by Liz Ann Sonders, Brad Sorenson, Jeffrey Kleintop, Charles Schwab and Company, Inc.

Key Points

- U.S. markets were roiled by so-called "unprecedented" political issues but bounced back quickly. Investing based on political winds is not likely to be a successful strategy and we urge focus on economic and earnings fundamentals.

- The U.S. economy is bouncing back from the weak first quarter while the labor market continues to tighten. A June rate hike by the Federal Reserve remains on the table for now.

- Global growth has picked up, but the recent slowdown and inversion of the yield curve in China are causing some concerns.

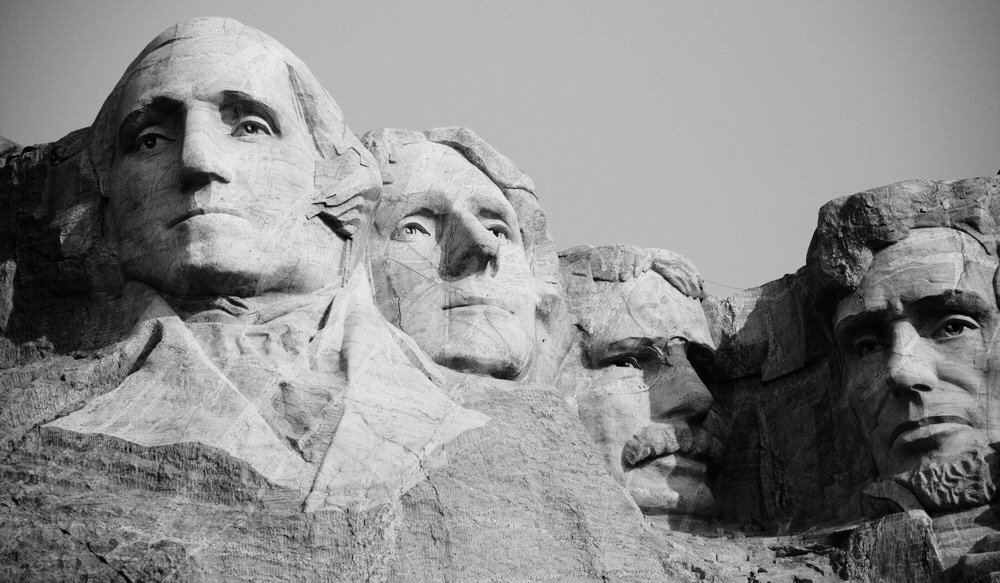

Politics invades the market

Political instability is in play these days with regard to the markets, but there are times when they move front-and-center. That occurred recently as impeachment of President Trump was brought up on the floor of the House of Representatives, and concerns spiked that the business-friendly portion of the President's agenda would fail to get enacted. Pundits and politicians are quick to pull out the "unprecedented" phrase to describe multiple actions by the current President and his staff. We aren't here to debate the merits or wisdom of the actions in question; just to point out that investors shouldn’t get too caught up in the political wrangling's with respect to investing decisions. It would not be unprecedented for Congress to criticize the president, or for the president to have missteps; although clearly impeachment is much less common. The institutions of U.S. government are not threatened, and, in fact, are working as the founders intended them, with the legislative and judicial branches providing checks and balances to the executive branch and vice versa. So we suggest keeping an eye, or maybe a squinted eye, on the political issues, because they can impact investment decisions at some point; but remain focused on your longer term goals and the more market-influencing fundamentals of economic and earnings growth.

The recent sharp, but single-day pullback was not extraordinary based on history and in fact may have been a healthy move as it allowed some of the overly optimistic sentiment conditions and complacency to ease. Stocks will likely experience more bouts of volatility in the coming months due to both political surprises and Fed policy communications. But we believe the trend can continue to be higher and that we remain in a secular bull market.

Recent pullback in context of market move since election

Source: FactSet, Standard & Poor's. As of May 23, 2017. Past performance is no guarantee of future results.

Earnings were strong and economy looks good

Reasons for our continued optimism include the mostly-completed earnings season which, according to Bloomberg, saw close to 80% of companies in the S&P 500 beat consensus earnings estimates; while more than 60% beat on the revenue estimates, a high historical beat rate for top-line growth (which is harder to manipulate). And despite ongoing political uncertainty, corporate confidence is holding up for now. The Empire Manufacturing Index slipped into negative territory at -1.0, but the Philadelphia Fed Index surprisingly rose to 38.8 from 22.0. Homebuilders also remain optimistic as the National Association of Homebuilders (NAHB) Housing Market Index (HMI) rose to a robust 70 from 68.

Homebuilders optimism rising

Source: FactSet, National Assoc. of Home Builders. As of May 23, 2017.

We're starting to see that optimism filter through to actions. Industrial Production rose 1.0% in the most recent reading, the largest gain since August of 2014, while capacity utilization rose to 76.7, the highest level since August 2015. These data points can be volatile, but they are pointed in the right direction. In addition, the Index of Leading Economic Indicators (LEI) continues to show a growing economy, posting a gain of 0.3% in the most recent reading.

Economy appears to be in good shape

Source: FactSet, U.S. Conference Board. As of May 23, 2017.

One of those leading indicators, and a potential indicator of both consumer and business confidence in action, is initial jobless claims, which continue to be remarkably low, indicating a continued tightening labor market.

Jobless claims are historically low

Source: FactSet, U.S. Dept. of Labor. As of May 23, 2017.

This historically low claims level, combined with the historically low unemployment rate of 4.4%, appears to be pushing wages higher. This should help to support consumer spending and, as was from earnings season, hasn't yet begun to dent corporate profitability.

Wages are moving higher

Source: FactSet, Federal Reserve Bank of Atlanta. As of May 23, 2017.

Fed likely still on track for June hike

Market odds of a June hike fell during the politically induced turmoil in the market but bounced back quickly (now close to 100%), and we remain confident that we’ll see another quarter point added to the fed funds rate. There are, of course, caveats, as escalation of political uncertainty or a sharp downturn in economic data could deter the Fed, but as of now it seems relatively intent on continuing their normalization process. Remember that the Fed has a dual mandate—full employment and contained inflation. Inflation doesn’t appear to be a problem at the moment so the Fed doesn't have to be overly aggressive. But we are at—or even below—"full" employment, allowing the Fed to continue to move toward policy normalization. For now the market appears comfortable with gradual hikes, and is now looking forward to more information with regard to the upcoming reduction in the Fed’s massive $4.5 trillion balance sheet (for more on this read Liz Ann Sonders' article Gimme Three Steps…and a Stumble?). Information regarding the balance sheet, and the process itself, is another potential source of volatility for the market.

Three impacts of a China slowdown

It's easy for U.S.-based investors to stay focused on domestic issues, but that would be a mistake in our view. Global economic growth got off to a mixed start in 2017. The Eurozone continued solid growth, with a 2% pace of annualized gross domestic product (GDP) in the first quarter (per Eurostat), extending the 2% pace of growth seen since the end of 2014. Japan’s annualized GDP growth came in at 2.2% in the first quarter (per the Japanese Cabinet Office)—marking five quarters in a row of growth, and the longest streak of growth in over a decade for recession-prone Japan. In contrast, growth in the United Kingdom slowed to 0.8% in the first quarter, while the United States grew just 1.2%. Yet all of these regions appear to be experiencing solid growth in the second quarter. An exception to this is China. In China, GDP growth was reported at 6.9% in the first quarter, above the government’s target of 6.5%; but China has started to show signs of an economic slowdown in the second quarter.

A swath of recent data reports have missed economists' expectations, including China's retail sales, industrial production, aggregate borrowing, and investment. Leading indicators of growth, like China’s purchasing managers indexes, fell in April, marking the second month of declines. Interest rates have been on the rise as financial conditions tighten, and the 5-to-10 year portion of China's yield curve has inverted (the yield on the 5-year government bond has risen above the yield on the 10-year)—often a sign of slower growth ahead. While China's growth could simply reaccelerate, a further slowdown holds three potential impacts for investors.

First, solid economic growth in developed countries does not make them immune to the effects of a China-driven slowdown in emerging market economic growth. A 1% slowdown in GDP growth in emerging markets has minimal impact on growth in the United States and United Kingdom; but it may slow GDP growth in Japan by about 0.5% and Europe by 0.3%, as you can see in the chart below based on an analysis performed by the International Monetary Fund (IMF). Growth has recently rebounded to near long-term averages in these regions. Slower growth could ease or even reverse the recent reflation in the euro and yen relative to the U.S. dollar.

Europe and Japan most exposed to China/EM slowdown

Source: Charles Schwab, data from IMF Multilateral Policy Report: 2014 Spillover Report, July 29, 2014.

Second, the slowdown is likely to be concentrated in construction activity given the pace of government infrastructure spending that has already taken place, as you can see in the chart below. The growth rate has dropped to the lowest level in many years in recent months suggesting slowing activity ahead.

China's slowing government infrastructure spending

Source: Charles Schwab, Bloomberg data as of 5/23/2017.

This construction slowdown may put downward pressure on commodity prices after rebounding 2016. Australia's stock market has closely mirrored the performance of global producers of building materials and commodities and could weaken along with commodity prices, as you can see below.

Australia’s stock market has performed like materials industries

Past performance is no guarantee of future results.

Total returns are in US dollars.

Source: Charles Schwab, Bloomberg data as of 5/23/2017.

Third, China's policymakers may react to increasing evidence of a slowdown with aggressive stimulus, just as they did when growth slowed in late 2015/early 2016. This may lead to the mini-cycle experienced in late 2015 to early 2017 starting over again. The lag between the mounting evidence of a slowdown and sufficient actions to revive growth may lead to a drop in global stocks. In the last mini-cycle, the MSCI AC World Index dropped 12% in the first 29 trading days of 2016 before the return of stimulus—combined with other actions to mitigate capital outflows—eased concerns, revived economic growth, and helped lift the prices of stocks and commodities.

A material slowdown in the world's second-largest economy may hold several impacts for investors that may prove to be temporary. A well-diversified asset allocation may help buffer portfolios from the volatility that may result.

So what?

Both political uncertainty and Fed policy changes could contribute to increased volatility, but solid economic and earnings growth—both in the United States and globally—should help the bull market to continue. We suggest looking past the political rhetoric for the most part and focusing on economic developments and the long-term stability the United States provides. Globally, we’re seeing improving growth, but China is a concern that bears watching and emphasizes the need for a globally diversified portfolio.

*****