by Frank Holmes, CIO, CEO, U.S. Global Investors

Share this page with your friends:

Please note: The Frank Talk articles listed below contain historical material. The data provided was current at the time of publication. For current information regarding any of the funds mentioned in these presentations, please visit the appropriate fund performance page.

May 15, 2017

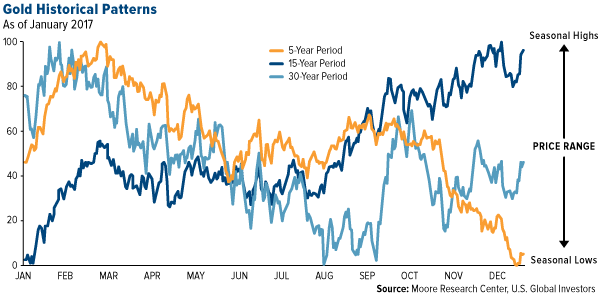

Here at the outset, I want to share with you an interesting observation we made last week of gold’s seasonal trading pattern. As you can see in the chart below, based on data provided by Moore Research Center, the five-year pattern, represented by the orange line, is diverging from the longer-term trends. Note that the index on the left measures the greatest tendency for the asset to make a seasonal high (100) or low (0) at a given time.

The data show that lows are now reached late in the year, not in January (according to the 15-year period, represented by the dark blue line) or August (according to the 30-year pattern, represented by the light blue line). Historically, September has seen the highest returns on gold as Indians make huge purchases in preparation for Diwali and the fourth-quarter wedding season, but lately we’ve seen changes. When we calculate the average monthly returns of the past five years, from January 2012 to December 2016, we find that January is the strongest month, returning 5.3 percent, followed by August with 2.3 percent. September actually returns negative 1.3 percent.

There could be a number of reasons why this is, but it’s important to recognize that the five-year period captures the bear market that dragged gold from its high of $1,900 an ounce in August 2011 to a recent low of $1,050 in December 2015. The years 2013, 2014 and 2015 all saw negative returns, so it’s little wonder why the orange line trends down from February-March to December.

Inflation Props Up Gold

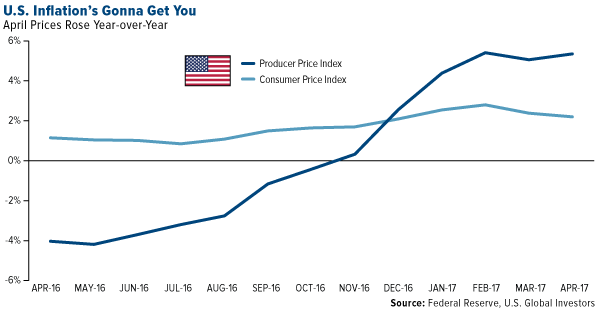

Consumer and producer prices rose in April compared to the same time last year, favoring gold prices going forward. Consumer goods climbed 2.2 percent, down slightly from March’s 2.4 percent. Wholesale goods, meanwhile, flew up 5.3 percent, higher than economists’ expectations and the strongest year-over-year increase in nearly six years.

On numerous occasions I’ve shown that higher inflation supports demand for gold, which has often been seen as a safe haven investment. The money you have sitting in the bank right now is guaranteed to lose value over time. The five-year Treasury bond is currently yielding a negative return. Diversiying a part of your portfolio into gold and gold stocks could help mitigate the effects of inflation on your household wealth. I’ve always recommended a 10 percent weighting with annual rebalances.

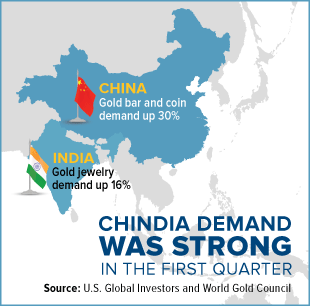

Chindia Demand Was Strong in the First Quarter

|

In India, no one questions this. Aside from property, gold is seen as the most reliable store of value, which is why it’s routinely given as a gift during weddings, graduations, births and other important life events.

Indians’ demand for gold jewelry jumped 16 percent year-over-year in the first quarter, according to the World Gold Council (WGC), as the country slowly recovers from the economic shock of Prime Minister Narendra Modi’s demonetization scheme in November.

Demand in China for gold bars and coins had an unusually strong start to the year, fueled by concerns over a weakening renminbi and uncertainty over the country’s real estate market. The first quarter has historically been a good time for Chinese demand, as that’s when the Lunar New Year falls. This year, though, demand was up an amazing 30 percent, with 105.9 metric tons (tonnes) purchased during the three-month period. According to the WGC, this was the fourth-strongest quarter on record.

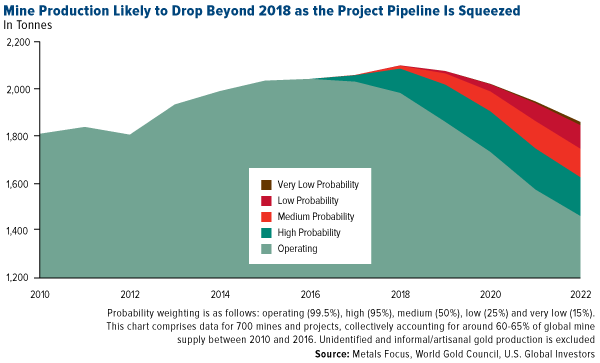

Looking ahead, gold prices could be supported by steadily declining mine production. Over the next five to 10 years, output from currently-operational mines is expected to drop off steeply as a consequence of deep spending cuts for project development as well as a lack of significant new deposit discoveries.

Between 2012 and 2016, capital expenditure for companies in the NYSE Arca Gold BUGS Index contracted 65 percent, the WGC reports. This will inevitably squeeze the supply chain and help prices firm up.

Stock Investors Have No Fear

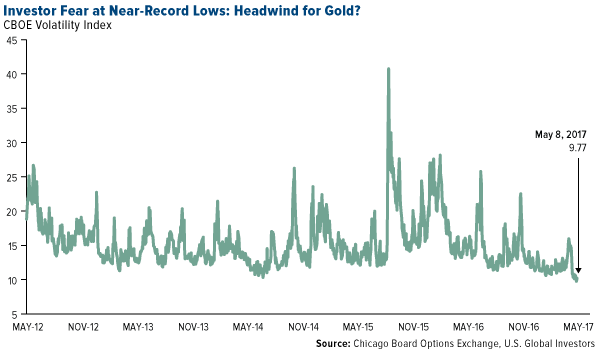

In the near term, gold faces a number of headwinds, including a strong U.S. dollar, rising nominal interest rates and a still-robust stock market. Despite recent geopolitical shockwaves such as President Donald Trump’s surprise firing of FBI director James Comey, investors still see stocks as a good place to be, with the CBOE Volatility Index, or VIX, trading at lows last seen in 1993.

Popularly known as the “fear gauge,” the VIX measures expected volatility in the S&P 500 Index over the next month. That it’s trading so low suggests that geopolitical uncertainty doesn’t always translate into investor uncertainty. Evidently Wall Street doesn’t share the same sense of impending doom as some voters and media figures appear to have right now concerning Comey’s termination and the ongoing investigation into possible collusion between the Trump campaign and the Russian government.

This matters because gold has historically benefited in times of crisis and uncertainty, whether real or perceived. But with the VIX signaling near-record-low fear in the marketplace, some investors might see this as weakening the case for gold.

Where We See the Gold Opportunities

In this environment, we seek high-quality producers that are profitable and show improvements in revenue and cash flow. This yields junior companies such as Klondex and Wesdome, both of which have demonstrated strong fundamentals, low SG&A (selling, general and administrative expenses), cost-conscientious management and higher-grade ore.

The recent bubble in gold stocks unwound, which was harmful to some quality gold names that were affected by the issues involving the VanEck Vectors Junior Gold Miners ETF (GDXJ), which I wrote about last week. Since the GDXJ methodology update was announced, the ETF has recorded large redemptions, with assets plunging as much as 25 percent.

The GDXJ doesn’t have any smart beta attributes—instead, it relies on market cap. As portfolio manager Ralph Aldis put it, this means “we find a lot of high-quality companies being indiscriminately sold down.” We see this as an opportunity to nibble at some attractive small-cap growth names.

All opinions expressed and data provided are subject to change without notice. Some of these opinions may not be appropriate to every investor. By clicking the link(s) above, you will be directed to a third-party website(s). U.S. Global Investors does not endorse all information supplied by this/these website(s) and is not responsible for its/their content.

The Consumer Price Index (CPI) is one of the most widely recognized price measures for tracking the price of a market basket of goods and services purchased by individuals. The weights of components are based on consumer spending patterns. The Producer Price Index (PPI) measures prices received by producers at the first commercial sale. The index measures goods at three stages of production: finished, intermediate and crude.

The NYSE Arca Gold BUGS (Basket of Unhedged Gold Stocks) Index (HUI) is a modified equal dollar weighted index of companies involved in gold mining. The HUI Index was designed to provide significant exposure to near term movements in gold prices by including companies that do not hedge their gold production beyond 1.5 years.

Chicago Board Options Exchange (CBOE) Volatility Index (VIX) shows the market's expectation of 30-day volatility.

The S&P 500 Stock Index is a widely recognized capitalization-weighted index of 500 common stock prices in U.S. companies.

Beta is a measure of the volatility, or systematic risk, of a security or a portfolio in comparison to the market as a whole.

Holdings may change daily. Holdings are reported as of the most recent quarter-end. The following securities mentioned in the article were held by one or more accounts managed by U.S. Global Investors as of 3/31/2017: Klondex Mines Ltd., Wesdome Gold Mines Ltd., VanEck Vectors Junior Gold Miners ETF.

This post was originally published at Frank Talk.

Copyright © U.S. Global Investors