by Brian Lampron, AIF, Commonwealth Financial Network

What if you could gain new clients without adding a significant amount of management time, cost, or work to your practice? Fortunately, certain efficiency-promoting processes can help you do just that.

To help streamline your advisory business, I suggest implementing the following best practices. Although all advisory firms can benefit from these methods, they're especially useful if your practice is growing.

1) Establish a Fee Schedule

Establishing a fee schedule is a key component of your business. It can help explain your fee structure to clients, provide transparency, and help maintain profitability. You'll want to evaluate the average fees charged by your competitors, as well as the value of your time and the services you plan to include in your fee. It may also be worthwhile to conside

A successful fee schedule will strike the delicate balance between charging rates that are appropriate and charging rates that are profitable. After all, you need to charge fees that are generous enough to support your company's infrastructure but that reflect a quantifiable value to clients.

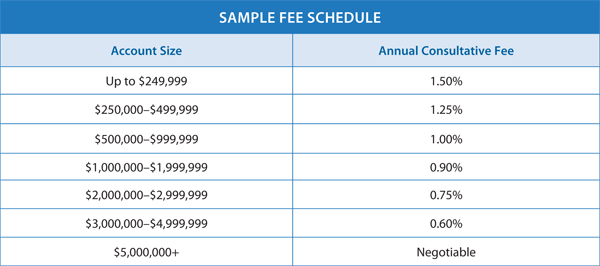

A word to the wise: When pricing your advisory business, you don't want to settle on a 1-percent fee for everyone and everything, as different prices for different account sizes may help maintain and improve profitability. Instead, a sample fee structure might look something like this.

2) Determine a Minimum Account Level

Determining a minimum account level can help ensure that you continue to attract the most profitable clients by allowing you to:

- Focus on building stronger relationships with larger and more valued clients

- Avoid losing key clients who feel they are underserved

- Increase profits without adding staff

- Ease the burden of maintaining smaller accounts

- Raise your clients' (and prospects') perception of you as a professional

Here at Commonwealth, affiliated advisors typically set their fee-based minimums at $100,000, $250,000, $500,000, or even higher—especially if their business consists mostly of Preferred Portfolio Services® (PPS) Custom clients. Also, Custom business can be time-consuming, as the advisor is responsible for all the management, research, rebalancing, and account servicing needs.

If you're concerned about turning away smaller clients, consider leveraging a turnkey asset management program, which allows you to outsource product selection, asset allocation, and rebalancing. Just remember: The time you spend on investment management services for smaller clients should be minimal, leaving you enough hours in the day to address other questions and needs while remaining profitable.

3) Use Model Portfolios

Model portfolios can save you time and resources as you grow your fee-based practice. Specifically, they allow you to:

- Be consistent in your client interactions

- Optimize efficiencies and systematize your processes

- Delegate responsibilities

- Reduce the number of investments you track

- Spend more time with clients and prospects

Bottom line? Model portfolios eliminate the need to reinvent the wheel for every client who walks through the door. Instead, you can simply select the predetermined model that best fits his or her financial objectives and risk tolerance.

4) Outsourcing Investment Management

Think of all the tasks you perform in managing your advisory accounts: researching funds, determining asset allocations, tweaking portfolios, trading, and rebalancing. By outsourcing investment management, you can drastically streamline your advisory business. With the time that you save, you can dedicate more hours to customer satisfaction and even offer more services, such as distribution planning, financial planning, estate planning, and more.

If you're like many financial professionals, you might not be comfortable with the idea of outsourcing investment management, no matter the benefits. You may feel that your clients are paying you to make investment decisions, or you may find it difficult to give up control and flexibility. (Remember, if you outsource, the wrap manager now has the control.) These are valid concerns, but I would argue that the time you can save and the possibility of offering more services in your practice will likely offset these challenges.

One last thing to keep in mind when contemplating outsourcing. Know that it is not an all-or-nothing proposition. You can outsource certain clients, certain types of accounts, or only a portion of a client's assets. With the financial industry becoming more complex, it might be an ideal time to concentrate on planning and advising, plus get more comfortable delegating as much as possible.

What other best practices have you implemented in your business? Do you outsource investment management? Please share your thoughts with us below!

Editor's Note: This post was originally published in October 2014, but we've updated it to bring you more relevant and timely information.

Commonwealth Financial Network is the nation’s largest privately held independent broker/dealer-RIA. This post originally appeared on Commonwealth Independent Advisor, the firm’s corporate blog.

Copyright © Commonwealth Financial Network