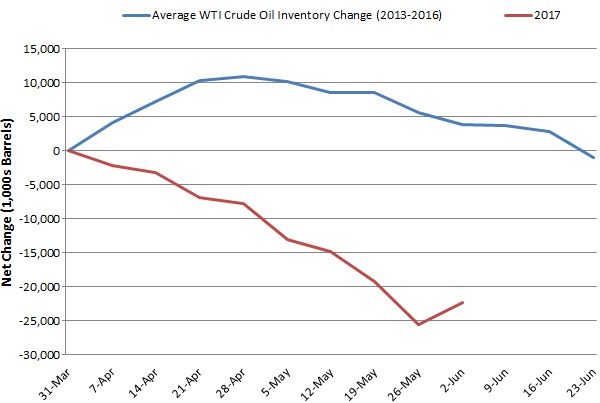

- Figure 2 shows that, as we expected, US crude oil inventories have dropped since March 2017 due to cuts by the Organization of the Petroleum Exporting Countries (OPEC). There was a marked delay between OPEC’s November agreement to cut production and a visible drop in US inventories. However, by the end of May 2017, the net change in inventories was 26 million barrels less crude than the prior four years’ average. Given the dynamics of supply and demand, I believe this type of cut in inventories will help support crude oil prices, which may bode well for commodity investors. More on that below.

Investors have been leaving commodities …

Sources: Bloomberg L.P., Morningstar, as of June 6, 2017. The blue line measures cumulative flows into Morningstar’s Commodities Broad Basket ETF category (including only ETFs that were incepted before Dec. 31, 2015, and excluding exchange-traded notes and other exchange-traded debt instruments).

… at the same time that energy fundamentals have been improving

Source: Bloomberg L.P., as of June 7, 2017. Inventories for 2013–2016 are measured from March 31 through June 23 for each of those years. Inventories for 2017 are measured from March 31 through June 2.

Supply trends could support oil prices

Interestingly, but not surprisingly, OPEC’s most recent cuts to US-bound oil shipments resulted in a shrinking spread between West Texas Intermediate (WTI) crude oil, which is the US oil benchmark, and the higher-priced European benchmark Brent crude oil. That’s because energy traders assumed that oil not sent to the US would probably end up in Europe in the near term, raising prices in the US while pressuring prices lower abroad. Indeed, this spread has moved significantly over the past week, as WTI went from trading $2.96 per barrel less than Brent on May 18 to only $2 less on June 7.1

Over the coming weeks and months, we will be keeping a close eye on the trend in the inventory numbers depicted in the chart above. While there will be blips in the volatile weekly numbers, I do expect the trend in lower US crude oil inventories to continue throughout 2017, pushing up 2017 and 2018 futures prices for WTI. This would potentially benefit commodity funds that carry significant exposure to energy commodities.

*******

Learn more about PowerShares DB Commodity Index Tracking Fund (DBC) and PowerShares Optimum Yield Diversified Commodity Strategy No K-1 Portfolio (PDBC).

1 Source: Bloomberg L.P., as of June 7, 2017

********

Important information

Blog header image: photomaster/Shutterstock.com

PowerShares DB Commodity Index Tracking Fund risks

Commodities and futures generally are volatile and are not suitable for all investors.

The value of the shares of the fund relate directly to the value of the futures contracts and other assets held by the fund, and any fluctuation in the value of these assets could adversely affect an investment in the fund’s shares.

Please review the prospectus for break-even figures for the fund.

The fund is speculative and involves a high degree of risk. An investor may lose all or substantially all of an investment in the fund.

The fund is not a mutual fund or any other type of Investment Company within the meaning of the Investment Company Act of 1940, as amended, and is not subject to regulation thereunder.

Shares in the fund are not FDIC insured, may lose value and have no bank guarantee.

This material must be accompanied or preceded by a prospectus. Please read the prospectus carefully before investing.

PowerShares Optimum Yield Diversified Commodity Strategy No K-1 Portfolio risks

There are risks involved with investing in ETFs, including possible loss of money. Actively managed ETFs do not necessarily seek to replicate the performance of a specified index. Actively managed ETFs are subject to risks similar to stocks, including those related to short selling and margin maintenance. Ordinary brokerage commissions apply. The fund’s return may not match the return of the index. The fund is subject to certain other risks. Please see the current prospectus for more information regarding the risk associated with an investment in the fund.

Risks of futures contracts include: an imperfect correlation between the value of the futures contract and the underlying commodity; possible lack of a liquid secondary market; inability to close a futures contract when desired; losses due to unanticipated market movements; obligation for the fund to make daily cash payments to maintain its required margin; failure to close a position may result in the fund receiving an illiquid commodity; and unfavorable execution prices.

In pursuing its investment strategy, particularly when “rolling” futures contracts, the fund may engage in frequent trading of its portfolio securities, resulting in a high portfolio turnover rate.

Commodity-linked notes may involve substantial risks, including risk of loss of a significant portion of principal and risks resulting from lack of a secondary trading market, temporary price distortions and counterparty risk.

Swaps are subject to leveraging, liquidity and counterparty risks, and therefore may be difficult to value. Adverse changes in the value or level of the swap can result in gains or losses that are substantially greater than invested, with the potential for unlimited loss.

The fund may hold illiquid securities that it may be unable to sell at the preferred time or price and could lose its entire investment in such securities.

Debt securities are affected by changing interest rates and changes in their effective maturities and credit quality.

Interest rate risk refers to the risk that bond prices generally fall as interest rates rise and vice versa.

An issuer may be unable to meet interest and/or principal payments, thereby causing its instruments to decrease in value and lowering the issuer’s credit rating.

The fund currently intends to effect creations and redemptions principally for cash, rather than principally in-kind because of the nature of the fund’s investments. As such, investments in the fund may be less tax efficient than investments in ETFs that create and redeem in-kind.

The fund is nondiversified and may experience greater volatility than a more diversified investment.

The fund is subject to management risk because it is an actively managed portfolio. The investment techniques and risk analysis used by the portfolio managers may not produce the desired results.

Investments linked to prices of commodities may be considered speculative. Significant exposure to commodities may subject the fund to greater volatility than traditional investments. The value of such instruments may be volatile and fluctuate widely based on a variety of factors. Price fluctuations may be quick and significant and may not correlate to price movements in other asset classes.

Source: ©2017 Morningstar Inc. All rights reserved. The information contained herein is proprietary to Morningstar and / or its content providers. It may not be copied or distributed and isn’t warranted to be accurate, complete or timely. Neither Morningstar nor its content providers are responsible for any damages or losses arising from any use of this information.

Copyright © Invesco