The “Great Rotation” myth

by Benjamin Streed, CFA, Fixed Income, Raymond James

In the aftermath of the US presidential election there was a general feeling of euphoria, that “risk on” would dominate the investment landscape and that economic growth, inflation and job creation would abound as taxes were cut and the regulatory backdrop trimmed down. This, like many other assumptions, was based on hope and led to soft economic data (surveys and sentiment) diverging strongly from hard (measurable) data to the largest margin on record. Nearly four months into the year and the euphoria has all but worn off, leaving the markets to once again wrestle with the reality of our current situation.

One of the most erroneous and misleading assumptions from the election was that there was a supposed abundance of “cash on the sidelines” just waiting to get into equities once the “all clear” was signaled. Furthermore, the multi-decade rally in the bond market was supposed to come to a close as well and funds in this sector were supposed to flow into equities as the aforementioned growth scenario panned out. “If you can find something everyone agrees on, it’s wrong” states the timeless quote from Mo Udall, a former US Representative and professional basketball player.

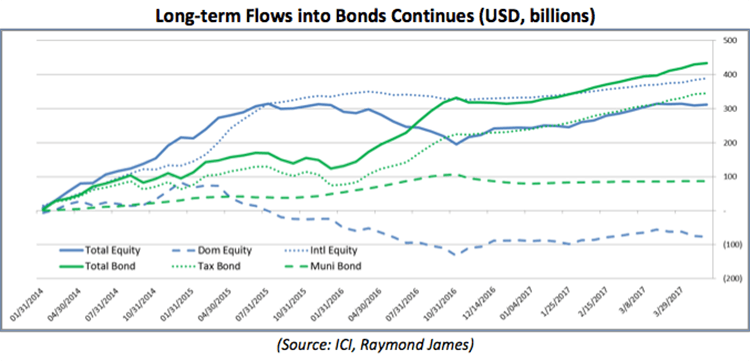

[Tweet "This “Great Rotation” away from bonds and into equities is emphatically, in the lingo of our times, “fake news”."]This “Great Rotation” away from bonds and into equities is emphatically, in the lingo of our times, “fake news”. According to the Investment Company Institute (ICI) which measures net fund flows for both ETFs and mutual funds paints a pristine picture, one that proves that there is not only an ongoing demand for high-quality, income-producing assets but a trend that has seen a ramp up in demand in the post-election world. The longer-term trend is below (first chart), and over the last three year’s we see a clear demand for fixed income securities despite the presumption for higher rates, inflation and growth in the US.

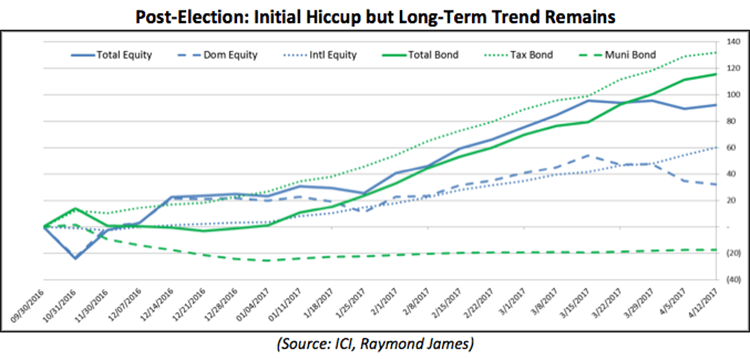

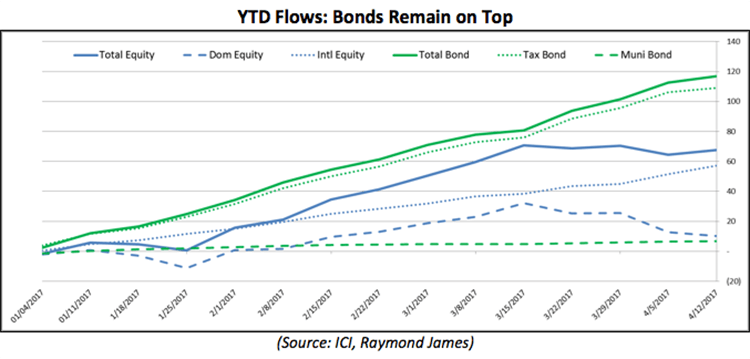

What happens when we look more near-term? Do the data show a change in sentiment? The short answer is no, but you likely already inferred that having read this far. There was some volatility as investors struggled to initially wrap their heads around the election results, but the reversal in trend reversed within a few weeks and markets quickly rebounded back to their longer-term trend (with the exception of muni flows, although these are recovering, albeit more slowly). Interestingly, despite the initial outflows from municipal bonds the aggregate demand for fixed income remains solidly in first place thanks to the unwavering demand for taxable bonds. The muni market is recovering as the Trump tax code changes are delayed and continue to be called into question. Overall, the takeaway is to always look at the data and question any rhetoric that presumes a massive shift in sentiment, no matter how good it sounds. Larger macroeconomic forces continue to be at play, forces that have an ongoing (and increasing) demand for high-quality, income-producing assets like bonds. At the end of the day, there is a global savings glut and demand for bonds outstrips supply by many, many times.

Copyright © Raymond James