by Jeffrey Saut, Chief Investment Strategist, Raymond James

“If I had time, I could pick out dozens of Herb Stein’s famous bon mots, which he sprinkled throughout his writings and in the days when he was chairman of Nixon's Council of Economic Advisors, 1972 to 1974. I have a few favorites that spring to mind. When asked by a reporter to explain why inflation was getting so high, when he had not predicted it, Herb put on a straight face and said: ‘If you take out all the things in the Consumer Price Index that have gone up, the index would actually go down.’ At another press conference, when he got irked with persistent questions on the same topic, he announced that ‘The Nixon Administration is against inflation and it is against deflation. We are for 'flation.’”

. . . Jude Wanniski, Polyconomics (1999)

I had the pleasure of listening to Pippa Malmgren speak last week at the Raymond James Financial Services National Conference. Philippa "Pippa" Malmgren, according to Wikipedia, is “an American policy analyst. She served as Special Assistant to the President of the United States, Barack Obama, for Economic Policy on the National Economic Council and is a former member of the U.S. President’s Working Group on Financial Markets. She is the founder of the DRPM Group and co-founder of H Robotics.”

As she spoke, I recalled the famous ‘flation quote from the effulgent Herb Stein begging the question, “Where are the Herb Steins of today when we really need them?!” The reason for that ‘flation recollection was Pippa’s belief that inflation is back. She is expecting inflation to pick up to 2.5% and maybe more. It was noted that China, too, is experiencing inflation with wages up five fold over the past three years. Pippa also spoke of “shrink inflation”, whereby manufactures put less product in a box rather than raising prices. Interestingly, she observed that the nozzle of a toothpaste tube keeps getting bigger so that users will use up the toothpaste faster, implying more purchases. Her investment recommendation was to buy assets that benefit from inflation (farmland, Select REITs, and MLPs).

Indeed, midstream Master Limited Partnerships (MLPs) clearly play to the inflation theme and stand to benefit if President Trump’s tax plan is adopted. As Reuter’s Rodrigo Campos and Liz Hampton write (as paraphrased):

The proposed changes include a cut to the top tax rate on pass-through businesses to 15 percent from the current rate of up to 36.9 percent. The change would largely benefit owners of private businesses, but investors holding shares of master limited partnerships, or MLPs, would receive the same treatment. MLPs build the pipelines and storage tanks and are a common corporate structure in the oil and gas infrastructure sector (read the article here: MLPs).

Looking at our fundamental analysts’ MLP research coverage list shows four midstream MLPs that all have Strong Buy ratings from our analysts and screen positive using our proprietary algorithms. They are: Enterprise Products Partners (EPD/$27.32); Tesoro Logistics (TLLP/$54.86); Western Refining (WNRL/$25.40); and Williams Partners (WPZ/$40.93). Using the same metrics to screen our Real Estate Investment Trust (REIT) research universe yields three names, all of which have Strong Buy ratings from our fundamental analysts. They are: Physicians Realty (DOC/$19.64); American Homes 4 Rent (AMH/$23.05); and Weyerhaeuser (WY/$33.87). As in the past, we feature these stocks for your “potential” buy lists.

Circling back to Pippa’s presentation, she reiterated China is experiencing inflation and that manufacturing quality control has declined so much that Mexico has become the new China. Along that line, she opined that Mexican manufacturing is up to U.S. product standards. Further dissing China, Pippa told us that Foxconn is going to build a plant in America, again because of the decline in Chinese quality control and the increase in wages. That said, it was inferred that China would invest some of its dollars to build America’s infrastructure. She also revealed that China has built a “firewall” to prevent the Chinese people from accessing “social media!” Folks, this has been one of the driving forces behind the return to U.S. “onshoring” (the return of manufacturing). Other topics under her discussion were The Russian Artic Sandbox (Sandbox), containment of North Korea, President Trump being likened to a “disruptive technology,” and the idea that the new quantitative easing is defense spending.

Meanwhile, while Andrew and I were attending and presenting at the conference, the equity markets were doing some “presenting” of their own. Almost unnoticed during the week was that the broad-based Value line Arithmetic Index made a new all-time high. Also registering new all-time highs were: the S&P 600, NASDAQ Composite, the NASDAQ 100, and the Russell 2000. As for the sectors, the Consumer Discretionary, Information Technology, and Materials sectors all made new all-time highs last week, which is consistent with the sectors we are overweight. To reiterate, we gave up on our model’s downside price target of 2270-2280 for the S&P 500 (SPX/2384.20) when our short and intermediate-term models flipped positive on April 19th and said to ready your “buy list” the next morning. Since then, most of the indices have experienced “upside gaps” in the charts. Such upside breakaway gaps often are indicative of a continuation chart pattern, meaning this could be the start of a new “leg” to the upside. As we said in last Thursday’s “Morning Tack”:

Could this be an exhaustion gap on the upside? Sure it could, but it could also be another new "leg" to the upside. That said, gaps tend to get filled, so we would wait right here on a trading basis to see if there is indeed a pullback to attempt to fill the upside gap. However, rather than fill said gap, the biggest surprise would be a surge to the upside from here since our models are not sensing much in the way of negativity right now.

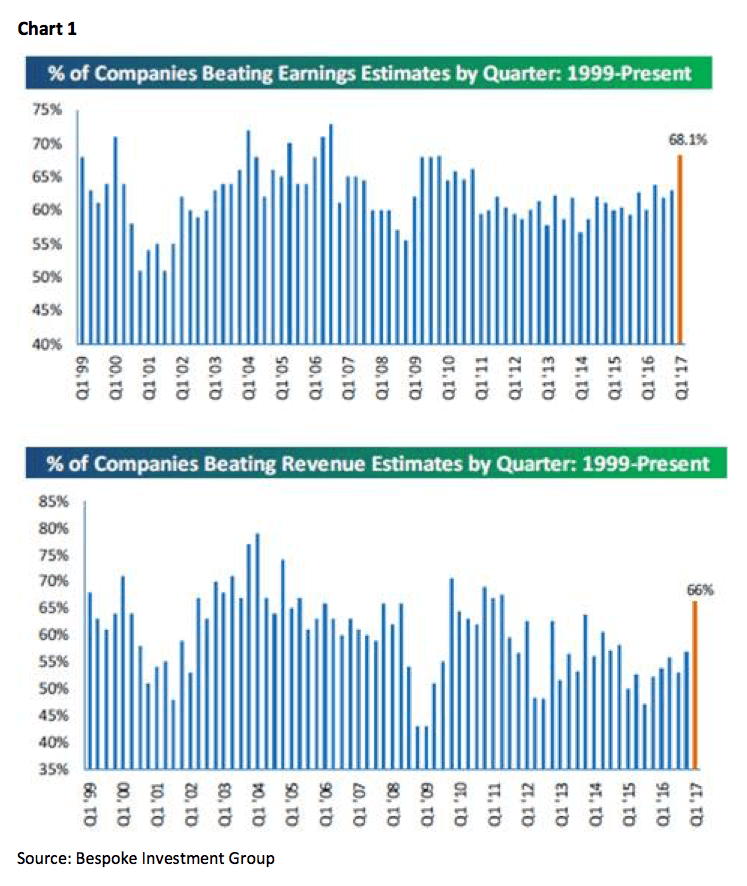

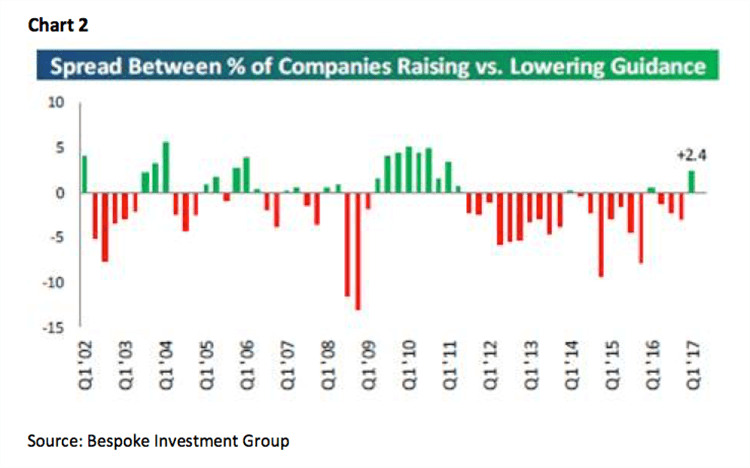

Plainly, the recent economic stats are not the driver of the equity markets’ rally given last week’s punk GDP report (+0.7%). We continue to think the rally’s driver is earnings, since our belief is the equity markets have transitioned from an interest rate-driven to an earnings-driven secular bull market. Categorically, earnings were the driver last week with 68.1% of reporting companies beating the estimates and 66.0% bettering the revenue estimates (chart 1 on page 3). Importantly, the percentage of companies raising earnings guidance, versus companies lowering guidance, has flipped positive for the first time in the last three quarters (chart 2 on page 3). Be bullish my friends, be bullish!

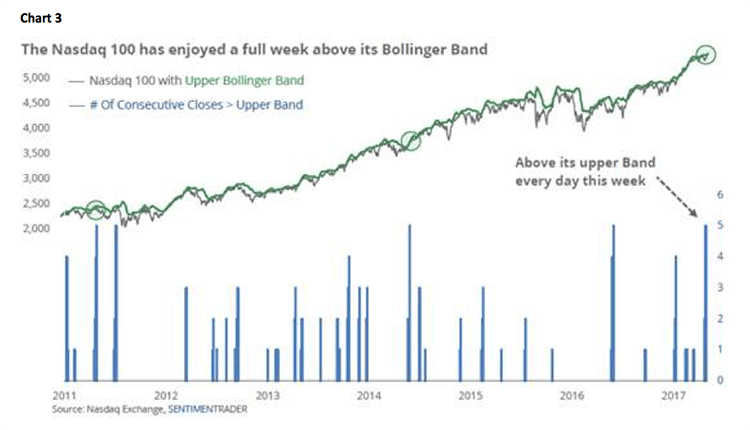

The call for this week: According to our friend Jason Goepfert (SentimenTrader):

Earlier this week, we took a look at a sort of breakout in the S&P 500. It closed above its upper Bollinger Band while the difference between the upper and lower Bands was small. This means that stocks were enjoying an upside thrust from what had been a tight trading range. Other indexes went along for the ride, including the Nasdaq 100 (NDX). Big tech stocks have been on fire, and the Nasdaq 100 is a prime beneficiary. So the index also closed above its upper Band on Monday; and Tuesday, Wednesday, Thursday, and Friday. This is the first time since May that the NDX skimmed above its upper Band every day for a week and the first time since 2014 that it occurred while the index was trading at a 52-week high (chart 3 on page 4),

This morning, the preopening S&P 500 futures are higher (+3.50) at 5:30 a.m. as North Korea threatens more nuclear tests, the U.S. deploys troops along the Syrian/Turkey boarder, and China’s manufacturing grows faster than expected. Alas, it must be a Monday . . .

Copyright © Raymond James