by Lance Roberts, Clarity Financial

I wanted to pick up on a discussion I started in this past weekend’s missive, with respect to both Friday’s rout in technology stocks as well as Monday’s rather nasty open. While the issue seemed to be a simple short-term rotation in the markets from large capitalization Technology and Discretionary stocks into the lagging small and mid-capitalization stocks, the sharpness of the “Tech Break” on Friday revealed an issue worth re-addressing. To wit:

“Both Discretionary and Technology plunged on Friday as a headline from Goldman Sachs questioning ‘tech valuations’ sent algo’s running wild. The plunge was extremely sharp but fortunately regained composure and shares rebounded. A ‘flash crash.’

One day, we will not be so lucky. But the point I want to highlight here is this is an example of the ‘price vacuum’ that can occur when computers lose control. I can not stress this enough.

This is THE REASON why the next major crash will be worse than the last.”

I am not alone in this reasoning. Just recently John Dizard wrote for the Financial Times:

“The most serious risks arising from ETFs are the macro consequences of too much capital being committed in too few places at the same time. The vehicles for over-concentration change over time, such as the ‘Nifty Fifty’ stocks back in 1973, Mexican and Argentine bonds a few years after that, internet shares in 1999, and commercial property every other decade, but the outcome is the same. Investors’ cash goes to money heaven, and there is a pro-cyclical decline in productive investment.

Risk concentration always seems rational at the beginning, and the initial successes of the trends it creates can be self-reinforcing. Since US growth stocks such as Avon, the cosmetics company, Polaroid, the photography group, and IBM, the computer company, outperformed the market, growth-orientated portfolio managers raised more money in the early 1970s, which then led to more cash going to buy the same stocks.”

Andrew Lapthorne from Societe Generale also weighed in:

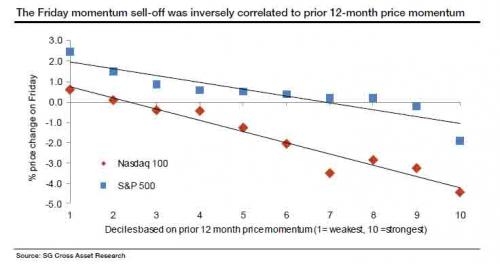

“The sell-offs themselves are not particularly unusual, but the uniformity of the prices moves all on the same day indicates a market driven by price chasing momentum, with investors heading for the door all at the same time.

Indeed, those S&P 500 stocks which sold-off on Friday were almost all from the strongest performing decile over the previous 12 months (the r-squared on the S&P 500 line in the chart below is 85%). Within Nasdaq, the relationship is even stronger at 95%.

Such a uniform sell-off strikes us as systematic, especially as the relationship weakens once you look at the broader and less liquid Nasdaq composite. For price chasing investors, Friday’s plunge serves as a warning; when it’s time to head for the door, you better move fast.”

These points are absolutely correct, and as I addressed in the Passive Indexing Trap:

“At some point, that reversion process will take hold. It is then investor ‘psychology’ will collide with ‘margin debt’ and ETF liquidity. It will be the equivalent of striking a match, lighting a stick of dynamite and throwing it into a tanker full of gasoline.

When the ‘herding’ into ETF’s begins to reverse, it will not be a slow and methodical process but rather a stampede with little regard to price, valuation or fundamental measures.

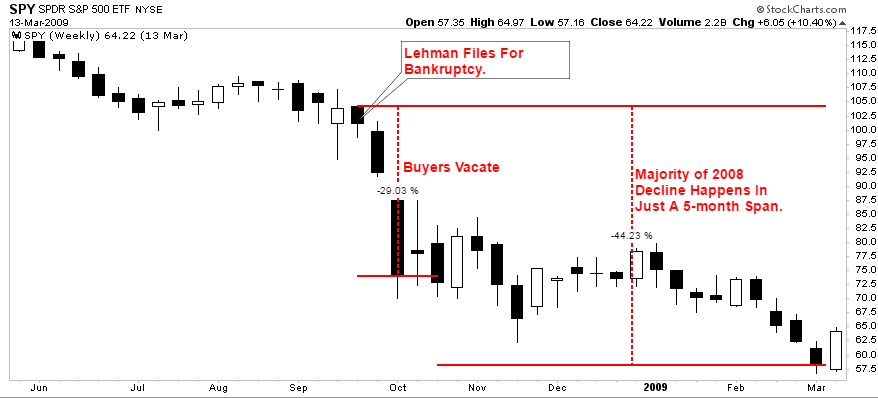

Importantly, as prices decline it will trigger margin calls which will induce more indiscriminate selling. The forced redemption cycle will cause catastrophic spreads between the current bid and ask pricing for ETF’s. As investors are forced to dump positions to meet margin calls, the lack of buyers will form a vacuum causing rapid price declines which leave investors helpless on the sidelines watching years of capital appreciation vanish in moments. Don’t believe me? It happened in 2008 as the ‘Lehman Moment’ left investors helpless watching the crash.”

“Over a 3-week span, investors lost 29% of their capital and 44% over the entire 3-month period. This is what happens during a margin liquidation event. It is fast, furious and without remorse.

Currently, with complacency and optimism near record levels, no one sees a severe market retracement as a possibility. But maybe that should be warning enough.”

Warning Shot

As was seen on Friday, and again on Monday, the consequence of a “rush for the exits” can leave investors a bit flat-footed in the process. However, don’t mistake the importance of that statement.

One of the biggest problems facing investors is ultimately when “something goes wrong.” When this happens, the initial response is paralysis, followed by a bit of panic, before ultimately falling prey to the host of emotional mistakes that repeatedly plague investors time and again.

This time is likely to be no different.

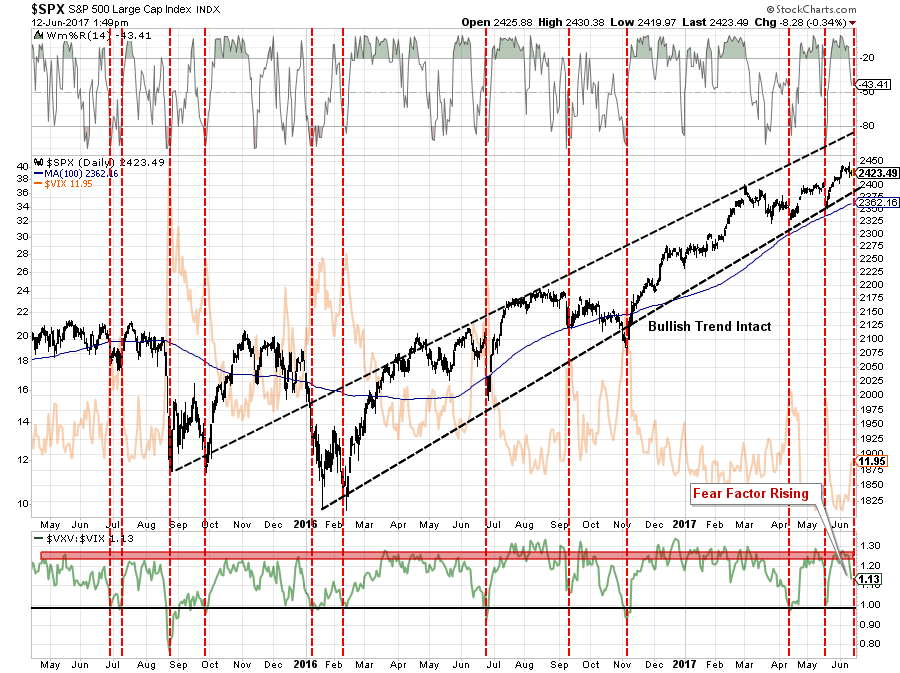

Currently, I do not believe that we have begun the next major corrective cycle. In fact, the current rout has all the earmarks of another “buy the dip” move to feed the ongoing bullish mantra.

While there is certainly damage being wrought in the Technology and Discretionary sectors, the rotation to Financials, Energy, Small and Mid-Capitalization areas are offsetting the correctionary process. As shown below, the markets remain confined to the bullish trend currently while the overbought condition is being reduced.

However, this should be a clear “warning shot” to investors who have piled into ETF’s in the hopes indexing will offset the penalties of not paying attention to the risk they have taken on.

“While passive indexing works while all prices are rising, the reverse is also true.”

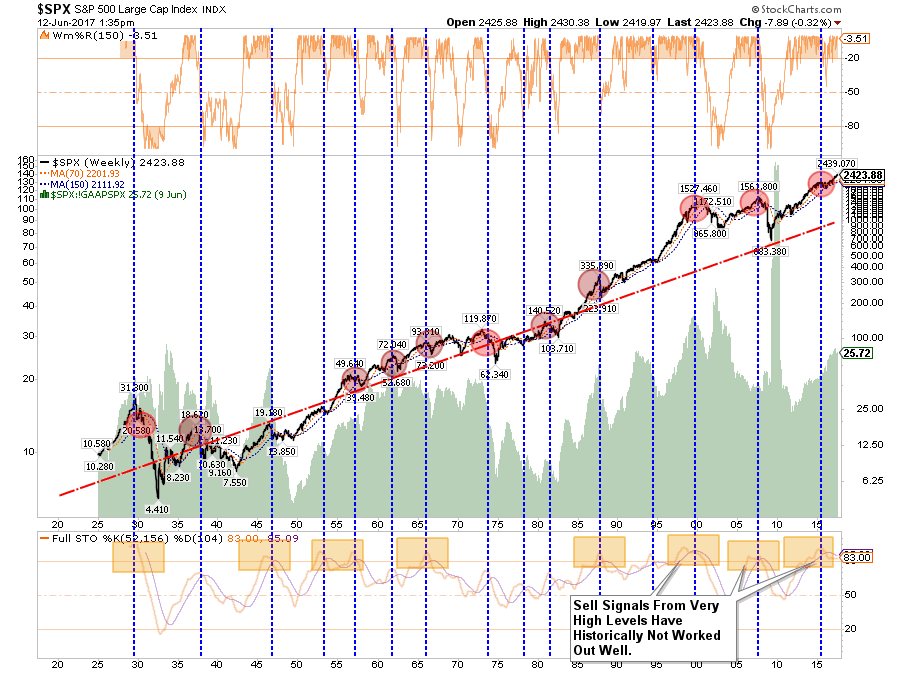

Importantly, it is only near peaks in extended bull markets that logic is dismissed for the seemingly easiest trend to make money. Today is no different as the chart below shows the odds are stacked against substantial market gains from current levels.

As my partner, Michael Lebowitz, noted in a recent posting:

“Nobody is going to ring a bell at the top of a market, but there are plenty of warped investment strategies and narratives from history that serve the same purpose — remember Internet companies with no earnings and sub-prime CDOs to name two.”

Once prices fall enough the previously “passive indexer” becomes an “active panic seller.” With the flood of money into “passive index” and “yield funds,” the tables are once again set for a dramatic and damaging ending.

In the near term, over the next several months or even a year, markets could very likely continue their bullish trend as long as nothing upsets the balance of investor confidence and market liquidity. However, of that, there is no guarantee.

As Ben Graham stated back in 1959:

“‘The more it changes, the more it’s the same thing.’ I have always thought this motto applied to the stock market better than anywhere else. Now the really important part of the proverb is the phrase, ‘the more it changes.’

The economic world has changed radically and will change even more. Most people think now that the essential nature of the stock market has been undergoing a corresponding change. But if my cliché is sound, then the stock market will continue to be essentially what it always was in the past, a place where a big bull market is inevitably followed by a big bear market.

In other words, a place where today’s free lunches are paid for doubly tomorrow. In the light of recent experience, I think the present level of the stock market is an extremely dangerous one.”

He is right, of course, things are little different now than they were then.

What is important to remember is that for every “bull market” there MUST be a “bear market.” While “passive indexing” sounds like a winning approach to “pace” the markets during the late stages of an advance, it is worth remembering it will also “pace” just as well during the subsequent decline.

Oh…so you say you’re going to “sell” those “passive ETF’s” before that happens?

Ahh! Well, you are not so “passive” after all.

Copyright © Clarity Financial