by Carl Tannenbaum, Asha Bangalore, Ankit Mital, Northern Trust

SUMMARY

- Interesting Times In Asia

- Looking at Productivity Though a Different Lens

Editor’s note: You can now follow our musings on ![]() Twitter @NT_CTannenbaum.

Twitter @NT_CTannenbaum.

“May you live in interesting times” is a traditional Chinese curse disguised as a blessing. Looking at emerging Asia today, it can certainly be said that it is both cursed and blessed.

The potential curses come in several forms. A Chinese slowdown and the threat from North Korea are proximate concerns. A bit further away geographically, but no less important economically, is the fear of a more protectionist America and a stronger U.S. dollar.

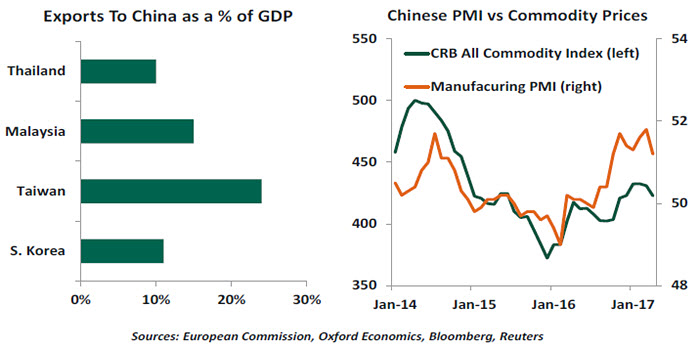

We have expressed our concerns over the current state of economic affairs in China a number of times, most recently last week. A Chinese “hard landing” (a financial crisis accompanied by a deep economic slump), would have a chilling effect on the economies of southeast Asia. But even if Chinese policymakers are able to engineer an orderly slowdown (trading off higher growth for more sustainable growth), a contraction in demand for imports, a fall in investment spending and a sharp correction in commodity prices would ensue.

Those developments would be especially damaging for China’s regional neighbors. Even though the Association of Southeast Asian Nations (ASEAN) countries have worked to diversify both their output and their trading relationships, they are still linked closely to the area’s economic heavyweight. It wasn’t surprising that Moody’s downgraded Hong Kong’s credit rating last week shortly after taking similar action on China.

China is an important export destination for Korea, Taiwan, Thailand, Malaysia and others. With China accounting for anywhere from 10% to 25% of exports from these countries, the impact from any prolonged slowdown would be painful. For commodity exporters Indonesia and Malaysia, the negative terms-of-trade shock from low commodity prices would perhaps be even more significant than the direct exposure of these countries’ economies to Chinese demand. Singapore and Hong Kong, the premier service and trading hubs in the region, would suffer from a general slowdown in economic activity.

Significant economic surpluses accumulated over more than three decades have allowed China to be generous with its financial resources. Almost all southeast Asian countries have attracted substantial private Chinese foreign direct investment, but even developing countries in western Asia, such as Pakistan, Sri Lanka and Nepal, have benefited from strategic infrastructure investment and funding from Beijing. More may on the horizon if the ambitious “One Belt, One Road” project comes to fruition.

This largess is unlikely to survive a Chinese economic slowdown. China has also been dealing with capital outflows over the past several years; while recent controls have slowed the flood to a trickle, a renewed exodus would serve to limit the Chinese consumption and investment that its regional partners rely upon.

This largess is unlikely to survive a Chinese economic slowdown. China has also been dealing with capital outflows over the past several years; while recent controls have slowed the flood to a trickle, a renewed exodus would serve to limit the Chinese consumption and investment that its regional partners rely upon.

Chinese political capital will be needed to check North Korea. If the worst fears in Korea are ever realized, the humanitarian cost would be catastrophic and dwarf any economic worries that we might have. The hope right now is that the new administration of Moon Jae-in in Seoul, along with its international partners, will be able to deescalate the situation with Pyongyang.

The focus for South Korea would then shift to much-needed corporate reforms. The South Korean economy has come to rely on just four family run conglomerates, known locally as ‘chaebol’, which account for almost half of all the stock market’s value. In the long run, Korea’s economy might benefit from a better mix of small and large firms.

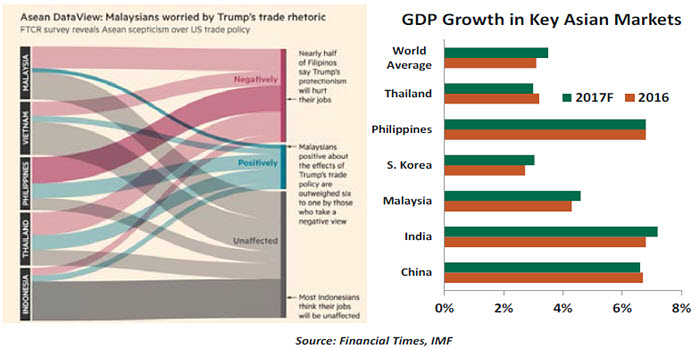

Looking across the Pacific, while the Trump administration’s tax agenda has been thrown off course, clouds of protectionism still linger above Asian export houses. Either through direct exports to the U.S. or indirect exports to the U.S. via China and Japan, countries such as South Korea, Thailand, Malaysia, Taiwan, Vietnam — and of course China — have significant exposure to the American market.

Unless access to the U.S. market is completely cut off — an unlikely scenario — the U.S. dollar would likely rise to offset some of the impact from trade barriers. Concerns have been expressed about the ability of Asian economies with substantial dollar-denominated debt to weather rising U.S. interest rates and a resulting depreciation of their local currencies versus the dollar. We believe these fears are somewhat overdone. Dollar liabilities now reside largely in corporate balance sheets (Indonesia is a notable exception), and in most cases are hedged. And unlike 1997, economies across Asia hold substantial foreign exchange reserves.

A few isolated incidents aside, Asian economies have handled currency swings fairly comfortably over the last decade or two. Three years ago, the U.S. Federal Reserve’s policy shift was preceded by a 25% appreciation of the U.S. Dollar Index over nine months, starting in July 2014. It proved to be a non-event for dollar borrowers from a risk perspective.

The U.S. dollar’s strength after Donald Trump’s victory prompted rumors about capital controls arising in the region, particularly in Malaysia. The concerns didn’t last more than a few days. Earlier this month, there was some excitement around the stability of the Hong Kong dollar’s peg with the U.S. dollar, with some speculating that Hong Kong could be forced to devalue. Now Hong Kong’s official foreign reserve holdings total more than the entire annual output of the island economy, and its net international investment position is triple of that. A 25 basis point hike from the Hong Kong Monetary Authority was enough to calm nerves.

The U.S. dollar’s strength after Donald Trump’s victory prompted rumors about capital controls arising in the region, particularly in Malaysia. The concerns didn’t last more than a few days. Earlier this month, there was some excitement around the stability of the Hong Kong dollar’s peg with the U.S. dollar, with some speculating that Hong Kong could be forced to devalue. Now Hong Kong’s official foreign reserve holdings total more than the entire annual output of the island economy, and its net international investment position is triple of that. A 25 basis point hike from the Hong Kong Monetary Authority was enough to calm nerves.

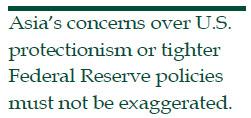

Economic activity in the region is expanding at a steady pace. Despite global concerns, Asia (ex-Japan) should continue to be the driver of global economic growth for the time being. Chinese policy makers have repeatedly surprised analysts with their ability to sustain the status quo. Our base case remains that of a moderation in growth, rather than any kind of crash. Furthermore, policy paralysis in Washington is likely to limit movements to restrict trade. Exporting nations in Asia are therefore likely to continue to utilize this path to prosperity.

Finally, India and the Philippines continue to expand rapidly and should be in a position to absorb increasing levels of goods and services from Asian providers.

The rainy spring season is setting in over southeast Asia. Heavy precipitation makes the area one of the most fertile in the world – but the occasional typhoon also crosses the region at this time of year. The region should be able to weather the normal storms, but keeping eyes on the skies for storms.

Hope for U.S. Productivity Growth

There is concern in many corners that industrial improvements have peaked in the United States, with dire consequences for productivity. However, optimists note that major sectors of the U.S. economy still have opportunities to capitalize on advances in technology. Recent research suggests differentiating between “digital industries” and “physical industries” may help steer strategies aimed at correcting America’s weak productivity trend.

In the United States, the aging of the population places a cap on growth of the work force, so gains in productivity are critical for increasing output and improving the nation’s standard of living. Faster growth also generates more revenue for the government, which can be directed toward reducing the debt or fulfilling other needs such as infrastructure, health care or education.

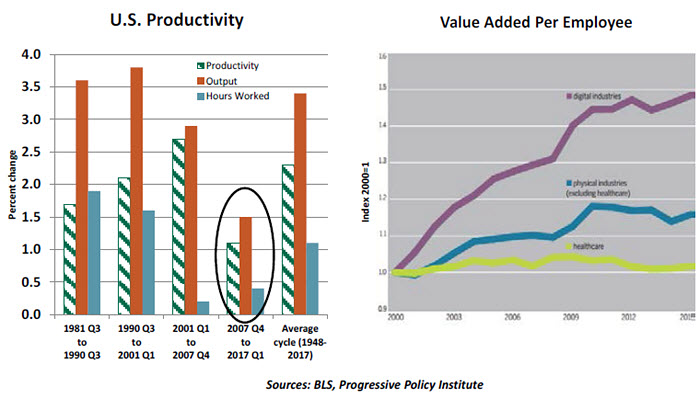

There has been a marked deceleration of productivity gains in the current expansion. The weakness is not uniform; “digital” industries have progressed much more rapidly than “physical” industries and health care in achieving efficiencies.

The output of “digital industries” is provided in digital form and can be readily delivered anywhere in the world via the internet. Entertainment, publishing, telecom, and finance are leading examples. “Physical industries” include agriculture, mining, construction and manufacturing (excluding computers and electronics).

It is estimated that digital industries account for 30% of private-sector gross domestic product (GDP) in the U.S. Information technology (IT) investment in this sector and productivity are progressing nicely. By contrast, physical industries are lagging, leaving room for progress.

IT investment in physical industries could lift overall productivity. Focusing on three examples provides a window into the potential that exists.

Information technology (IT) has reshaped the oil and gas industry since 2008. In the last five years, oil production in the United States nearly doubled from 5.6 million to 9 million barrels per day. During the same period, employment in this sector increased by only 15%. IT played a big role in this advance: three-dimensional computer modeling of underground geological formations enabled the shale oil industry to expand output without a corresponding increase in employment.

A second wave of the shale revolution is anticipated in the years ahead, with big data analysis of the reams of statistics gathered from shale fields. Reportedly, Pioneer Natural Resources’ oil production costs in the Permian Basin, following technological enhancements, will match Saudi Arabia’s cost of oil production.

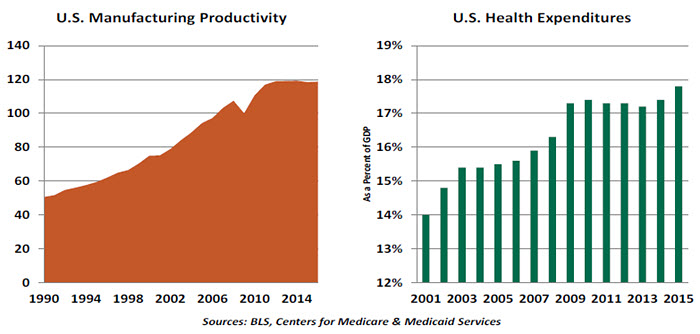

Manufacturing, which includes industries such as autos, apparel, furniture and others, is another sector that may be ripe for efficiency enhancing strategies. An in-depth study of productivity trends across 21 major industries indicates that computers and electronics industry played a critical role in lifting overall productivity but masked the performance of other industries.

Manufacturing, which includes industries such as autos, apparel, furniture and others, is another sector that may be ripe for efficiency enhancing strategies. An in-depth study of productivity trends across 21 major industries indicates that computers and electronics industry played a critical role in lifting overall productivity but masked the performance of other industries.

Industries such as chemicals, fabricated metal products, wood products, machinery and furniture have lagged significantly in comparison with others, partly due to a lack of capital investment. Capital stock of the factory sector excluding computers and electronics shows a meaningful recovery only in the last three years, although the expansion is nearly eight years old. Tax credits to lift IT capital investment in factories outside of the high-tech sector may be one way to enhance efficiencies at the nation’s factories.

Moving on to the healthcare industry, its share of GDP is projected to grow from 17% to 20% in next few years. Even after discounting for measurement problems of productivity growth in the industry, it ranks below that of the economy as a whole on this front. Given the projected size of this sector, it is important to find the means to change the high-cost situation.

Moving on to the healthcare industry, its share of GDP is projected to grow from 17% to 20% in next few years. Even after discounting for measurement problems of productivity growth in the industry, it ranks below that of the economy as a whole on this front. Given the projected size of this sector, it is important to find the means to change the high-cost situation.

In the last five years, the U.S. population increased 3.6%, while the number of healthcare workers has risen 10%. It is widely recognized that inefficiencies in hospitals and physician’s offices, along with high administrative costs, are the major problem areas. Broadly speaking, automation in the healthcare industry can be blended into the workflow to yield large benefits.

There are also more sophisticated approaches evolving to treat diseases. IBM’s “Watson Health” ecosystem is a collaboration of more than a dozen cancer institutes to find new ways to treat the disease using genomic data. It is also working with major companies to develop new methods to treat disease, transform care management, store and analyze data and scientific papers. These partnerships aim to deliver effective care at lower costs by combining knowledge and data.

To intensify such efforts, policies that promote innovation through the use of information and encourage the medical establishment to participate and deploy these methods will be essential.

These are a few examples of industries for which suitable strategies can bring about change. The key is that there is ample room for productivity growth in the U.S. economy if policies can be implemented to promote the needed efforts.

Copyright © Northern Trust