Headline Inflation Leaves Door Open for US Rate Hikes, but...

by Eric Winograd, Fixed Income AllianceBernstein

US inflation bounced back last month, but by less than expected. The data should support two more rate hikes in 2017, but if inflation doesn’t pick up, it may impact plans for more aggressive policy tightening down the road.

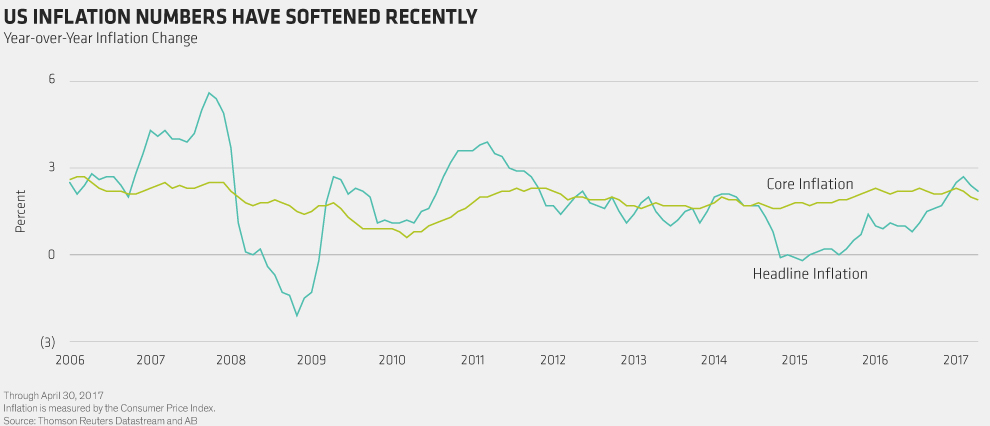

After posting a negative US Consumer Price Inflation (CPI) reading in March, April’s numbers were substantially improved—but the magnitude of the bounceback was smaller than expected (Display). Headline CPI rose by 2.2% year over year, and core CPI, which excludes food and energy prices, rose by 1.9%. Both numbers were slightly lower than the market expected.

Our view is that the data are strong enough to allow the Federal Open Market Committee (FOMC) to raise official short-term rates in June, but soft enough to tamp down expectations of more aggressive tightening later. We still expect a rate hike next month and one more later this year, but if CPI doesn’t show a bit more life in the next couple of months, we’ll have to revisit our second-half forecasts.

The deceleration in headline inflation is easy enough to explain: top-line prices continue to move in near lockstep with oil prices, and recent commodity price declines suggest that headline CPI is likely to fall farther in coming months. Because headline CPI is so closely linked to commodity prices, the Fed doesn’t generally focus on it. Instead, officials prefer to look at core inflation, which is both more stable and more heavily influenced by monetary policy.

Confusing Core Inflation Picture

For core inflation, the picture isn’t as clear.

The last two data releases were the weakest since 2013 in terms of month-over-month changes. That message is completely at odds with the drop in unemployment and generally solid economic data. There’s no clear explanation from financial markets, either: the US dollar has generally weakened, and while commodities have moved lower, they haven’t declined by enough to suggest this kind of deceleration.

Part of the story is a deceleration in owners’ equivalent rent, which appears to have topped out and is moving persistently lower as oversupply pushes rents down. That category is more significant to core CPI than to core personal consumption expenditures (PCE), the Fed’s preferred measure of inflation. But it will pull both series lower: core PCE will likely be up by 1.5% year over year when the data are released at the end of this month.

Still, even beyond housing, core inflation numbers have been weak for the last couple of months—and it isn’t just one category pulling down the figure, as goods prices did earlier in the cycle. Weakness in more than one category for consecutive months isn’t enough to raise alarm bells, but it is enough to think that we—and the FOMC—should watch closely to see if something has changed in the inflation process.

We don’t think there’s enough time or new information for the FOMC to change course on rates and policy by June, but another month or two of these types of inflation numbers will make second-half rate hikes start to look less likely.

The views expressed herein do not constitute research, investment advice or trade recommendations and do not necessarily represent the views of all AB portfolio-management teams.

Copyright © AllianceBernstein